The CD Player Is Still Working Though

mgkaya/iStock via Getty Images

Get the Title? No? Here is a hint.

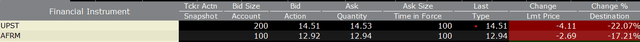

Interactive Brokers

When we last covered Upstart Holdings Inc. (NASDAQ:UPST), we did not play coy with the message. Sure, this was oversold and yes, we did not want to get in on the short side with such a large short interest, but the case for owning this stock remained abysmal. Specifically, we said,

Fundamentally, though, this is about as broken as it gets. Revenues are going to go down substantially, and we will likely get more downward pressures when we hit a recession. Reverse engineering profits is very hard, and what we mean by that is you cannot contract into profitability. In our opinion, you can write off even the possibility of GAAP profits in 2023.

Source: Yeah, That Was Really Bad

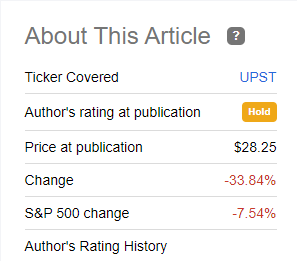

Upstart handily underperformed the broader market since then, and the only relief bulls got was from the fact that $0.00 was not too far off.

Seeking Alpha

We look now at the recently released results and tell you if it is time to get long this growth name.

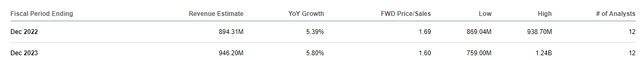

Upstart had guided to $170 million in revenues for Q3-2022 and as expected, analysts circled around that number.

Seeking Alpha Q3-2022 Estimates

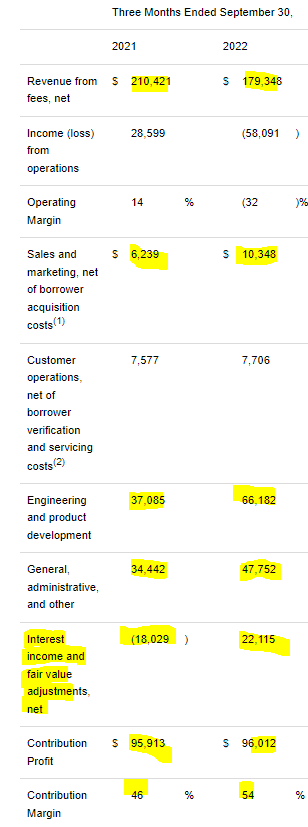

Upstart blew through the low end and total revenue was $157 million, a stunning 30% drop from last year. Transaction volume was worse at a 48% drop from 2021 and only $1.9 billion of loans were originated. Contribution profit edged up a bit, and margins improved a good deal. This was a bit of a surprise considering how steeply volumes dropped off. It was even more interesting in light of the fact that expenses went up in every single category with engineering and product development up by 78% year over year.

UPST Q3-2022 Press Release

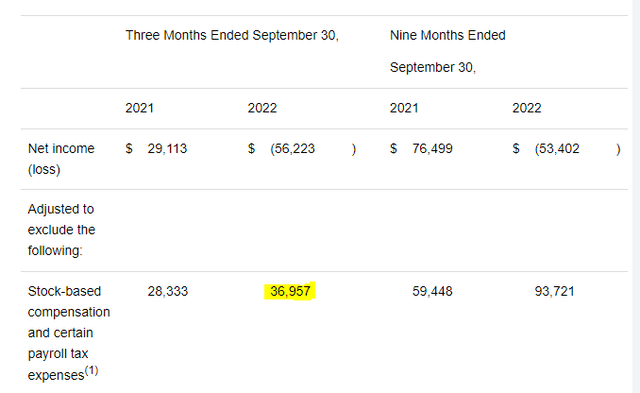

The magic came from the “interest income and fair value adjustments” category and that changed the bottom number. Even getting past the unusual nature of this adjustment, losses were everywhere. GAAP loss, and the only one that counts here, was $56 million.

Guidance & Outlook

If readers will recall, our bet with the bulls was on something rather specific.

We are going to go out on a limb here and say that UPST misses the 2023 revenue estimate number by at least 50%.

Source: Yeah, That Was Really Bad

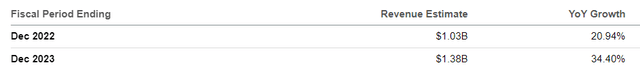

We were referring to revenue estimates which seemed to have appeared straight out of Narnia.

Analyst Estimates On Aug 8 2022

Upstart guided for a paltry $135 million (midpoint) in revenues for Q4-2022. If you annualize that, you come to $540 million. That number would validate our stance in spades. The problem is that no one on Wall Street is close to this number.

Analyst Estimates Today

The downgrade cycle is not even close to being over when revenue estimates are so far above where the company is going to come in. With reverse economies of scale in play, expect GAAP losses to reach $3.00-$4.00 per share on a $540 million revenue base. This is likely generous, as stock-based compensation alone is running at $150 million a year.

UPST Q3-2022

Verdict

The players change but the story remains the same. Upstart’s model is broken and apparently only functions when things are really good. We say “really good” because we have not hit the official recession benchmark and things have completely fallen apart. In our last three articles we suggested that this was making a beeline for the tangible book value. This tangible book value is now close to $7.50/share. Of course, we have been so right on the speed of the decline in revenues, that we now have to factor in a faster erosion of tangible book value.

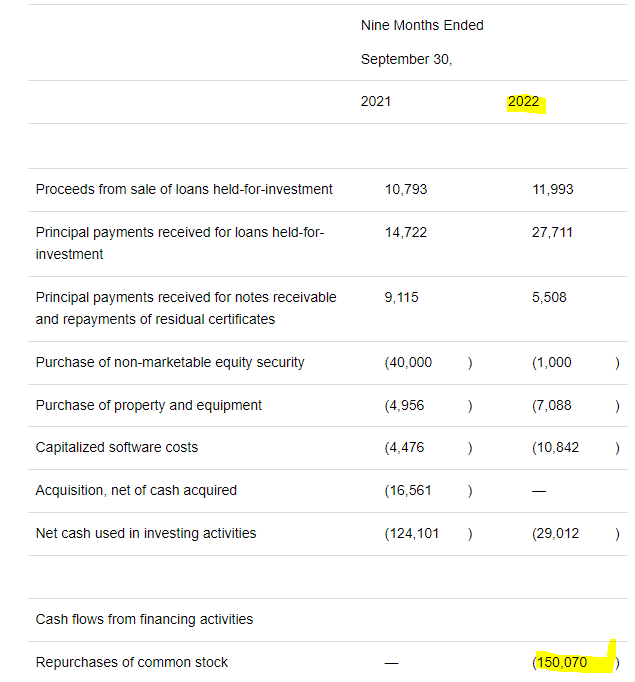

Upstart has also made things worse for itself by blowing through $150 million on stock repurchases.

UPST Q3-2022 Press Release

In the latest quarter purchases were at an average price of about $27/share. All these buybacks have done little to stop stock-based compensation from diluting the overall share count. They have also done little to restore investor confidence in the company.

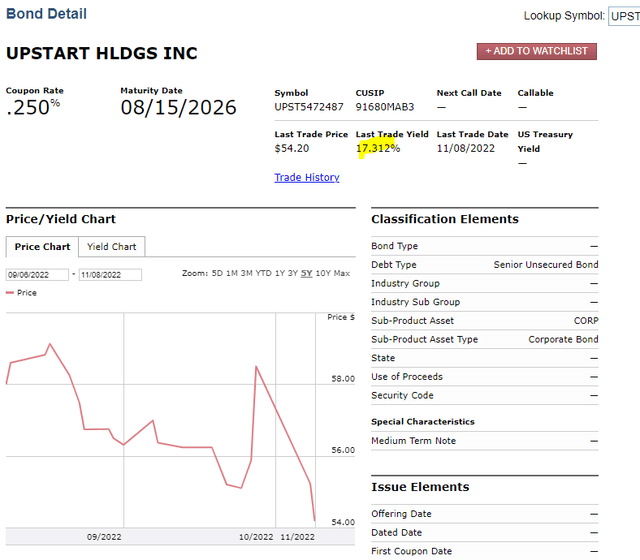

What it has done is reduce the flexibility to react to negative market conditions. On our last action piece, we suggested that investors only consider the notes which had a big double-digit yield to maturity.

FINRA

After these results and seeing our bearish slant get validated, we are suggesting investors not even consider these notes. There is no growth. There are only losses in store and at the burn rate that is coming ahead, we are now agreeing with the bondholders that the 17% yield is not remotely appetizing. Look for single digits soon and a reverse split in 2023.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment