SimonSkafar

Seeding the Portfolio With Durable Franchises

Market Overview

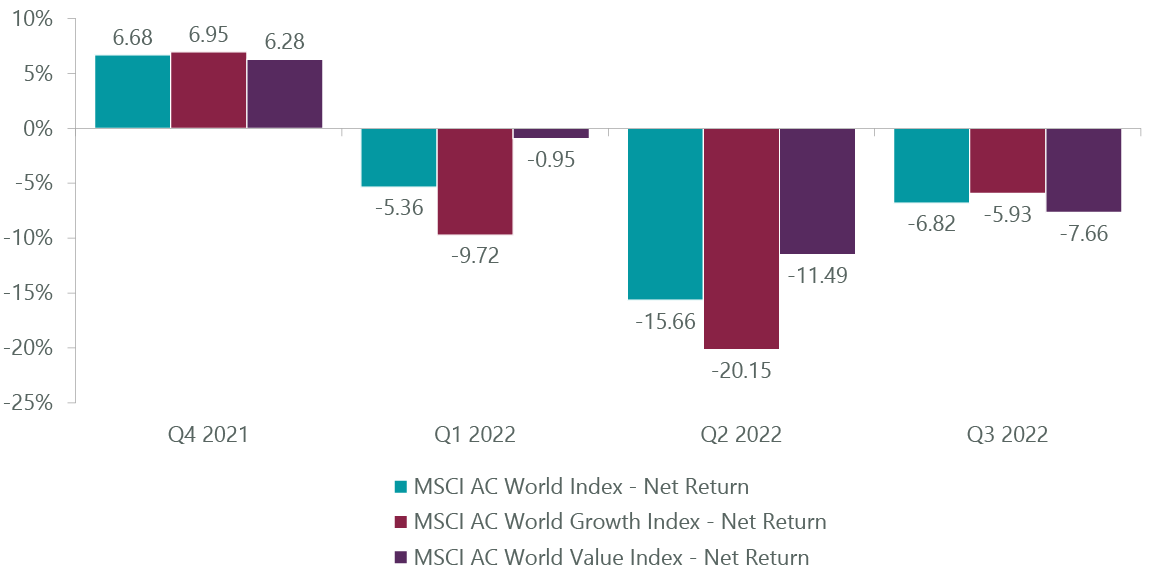

A stout U.S. economy kept the Federal Reserve on the aggressive side of interest rate hikes in the third quarter, setting the tone for monetary tightening across global markets. In Europe, power prices continued to climb stemming from the Russian invasion of Ukraine with worsening disruption of energy markets keeping inflationary impacts severe. This movement to a higher rate regime caused global equity losses to continue, with the benchmark MSCI All Country World Index down 6.82% for the quarter, bringing its year-to-date drawdown to 25.63%. The S&P 500 Index, a proxy for U.S. stocks, declined 4.88% for the quarter, the developed market MSCI EAFE Index fell 9.36% while the MSCI Emerging Markets Index dropped 11.57% over the last three months.

Growth stocks held up better than value, snapping a two-quarter losing streak, as global recession fears weighed more heavily on companies tied to the broader economy. The MSCI ACWI Growth Index was down 5.93% for the quarter and the MSCI ACWI Value Index off by 7.66%. Year to date, growth still lags value significantly with the biggest negative impact felt in the first quarter.

Exhibit 1: MSCI Growth vs. Value Performance

Source: FactSet.

The tipping point for U.S. stocks came in late August in Jackson Hole, where Fed Chair Powell pledged to continue raising interest rates and keep them high for a sustained period to stave off inflation. His comments all but eliminated the chance of a “Fed pivot” toward looser conditions, with the 10-year U.S. Treasury yield climbing 82 bps to finish at 3.83%, near its highest levels in over a decade. Rising rates are particularly trying for the long-duration growth companies we target whose earnings are discounted years into the future. We are already seeing the headwinds on margins and earnings while a hawkish Fed has also contributed to a surge in the U.S. dollar, creating foreign exchange difficulties for multinational firms like Microsoft (MSFT) that generate significant revenue overseas.

