MF3d/E+ via Getty Images

When you light a candle, you also cast a shadow.”― Ursula K. Le Guin

Today, we take our first look at a small developmental firm that is already deep in ‘Busted IPO’ territory thanks to mixed trial results from its lead candidate. However, the firm has other ‘shots on goal‘ in its pipeline as well as some recent insider buying in the shares. A full analysis follow below.

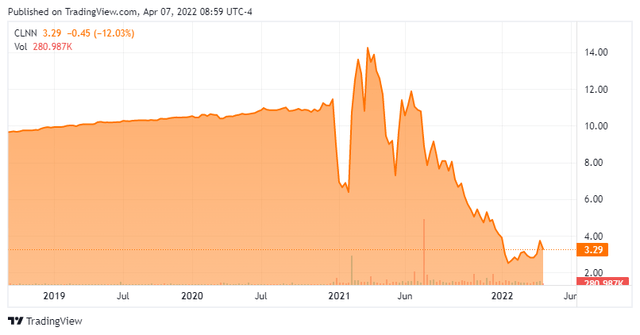

CLNN – Stock Chart (Seeking Alpha)

Company Overview

Clene Inc. (NASDAQ:CLNN) is a Salt Lake City based clinical-stage biopharmaceutical concern focused on the development of therapies that leverage its expertise in nanotechnology. The company has one nanotherapeutic in the clinic undergoing evaluation in three neurological indications and a second asset that is being assessed as an anti-viral and anti-bacterial agent in one study. Clene began operations in 2013 and went public at the end of 2020 when it reversed merged into special purpose acquisition company (SPAC) Tottenham Creative Worldwide with its first trade transacted at $10.82. Tottenham went public in 2018, raising gross proceeds of $46 million at $10 per unit with each unit including one share of common stock and a half a warrant to purchase a share of common stock at $11.50. Shares of CLNN currently trade just over $3.00 a share, translating to market cap of approximately $225 million.

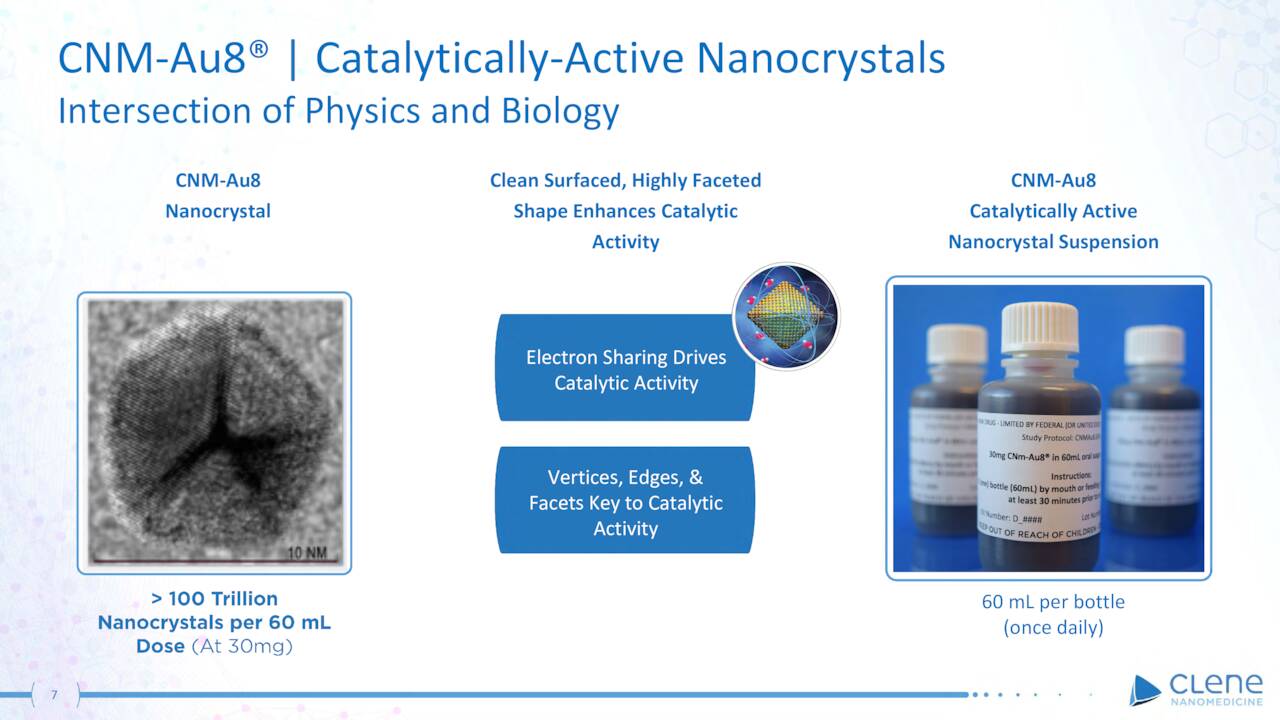

The company has developed an electrochemistry drug platform that, “draws from advances in nanotechnology, plasma and quantum physics, material science, and biochemistry” to develop highly catalytic and non-toxic, clean-surfaced metal nanocrystals. In the creation of these therapeutic nanoparticles, capping agents are introduced to act as stabilizing vehicles that stop uncontrolled growth. They are absorbed on the surface of nanoparticles to occupy the active sites of the catalyst.

