Sundry Photography

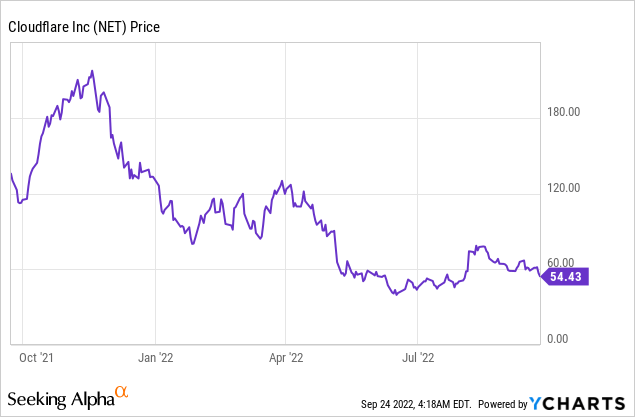

Cloudflare (NYSE:NET) is on a mission to “build a better internet”, the company plans to do this through its vast network of data centers globally. Its stock price has been butchered by 74% from its all-time highs, due to the high inflation and rising interest rate environment which has compressed the valuation multiples of “growth stocks”. However, the business has still been growing strong and recently beat both revenue and earnings estimates in the second quarter. In this post, I’m going to break down the business model, financials, and valuation, let’s dive in.

Business Model

Cloudflare is one of the world’s most widely used Content Delivery Networks [CDNs] and Cloud Security platforms. A CDN basically consists of a network of data centers all over the world that hold a “cached” version of a website you are visiting. For example, imagine you’re in Los Angeles, California, and want to access a website that is based in Japan. Then rather than you trying to pull the files directly from Japan, the website will likely have a copy or cached version of the website at a data center in Los Angeles. A closer data center means, the website request is likely to be executed much faster and provides a better user experience. In addition, this acts as a nice security measure which means if there is a hack or disaster in one data center, you should still be able to receive the website files from another, in networking we call this “redundancy”.

Cloudflare operates at a ginormous scale and the company estimates 95% of the world’s population is within just 50 milliseconds of a Cloudflare data center. The business has coverage across over 100 countries and 250 cities, which includes China. Cloudflare also has plans to link over 1000 office buildings and multi-dwelling apartment buildings directly into their network.

Cloudflare Map (Investor presentation 2022)

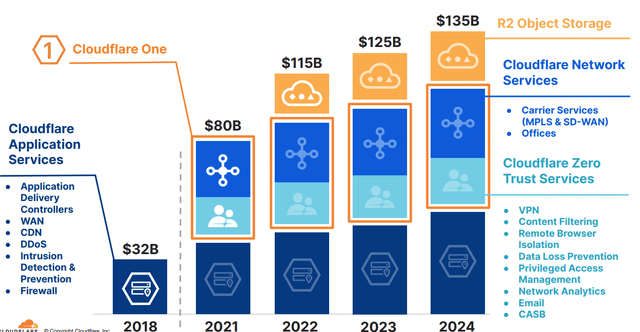

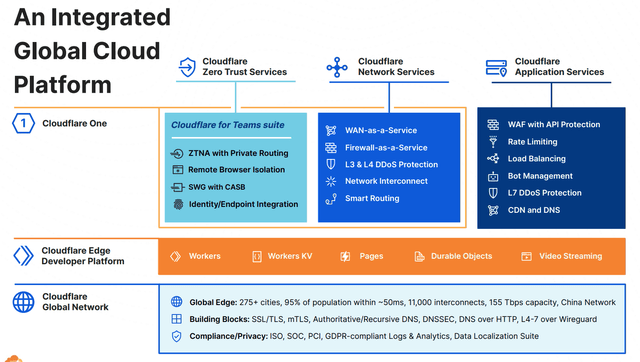

Cloudflare is not just a CDN, as you can see from the graphic below the business is using its global network or backbone to build SaaS applications and services on top. Cloudflare One is its flagship platform which provides three main services; a Zero Trust service, Network services, and applications.

Zero Trust is a cybersecurity framework that aims to give users on a network “least privileged access”. This basically means that users are only given access to the applications they need, for example; the manufacturing department is given access to an inventory database but not to finance applications. This may seem like common sense but most networks are setup in the opposite way in that once you log in you can access pretty much everything, this is really dangerous when it comes to cyberattacks as hackers can move laterally.

A Zero Trust Network Architecture can be combined with private routing can effectively offer a faster, safer alternative to a Virtual Private Network or VPN. This is especially necessary given the rise in hybrid workforces, which must access a corporate network remotely. The main competitor and market leader in Zero Trust Networks is Zscaler (ZS) a stock I have covered previously. However, due to the market size and growth Cloudflare still has an opportunity to gain traction. The Zero Trust security market was worth $23 billion in 2021 and is forecasted to grow at a compounded annual growth rate [CAGR] of 17.5% and reach nearly $100 billion by 2030.

Cloudflare’s Network services consist of firewalls and wide area network [WAN] as a service. A WAN is basically used by corporations to connect different regional offices on the same network. In addition, Cloudflare offers DDoS [Distributed Denial of Services] protection which helps to prevent a popular cybersecurity attack. A DDoS attack effectively overloads the capacity of a server with multiple requests. If you have a corporate network with physical hardware it can only handle so many requests. Whereas, with the cloud, an overload is much more difficult as they would have to try and take down multiple data centers.

Cloudflare also offers applications such as DNS [Domain Name System] which translates a website name such as “Google.com” into the IP address of the server which hosts the website.

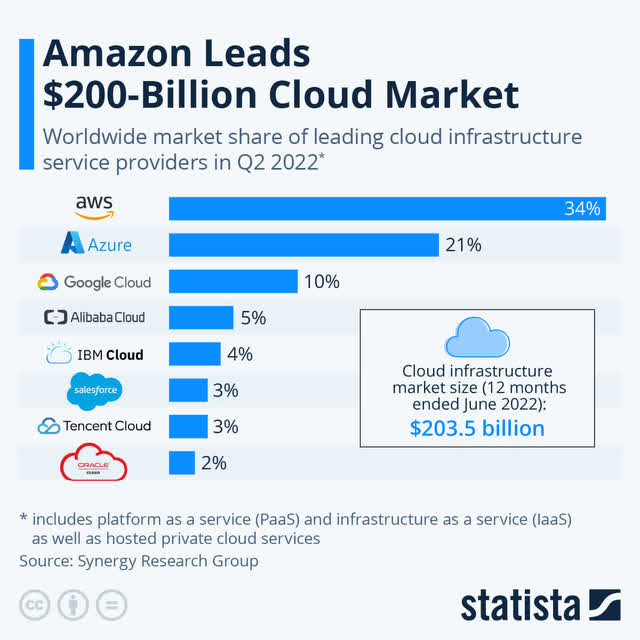

The cloud industry is dominated by the three main titans, Amazon (AMZN) with AWS, Microsoft Azure (MSFT), and Google Cloud (GOOG) (GOOGL). Cloudflare doesn’t have anywhere near the scale or technology prowess that these businesses have. However, the business does offer a great alternative as a “hybrid” cloud provider as the platform can be used to integrate with AWS, Azure, and Google cloud, as well as on-premises hardware.

Hybrid cloud is more popular than you may think with 82% of IT leaders saying they have adopted the hybrid cloud, with close to half deploying between two and three public cloud providers. Thus Cloudflare is expected to have a total addressable market of $135 billion by 2024.

TAM (Investor Presentation 2022)

Growing Financials

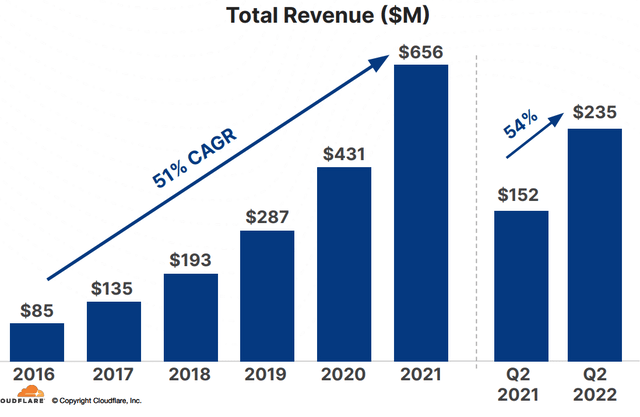

Cloudflare generated strong financial results for the second quarter of 2022. Revenue was $234.5 million which increased by a blistering 54% year over year. This beat analyst estimates by $7 million and is even greater than their 6-year average CAGR of 51%.