Economic policy came to the fore during the quarter, with the European Central Bank (ECB) following the U.S. Federal Reserve in implementing aggressive interest rates hikes. The ECB raised rates by 75 bps in September, following up a 50-bps increase in July, and revised upward its inflation expectations to 8.1%. Weeks later, the newly elected U.K. Prime Minister pushed through a package of tax cuts meant to offset similar monetary tightening by the Bank of England. This unorthodox policy caused the British pound to sink to its lowest level against the U.S. dollar since 1985, with the euro enduring a similar rout and falling below parity against the greenback for the first time in 20 years.

The moves come amidst the ongoing conflict between Russia and Ukraine and additional cuts of Russian natural gas to key markets across Europe. Heightened volatility in the region’s equity and fixed income markets is likely to continue as more governments follow the U.K., Germany and France in passing subsidy measures to cover surging utility bills heading into the winter. Such spending will further inflate budget deficits, leading to a still weaker euro, higher inflation and more pressure on the ECB to tighten monetary policy.

The positioning moves we made over the last year in preparation for such extreme macro headwinds enabled the ClearBridge Global Growth Strategy to outperform the benchmark for the second straight quarter. We attribute this to our investment philosophy that high-quality growth companies with sustainable advantages will persevere through economic storms and come out stronger on the other side.

Portfolio Positioning

We have regularly written about our risk management efforts including reducing exposure to emerging growth companies, the most volatile part of the spectrum of growth we target. These companies are typically early in their growth cycle, with a long runway for top line growth, but have generally low earnings relative to their long-term potential. Emerging growth did very well in a low interest rate environment, with many becoming COVID-19 beneficiaries. However, as we enter a rising rate environment, markets are increasingly favoring companies with near-term earnings and cash flows. As a result, we have trimmed this allocation significantly, beginning in 2020 and throughout 2021. Nevertheless, we continue to hold several emerging growth stocks, two of which were leading contributors in the third quarter: U.S. electric vehicle maker Tesla and Australian workflow software maker Atlassian.

The proceeds from our repositioning sales continue to be put to work across the Strategy’s secular and structural growth buckets, with a dedicated focus on secular, quality compounders. These companies have strong balance sheets, good cash flow generation and significant pricing power, characteristics that should enable them to get stronger through the storm impacting international equities.

Our recent positioning moves, highlighted by five new additions, reinforce this focus on managing a portfolio of resilient growth companies. Haleon (HLN), a U.K.-based consumer health spinout of GlaxoSmithKline, is comprised of a combination of consumer health brands across various over the counter health care categories, oral health as well as vitamins and supplements, with leading share positions in multiple categories. The company generates approximately £10 billion in revenues globally with its flagship brands generating close to 60% of sales at higher-than-average profit margins. Also in the U.K., we added RELX (RELX), a publisher serving professional customers. The company, formerly known as Reed Elsevier, has top market positions across risk and analytics; scientific, medical and technical publishing; legal, regulatory and business information analytics; and face-to-face and digital exhibitions. RELX is highly profitable, with operating margins upwards of 30% and low capex requirements.

Like the U.K., Japan is another outlier in a global regime of monetary tightening as its government has kept rates low and actively intervened in currency markets to slow the decline of the yen. We continued to increase exposure to Japan with the purchase of Sony (SONY) in the consumer discretionary sector and Daiichi Sankyo (OTCPK:DSKYF) in health care. Sony’s diverse lines of business span numerous industries, including video games, semiconductors, TV and music entertainment, and financial services. The majority of its $88 billion in revenue is generated from consolidated markets where it has a leading position. Finally, Sony has completed its transition from a low-quality business with similar margins and reduced visibility to an industry leader with elevated margins, a greater proportion of recurring revenues and more first-party content. Daiichi Sankyo is a pharmaceutical company on the forefront of cancer treatment with antibody drug conjugates (ADXS) targeting breast and other hard to treat cancers. Its partnership with AstraZeneca (AZN) for Enhertu offers meaningful upside for the company.

