undefined undefined

Author’s note: This article was released as part of the CEF Weekly Roundup released to members on June 29, 2022. Please check latest data before investing.

The rights offerings for Cornerstone Strategic Value Fund, Inc. (NYSE:CLM) and Cornerstone Total Return Fund, Inc. (NYSE:CRF) have expired. We analyzed the rights offering situation in some detail when it was first announced in a previous CEF Weekly Roundup.

Cornerstone rights offerings

In brief, this was a 1-for-3 offering where the subscription price was the greater of 112% of NAV or 65% of the market price at expiry. Cornerstone rights offerings are relatively unusual as far as CEF offerings go, for two reasons. First, the subscription offering formula guarantees that the offering will be accretive to the funds, which is beneficial for long-term shareholders. Secondly, the funds have a generous over-allotment policy of up to 100% of the primary subscription, meaning that each fund can grow its share count by up to 66.7% in one go if both the primary subscription and the entire over-allotment are fully subscribed.

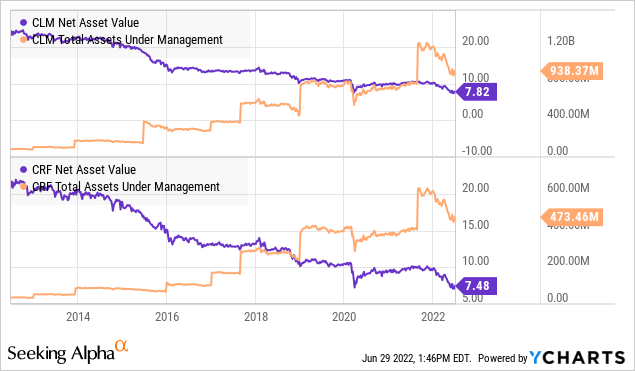

Because of the Cornerstone funds’ frequent rights offerings (which happened most years), the funds have successfully managed to grow their AUM by many times over even while the NAV/share dwindles due to paying out unsustainable 21% yields.

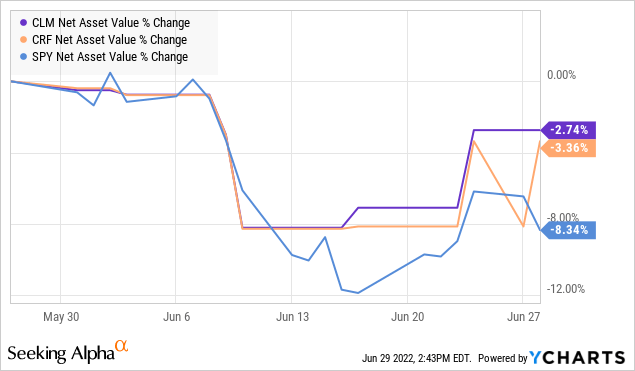

YCharts

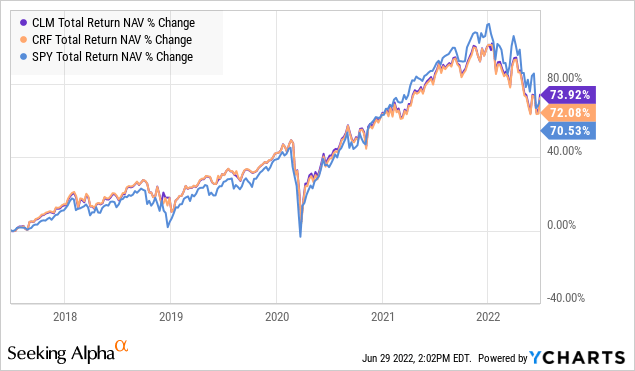

Yet, despite the destructive nature of the return-of-capital distributions (destructive ROC), the total NAV return (including distributions) performance of the funds have matched, nay even exceeded the S&P 500 (SPY). This is mainly due to the accretive rights offerings that provide a boost to the NAV/share of the funds. In terms of their actual portfolio, they match the S&P 500 fairly closely.