Revenue (Cloudflare Investor Presentation)

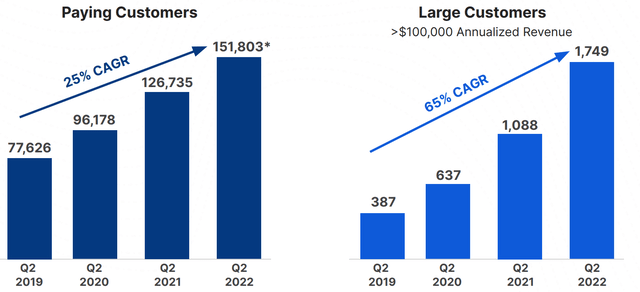

Cloudflare’s CDN operates with a freemium model which attracts many smaller website publishers (I use them for my own website). However, the company then uses a “land and expand” approach to up-sell to larger customers. Cloudflare defines “larger customers” of those with >$100k of annual revenue. In the second quarter, the business added a record 212 new larger customers, to a total of 1,749 which now contribute to over 60% of total revenue.

Cloudflare Customers (Investor report 2022)

The CEO exuded confidence in the Q2 earnings call, with regards to going head to head with more established competitors such as Zscaler. For example, a Fortune 500 energy company signed a $784,000 three-year deal with the business, moving from Zscaler as they found Cloudflare to be easier to use and it integrated better.

“We like our win rates when we go head-to-head with Zscaler and Palo Alto Networks because our product is better and can scale to meet the needs of complex organizations” – Matthew Prince (Cloudflare founder and CEO)

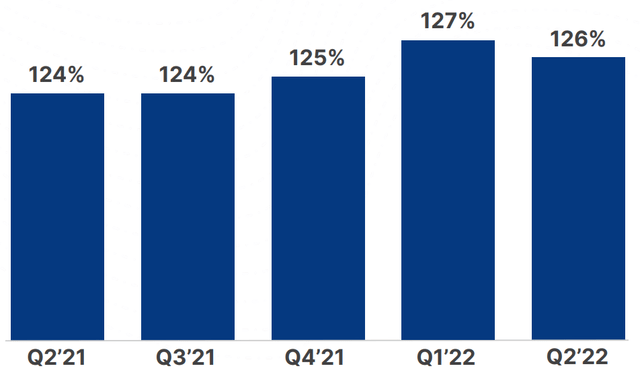

A key indicator to watch when analyzing any SaaS business is its Net dollar retention rate. In this case, Cloudflare had a retention rate of 126% in the second quarter which is up 2% year over year. This shows customers are finding the product “sticky” and spending more through upsells. This makes complete sense, as there are high switching associated with moving your website or IT services to the cloud. Most companies will have the mentality of “if it is not broken don’t try and fix it”, which is ironically why it has taken businesses so long to move to the cloud in the first place. Therefore a land grab is happening right now in the cloud market. I envision a point in time when almost every company in the world will have at least some of their IT in the “cloud”. This is driven by many reasons including efficiency, flexibility and cost savings.

Cloudflare generated a strong gross profit of $178.7 million with a margin of 78.9% which actually increased by 20 basis points sequentially despite cost pressure.

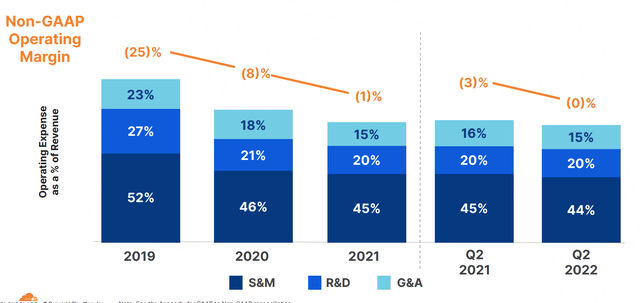

Operating expenses as a portion of revenue increased 3% sequentially, however it did decrease by 2% year over year to 79%, which was a positive sign. The company hired aggressively in Q2 and increased its headcount by 49% year over year to over 3,000 employees.

Sales and marketing expenses were $103.9 million in the quarter, this decreased to 44% from 45% in the same quarter last year, which was a positive sign. R&D expenses were $46.2 million which was flat year over year.

G&A expenses were $35.8 million, which decreased by 1% year over year. Overall the business is showing signs of operating leverage as it scales which is a positive sign.

The business generated an operating loss of $891,000 which was a vast improvement over the $4 million loss produced in the equivalent quarter last year. When I dive under the hood I discovered that the business would have turned a positive profit if not for the acquisition of Area 1.

Non GAAP operating Margin (Investor Presentation August 2022)

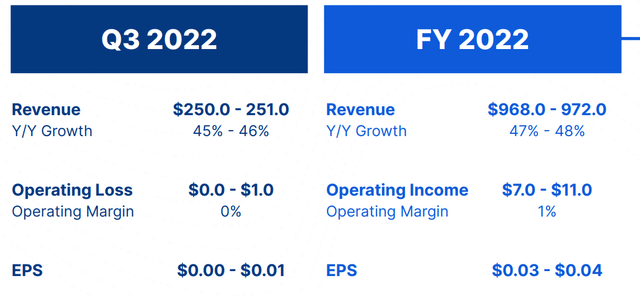

Free Cash flow also showed improvement, with a negative $4.4 million generated vs a negative $9.8 million in the prior year. Moving forward, management guided for 47% to 48% year-over-year revenue growth to $968 million in the full year 2022. With positive operating income between $7 million and $10 million or a 1% margin for the full year 2022.

Cloudflare has a solid balance sheet with cash, cash equivalents and short term investments equal to $1.6 billion. In addition, the company has long term debt of approximately $1.4 billion.

Advanced Valuation

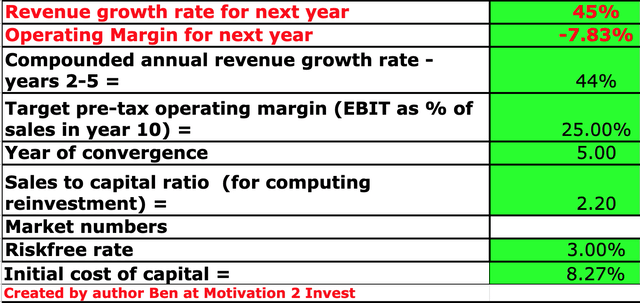

In order to value Cloudflare, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 45% revenue growth for next year and 44% per year over the next 2 to 5 years, which is fairly conservative given guidance and past growth rates of over 50%.

Cloudflare stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted the business to continue to gain market share in the cloud and its operating margin to continue to improve to 25% over the next 5 years. In addition, I have capitalized R&D expenses to improve the accuracy of the valuation.

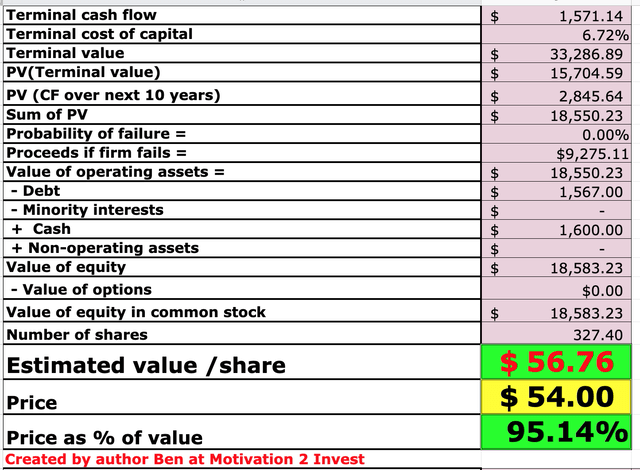

Cloudflare stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $56/share the stock is trading at ~$54 per share at the time of writing and thus I will deem it to be “fair value”.

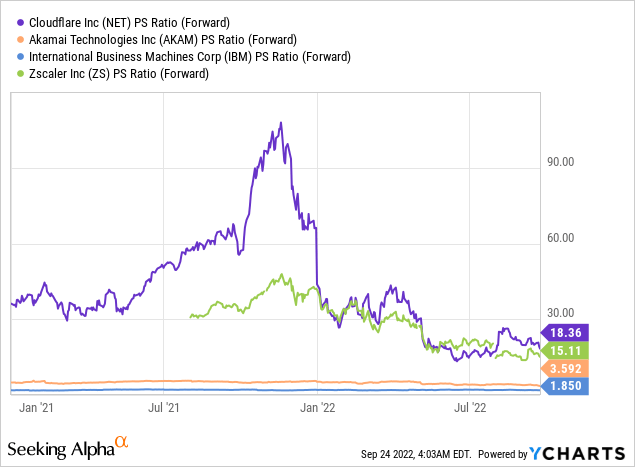

As an extra data point, Cloudflare trades at a Price to Sales Ratio = 18.4, which is cheaper than historic levels of over 100 in 2021. However, the business is trading at a slightly higher valuation than competitor Zscaler. In addition, it is much more expensive than CDN competitor Akamai (AKAM) which trades at a Price to Sales = 3.6.

Risks

Recession/IT spending slowdown

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. These recession fears may cause businesses to cut back or delay IT spending. Management highlighted signs of this in the first quarter but have adapted their strategy to focus more on an “ROI driven” value proposition for customers which has worked well.

Final Thoughts

Cloudflare is a leading CDN and is poised to become a major player in hybrid cloud and applications. The company has been growing its revenue strong and the TAM is huge. Cloudflare is “fairly valued” intrinsically and thus looks to be a great long term investment on the future of the internet and the cloud.

Be the first to comment