Md Babul Hosen/iStock via Getty Images

Investment Summary

The integration of technology into invasive and non-invasive surgical medicine has resulted in tremendous advancements across the treatment spectrum. Robotics is a key thematic underpinning large growth in the medical technology sector in 2022. One of the hidden gems in this corner of the market is PROCEPT BioRobotics Corporation (NASDAQ:NASDAQ:PRCT). The stock has climbed 74% this year-to-date, to a $2.05Bn market cap. We note the many growth levers present in its latest numbers.

PRCT is a surgical robotics company with special focus on benign prostatic hypertrophy (“BPH”). It’s hallmark is the AquaBeaM robotic system (“AB”), which uses the novel Aquablation therapy. The therapy is meaningfully differentiated as a heat-free option [amongst many others], using heat-free waterjet resection.

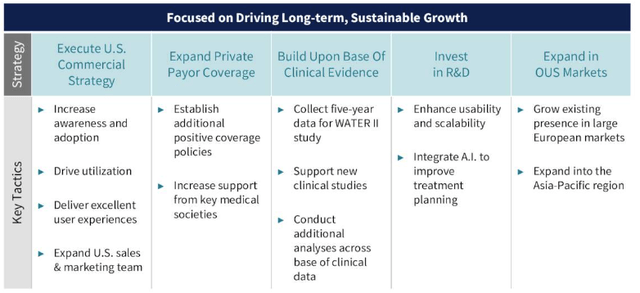

We posit PRCT is uniquely positioned for sustained momentum around its AquaBeam system thanks to a myriad of growth catalysts looking ahead. Firstly, the company follows a capital allocation and recurring revenue model, with additional upsides tacked onto the end product to create a stream of workflow for surgeons. With this model, each additional AB system adds leverage to PRCT’s revenue volume when it is installed. Further, hospitals continue to standardize treatment paradigms, and this aligns well with the Aquablation offering given its unique ability to treat BPH lesions of all sizes.

Exhibit 1. PRCT Growth continuum

Data & Image: PRCT Q3 Earnings Summary [Presentation]

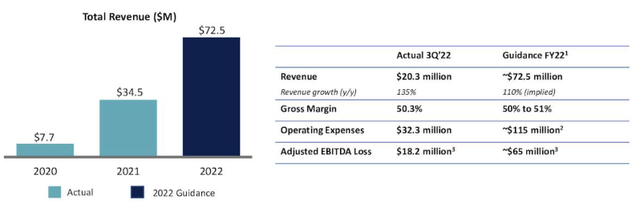

Q3 results exciting for future value creation

For Q3 2022, PRCT reported 135% YoY Q3 revenue growth to $20.3mm, underscored by robotic system sales and utilization from current installations during the quarter. Seeing the company’s capital allocation and recurring revenue model, it’s now a matter of increasing the pace of installations and broadening utilization on the installed base.

Speaking of the installed base, PRCT increased it to 139 systems, now with around 2,700 hospitals performing BPH surgeries. Of these, 31% are considered high-volume targets by the company. It sees these as high liquidity sites that prioritize innovation and technology integration.

It’s still early days along the launch curve for PRCT, but the current pace of sales is promising. It sold 26 AB Robotic systems in Q3, amounting to revenue of $9.8mm. This is a 95% YoY growth and was underpinned by turnover from the high-volume sites mentioned earlier. We note that U.S. handpiece and consumables revenue also came in 267% higher YoY, to $8mm versus the same time last year.

These are tremendous growth percentages that the market is paying serious attention to. Should it continue at this pace, there’s good reason to see this inflecting positively on the share price.

Exhibit 2. PRCT’s capital allocation and recurring revenue creates a positive feedback look and ratchets up operating leverage with each additional installation

Data & Image: PRCT Q3 Earnings Summary [Presentation]

Utilization is the second key factor in the investment debate, as mentioned. Management notes it believes the bolus of procedure volumes are transurethral resection of the prostate (“TURP”) and photoselective vaporization of the prostate (“PVP”) converts. These are the two most common BPH procedures in the current standard of care.

At the hospital level, we noted management’s language around sequential increases in utilization from its installed base. It is seeing more surgeon uptake per quarter, and this is pulling through to drive the pace of new accounts.

The AB Robotics System is a key differentiator given that it uniquely provides applies to BPH of all sizes. Typically, the most common treated size is 60–80mm. PRCT overcomes this hurdle and broadens its patient market in this vein. This has also been identified as a key conversion-factor from traditional therapies to date. As a result, utilization per account lifted ~60% YoY with the average handpiece selling for $3,100 during the quarter. It shipped 2,300 handpieces in its US market – up 174% from the year prior.