However, for the therapeutics that Clene is developing, any capping agent hinders their catalytic performance; and thus, their efficacy. Clean surfaced means an absence of capping agents, meaning they have the ability to donate or receive an electron within biological systems. As such, Clene’s approach is an entirely different paradigm from traditional biologics that are limited to a single target or pathway. Its nanocrystals can theoretically exchange thousands of electrons per second, addressing bioenergetic deficits in the cells, and thus have application across multiple diseases.

Pipeline:

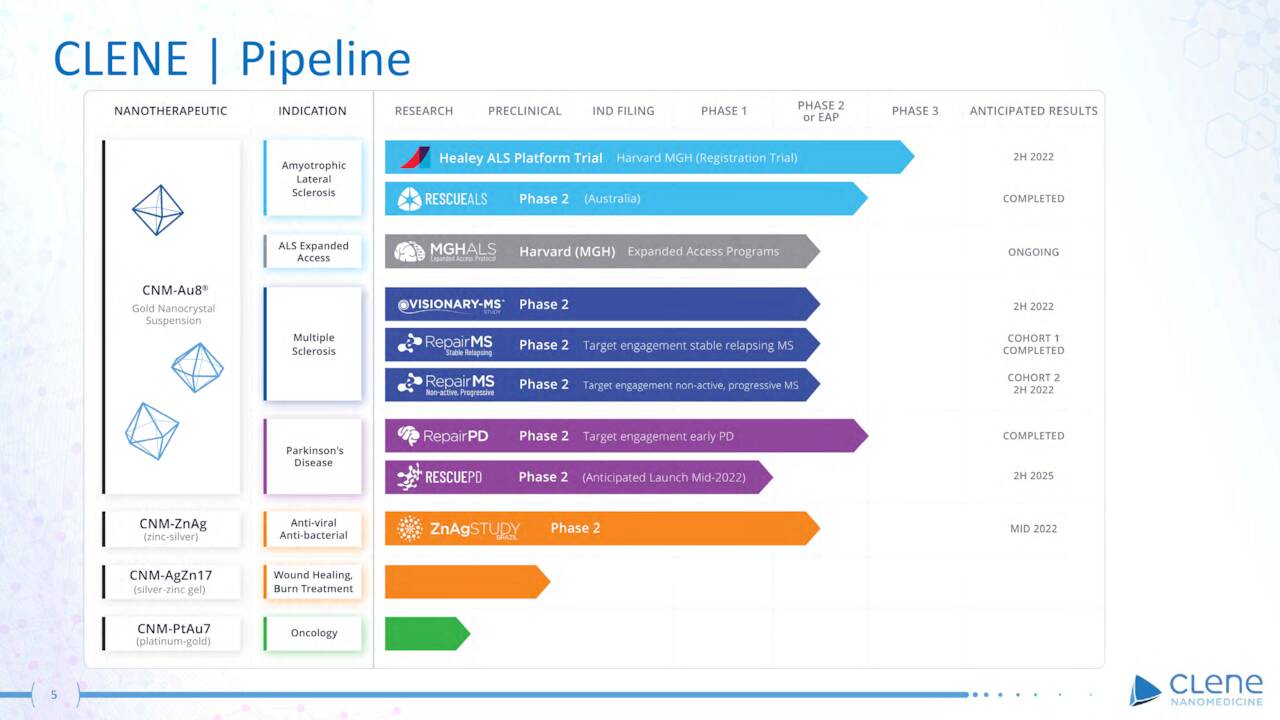

From its potentially revolutionary platform, the company has developed two clinical candidates.

Pipeline – CLNN (March Company Presentation)

CNM-Au8. Since neurons consume copious amounts of energy, Clene has directed its resources toward central nervous system [CNS] diseases as the initial targets for its therapies. Its lead candidate (CNM-Au8) targets the bioenergetic deficits, oxidative stress, and misfolded proteins that characterize CNS maladies. CNM-Au8 is clean-surfaced, highly faceted nanocrystalline gold in an aqueous suspension (for once-daily oral administration) that the company believes can facilitate remyelination and prevent neurodegeneration. As such, it is being investigated as a therapy for amyotrophic lateral sclerosis (ALS), Parkinson’s disease [PD], and multiple sclerosis [MS].

CLNN – CNM-Au8 (March Company Presentation)

In a randomized, placebo-controlled 45-patient Phase 2 early-stage ALS study, CNM-Au8 demonstrated decidedly mixed results, failing to achieve statistical significance in its primary and secondary efficacy endpoints of changes in motor unit index [MUNIX] and forced vitality (pulmonary) capacity values from baseline at week 36, respectively. However, statistical significance was achieved on exploratory endpoints of disease progression (p=0.0125) – defined as death, invasive or non-invasive ventilation, or gastrostomy tube – ALS Functional Rating Scale Revised (ALSFRS-R) 6-point decline (p=0.035), and a quality of life measure (p=0.018). Furthermore, CNM-Au8 was very well tolerated.

News of this trial failure sent shares of CLNN 13% lower to $4.80 in the subsequent trading session (November 2, 2021). However, thinly traded Clene stock recovered those losses later in the month before resuming its bearish trend. The company did post updated and more encouraging interim analysis on this study on April 1st, which gave a decent boost to the shares.

Based on learnings during the Phase 2 trial, Clene initiated a 160-patient Phase 3 study (HEALEY ALS) in July 2020. The trial will have four dosing cohorts (three active; one placebo). Primary endpoint will be change in ALSFRS-R from baseline at week 24, with survival one of the secondary endpoints. A full unblinded data readout is anticipated in 2H22.

Needless to say, with life expectancy only three to five years on the current crop of ineffective therapies, a successful trial outcome would be significant for the 30,000-patient American ALS community and the company.

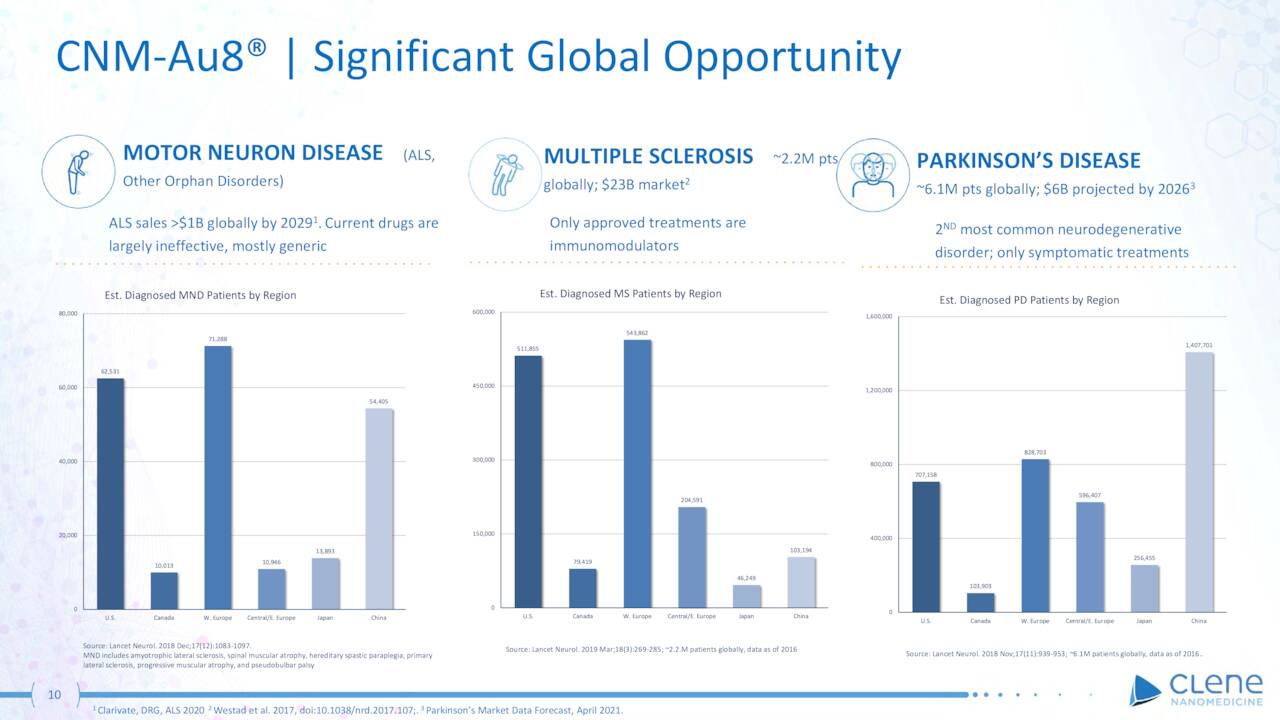

CLNN – CNM-Au8 Opportunities (March Company Presentation)

The second indication Clene is pursuing with CNM-Au8 is relapsing MS, for which it is currently conducting a double-blind, randomized (2:1), 150-patient Phase 2 trial (VISIONARY-MS) to assess its candidate as a remyelinating and neuro-reparative treatment. The primary endpoint is change in low contrast letter acuity [LCLA] at week 24 with the secondary endpoint a functional composite score (MSFC) including LCLA and timed 25-foot walk test, amongst others. Encouraging interim blinded data was announced in October 2021, with the overall CNM-Au8 study population demonstrating statistically significant improvements in both LCLA (p<0.0001) and average MSFC scores (p<0.0001) versus baseline at weeks 24, 36, and 48. Top-line, unblinded data are expected in 1H23.

If successful, the opportunity for Clene is significant, but the space is crowed with deeply resourced Big Pharma giants. There are ~2.2 million MS patients globally, of which ~511,000 reside in the U.S. Current treatment options are immunomodulators – including Roche’s (OTCQX:RHHBY) Ocrevus and Novartis’ (NVS) Kesimpta, amongst others – which comprise a ~$25 billion worldwide treatment.

The company also expects to enter CNM-Au8 into a Phase 2 trial for PD in 1H22 after a Phase 2 biomarker trial demonstrated statistically meaningful improvements in the brain energy NAD+/NADH ratio.

CNM-ZnAg. Furthermore, Clene is conducting a 276-patient Phase 2 study in Brazil exploring its zinc-silver nanoparticle solution (CNM-ZnAg) as a therapeutic for Covid-19. Data from this trial are anticipated in 1H22.

Balance Sheet & Analyst Commentary

To bankroll these studies, the company held cash of just over $50 million and principal debt of $25 million as of year end 2021, which should carry it into 2H23.

Street analysts are unanimously bullish on Clene’s prospects with three buy and two outperform ratings, as well as a median twelve-month price objective of $20. However, Cantor Fitzgerald lowered its price target from $24 to $15 after the ALS trial news in November 2021.

Board member David Matlin is also optimistic regarding the company’s future based on his February 1, 2022 purchase of 101,352 shares at $2.96, raising his total ownership interest to just shy of 1.75 million. He also added just over $300,000 in new shares in the back half of March.

Verdict

The last time Clene traded above its IPO price was in mid-July 2021, when a July 14th webinar regarding ALS, MS, and CMN-Au8 was hosted by the company. Shares of CLNN traded volatilely higher on significant volume in the two sessions prior to the virtual meeting, reaching an all-time high (intraday) of $17.82 on July 13th. Not overwhelmed by what it heard at the webinar, or in subsequent trial results, the market has taken the stock on a gradual, yet relentless retreat to the mid-$2 level before somewhat of bounce over the past month.

Clene’s nanoparticle approach could be revolutionary – you can’t get too much smaller than electron transfer – but it also appears that it has not completely gotten its arms around CMN-Au8. It is curious that an exploratory endpoint (ALSFSR-R) of an unsuccessful Phase 2 ALS trial is the primary endpoint of a potentially pivotal Phase 3 study. However, with so little advancement in ALS therapy and statistically significant outcomes achieved in quality of life and disease progression – two other exploratory and seemingly important endpoints of the Phase 2 ALS study – there is certainly a solid chance of success in the Phase 3 trial.

Furthermore, although the space is crowded, interim returns on VISIONARY-MS Phase 2 study are very encouraging. However, the trial is still over a year from yielding unblinded top-line results. A Phase 2 PD efficacy trial won’t produce actionable data until 1H24 at the earliest.

With a sub-$4 price tag, for the next twelve months, ownership in Clene distills down to an option on the ALS Phase 3 trial results, expected (most likely) in 3Q21. Positive data dictates a significant move higher in share price, likely followed by a well-received capital raise. Negative data brings into question the entire approach and a highly dilutive capital raise, with the company’s future riding on the VISIONARY-MS study. This makes CLNN ineligible for a large stake at this time.

However, for those who have a high risk tolerance, the likelihood of approvable ALS data and subsequent multi-bagger returns outweigh the risk of negative data and a halving of its stock price, making a very small investment advisable. Another way to play it is with a covered call up until June 2022, although the wide spreads in the very thinly traded options may hinder robust returns employing this strategy. For my own account, I added a few hundred shares as a speculative investment when this analysis was first presented exclusively to Busted IPO Forum members one month ago.

In every walk with nature, one receives far more than he seeks.” John Muir

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment