PonyWang/E+ via Getty Images

Investment thesis

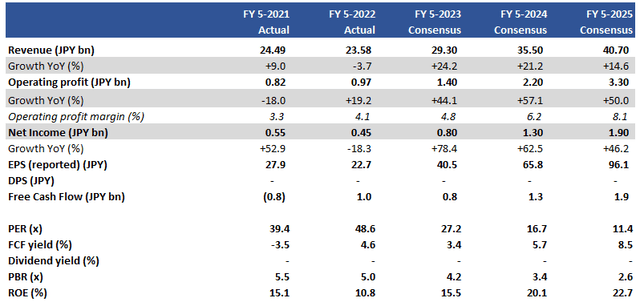

Consensus estimates predict a sustainable double-digit growth outlook for Japanese influencer production and management company UUUM (OTCPK:UUMMF). We have concerns over the business model with its low profitability pointing to limited competitiveness, and patchy track record over the last 4 years. With the shares trading on PER FY5/2023 27.2x, we rate the shares as neutral.

Quick primer

Established in 2013, UUUM is a Japanese management and production company for online influencers and conducts marketing services. The largest proportion of revenue is derived from AdSense online advertising revenue on YouTube. It has Japan’s most popular YouTuber HIKAKIN on its books and had 191 exclusive content providers and 13,818 affiliated video channels in May 2022. It aims to expand its business to different social media platforms, build alliances with other social media platforms, and creators and provide comprehensive advertising services.

The company benefitted from the pandemic lockdowns as quarterly channel views peaked in Q4 FY5/2020 at 14.4 billion views. Since then, quarterly views have been steady at around 12.0 billion similar to pre-pandemic levels.

FY5/2022 results showed slight negative reported sales growth YoY of 3.7%, but this was due to an accounting policy change in revenue recognition; underlying growth was 10% YoY.

The company’s operating margins peaked at 6.3% in FY5/2019 and averaged 4.5% over the last 4 years.

Key financials with consensus estimates

Key financials with consensus estimates (Company, Refinitiv)

Our objectives

UUUM has embarked on a plan to lower its dependency on YouTube AdSense revenues which made up 45% of FY5/2022 total sales by 1) expanding to new business spheres with influencers such as person-to-consumer (P2C) advertising, TV appearances, events, and merchandising, and 2) comprehensive social marketing services to include both digital and TV advertising. With increasing competition, changes in influencer popularity, and a sense of a maturing market, we want to assess whether these strategies will be meaningful for the company.

P2C to the rescue?

Many in the marketing industry believe that there is a consumer-driven shift toward P2C advertising. This is an extension of B2C, whereby an influencer shares a business or brand’s message directly with the consumer. This is seen as a more effective tool as the targeted audience prefers to talk to a person they like and respect, unlike a corporate brand.

UUUM says that they began to get some traction in P2C advertising in Q4 FY5/2021, but only managed to generate JPY1.1 billion/USD10 million in sales in FY5/2022. However, as over 60% of this was in Q4 FY5/2022, there appears to be a major acceleration in recent demand. The company expects this to be a key driver for growth in FY5/2023, and we estimate P2C advertising will grow to around JPY4.0 billion/USD360 million YoY.

What appears to be key for UUUM is that thankfully despite the relative lack of growth in channel views, this has not necessarily meant a fall in popularity of the key exclusive influencers on their platform. Management seems to be aware that it needs to focus its resource on the real rainmakers and have reduced the number of influencers with exclusivity from 313 in FY5/2021 to 191 in FY5/2022 (page 19). With this core group, it does look likely that P2C advertising will be a new source of sales growth for the business as it becomes a more accepted practice in the marketing industry. The bigger issue is whether this type of advertising is an incremental positive or will simply substitute current forms of online marketing – we believe it is somewhere in the middle, and that UUUM should see some benefit from this trend.

Context-driven marketing

To date, UUUM has focused on developing advertising income by producing tie-up content between influencers and brands on YouTube. Whilst this has been both a logical and successful outcome, the company has been operating purely in the online marketing space and it has aimed to expand into traditional media markets such as terrestrial TV and promotion activities such as events which together still make up over 50% of the domestic advertising industry. The company has also begun to successfully run YouTube-unrelated video advertising campaigns.

Shift to traditional media could result in lower returns versus digital marketing given the need for greater resources and less automation. However, it will serve to grow sales volume and act to reinforce the influencers’ commercial value on their books positively. A potential issue could be whether online influencers will have the same pulling power outside of digital media (the average Japanese TV audience has an older age demographic not usually associated with YouTubers). Some in traditional media appear convinced, with UUUM announcing a joint venture with traditional domestic advertising agency giant Hakuhodo DY Holdings (OTCPK:HKUOY) this month.

Valuation

Consensus estimates have the shares trading on PER FY5/2023 27.2x on 44% OP growth YoY, and with free cash flow yield at 3.4%. These current valuations in isolation do not look hugely discounted, and perhaps for a microcap look perfectly adequate pricing with current growth prospects. One also sees that with low single-digit operating margins (only 4.1% in FY5/2022, average of 4.5% over the last 4 years), there appear to be limited margins for error in business execution.

What is more attractive is the medium-term view held, with consensus appearing confident in predicting steady high double-digit earnings growth into FY5/2025, resulting in an attractive free cash flow yield of 8.5%. However, operating margins rising to over 8% look too bullish.

Risks

The upside risk to investing in UUUM is continued sustained earnings growth in the business as it successfully scales via expansion in P2C and traditional media advertising.

Downside risk appears to stem from whether the company has a truly defensible and differentiated business, which is slightly doubtful given its low levels of profitability. Loss of key influencer talent, changing economics at YouTube, investment costs for business expansion, and increasing competition may mean that future earnings growth may not be as simple as currently predicted; the pandemic was a clear tailwind, but sales volumes have not grown dramatically over the last 4 years.

Conclusion

With the current share price at nearly half of the IPO price in August 2017, investors may think that the company is cheaply priced and an opportunity to invest. Consensus estimates point to a positive outlook, but we believe the risk-reward is not conducive and attractive enough. Our key concerns are management’s relatively poor track record over the last 4 years which places a limit on future margin expansion, the limits over how defensible the business appears, and valuations that look fair at best. We rate the shares as neutral.

Be the first to comment