It’s also worth noting that CMS finalized its FY23 hospital outpatient rates on 1 November. We confirm the Level 6 APC code for Aquablation will provide the hospital with ~$8,588 for each procedure, a 150bps spread on FY22 rates. PRTC received additional payer coverage from Horizon and Blue Cross Blue Shield plans last quarter.

Guidance points to steep ramp on revenue growth

Management increased FY22 guidance to $72.5mm, calling for 110% YoY upside at the top-line. This is a 25% increase from earlier estimates. Growth assumptions are built around an increase in the cadence of AB systems sold in Q4.

It hopes to realize an average selling price of $370,000 per system during the quarter. With handpieces, it hopes to keep average selling price in-line with Q3. It also forecasts gross margin to fall in-line with Q3 at 50–51% and this will pull down favorably to core EBITDA of negative $64.3mm in our estimate. With the revenue ramp-up, it also predicts OpEx to stretch up to $115mm, with the bulk of spend on building the commercial sales team.

A summary of PRCT’s FY22 projections are noted in Exhibit 4.

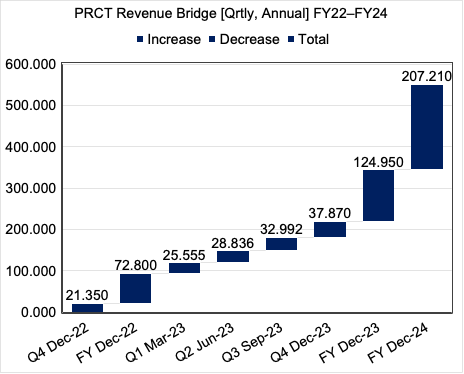

We foresee a steep lift in revenue growth ahead for PRCT with ~$125mm and $207 million on the horizon for FY23 and FY24 respectively, as seen below [Exhibit 3].

Exhibit 3. PRCT Projected revenue bridge FY22–FY24 [quarterly, annual]

Data: HB Insights Estimates

Exhibit 4. PRCT internal FY22 growth projections

Data: PRCT Investor Presentation Slideshow

Valuation and conclusion

With PRCT so early in its growth curve, we’ve modelled revenue growth as the primary driver of share price appreciation. The company projects FY22 sales in the $72.5mm range. We are aligned with this figure.

We believe the company should be trading at a premium to sales given the promising growth potential on offer. It currently trades at 32x trailing revenue, and 27.6x sales estimates of $7.5mm. This is above the GICS Health Care Equipment industry mean of ~4x by several turns.

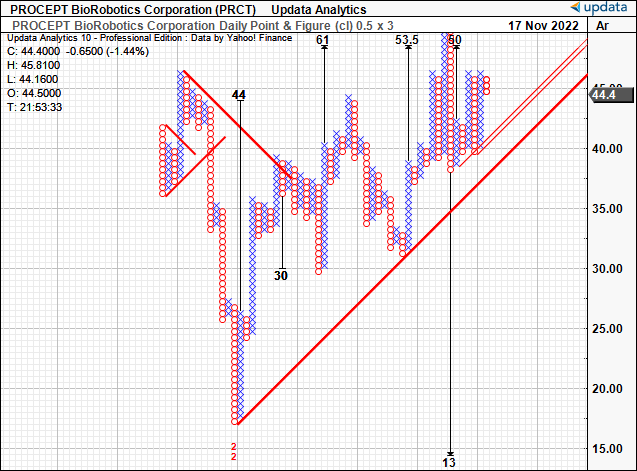

We think that 27.5x this year’s sales is still tight and believe it should trade up closer its trailing average of 32x seeing the >100% YoY growth forecasts. We are confident the company will meet its growth guidance at the top-line. Applying the 32x multiple to the $72.5mm estimate derives a price target of $51. Doing the same to FY23 estimates of $124.9mm yields a target of $89.40 These serve as adequate first and second price objectives and are well supported by technical calculations, seen below [Exhibit 5].

Key risks to the thesis include:

- Company misses sales guidance in Q4 results, reducing prospects for revenue growth next year.

- Inflation inputs erode future operating margins, scaling back management’s growth initiatives.

- Large price reversal to the downside with prices falling more than 10% below today’s price of $44.

- Investors should pay close attention to these risks as a matter of priority before considering any kind of position.

Net-net, we rate PRCT a buy due to its insulated core offering and exposure to high-growth markets. We are seeking first and second price objectives of $50, and then $89 respectively.

Exhibit 5. Point and figure charting points to upside targets ~$50–$53.

Data: Updata

Be the first to comment