hapabapa

Overview

Zillow (NASDAQ:ZG) is currently undervalued by ~200%. I believe ZG’s true value will be realized once we get past this horrific macro environment that admittedly is not good for ZG. However, once we get past this, ZG should continue to sustain its leadership position and be a winner in the U.S. residential home industry.

Business description

ZG gives users instantaneous access to information about selling, buying, renting, and financing homes. It has three main divisions (ZG 2021-10K):

- Homes: The Homes segment contains the financial results from our direct purchases and sales of homes via Zillow Offers (discontinued on Nov 2021), as well as the financial results from title and escrow services provided via Zillow Closing Services.

- Internet, Media, and Technology (IMT): Premier Agent, rentals and new construction marketplaces, dotloop, ShowingTime, display, and other advertising and business software solutions.

- Mortgages: Profits from Zillow Home Loans mortgage originations and advertising to mortgage lenders and other mortgage professionals make up the bulk of this revenue stream.

As of FY21, the revenue split between these segments are 74% Homes, 23% IMT, and 3% Mortgages. ZG operates only in the U.S.

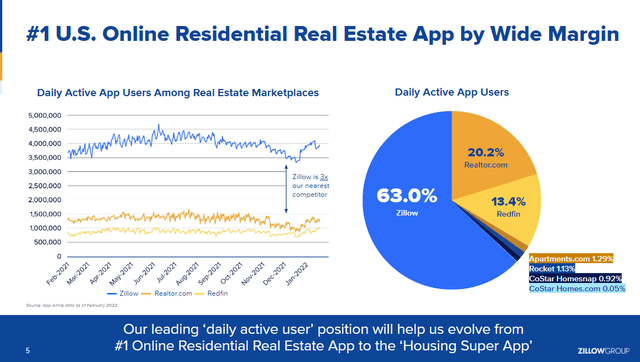

Number 1 player in a large core TAM with room to expand to adjacencies

ZG serves a massive core TAM (house transactions) that is estimated to generate around $100 billion in annual revenue by 2021, or about 5% of the entire $2 trillion residential real estate market. As of FY21, ZG is used by 67% of U.S. home buyers, while only 25% of actual U.S. home buyers have reached out to connect with ZG. ZG’s 234 million MAUs are nearly three times as large as those of the runner-up, making them the primary driver of their market dominance.

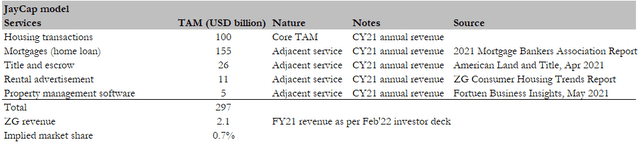

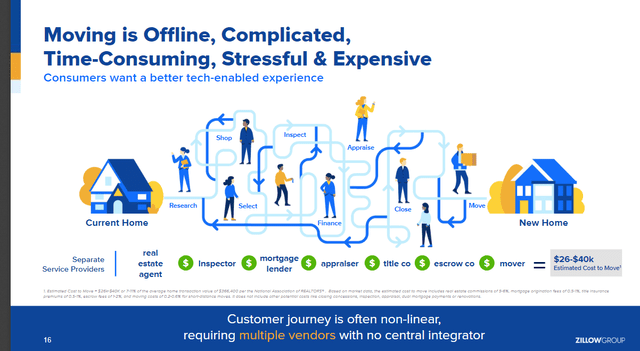

In addition to its core TAM, ZG provides adjacent services that nearly triple its TAM, from $100 billion to $297 billion. ZG has a 0.7% market share as of FY21. I believe ZG has many opportunities to expand this TAM, such as home insurance, home renovation services, moving services, and home appraisal services. Rolling out all of these services would significantly increase ZG’s growth runway and turn ZG into a one-stop shop for all home buyers’ needs.

Author’s estimates ZG Feb 22 investor deck

In short, despite having a massive user base and a dominant position in its ecosystem, Zillow’s revenue is only 3.6% of its TAM, as demonstrated by the above analysis. I believe ZG can, and it intends to further expand its TAM and has been rolling out services to consolidate control of the lead market.

Flex model increases conversion and monetization rates

Historically, ZG has made money off of real estate agents by selling advertisements to those who wish to link up with ZG users and ultimately convert them into homebuyers. The prices for the ads were determined through a cost-per-impression auction, also known as market-based pricing. A real estate agent fronted their own cash for the ad, with the expectation that some fraction of the leads gleaned would eventually result in a closed deal. Typically, the buyer would wait a few weeks after the ad was paid for before making the purchase. Working capital issues have made it hard for ZG to increase its share of platform economics in the past.

However, the introduction of Flex has radically changed the economic and incentive framework. Flex, Zillow’s new monetization strategy for its Premier Agent advertising division, was introduced in 2018. With Flex, the traditional up-front cash payment is swapped for a riskier, contingent consideration paid at the deal’s close. Agents pay Zillow a large commission share (typically 30-35% according to Flex Pricing), but they don’t pay until the deal closes because Zillow takes on all the risk. The impact of this update is substantial because it allows Zillow to send leads to the best-performing agent teams rather than the team that happens to win an ad auction. Conversion rates benefit from this. Users of Flex can save money in the long run by delaying the need to spend money on advertising, which they can then use to better resource their company for increased responsiveness and wider prospect coverage. By connecting the customer with a more receptive and competent agent, these alterations have the potential to boost close rates and improve the customer service experience overall.

