PrathanChorruangsak

HEXO Corp. (NASDAQ:HEXO) delivered quarterly sales growth close to 22%-29% in Ontario and Alberta, and reported a significant decrease in net debt. Considering the expectations of other analysts about positive EBITDA in 2024 and the promises about positive cash flow, HEXO is, in my view, undervalued. My discounted cash flow models implied a fair valuation that remains significantly higher than the current market price.

HEXO

HEXO is a licensed producer of cannabis. Some of the company’s brands include Redecan, Original Stash, 48North, Trail Mix, Bake Sale, and Latitude. The company also operates in the medical market in Canada and Israel.

In my view, after the successful closure of the agreement with Tilray, it is the right time to review HEXO’s expectations. I believe that the most relevant in the agreement is the intention of delivering positive cash flow in the near future.

The transactions with Tilray Brands solidify the strategic partnership between HEXO and Tilray Brands and provide HEXO with a recapitalized balance sheet and the financial flexibility necessary to accelerate its transformation into a cash flow positive business within the next four quarters. Source: HEXO Completes Transactions With Tilray Brands

It is also worth noting that in the last quarterly report, HEXO noted the successful refinancing of some of its debt. In my view, there are many financial sponsors, like KAOS Capital Ltd, which are ready to offer financing in order to pay HEXO’s financial obligations:

Concurrent with the debt restructuring, in Q3’22 the Company entered into a definitive agreement with an affiliate of KAOS Capital Ltd , to provide a $180 million equity purchase agreement, which could provide the Company access to $5 million capital per month over a 36-month period in order to help ensure debt and interest repayments under the amended and reassigned secured note can be met. Source: Quarterly Report For Q4 2022

Beneficial Quarterly Figures And Analysts Expect Positive EBITDA By 2024

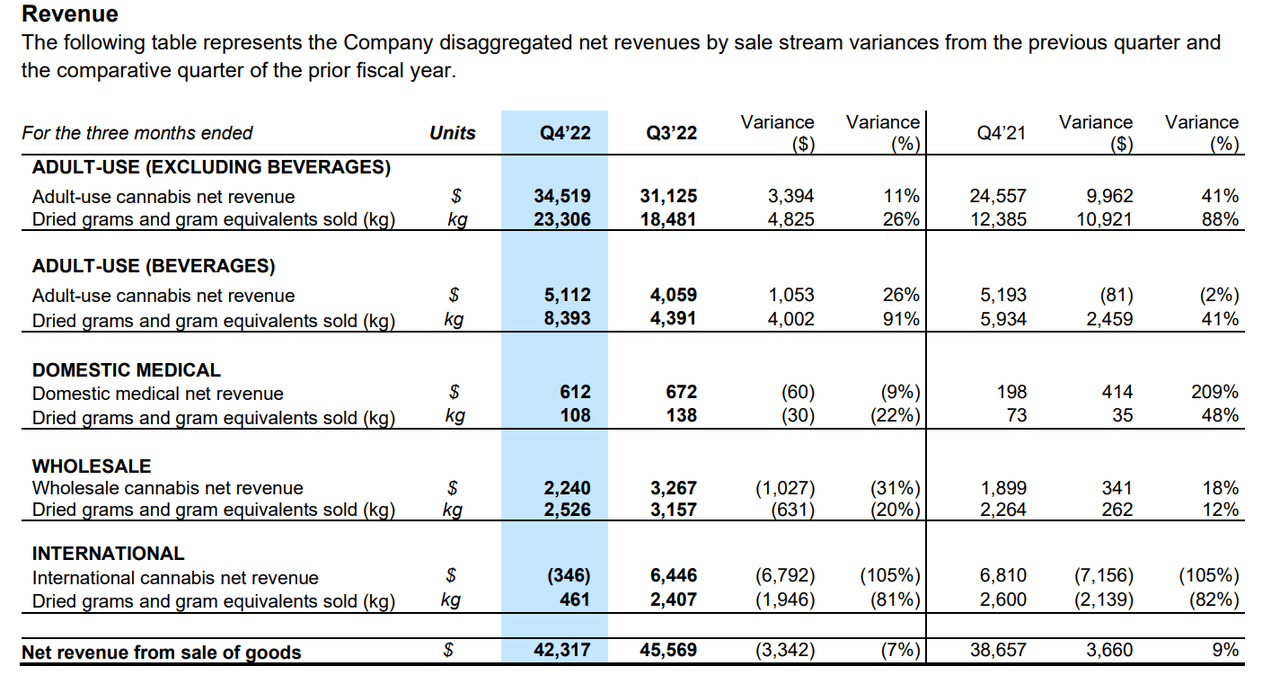

I believe that the figures reported in Q4 2022 were beneficial mainly for the adult use business segments. With a minor decline in wholesale business and international sale of cannabis, all the other sectors reported revenue growth.

Source: Quarterly Report For Q4 2022

Among the drivers of revenue growth, HEXO reported 22% and 29% sales growth in Ontario and Alberta respectively thanks to an eventual increase in demand. In my view, if supply continues to increase in other areas of the world, we could see sales growth like HEXO reports in Canada:

The Company’s Q4’22 adult-use net sales experienced growth in the key markets of Ontario and Alberta of 22% and 29%, respectively, due to greater availability of supply and increased velocity of highly demanded products. Source: Source: Quarterly Report For Q4 2022

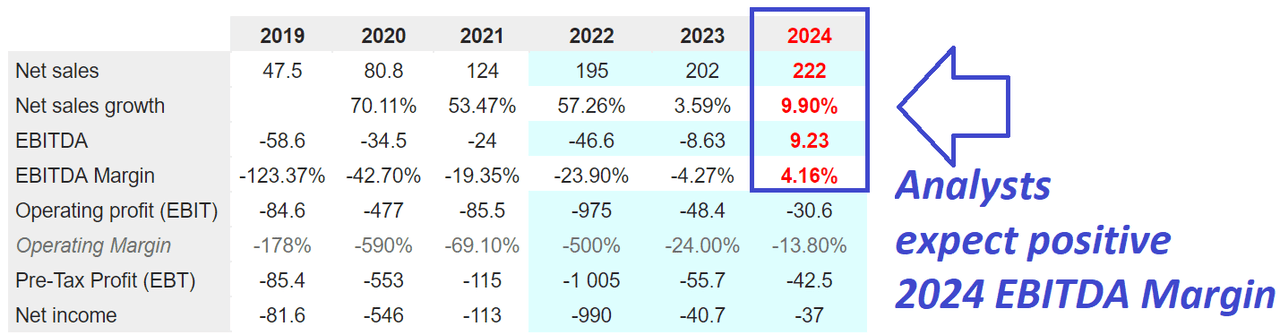

My opinion about the expectations of other analysts was quite optimistic. Forecasts from other companies include 2024 net sales growth around 9%, net sales close to CAD 222 million, and an EBITDA margin of 4%. In my view, as soon as investors learn about the incoming increase in EBITDA, demand for the stock will most likely increase.

Marketscreener.com

Balance Sheet

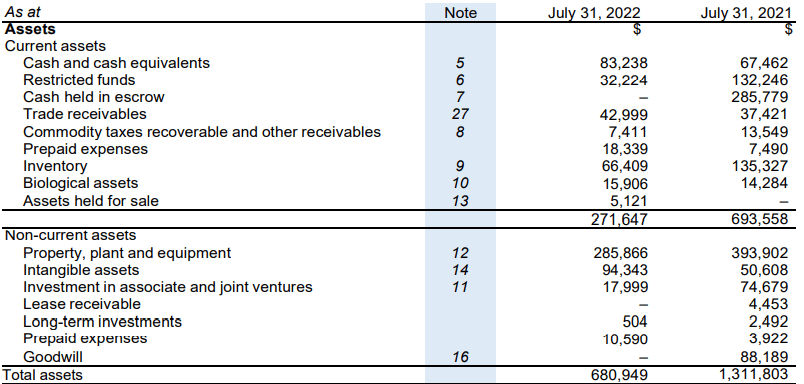

As of July 31, 2022, HEXO reported CAD 680 million in total assets with CAD 83 million in cash and inventory worth CAD 66 million. With an asset/liability ratio close to 2x, HEXO is in good shape. With that, the total amount of debt is worth studying, which may be worrying for certain investors.

Source: Quarterly Report For Q4 2022

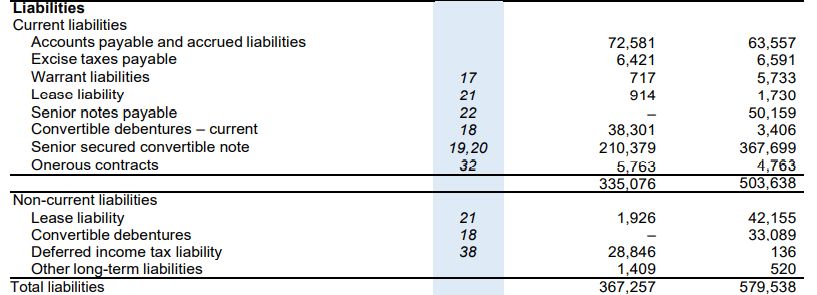

HEXO reports convertible debentures of CAD 38 million and senior secured convertible notes worth CAD 210 million. In my opinion, future free cash flow will most likely help pay the company’s debt. Besides, considering the company’s production capacity, I wouldn’t expect that banks would stop offering debt financing.

