Hramovnick

Coal and Fossil Fuels

Renewable energy may be the wave of the future. But the reality following Russia’s invasion of Ukraine is that the reliance on fossil fuels is here to stay for the foreseeable future. While coal may not be the preferred answer, as it is considered the dirtiest of fossil fuels and responsible for some of the highest greenhouse gas emissions, and a large contributor to climate change, the reality is that investors stand behind the surging commodity.

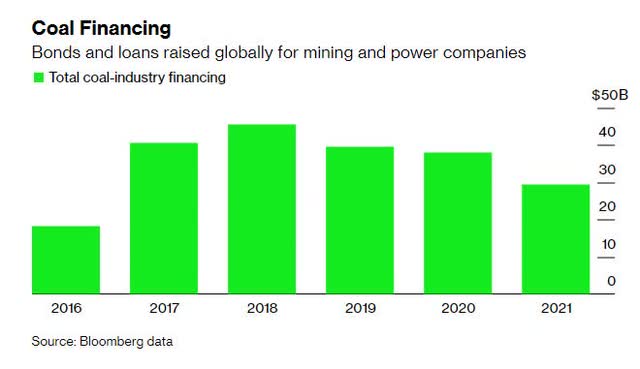

Banks Financing Coal Projects Chart (Bloomberg Data)

Financing for coal-related projects has nearly doubled since last year, and despite the climate concerns, bankers continue to raise money to capitalize on the demand.

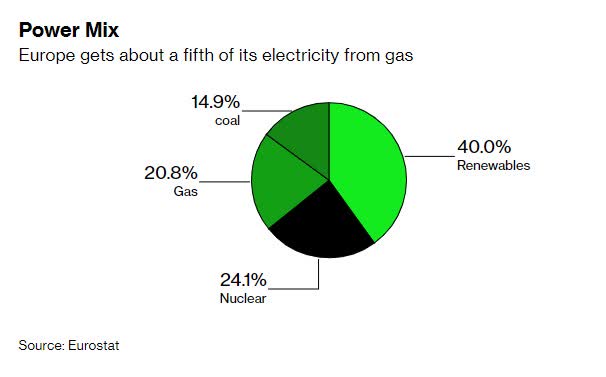

European Power Mix (Eurostat and Bloomberg)

While Europe’s energy mix is diverse, with 40% renewable and approximately 20% natural gas, Western sanctions against Russia’s economy have resulted in Eurozone nations like Germany reopening coal plants. Coal prices began the year trading at $134 per metric ton and are currently selling for $418. This is why Alliance Resource Partners (NASDAQ:ARLP) is well-positioned in the coal pricing environment and why Seeking Alpha Authors and myself rank it as one of our Top Rated Stocks.

According to a report by Trading Economics,

“The International Energy Agency sees coal consumption in Europe rising by 7% in 2022 on top of last year’s 14% surge, with the continent now turning to seaborne coal from South Africa, Indonesia, and even as far away as Australia as it halts imports from Russia. Demand for coal in India, the world’s second-biggest coal importer behind China, is expected to rise almost 10% in 2022 as the country’s economy expands and electricity use increases.”

Given the robust demand and no signs of abating as winter draws near, Europe needs fuel. ARLP offers excellent growth and profitability and substantially increased production, offering investors a great potential stock pick for portfolios.

Investing in Coal Stocks With High Dividend Yields

Historically, coal – like many fossil fuels – is the cheaper but worse alternative to the environment. Despite this, worldwide coal consumption increased by 5.8% in 2021, nearly its most significant annual increase ever, accounting for 56% of the total energy consumption. As one of the biggest coal producers in the United States and a Master Limited Partnership (MLP), Alliance Resource Partners offers high dividend yields, returning most of its earnings to shareholders. With tremendous tailwinds, let’s dive into why ARLP is rated a top stock by SA Authors.

Alliance Resource Partners, L.P. (ARLP)

-

Market Capitalization: $3.23B

-

Dividend Yield (FWD): 6.31%

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 8/23): 3 out of 246

-

Quant Industry Ranking (as of 8/23): 1 out of 16

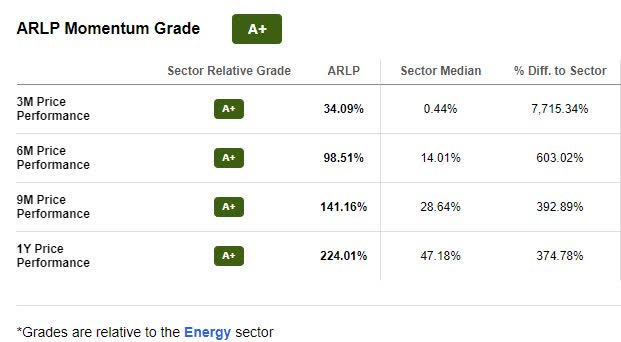

Headquartered in Tulsa, Oklahoma, Alliance Resource Partners is one of the largest coal producers in the U.S., producing and marketing coal to utilities and industrial users nationwide. ARLP’s long-term outlook appears strong given the company’s A+ momentum grade and overall price performance. Strongly bullish, many analysts call the stock overbought as investors are capitalizing on the purchase of this stock, driving the share price higher. As you can see, shares of ARLP have experienced substantial quarter-over-quarter increases relative to the sector, +392.89% over nine months and +374.78% over the last year.

ARLP Stock Momentum (Seeking Alpha Premium)

Short-term price is an excellent indicator of investor interest in a stock, and when compared to the coal and consumable fuels industry, it’s clear ARLP is one of the tops. Given the pent-up demand for coal and ARLP’s discounted valuation, this stock is a strong buy according to Seeking Alpha’s quant ratings.

