yodiyim/iStock via Getty Images

Technicals

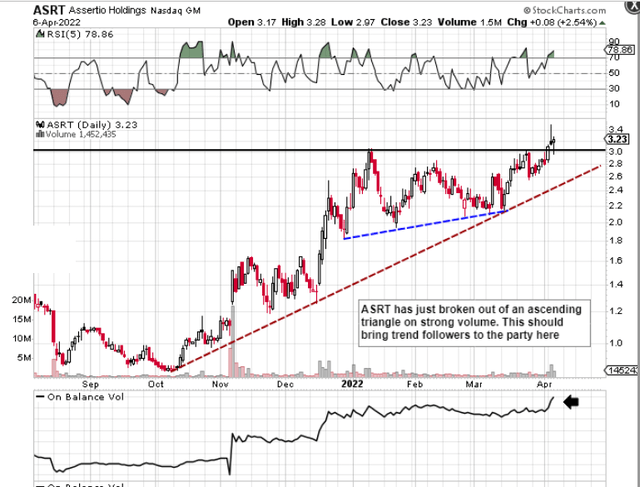

If we look at a technical chart of Assertio Holdings, Inc. (NASDAQ:ASRT), we can see that shares recently punched above their previous 2022 highs of approximately $3 a share printed on the 10th of January last. Therefore, what was previously overhead resistance should now become overhead support. In fact, as we have depicted below on the technical chart, the recent breakout is pointing towards a confirmed ascending triangle which either began in October or December of last year. The sizable increase in buying volume gives more weight to the bullish triangle. Furthermore, the breakout ties in with how short interest has been come down significantly in recent periods. At the end of January this year, for example, well over 1 million shares of the float were being shorted at the time. However, this number has been literally cut in half over the past 8 weeks as short-sellers have begun to bail for the exits. Although no new insider buying has taken place as a result of the breakout, we did see Assertio’s CEO, CFO & CAO all buying shares in May of last year.

Ascending Triangle Breakout In ASRT (Stockcharts.com)

Investors should not underestimate the importance of a stock’s technicals. Why? Because obeying the technicals ensure that one keeps their focus on what is actually taking place within Assertio instead of what should be taking place. Many core fundamental-based investors have found out the hard way that attractive value-orientated stocks can trade irrationally for years on end before finally producing a bullish trend.

Profitability

Nevertheless, when the stock’s fundamentals are aligned with its technicals (which we seem to have in ASRT), the probability of achieving a successful investment increases meaningfully. Take Assertio’s profitability for example. Product sales jumped 24% in Q4 on strong Indocin & Cambia numbers which resulted in a 19% top-line growth rate for the year. When we factor in Assertio’s strong top-line growth rate with its trailing EBITDA margin of 44.24%, it doesn’t take a genius to figure out that profitability will continue to improve on the back of the company’s robust sales growth.

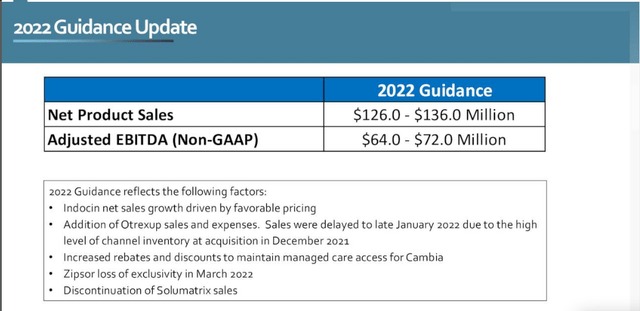

In fact, sales are expected to rise by a further 19% in fiscal 2022 to come in at just under $132 million with adjusted EBITDA being projected to hit $68 million as we can see below. Suffice it to say the 2022 adjusted EBITDA projection is a significant improvement and a far cry from the $16.28 million number reported in fiscal 2020. Furthermore, the company generated almost $6 million of operating cash flow in fiscal 2021 and that number would have been significantly more but for the one-off legal payments as well as funds that extended the Indocin supply agreement. Suffice it to say, Assertio’s trend concerning its cash flow as well as how its debt to equity ratio has dropped from 1.3 in fiscal 2020 to 0.6 presently leads us to believe that the stock is well-positioned for long-term gains. Management continues to see multiple acquisition possibilities in the market which the company should be able to take advantage of due to its strong balance sheet.

Assertio Holdings 2022 Guidance (Q4 Earnings Presentation)

Valuation

Profitability is one thing because we are dealing with reported numbers. Putting an accurate valuation on a company is entirely different which many times (due to assumptions, etc) results in analysts coming to different conclusions. From a sales standpoint for example, despite Assertio’s searing top-line growth at present, its forward sales multiple of 1.11 is still trending ahead of the company’s 5-year average of 0.98. Comparing Assertio in 2022 with the company just five years ago is a fool’s game though when we take into account the dilution, the stock depreciation, and how the firm has downsized to a significant degree.

However, if we instead calculate the Enterprise value to sales (EV/sales) which brings Assertio’s equity and debt into the equation, we see a much more attractive trend and significant discount in the stock at present. Assertio’s forward Enterprise Value to sales multiple comes in at 1.41 whereas the 5-year average for this multiple comes in at 2.12. Furthermore, the forward GAAP earnings multiple of 9.23 will result in increased cash flow and will give the company more options on how to manage the balance sheet with respect to reducing the cost of capital as well as making strong acquisitions to keep growth strong.

Conclusion

Therefore to sum up, given Assertio Holdings’ cheap sales, growing profitability, and bullish technicals, we continue to believe this play has significant upside. Investors may get a second bite of the cherry if indeed newly formed support gets tested once more here in the near term. We look forward to continued coverage.

Be the first to comment