MaboHH

Deal Details

In May of this year, Broadcom (AVGO) and VMware (NYSE:VMW) announced an agreement in which Broadcom would acquire VMware for about $61 billion in cash and stock. The deal is expected to close during Broadcom’s fiscal year 2023, which begins in November of this year. The deal is structured to allow VMware shareholders the choice between receiving $142.50 in cash or 0.2520 shares of Broadcom common stock for each VMware share. These elections will be subject to proration, meaning 50% will be completed in cash and 50% in Broadcom stock. The average consideration for the acquisition will be approximately $138-$140/ share, compared to about $122/share for VMware currently, representing a premium of 13-16%. Of course, aggressive traders could choose to buy call options or use leverage to greatly enhance this return. Although it is important to note that trading activity to 2023 call options for VMware is limited, making liquidity and pricing a concern. The deal has been approved unanimously by the board of directors of both companies and is awaiting full regulatory approval. As part of the deal, Broadcom will assume $8 billion of VMware net debt and secure $32 billion in new financing, which is already committed.

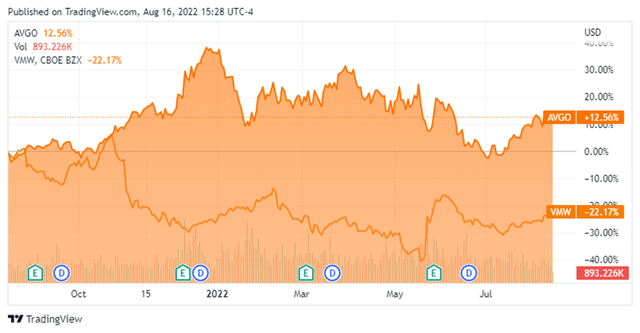

The premium that can earned by buying shares of VMware now is attractive given the high probability that the deal will close. While VMware traded into the low $130s following the announcement, it slid below $110 with the broader sell-off in tech that may have bottomed in July and is now in the low $120s. Given the weakness in stocks this year, and technology in particular, the spread on this deal remains wider than one would expect. Broadcom has a long history of growth through acquisition and has already mapped out its transition plan in detail for all stakeholders of both businesses. Acquisitions made by Broadcom in recent year include Brocade Communications Systems in 2017, CA Technologies in 2018, and Symantec Enterprise Security in 2019.

1-year performance of AVGO and VMW (Seeking Alpha)

Complementary Businesses

VMware, founded in 1998, provides multi-cloud services for apps, and is best known for its virtualization technology. The company now focuses on cloud management and infrastructure, networking, security, and digital workspaces. By acquiring VMware, Broadcom will increase revenue earned from software sales to approximately 49% of all revenue. Furthermore, Broadcom expects to add about $8.5 billion to its EBITDA within three years of closing the transaction, about a 50% increase from where it is today.

Broadcom develops, designs, and supplies what it calls semiconductor solutions and infrastructure software. The company services data centers, networking, enterprise software, broadband, wireless, storage, and industrial markets globally.

Broadcom is a Strong and Capable Buyer

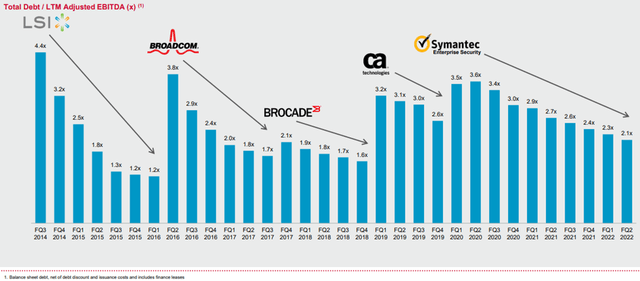

Broadcom is in exceptional financial condition with over $9 billion in cash, rapidly growing revenue and net income, and is trading at about 14x forward earnings. The company also pays a healthy dividend with a current yield just under 3% and has renewed its commitment to paying out 50% of the previous year’s free cash flow to shareholders. Broadcom’s dividend per share has grown at a compound annual growth rate of 43% since 2016. Company management has committed to paying down debt following the VMware acquisition to return the total debt/EBITDA ratio to below 2.5x within two years.

Deleveraging Following Acquisitions (Broadcom)

The risks to the deal not closing appear manageable. Given Broadcom’s track record over decades and the approval of the board of directors at both companies, the likelihood that this deal closes is high. Possible setbacks would be if there are any regulatory issues that are currently unknown preventing/slowing the closing, the $32 billion of financing falling through, or other unforeseen changes to market conditions or those directly related to either business.

VMware Will be Accretive to Broadcom’s Business

Once acquired, Broadcom shareholders will own about 88% of the company and VMware shareholders will own 12% on a fully diluted basis. Broadcom sees VMware’s business as a key component to the company’s long-term growth strategy. VMware is a leader in an established and growing business, boasts an impressive IP portfolio, and will add significantly to operating results of the combined entity. Broadcom management has identified several avenues through which it believes it can greatly increase VMware’s contribution to EBITDA. From growth of recurring revenue channels, to adding depth within current customer relationships, to eliminating redundant administrative functions, Broadcom believes it can increase EBITDA for VMware from $4.7 billion in fiscal year 2022 to a target run rate $8.5 billion shortly after closing the transaction.

Final Thoughts

Given the fundamentals of both Broadcom and VMware combined with Broadcom’s long-term acquisition strategy, this deal has a high probability of closing, and likely within the next year. If the deal is derailed and doesn’t close, traders are left holding an industry leader that is well-positioned for continued growth for the foreseeable future. Due to the weak start to the year for stocks, and particularly the tech sector, this trade offers a strong premium that is low risk in a volatile market. I look forward to your feedback in the comment section below.

Be the first to comment