Brazilian buildings coated in AkzoNobel paint | AkzoNobel

As COVID-19 traverses the globe, I hope you are staying safe and following your local health guidelines.

The concept of a “pandemic proof” company sits uneasily with this writer as I think we have far too little information to predict what will happen in the coming year. I bet you’re behaving very differently this week than a fortnight before. The virus is ever-changing and we are always learning.

COVID-19 is affecting virtually every company on earth, perhaps none more so than AkzoNobel (OTCQX:AKZOF), one of the world’s largest paint and coatings manufacturers. The company’s origins date back hundreds of years but it might be best known in the US for PPG’s failed takeover bid in 2017.

Once a highly diverse entity, Akzo has sharpened its focus with the divestment of Specialty Chemicals in 2018. It is the chief rival to PPG (PPG) and Sherwin-Williams (SHW) and well worth a deeper look.

About

Based in Amsterdam, AkzoNobel is a leading global player in paint and coatings. A part of the modern firm dates back to 1646 and the company has dabbled in all sorts of businesses over the years. Today, Akzo is primarily concerned with architectural paint and performance coatings for planes, ships, cars and industry. You may know its brands such as Dulux, Interpon and Sikkens. The company has over 30,000 employees across the globe and is led by CEO Thierry Vanlancker.

Strengths

Strong Position in Industry

According to Paint & Coatings Magazine, there are three major players in the global paint and coatings industry: PPG, Sherwin-Williams and AkzoNobel.

A recent report from Kusumgar, Nerlfi & Growney, estimated that the global industry was worth $132 billion in 2019. The group predicted annual growth in the industry of 4% through 2024 but we are yet to see the lasting effects of COVID-19.

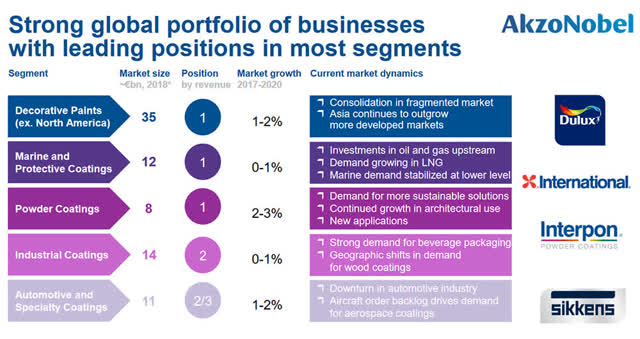

Akzo is a significant player in its chosen markets | AkzoNobel Investor Presentation

Akzo is a significant player in its chosen markets | AkzoNobel Investor Presentation

K,N&G ranked AkzoNobel as a top three presence in decorative paint and a top two player in industrial coatings. The Dutch company puts itself at no.1 in powder coatings, marine and protective coatings and decorative paint (excluding North America).

Whatever the source of info, it’s clear that Akzo has a firm footing in the industry overall.

Solid Balance Sheet

Given the extraordinary uncertainty around, it’s a good thing that Akzo’s finances are in decent shape. The firm ended 2019 with €1.3 billion in cash available and access to a revolver worth €1.8 billion.

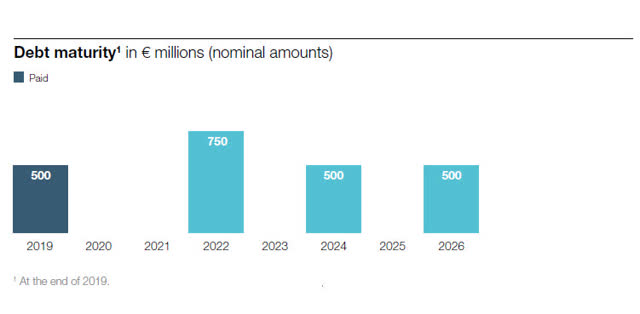

Thankfully, Akzo has a laddered debt schedule | AkzoNobel 2019 Report

Thankfully, Akzo has a laddered debt schedule | AkzoNobel 2019 Report

The company has just over €2 billion in long-term debt on the books but none of that matures in this year or the next. The first large tranche (€750 million) falls due in 2022.