YCharts

Sell-and-rebuy beats buy-and-hold, again

Of course, investors buy and sell at market price, not NAV. For the Cornerstone funds, an individual investor’s performance could be even better if they time their buys and sells according to the regular rights offerings that the funds conduct. Here, we recommended Income Lab members to sell CLM/CRF in advance of their impending rights offering and to buy back later in a previous Weekly CEF Roundup:

For those who currently hold CLM/CRF shares, then my suggestion is to perform the “sell and rebuy” strategy where you sell now and then rebuy at a hopefully lower price once the rights offering concludes.

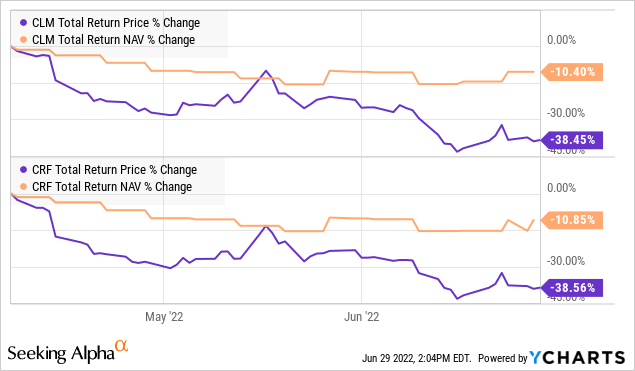

This recommendation has been proven to be correct once again, with CLM and CRF’s price returns dramatically underperforming their NAV returns since the original announcement of the rights offerings. One could easily now buy back the previously sold CLM/CRF shares and gain over +60% of “free shares” of the funds that way. This would have been a much better result than holding the entire position* through the offering period and subscribing for slightly discounted shares. Free shares are better than discounted shares, am I right? (*We’ll discuss the hold a token amount and oversubscribe strategy below).

YCharts

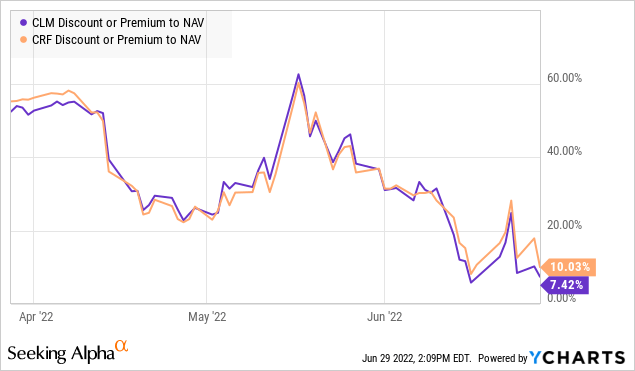

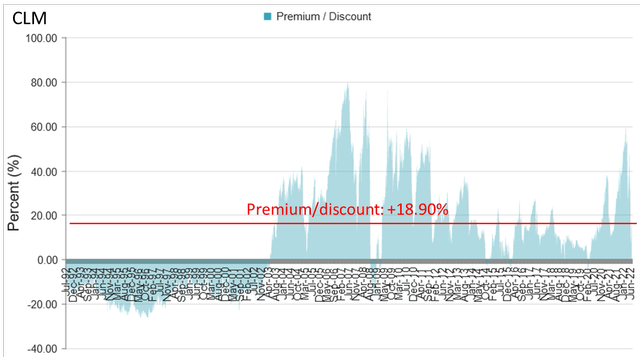

The underperformance was due to the funds’ collapsing valuations, which generally happens over rights offering periods. The drop in premia for CLM and CRF was especially severe this time as it coincided with the onset of a bear market in the broader equity markets.

YCharts

Also, see that spike in premium back up to the +60% level in mid-May? If you remember, this was due to the announcement by Cornerstone that the rights offerings would be suspended. One week later though the managers announced that the offerings would resume at a later date, and the premium dutifully retreated. We also discussed this in a previous CEF Weekly Roundup.

Rights offerings were highly accretive

CLM closed at a share price of $9.70 and an NAV of $7.38 on the expiry date of June 10, 2022, equating to a premium of +31.44%. The 112% NAV floor kicked in, resulting in a final subscription price of $8.27. Similarly, CRF closed at a share price of $9.10 and an NAV of $7.10 on the expiry date, for a premium of +28.17%. The final subscription price based on the 112% NAV floor was $7.95.

CLM received $783 million in subscription and CRF received $410 million in subscription requests. These are very impressive numbers, given that CLM and CRF had AUMs of $938 and $473 million before the offering, and demonstrate investors’ strong enthusiasm for these yield vehicles.

What this means is that both funds’ rights offerings were oversubscribed, even up to the 100% of over-allotment shares! Hence, both funds should be able to expand their AUM by 66.7%, with CLM becoming a $1.5 billion AUM fund while CRF jumps to a more modest $784 million.

My back-of-the-envelope calculation suggests that due to the high subscription rate, CLM and CRF will benefit significantly from NAV/share accretion, to the tune of +4.8% for both funds. For the long-term shareholder, this is an amazing result which they should be happy about. Indeed, we can see the positive effect of NAV accretion when the new shares were issued “on or about Thursday, June 16, 2022”, with CLM and CRF falling less than SPY over the past month.

YCharts

Oversubscription strategy a winner

In the original analysis of the Cornerstone fund offerings for this year, I proposed a new strategy whereby an investor would only hold a token amount of CLM and CRF heading into the ex-rights date, but then oversubscribe for as many new shares as they wanted to. This would enable an investor to largely avoid the negative price action rights offering associated with the rights offering period, while still being able to take part in the offering to receive new discounted shares which could potentially be flipped back to the market for a profit when the premium recovers. I personally attempted this strategy in my portfolio, though I did not make it a portfolio position due to the variability in oversubscription results.

Due to the rapidly declining premium of both funds as well as negative sentiment in broader equity markets around the expiry date of the offering, the trade turned even negative for a while. This was a risk that we had identified in another Weekly CEF Roundup before the offering expired:

How profitable the oversubscription strategy is will largely hinge on how quickly the premium of CLM/CRF recovers, if it all. If CLM/CRF crashes after the offering is over, one would either have to sell the new shares at a loss, or either be content with holding a long position of these funds, assigned at a +12% premium (which is kind of like a put option, actually!).

CEFConnect

Future outlook

For those investors who wish to continue holding onto CLM (+18.90% premium) and CRF (+20.72% premium), the current premium/discount valuation of the funds make them fairly-valued, in my opinion. On the chance that CLM and CRF return to their previously high levels of premium, further profits could potentially be made. Keep in mind though that since CLM and CRF have similar exposure to the S&P 500, the profit/loss computation of these funds would also be affected by broader market movements as well in addition to premium/discount variations.

Strategy statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to “double compound“ your income.

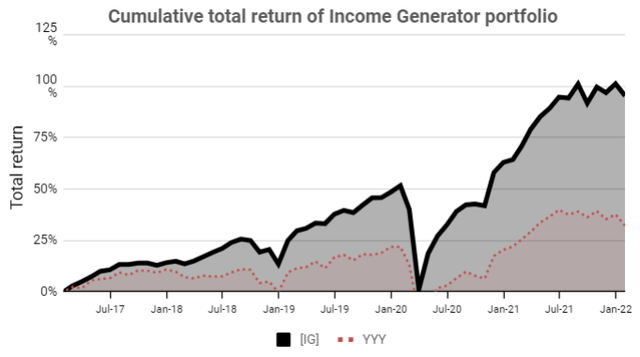

It’s the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Remember, it’s really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

Be the first to comment