I expect a sizable effect on ZG’s profit economics as a result of the increased adoption of Flex as it becomes more central to the business. The company’s rapid expansion with high incremental margins is not hard to conceive of, as the expansion does not require any minor adjustments on the part of the target audience, which is a major plus. ZG is in a good position to sell additional products to homebuyers and sellers as it continues to consolidate the market and increase its consumer share. Mortgage loan origination and closing are two of the most obvious areas for growth. ZG has made inroads in both categories in recent years, acquiring businesses to serve as the foundation for their offerings. This is a smart move on their part because neither category requires a huge investment in capital intensity or balance sheet risk, and each has a high revenue per transaction compared to market-based pricing or Flex.

Data is king

Ultimately, ZG is addressing the information gap (price discovery) between buyer and seller. The only way to solve this is to have a large number of data points, which only comes with scale. ZG’s database of over 135 million homes in the U.S. is the result of complex data aggregation from multiple sources of property, transaction, and listing data, as well as user updates to over 38 million property records. In 2021, Zillow also become a licensed brokerage, giving it access to higher-quality, real-time data from multiple listing services across the U.S. through a significantly reduced number of data feeds.

Partnership with Opendoor is a plus

It is still debatable whether iBuying has sustainable economics at scale and across the housing cycle, but it is clear that ZG has alternatives to being the counterparty and risking its balance sheet when providing products and services to sellers. ZG’s partnership with Opendoor (OPEN) is an illustration of this concept; under this arrangement, ZG receives a referral fee on sales while OPEN is responsible for managing its balance sheet. In terms of profitability and capital requirements, this product is vastly superior to the one ZG just got out of.

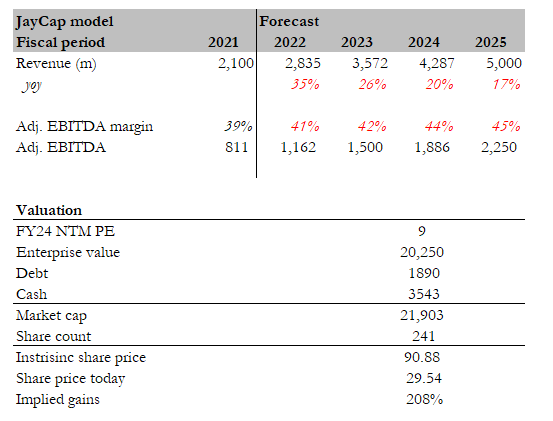

Forecast

Based on my investment thesis, I expect ZG to continue to sustain its leadership position due to scale and profitability to improve. For my model, I expect revenue to hit management’s FY25 guidance of $5 billion, representing ~ 24% CAGR. I believe this is definitely possible given the huge TAM that ZG is operating in. At $5 billion in revenue, ZG is still only ~2% of the entire TAM. As for profits, adj. EBITDA margins should hit management’s FY25 guidance of 45%, thereby generating $2.25 billion of adj. EBITDA. I believe ZG can definitely achieve this given the mix shift impact of Flex.

I calculated an intrinsic value of $90.88 based on the aforementioned assumptions and a 9x NTM EBITDA (which is where it is trading today), which is 200% higher than the current share price of $29.54.

Author’s estimates

Red Flags

Heavily dependent on the health of the U.S. housing market

To thrive, ZG needs a strong residential real estate market in the United States. The company could suffer losses from a number of uncontrollable sources. In the event of a recurrence of COVID-19, for example, a rise in the unemployment rate, an increase in interest rates (which is currently occurring), or a drop in consumer demand (happening now).

Mortgage segment growth is dependent on the capital markets

ZG’s Home Loans funds the majority of its lending operations through warehouse and loan repurchase facilities, which are reliant on third parties willing to take on this risk. As a result, in order to expand this segment, ZG must constantly find willing parties to take on this risk. In a risk-off environment like the one we’re in, parties willing to take on this risk typically demand high interest rates as compensation; this could result in a margin squeeze because ZG may not be able to pass on all of the rates to the borrower.

Huge TAM attracts competition

ZG operates in a huge TAM, which is a good thing. However, as with all industries that have attractive unit economics and a huge opportunity set, they attract competition. Until such a time when ZG has a very large market share, where it can set a price ceiling to reduce the profit economics of a new player and stay profitable, the long-term margin guided by ZG could take a long time to realize.

Conclusion

ZG is undervalued at its current share price as of the date of this writing. ZG is a leading player with an extremely long runway of growth, stemmed by the larger TAM that can be further expanded by offering more services. The introduction of the new revenue model provides near-term upside to profitability and enables ZG to solidify its leadership by garnering more users onto its platform. The current macro environment may not be the best set up for ZG, but I believe once we get over this, ZG will be a real winner in the U.S. residential home industry.

Be the first to comment