Going into the COVID-19 crisis, Akzo had lower medium grade credit ratings from Moody’s (Baa1) and S&P (BBB+). In the 2019 annual report, management reaffirmed the company’s commitment to “maintaining a strong investment grade rating.”

While it’s too early to tell how well the company can weather the near future, CEO Thierry Vanlancker was confident in a recent update.

“AkzoNobel has a strong balance sheet and solid cash position. At December 31, 2019, net cash and cash equivalents were €1.2 billion and financial leverage was 0.7x net debt/EBITDA.”

Weaknesses

Exposure to COVID-19

Dulux paint made in Chengdu, China | AkzoNobel

Dulux paint made in Chengdu, China | AkzoNobel

Given the hands-on nature of its work, and the company’s strong presence in China, Akzo is particularly affected by the outbreak. The firm has a factory in Wuhan and facilities across the country.

In a news update at the end of March, CEO Vanlancker projected a difficult 2020:

“Headwinds related to COVID-19, including unpredictable and lower end market demand as well as various measures impacting our business operations, are increasing for most parts of the world and will have a significant impact during Q2…The significant market disruption forces us to pause key parts of our transformation and hence to suspend our 2020 financial ambition.”

On a positive note, Vanlancker stated that Chinese operations were getting back to normal. However, with restrictions still in place there and concerns over the virus re-emerging, it’s a situation to monitor.

Slowdown in Segments

Akzo has wide exposure to regions and industries that are challenged regardless of the impact of COVID-19.

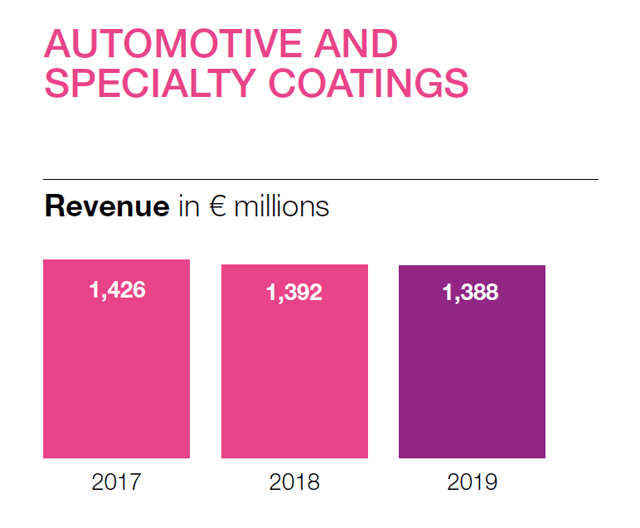

60% of the company’s 2019 sales came from performance coatings with almost €1.4 billion in revenue from automotive and aviation.

Since the peak of 95.2 million cars sold in 2017, global sales have dropped year-on-year and fell 4% in 2019.

Declining revenue | AkzoNobel 2019 Report

Declining revenue | AkzoNobel 2019 Report

Akzo is naturally affected by less demand for automobiles and described 2019 as a “challenging year in automotive OEM segments due to headwinds, in line with overall market dynamics”.

Another area of concern is Europe as 45% of Akzo’s 2019 revenue came from the continent. Growth in the region has contracted in recent years and the ECB predicts a recession between 2-5% in 2020.

Dividend

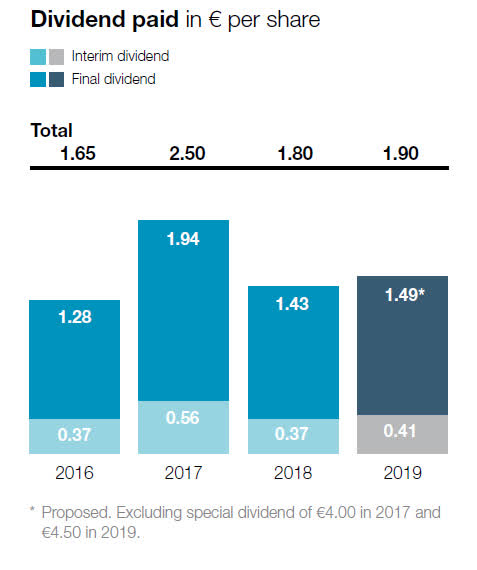

Akzo’s aim is to pay a “stable to rising dividend”. For 2019, there will be a final dividend (paid this year) of €1.90. That’s almost 6% higher than the 2018 outlay giving a current yield of 3.2%.

An increasing dividend in recent years | AkzoNobel 2019 Report

When you browse through the company’s literature, you will notice special dividends related to the divestment of the Specialty Chemicals division in 2018. The current dividend is covered by 2019 earnings per share (€2.42 excluding discontinued operations) but the payout ratio is very high at 78%.

If the COVID-19 outbreak had not happened, I’d have expected a moderate rise in the dividend as the company waited for earnings per share to increase in coming years. Given the current uncertainty however, I doubt there will be an increase and hopefully the company’s strong financials allow it to maintain the payment.

Buybacks

In 2019, Akzo repurchased 31.2 million shares for a total sum of €2.5 billion. That gives us an average price per share of €80.10. This is unfortunate given the current price of approximately €58, but no one could have foreseen the devastation that COVID-19 would reek in 2020.

A new €500 million repurchasing programme was announced in October 2019 with over 5.5 million shares acquired by Akzo up to the end of March 2020. At one stage last month, the company took back 329,000 shares for an average price of €54.84.

Akzo’s share count has decreased considerably in recent times. The weighted average number of common shares fell from almost 255 million in 2018 to 213 million last year, a drop of almost 17%.

Valuation

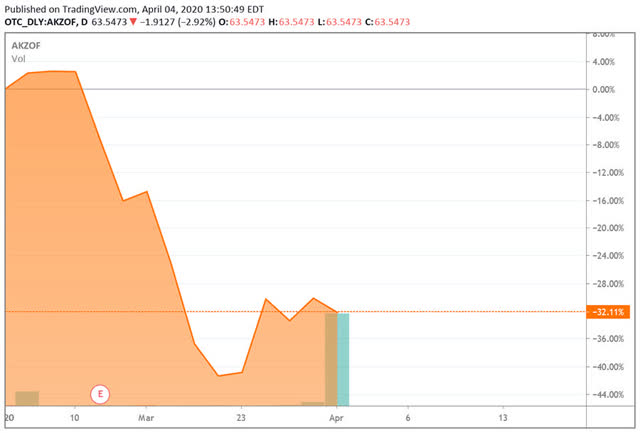

Like most companies out there, Akzo’s share price has taken a hammering so far in 2020. The company’s European stock started the year at €91.24 per share but has lost over a third of its value since.

A look at Akzo’s ADR share decline in 2020 | Seeking Alpha

A look at Akzo’s ADR share decline in 2020 | Seeking Alpha

On January 1st, 2020, Akzo’s trailing price-to-earnings ratio was an extremely lofty 37 if we exclude the discontinued operations. At the start of April, the P/E figure lies at a still elevated 24.

Consensus estimates, which were last updated in February, predict revenue of €9.3 billion in 2020 and EPS of €3.87. However, we’re a long way from resolving the issues around COVID-19 so I’m not paying much attention to earnings projections for the time being.

Conclusion

Going into the COVID-19 outbreak, AkzoNobel was a leading figure in the global paint and coatings industry and I think that will continue whenever we emerge from the current situation.

After analyzing the company’s documents recently, I like the measured management style that balances growth with a solid balance sheet. Under Vanlancker’s leadership, Akzo is clearly making strides to improve margins since the PPG takeover approach.

Notes of concern include the firm’s exposure to regions badly affected by coronavirus, and recessionary trends in sectors like automotive.

Overall, AkzoNobel is a company that suits my investment strategy but I’d be cautious about getting in given the current situation.

To readers, stay safe and be careful with your investments through this period.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment