Abu Hanifah/iStock via Getty Images

Investment Thesis

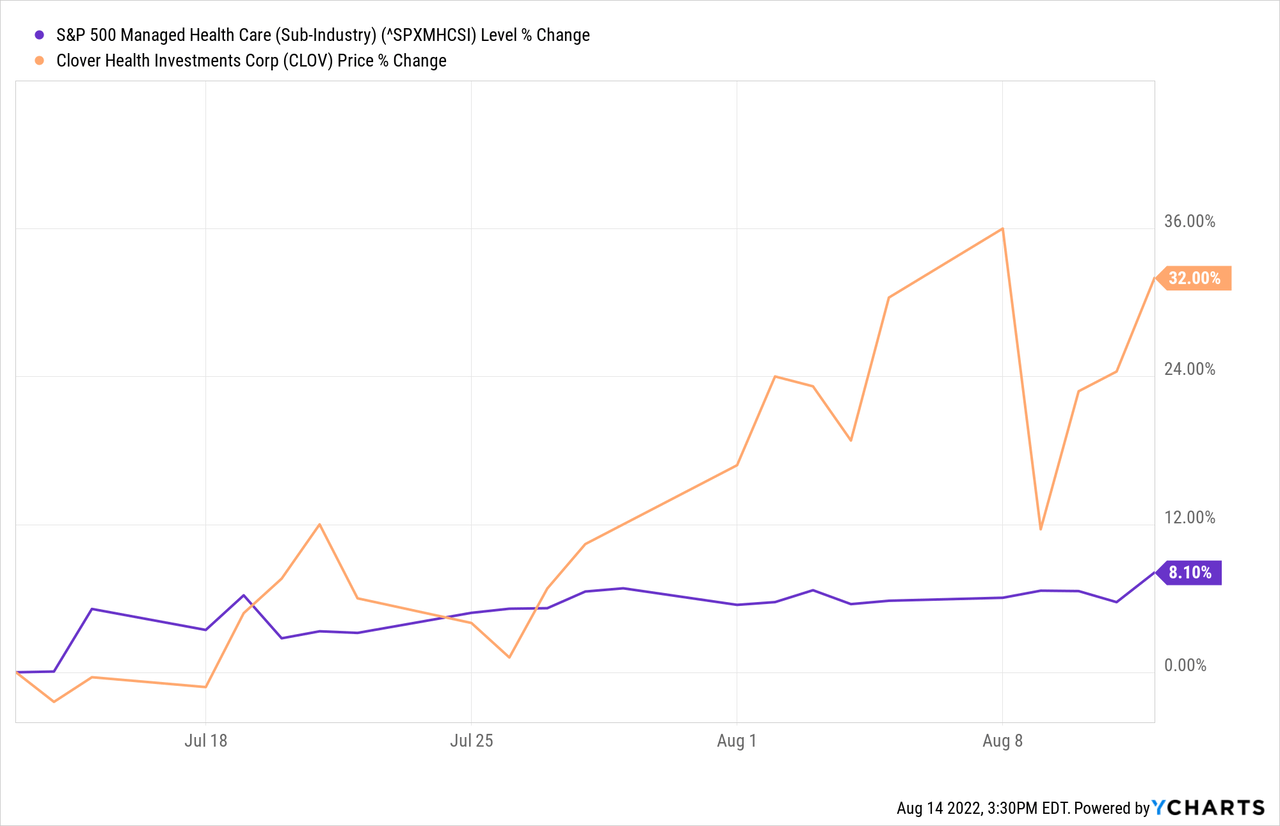

Clover Health (NASDAQ:CLOV) shares rebounded nicely this summer, outperforming S&P 500 Managed Care Index by 24% after reaching all-time lows in March 2022. Seeking Alpha Quant Score captures this improving momentum compared to the three- and six-month periods shown below.

Seeking Alpha Quant Score Ratings

The fledgling Medicare Advantage insurance company delivered on its promises to improve profitability, verifying the sustainability of its unique, open provider network insurance model against all odds, proving doubters wrong.

The company attracted skepticism from hedge funds, who correctly called out the company for overestimating or misleading investors about the capabilities of its patient management system, called Clover Assistant “CA.” The company now faces a class action lawsuit after a judge denied its motion to dismiss and has 11% of its shares on loan in short positions. As outsiders, we can argue all day about the capabilities and value of Clover Assistant. What matters is that the company demonstrated a solid and profitable business model supported by a thriving Medicare Advantage “MA” segment.

Beyond temporary COVID disruptions, data show that the longer a member stays on CLOV’s plan, the lesser their Medical Cost Ratio “MCR.” Whether that be from CA or an insurance agent crunching numbers on an Excel sheet doesn’t matter in my view.

Revenue Trends

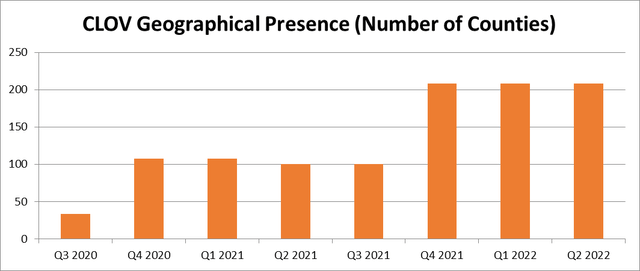

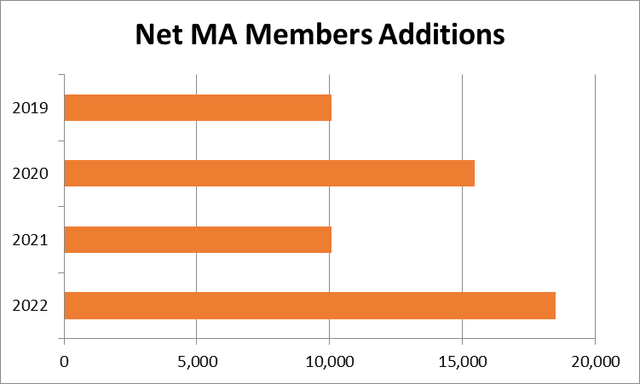

US aging population has long been part of CLOV’s pitch to investors, and one can easily misapply this proposition to revenue forecasts. The industry is highly competitive, with many peers with more expertise in attracting seniors than CLOV. Another factor is the number of counties in which a company operates, which I believe is a more influential growth driver than demographic trends. The platform size, as measured by the number of operating regions, underpin the difference between, for example, Humana (HUM), which added 218,000 new MA members this year, compared to CLOV, which is only working in a handful of States, adding 24,000 new members.

To manage expenses, CLOV decided to slow down its geographic expansion until it absorbs the new members into its platform. As mentioned above, the more time a member stays on its plan, the lower its MCR. Management wisely decided to limit expansion until MCR costs normalize for these new members, especially after the rapid growth in recent quarters.

Author’s estimates based on company filings

Not all counties are created equal. The percentage of people becoming eligible for Medicare varies from county to county, and so does the attitude towards MA, including misconceptions when comparing the service to traditional Medicare. For example, in Wyoming, MA penetration is 3.7%, compared to 51% in Florida. This partially explains why MA members’ additions have varied from one period to the other, demonstrating a non-linear correlation with geographical expansion.

Author’s estimates based on company filings

Direct contracting has been a lifesaver for CLOV; without it, I don’t think it would have achieved the attractive valuation it does today. It was pure luck, thanks to Jared Kushner’s college roommate, who brought the idea to his old-time friend before establishing and leading the program for a few years. Because CLOV runs an open network, allowing members to choose their provider, it received a disproportionate number of members, far bigger than its size compared to other more established companies. Today, two-thirds of lives covered by CLOV are DC members.

When Vivek Garipalli pitched his idea of an open network MA insurer, many were skeptical over the ability of such a model to generate profit. Most insurers channel their members to a limited provider network, concentrating their scale and using it to negotiate lower prices. In the first half of this year, CLOV proved that it could provide an open network and remain profitable. Its MA segment has a GAAP MCR ratio of 94%.

There is still work to be done in the DC segment, which has an MCR ratio of 103%. However, previous patterns show that new members’ MCR rises initially before normalizing profitability. The company almost tripled its DC members in the past six months, creating pressure on expenses and translating to high MCR.

A new program called ACO Reach will replace direct contracting in January 2023, and Clover doesn’t need to reapply and will maintain its current DC members. The new program brings small changes, favorably impacting CLOV due to its strategy focusing on ethnic minorities. First, under the new program, insurers will be allowed to code up risk factors based on ethnicity. CLOV has the highest percentage of ethnic minorities in the managed care industry, standing at 50%. Given this percentage, CLOV stands to benefit more than any other managed care company in the sector. The company will also receive cash for simply reporting the ethnic race of members covered.

Valuation

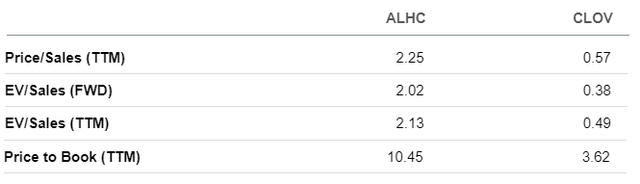

The unprofitability of the DC segment puts pressure on CLOV’s bottom line, making it harder to justify valuation without assuming that the company will succeed in normalizing MCR. Based on historical MCR patterns, I believe there is an 80% chance of success, a figure we will incorporate in the valuation analysis below. Before that, let’s compare CLOV with other emerging (and unprofitable) managed care providers, namely Alignment Health (ALHC).

From the table above, we can see that CLOV trades at a fraction of the price of similar unprofitable MA insurance companies. The growth rate of CLOV is higher than ALHC, supporting our conviction that the former is undervalued. For example, this year, CLOV added about 20,000 new customers, compared with ALHC’s 11,000.

Looking at more established peers such as Humana and UnitedHealth (UNH), we can see that these companies have a net income margin of 3.7% and 5.7% on average in the past five years. Their P/E ratio stands around 20x and is slightly high, and at current prices wouldn’t attract smart money. However, applying a more moderate P/E ratio of 15x and using the profitability ratios of these companies as a proxy for CLOV’s net income margin run rate yields an adjusted P/E ratio for CLOV at EPS = $0.27, based on 475.7 million shares. Applying a 20% discount due to uncertainty regarding its DC segment profitability translates to a target share price of $3.24. These calculations are based on current revenue levels and exclude growth premiums. In other words, statistically speaking, investors buying CLOV today are getting its growth premium for free.

Summary

CLOV likely overestimated the value of CA software, creating a hype among meme traders that has now subdued, leaving bearish mutual funds in the control of the share price, notwithstanding recent stock price momentum. However, this doesn’t matter right now after the company demonstrated its ability to be profitable, as mirrored in its MA segment MCR ratio. The company is undervalued compared to market contenders in a similar growth phase, such as ALHC, and compared to more established peers such as HUM and UNH.

Be the first to comment