In the U.S., we initiated a position in pharmaceutical maker Eli Lilly (LLY) as it brings out new drug candidates for diabetes and Alzheimer’s disease. New drugs impact diabetes but have also demonstrated significant weight loss for patients who are overweight and have other co-morbidity issues as a result. Lilly is one of the two key players in diabetes care and we believe the potential market opportunity is much higher than the consensus forecasts as we are seeing evidence of accelerating adoption.

Outlook

U.S. equities are entering a period of the bear market that will be characterized by massive negative earnings revisions. We saw it early in the summer among big box retailers that held too much of the wrong inventory and it is now spreading into sectors including technology, materials, and financials. Most sectors will likely feel margin pressure, with the possible exception of energy. At this stage, with the Fed signaling a continued tightening cycle, the three factors that drive stock returns — the risk-free rate, the equity risk premium and earnings — are all headwinds.

The coming months will likely be volatile as economic data downshifts slowly, policy makers try to regain their inflation fighting credentials and investors remain fearful of extreme policy errors. Markets have corrected meaningfully as earnings multiples have derated to relatively low and, in some cases, recession levels. Europe in particular has seen sharp cuts in equity allocations as good companies are sold off simply due to their location. However, we believe the region could be one of the larger upside candidates as markets and economies normalize. We maintain that European earnings may have greater resiliency than current stock prices suggest due to strength in the energy sector and a weak euro. While the timing to get more offensive is difficult to pin down, our portfolio holds high-quality growth companies which should be the winners of this downturn. These companies have good balance sheets, cash flows and strong management capable of employing inorganic means of growth, such as acquisitions, in lieu of slower, organic growth. Several of our companies have remarked that valuations have come back into more attractive ranges after many years of discipline and remaining on the sidelines. We continue to expand our watchlist of potential candidates and buy exceptional growth stocks as we believe that, over a market cycle, investing in growth generates excess returns.

From a macro standpoint, the deterioration in current economic conditions may be close to stabilizing. Supply chain disruptions, apart from commodities, are improving, shipping costs are declining and inventories are in good shape. Housing markets are also cooling, but the trajectory of wages and energy prices are still uncertain. Consumers will likely be more careful with regards to where and how much they spend, and we expect industrial activity to trend lower over the shorter term. A turning point for equities historically takes place when the central banks start to pivot. We are hopeful that a systemic financial event will not be the cause of this pivot but are watching that risk as well. We believe inflationary pressures could abate in 2023, tempering the aggressiveness of central banks.

Portfolio Highlights

During the third quarter, the ClearBridge Global Growth Strategy outperformed its MSCI ACWI benchmark. On an absolute basis, the Strategy saw losses across nine of the 10 sectors in which it was invested (out of 11 total) with the consumer discretionary sector the lone contributor while the health care, financials and information technology (IT) sectors were the primary detractors.

On a relative basis, overall stock selection and sector allocation contributed to performance. In particular, stock selection in the industrials, consumer discretionary and IT sectors and an underweight to the communication services sector supported results. Conversely, stock selection in the financials, consumer staples and materials sectors hurt relative returns.

On a regional basis, stock selection in North America, Japan, Europe Ex U.K. and the U.K. as well as an underweight to emerging markets drove performance. Meanwhile, an overweight to Europe Ex U.K. proved detrimental.

On an individual stock basis, the largest contributors to absolute returns in the quarter included United Rentals (URI) and MonotaRO (OTCPK:MONOY) in the industrials sector, Tesla (TSLA) and TJX Companies (TJX) in the consumer discretionary sector and Raymond James Financial (RJF) in the financials sector. The greatest detractors from absolute returns included positions in AIA in the financials sector, Avantor (AVTR) in the health care sector, Microsoft in the IT sector, Alphabet (GOOG, GOOGL) in the communication services sector and Coty (COTY) in the consumer staples sector.

In addition to the transactions mentioned above, we closed positions in Progressive (PGR), Intesa Sanpaolo (OTCPK:ISNPY) and CIBC in the financials sector, T-Mobile (TMUS) in the communication services sector, and Canadian Pacific Railway (CP), Atlas Copco (OTCPK:ATLKY) and MonotaRO in the industrials sector.

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment