LeoPatrizi

Continuing my series of articles discussing dividend strategies, today I would like to take a closer look at the Global X S&P 500 Quality Dividend ETF (NYSEARCA:QDIV), which I touched upon briefly in my note on the Capital Group Dividend Value ETF (CGDV) published recently.

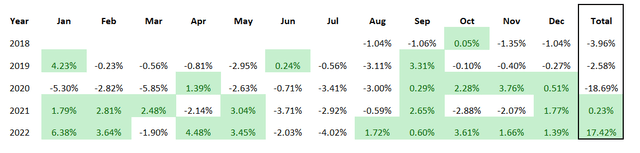

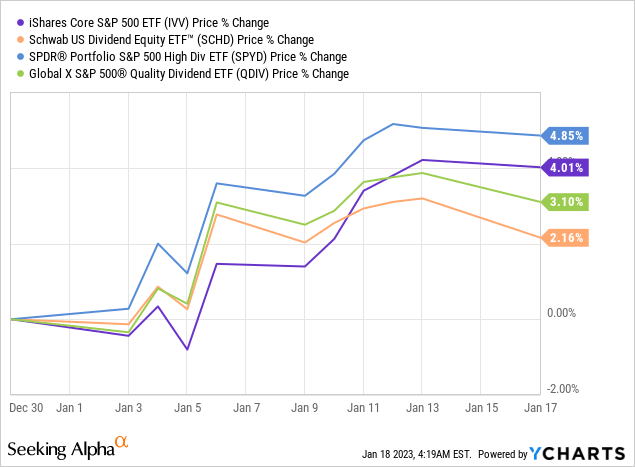

To begin with, the essential advantage of this investment vehicle is that last year, despite the gloom that engulfed the global equity markets, it lost just 74 bps, outperforming the iShares Core S&P 500 ETF (IVV) by a respectable 17.4%, its best result since inception in 2018, finishing ahead of it all months except for March, June, and July. Speaking of the tailwinds, I am of the opinion that its outperformance was mostly supported by the high-yield factor (which might be considered as one of the simpler interpretations of the value factor), as well as impeccable profitability characteristics of its holdings, something investors favor in the capital shortage era. On a side note, monthly distributions are another noteworthy advantage.

Nevertheless, QDIV does have a few drawbacks, principally related to liquidity. Let us delve deeper to weigh up all the nuances and arrive at a balanced conclusion on whether it is worth buying into the fund in the current environment or not.

What principles lie at the crux of QDIV’s investment strategy?

QDIV’s investment strategy is centered on the S&P 500 Quality High Dividend Index. To qualify for inclusion, an S&P 500 constituent must possess a mix of both high quality (measured using Return on Equity, accruals, and financial leverage) and high yield characteristics (assessed using the indicated annual dividend yield). Importantly, to compete for a place in this index, a company cannot be valued at less than $6.1 billion.

Stocks that qualified are weighted equally, while a GICS sector cannot account for more than 25%, a rule added more likely to ensure comfortable diversification; the index is reconstituted and rebalanced on a biannual basis, in June and December.

Delving deeper into the portfolio

As of January 13, the QDIV portfolio included 77 equities, with a pronounced tilt towards the consumer staples (17.4%) and industrials (15.3%) sectors. Large-cap consumer staples traditionally sport premium valuations owing to the resilience of their business models, including the ability to benefit from inflation and also weather a recession relatively unscathed thanks to the inelastic demand phenomenon. Below, I will examine whether QDIV’s large exposure to this defensive sector took its toll on its valuation characteristics or not.

Meanwhile, the fund has almost completely ignored utilities (two stocks, 2.6% weight in total) and real estate (also two equities, 2.5%). It is also of note that QDIV holdings account for only 18.5% of IVV’s net assets.

Tracking a fraction of the bellwether S&P 500 index, QDIV is naturally tilted towards mega- and large-cap stocks, even though the smart beta weighting schema should, in theory, bolster smaller names. So, it did, though only a little. To corroborate, only three of QDIV’s current holdings have a market value below $10 billion, with a total weight of slightly above 4%. At the same time, mega-caps account for over 26%, with Exxon Mobil (XOM), an energy supermajor, being the most generously valued player, sporting a market capitalization of almost $466 billion thanks to buoyant oil market conditions that catapulted its share price last year.

Overall, my calculations show that the weighted-average market cap of the portfolio is $81.9 billion, which is, to contextualize, about 5.2x lower than IVV’s.

Tapestry, Inc. (TPR), a $10.5 billion high-end accessories and lifestyle products company owning the Coach, Kate Spade, and Stuart Weitzman brands, is the most significant holding at the moment, with around 1.5% weight. Its presence in the QDIV portfolio is hardly coincidental as the stock boasts both high-yield and high-quality characteristics. TPR has a dividend yield of 2.5% (close to 1.5x higher than the S&P 500’s weighted average yield), a cash flow yield of 6.3%, and a Return on Equity of 30.5%. Though the latter figure is clearly distorted by a high level of borrowings (~144% Debt/Equity), it does not immediately imply TPR has hidden capital efficiency issues. Contrarily, the Return on Total Capital of over 12% is a strong result.

Quality close to perfect

QDIV’s investment strategy is quality and high yield-centered. And upon deeper inspection, I should justly conclude that it did succeed in picking only the most profitable names from the S&P 500. Let me share a few essential facts to corroborate:

- QDIV has exposure to only one company with a Quant Profitability grade of less than B-, Juniper Networks (JNPR), a C+ rated stock that accounts for 1.2% of the net assets.

- Speaking about capital efficiency, my analysis revealed that the portfolio has an astounding Return on Equity (calculated as a weighted average) of 41.5%. However, the figure is skewed by a high level of debt, like in the case of Kimberly-Clark (KMB) which has a 1518% D/E.

- Nevertheless, the median Return on Total Capital for companies outside the financial sector, a more reliable metric, is 12.1%, which I consider comparatively strong.

- Finally, over 92% of the holdings have a dividend yield below earnings yield, which indicates the DPS is fully covered by earnings per share. Besides, over 88% (ex-financials) have a cash flow yield equal to or materially above the DY.

Valuation: Not completely faultless

- Almost 29% of the holdings have at least a B- Quant Valuation grade and higher, including 8.8% deployed to A-rated. These stocks are principally from either the IT (5 in total) or materials (4 companies) sectors. Unfortunately, I would not say this is optimal as I would prefer close to 50% at least. Yet in fairness, this is adequate for a large-size top-quality equity basket.

- The weighted-average earnings yield is 7.7%, as per my estimates, which means the LTM P/E is less than 13x. Barely surprisingly, the WA Forward EPS growth rate is only 8.7%.

- The WA dividend yield is 3.3% while IVV is approximately 1.7%.

- Finally, the WA Price/Sales ratio is only 2.59x; IVV comes in at over 4.5x.

Performance analysis: Defying bears amid the capital shortage

QDIV was incepted on 13 July 2018. During the August 2018 – December 2022 period, it underperformed IVV, as well as the Schwab U.S. Dividend Equity ETF (SCHD), a fund that has a sophisticated quality ingredient in its strategy, SPDR Portfolio S&P 500 High Dividend ETF (SPYD), and WisdomTree U.S. High Dividend ETF (DHS) that I selected for comparison purposes. Its standard deviation appeared to be the second highest in this group.

| Portfolio | QDIV | IVV | SPYD | SCHD | DHS |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $14,106 | $14,710 | $12,736 | $17,035 | $14,203 |

| CAGR | 8.10% | 9.13% | 5.63% | 12.82% | 8.27% |

| Stdev | 21.93% | 19.47% | 23.33% | 18.69% | 18.40% |

| Best Year | 28.99% | 31.25% | 30.18% | 29.87% | 23.03% |

| Worst Year | -14.13% | -18.16% | -11.53% | -7.46% | -7.52% |

| Max. Drawdown | -31.10% | -23.93% | -36.55% | -21.54% | -25.89% |

| Sharpe Ratio | 0.41 | 0.48 | 0.3 | 0.67 | 0.46 |

| Sortino Ratio | 0.59 | 0.71 | 0.41 | 1.08 | 0.68 |

| Market Correlation | 0.91 | 1 | 0.84 | 0.93 | 0.86 |

Created by the author using data from Portfolio Visualizer

Looking at annual and monthly performance, QDIV had a fairly lackluster 2018, as well as 2019, and especially 2020, when it grossly underperformed IVV as the latter capitalized on the pandemic winners that were on a tear thanks to the ultra-loose monetary policy that supercharged the massive rebound after the March sell-off; meanwhile, high-yield names languished. But the tables turned in 2021 when the capital rotation reinvigorated value stocks.

Created by the author using data from Portfolio Visualizer

Conclusion

QDIV favors high-yield S&P 500 stocks without compromising on quality. This is a strategy investors have reasons to like, for instance, because it is capable of filtering out yield traps by assessing capital efficiency and leverage.

Even though it had subpar years in the past, QDIV solidly outperformed IVV in 2022. It has also started 2023 on an up note.

I believe QDIV deserves a Buy rating owing to adequate (for the mega/large-cap echelon) value characteristics, as well as quality nothing short of excellent.

I anticipate this mix to continue performing strongly at least until the inflation issue dissipates completely. Its expense ratio is comfortable, just 20 bps.

There are risks too. First, I highlight a small AUM of just $63.4 million as the main concern; however, trends are encouraging. Second, the fund has exposure to overpriced stocks; ~30% have a D (+/-) Quant Valuation grade and worse, and unsurprisingly, the bulk of them (9 companies) are from the consumer staples sector.

Be the first to comment