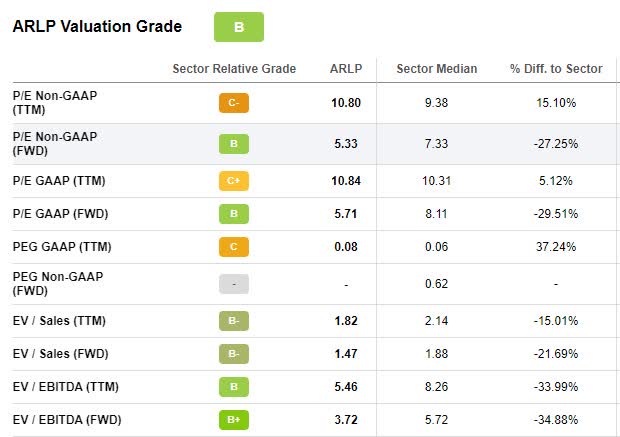

ARLP Stock Valuation

Ranking #2 in its industry and sector and trading at a price under $30/share, ARLP’s valuation is attractive, especially trading nearly 30% below the sector. With a forward P/E ratio of 5.33x, forward EV/Sales of 1.47x, and forward EV/EBITDA of 3.72x, these solid metrics substantiate that this stock comes at a discount with its B overall grade.

ARLP Stock Valuation (Seeking Alpha Premium)

As inflation and recession fears persist, the energy sector has proven resilient, with commodities offering portfolio diversification and a hedge against inflation. Let’s dive into Alliance Resource Partners’ other metrics.

ARLP Stock Growth & Profitability

Possessing a 6.31% forward dividend yield, increased need for fossil fuels, and high demand for coal throughout Europe have led to the tremendous growth of Alliance Resource Partners. ARLP reported Q2 earnings results that beat top- and bottom-line, resulting in two analysts revising FY1 earnings up; EPS of $1.23 beat by $0.29, and revenue of $616.50M beat by more than 70% year-over-year. Not only does the company maintain a solid balance sheet and cash flow, but increasing cash from operations has benefited shareholders looking for regular passive income. ARLP’s management plans to increase its distribution payout, and as noted by fellow Seeking Alpha author Michael Wiggins De Oliveira, Alliance Resource Partners: Coal Miner’s 2023 EPS Could Be Stronger Than 2022.

“ARLP [is] targeting increases to unitholder distributions of 10.0% to 15.0% per quarter over the balance of this year. Consequently, it’s possible that in Q2 2022, ARLP will announce a $0.40 distribution per unit…Looking further ahead, if we were to see just a 10% sequential increase from Q2 into Q3, we would then see somewhere close to $0.55 distribution per unit.”-De Oliveira

Driven by increased sales and higher prices, Alliance delivered strong Q2 results over its critical operating and financial metrics. Coal sales and production volumes were +13.9% and 18.7%, respectively, as royalty sales for oil and gas were up 27.6% and 11.9%, respectively.

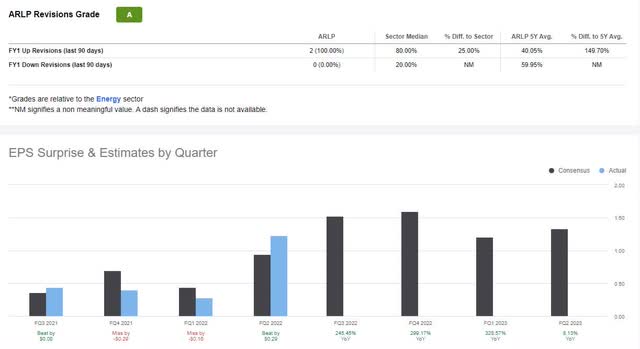

ARLP Stock Revisions & EPS (Seeking Alpha Premium)

With $83.5m in free cash flow, Alliance returned $45.8M to unitholders via a quarterly distribution and has strengthened its balance sheet and fueled the company’s growth.

“These exceptional results were achieved despite the continued negative impact [of] ARLP’s financial and operating results of ongoing transportation disruptions, primarily due to poor performance by the railroads. At the end of the 2022 quarter, approximately 722,000 tons of ARLP’s planned coal shipments were delayed by these transportation issues. We currently expect the bulk of these delayed coal shipments will be delivered over the balance of this year, but we recognize the possibility that some shipments may shift into 2023”-Brian Cantrell, Alliance SVP & CFO.

With its strong outlook and quantitative metrics, I believe ARLP is in a Strong Buy position for portfolios looking to hedge against inflation and capitalize on potential growth and profits while still getting a stock price at a discount.

A High-Yield Energy Stock for Value & Growth Investors

The energy sector (XLE) continues to rally and is +42% YTD, as global coal supplies remain in high demand and short supply. Investing in coal as an inflationary and recession-resilient option offers portfolio diversification, and its pricing power is an excellent option to capitalize on its rising price. Here is a list of SA Quant’s Top Rated Coal Stocks and Top Rated Energy Stocks.

Alliance Resource Partners is very attractive on growth and profitability metrics, possessing forward revenue growth above 26% and forward EBITDA growth above 44%. While also an undervalued company with tremendous tailwinds, Russia’s invasion and continued strife in the Eurozone should allow coal demand to be robust as European nations seek alternative energy sources. With ARLP as one of the largest domestic coal producers, this stock is attractive for portfolios as demand remains high.

Many investors are dedicated to finding discounted stocks that trade at lower prices while wanting to capitalize on growth opportunities. ARLP stock represents both value and growth. Our tools help ensure your portfolio contains strong investments that increase over time. If you’re interested in other SA Quant ranked value or growth stocks, search our Top Value Stocks or Top Growth Stocks for ideas.

Be the first to comment