David Ramos

Thesis

We urged investors in our previous update on Microsoft Corporation (NASDAQ:MSFT) stock to be cautious in adding at those levels, despite its robust summer rally to form its August highs.

However, the main bugbear with MSFT is undoubtedly its valuation. Despite its battering from its November 2021 highs (down 32%), its valuation was not attractive at its August highs amid harsher macro headwinds. Furthermore, Microsoft’s PC business could be further impacted by weak end demand at the PC OEMs, aggravated by challenging comps and record inflation. The enterprise environment has also turned more cautious, with the sales cycle getting more deliberate and stretching longer. Therefore, MSFT valuation multiples need to account for these headwinds accordingly to justify execution risks over the next few quarters at least.

Notably, MSFT has fallen back to its June lows and re-testing its critical support zone. We have yet to discern a bullish reversal that could help stanch further downside volatility. However, the opportunity for a reversal from here is still possible, given the pace of the recent pullback.

We also deduce that its valuation is more attractive now, which could support a bottoming process predicated on its June lows.

Therefore, we believe it’s appropriate to revise our rating from Hold to Buy and encourage investors to start layering in.

MSFT Stock Is At Most Fairly Valued, But Not Cheap

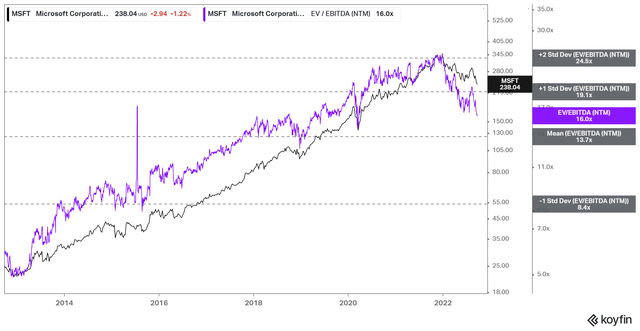

MSFT NTM EBITDA multiples valuation trend (koyfin)

MSFT surged to NTM EBITDA multiples that exceeded its 10Y mean in November 2021. Notably, it settled at the two standard deviation zone above its mean. As a result, one could even argue that MSFT was well-overvalued at those levels. Furthermore, those were such frothy levels that even CEO Satya Nadella managed to sell over $285M of his holdings in November 2021, while the “long-term” investors held on. If Nadella was a stock picker, he nailed it with his timing in clearing his massive inventory of MSFT shares.

However, the battering over the past year has sent MSFT falling back closer to its 10Y mean of 13.7x, but still not there yet. Notwithstanding, we believe that zone seems robust, as it has supported MSFT against further downside since 2018. Hence, we posit that the market has likely re-rated MSFT, given robust execution in its cloud business.

Microsoft Can Sustain Against Recessionary Risks

We believe there’s little doubt that no company can be immune to a looming recession engineered by the Fed’s rapid rate hikes. Even Microsoft CCO Judson Althoff accentuated this in a recent September conference. He added:

The economic environment is arguably the most uncertain we’ve seen in decades. [But], if you think about it at a macro level, customers right now are still trying to solve the same problems they were trying to solve before this economic crisis unfolded. And then on top of that, cybercrime is on the rise. The bad guys aren’t slowing down. And so threats are coming from everywhere, even nation-states, and preparing your enterprise to be able to tackle those things is a very difficult thing. And so all of that happens on top of having to find a way to solve for it while spending less money. (Goldman Sachs Communacopia + Technology Conference 2022)

Therefore, we believe it’s pretty clear that the company remains confident of its secular opportunities through the cycle, given Microsoft’s scale, technology leadership, and integration capabilities. As a result, investors shouldn’t understate Microsoft’s competitive moat through an economic recession, given its secular drivers.

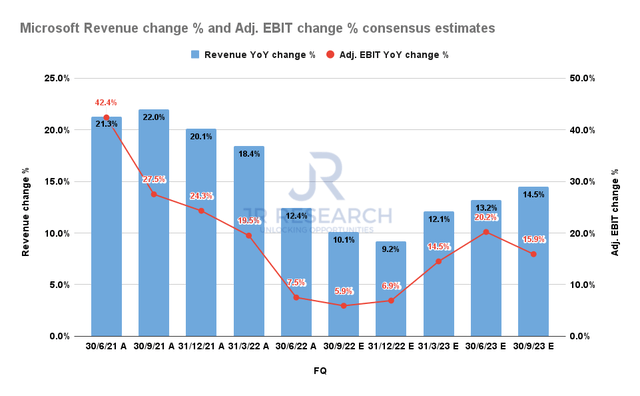

Microsoft Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

As seen above, we believe the consensus estimates (very bullish) are credible, as the Street projects for Microsoft’s revenue and adjusted EBIT growth to reaccelerate from 2023. Therefore, Microsoft is not expected to suffer a cyclical hangover from the impending recession that could hurt economically sensitive industries more significantly.

Notwithstanding, the marked digestion in its PC business should continue to put further pressure on its near-term performance. However, Microsoft’s robust cloud business should help mitigate the weakness, even though investors should expect a slowdown over the next few quarters.

We assessed that the market has likely anticipated these challenges, coupled with tougher comps to lap, as it pummeled MSFT over the past year. Moreover, the market understood that Microsoft couldn’t sustain its peak valuations as its growth could slow.

Is MSFT Stock A Buy, Sell, Or Hold?

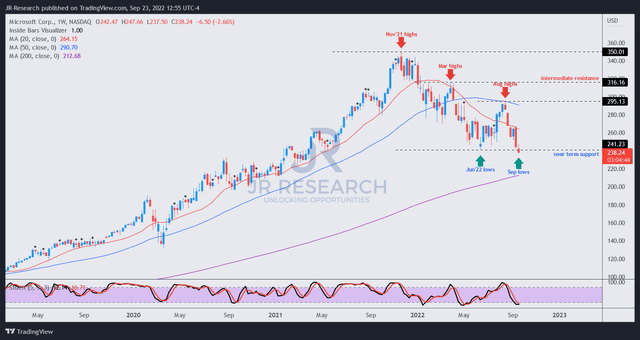

MSFT price chart (weekly) (TradingView)

MSFT remains in a medium-term downtrend, with its recent August highs forming its near-term resistance zone. However, investors should note that MSFT’s long-term uptrend bias remains intact. Hence, investors need to assess whether they expect its June lows to hold robustly, despite the recent significant pullback.

Our assessment indicates that the pummeling from its August highs is emblematic of a rapid plunge to force capitulation over the past five to six weeks. Hence, we expect to find robust buying support at the current levels that could help deny further selling downside. However, we must caution that we have yet to observe a bullish reversal. Hence, if you decide to add exposure, it could prove to be premature.

More conservative investors can consider waiting for a validated bullish reversal over the next few weeks or wait for a sustained bottoming process. However, we are confident that its valuation has improved adequately back into fair value zones for investors to start layering in.

As such, we revise our rating on MSFT stock from Hold to Buy.

Be the first to comment