Ja’Crispy

Basic Thesis

For anyone who doesn’t know, Coinbase (NASDAQ:COIN) offers customers a platform to trade cryptocurrencies. Think of it as a brokerage for crypto where clients can trade and custody their holdings or hold cash. The company was an early mover in the space when trading and holding crypto was more onerous. As a result, the company earned incredibly fat commissions for trading (percent of trade value rather than flat dollars per trade) and high margins for other services. As cryptocurrencies proliferated and prices soared, the company grew revenues quickly and hired aggressively to capture even more growth. I believe we are seeing the downside of the crypto growth curve, better and cheaper competition for trading volumes, the decline of the company’s highest margin products and a bloated cost structure that management will struggle to cut fast enough to offset declining revenues.

The biggest threat to COIN right now in my opinion is the company’s cost to trade, or what is commonly referred to as take-rate. Putting it bluntly, COIN’s fees for retail traders are pretty egregious, ranging from 0.50-1.49%. This compares to competitors like Interactive Brokers (IBKR), who charge 0.12-0.18%. Moreover, institutional investors on COIN, who use a service called Coinbase Prime, get an even better deal. The company likes to tout the growth of institutional investors on its platform, but given they put lower commissions and potentially trade less frequently, to date institutions have not been big revenue contributors.

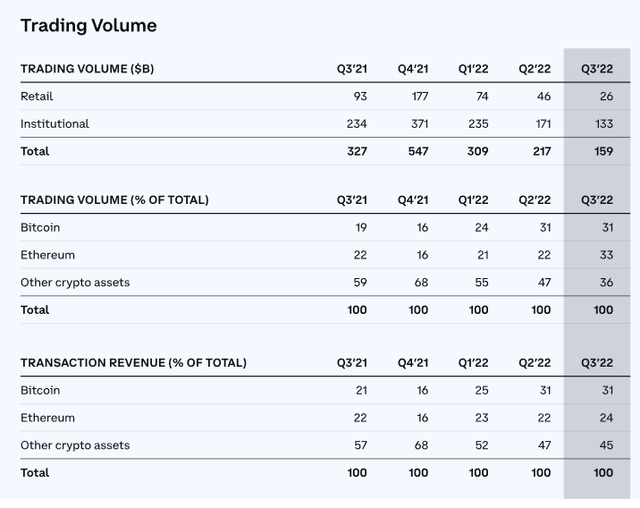

Another big hit to the company is the meltdown of altcoins (e.g., coins other than Bitcoin (BTC-USD) and Ethereum (ETH-USD) which has accelerated with the implosion of FTX (FTT-USD). Altcoin trading represented 36% of trading volume in Q3 but 45% of total revenue at COIN. I believe we will see both declines in altcoin trading volume and take rate.

Coinbase Trading Volumes (Q3 Earnings Supplement)

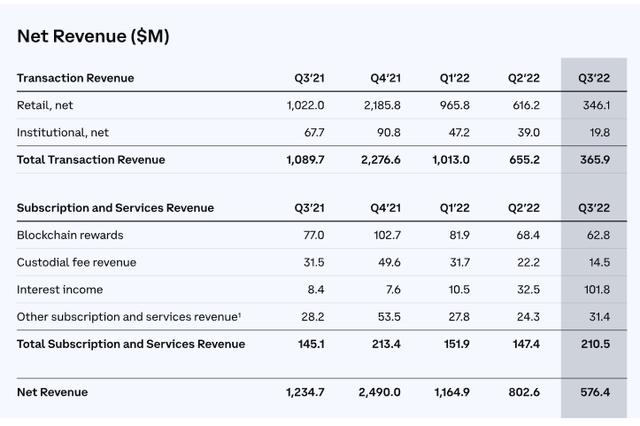

One bright spot the company likes to point to is subscription revenue, which has been growing. However, the biggest part of this subscription growth is interest income, which is basically income the company has been earning on cash left in customer accounts. While it’s certainly possible clients will leave cash in these accounts, I seriously doubt that customers will leave it there for long if they don’t get a fair interest rate.

Coinbase Quarterly Revenues (Q3 Earnings Supplement)

I have heard the argument that the demise of FTX will lead to market share gains by companies like COIN. I think there is some merit to that but not enough to offset revenue pressures. Moreover, beyond the potential of competition and lower fees from other brokerages, there is the potential from competition from decentralized exchanges like Uniswap (UNI-USD). These decentralized exchanges have far fewer employees and therefore far lower cost structures than COIN. These decentralized exchanges have seen similar trading volumes to COIN since FTX blew up.

Valuation

As one can see from the volatility and composition of net revenue above, it is really hard to pin down a topline number. Expenses are easier but still not particularly easy either given what the company has done the past few quarters.

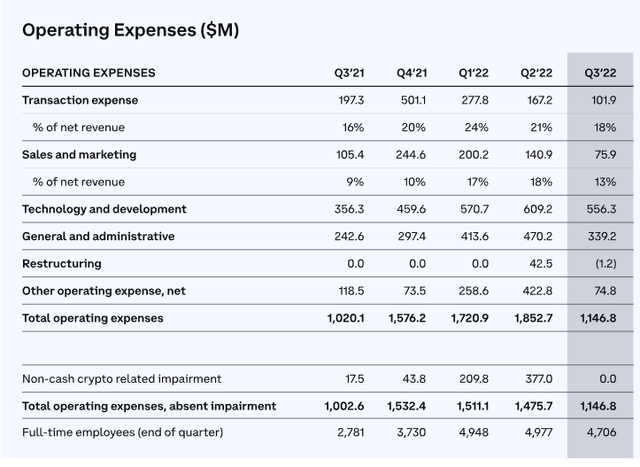

Coinbase Operating Expenses (Q3 Earnings Supplement)

With such volatile top lines and expense lines, coming up with EBITDA and cash flows are very difficult. However, consistent with COIN CFO’s warning on Q3 conference call, I believe that both transaction and subscription revenues will be pressured going forward (even assuming higher interest rates on higher cash balances). The company is pledging to cut cost, but there is a lot of wood to chop there.

As such, I see a strong possibility that the company will be both EBITDA and cash flow negative for the foreseeable future. Against that backdrop, I see the company’s $9.5 billion market cap as highly at risk, even after the major price declines the stock has already seen and a relatively high short interest.

Risks

Given that 18% short interest as a percentage of float, this stock can rally very hard, very fast. For example, the stock popped after mediocre Q3 earnings just on the back of slightly higher-than-expected transactions and the prospect of cost cuts. This volatility is a price to pay for the short or owning puts. I think the trends make it worthwhile, but the volatility needs to be taken into account. Furthermore, if Bitcoin and Ethereum rally, you could see the stock pop too even though I think the company’s fortunes are in trouble no matter what happens to the major coins.

Conclusion

I think this short bet works for a number of reasons: declining altcoin volumes, take rate pressure, customers moving cash out of their accounts, and competition from retail brokerages and decentralized exchanges. One needs some resolve and an iron stomach to hold puts or the stock short, but I see this business in terminal decline with commensurate negative EBITDA and cash flows.

Be the first to comment