Source: Quarterly Report For Q4 2022

In-house Production Capabilities, More Efficiently Processes, And The Development Of The Network Could Bring To A Valuation Of $0.5 Per Share

Under normal circumstances, I believe that manufacturing and production costs will likely reduce thanks to the company’s recently announced new best practices. As a result, in my view, optimization will likely bring increases in EBITDA margin and FCF margins. In this regard, HEXO provided the following information:

The company is actively applying best practices and learnings from its highest-margin categories and top facilities, across its entire operations to improve and optimize productivity. Source: Report From HEXO

Let’s also note that HEXO recently found synergistic cost savings opportunities, which will most likely enhance future financial figures. More in detail, HEXO is now proposing in-house production capabilities, a reconfiguration of the company’s production network, and more work to be done in the Redecan facility.

The company has identified synergistic cost savings opportunities from optimizing HEXO’s production network and leveraging the capacities of its recent acquisitions. Specifically, this includes: transitioning from co-packaging agreement towards in-house production capabilities; leveraging HEXO’s scale to deliver on procurement savings; and reconfiguring the Company’s production network to achieve greater efficiencies, for example, moving vape production and distillate production to the Redecan facility. Source: Report From HEXO

Finally, HEXO announced better demand planning from now on. According to a report, customers are expecting much more demand from HEXO, which only delivers close to 70% of the demand. Organic growth would most likely help management cope with demand, and most likely bring revenue growth:

To increase revenue, the Company plans on accelerating growth through organic market share gains and capturing revenue opportunities through better demand planning. For example, currently, the Company is only delivering 65% to 70% of demand to its customers. Going forward, the Company will connect its demand forecast to what it intends to harvest. Source: Report From HEXO

Experts believe that the recreational cannabis market compound annual growth rate could reach 13.4% from 2021 to 2030. Under this scenario, I assumed that HEXO would experience close to the same sales growth, which is, in my view, a conservative sales growth.

Our forecast implies a recreational cannabis market compound annual growth rate of ~13.4% from 2021e to 2030e, mostly driven by a higher percentage of cannabis prevalence in Canada to reach a total addressable consumer population of 10.1mm in 2030e. Source: Canadian Cannabis Market Size Forecast: +13% CAGR Through 2030e

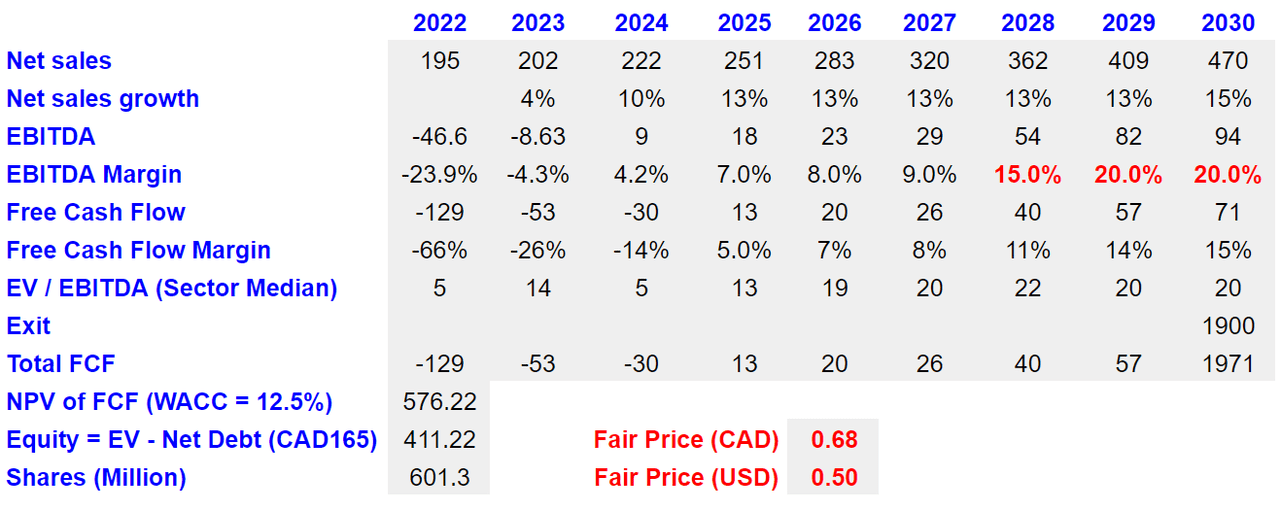

If we assume that more revenue may bring larger economies of scale, I believe that assuming larger EBITDA margin makes sense. I assumed that sales growth would grow from 4% in 2024 to 20% in 2030. Free cash flow would also grow from 5% in 2025 to around 15% in 2030. I believe that my figures are quite conservative.

My results included free cash flow around CAD 13 million to CAD 70 million, and with an EV/EBITDA of 20x, the terminal value would be close to CAD 2 billion. With a discount of 12.5%, I obtained an implied enterprise value close to CAD576 million. Finally, the implied fair price would be around $0.50 per share.

My DCF Model

HEXO Signed Several Covenant Agreements, Which May Limit The Company’s Ability To Grow

In my view, the largest issue for HEXO may be that banks have signed several agreements with management that limit the company’s activities. It means that the company will need to report certain financial figures in order to receive further debt financing. As a result, perhaps HEXO’s operations may be less aggressive as expected, which may lower the company’s revenue growth.

The Senior Notes contain customary events of default, including for non-payment, misrepresentation, breach of covenants, defaults under other material indebtedness, material adverse change, bankruptcy, change of control and material judgments. Among other things, we are required to maintain a minimum liquidity of at least US$35.0 million at all times, and in some cases, of at least US$80.0 million. Source: Report From HEXO

HEXO may not report positive EBITDA until 2024, and I foresee positive cash flow from operations in 2025. From now until 2024 or 2025, HEXO may require additional capital either in the form of debt or equity. If HEXO issues further shares, in my view, the fair price would diminish, and the stock price could decline.

To the extent that the Company has negative cash flows in future periods, HEXO may require additional financing to fund its operations to the point where it is generating positive cash flows, and continued negative cash flow may restrict HEXO’s ability to pursue its business objectives. If additional liquidity is required, management plans to secure the necessary financing through the issuance of new public or private equity or debt instruments. Source: Report From HEXO

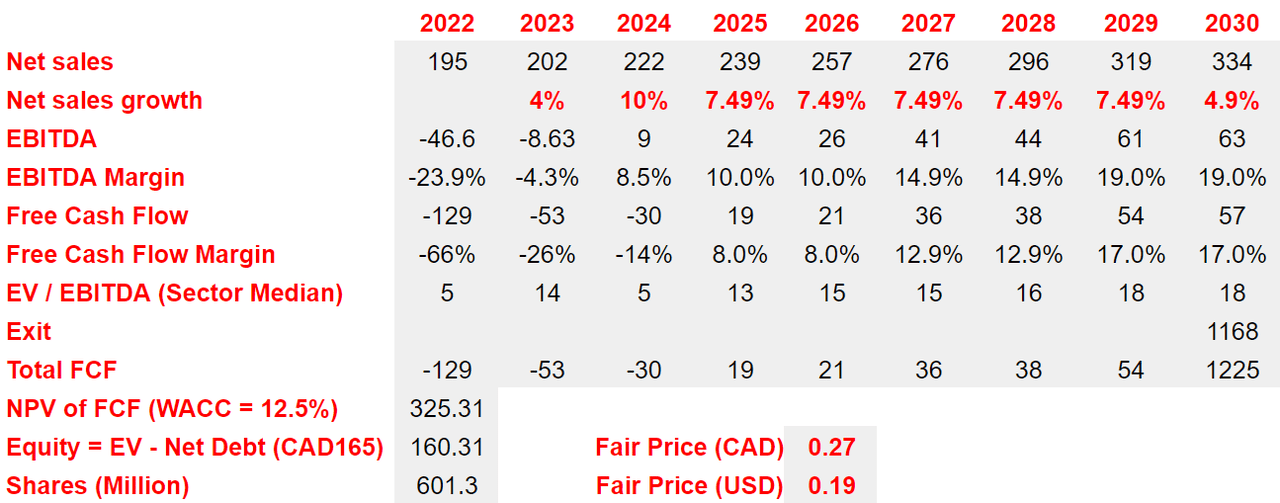

Under this scenario, I assumed sales growth close to 7.49% from 2025 to 2029, an EBITDA margin around 10%-19%, and FCF/Sales ratio of 8%-17%. 2030 FCF would be close to CAD57 million. With a discount of 12.5%, the implied equity valuation would stand at CAD160 million, and the fair price would be $0.19 per share.

My DCF Model

My Takeaway

HEXO recently delivered adult-use net sales growth of 22% and 29% in the key markets of Ontario and Alberta respectively. In my view, once management successfully increases supply in other areas, revenue growth may look like that in Canada. The recent decrease in debt and the expectations of positive EBITDA by other investment analysts are also worth noting. In my view, HEXO remains substantially undervalued by the market. Future projection of future free cash flow implied a stock valuation close to $0.5 per share.

Be the first to comment