HJBC/iStock Editorial via Getty Images

Dear readers/followers,

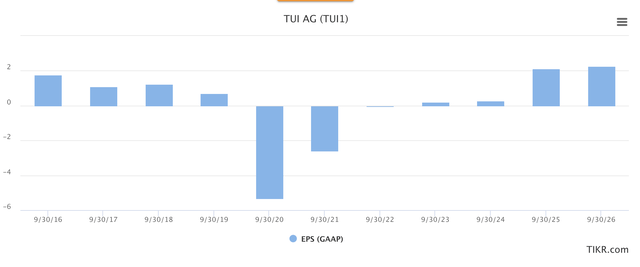

In this article, I’m going to revisit TUI (OTCPK:TUIFF), a formerly-great travel stock that took a massive beating during COVID-19 and the following years. Since my first article, the company has lost large swathes of its market capitalization, and the investment I made, though I sold in 2021, has been a negative one so far.

I do believe that travel companies have a continued, relevant place in our society and how people travel – but this role might change somewhat going forward. With this in mind, I’m revisiting TUI in this more comprehensive article and see where I stand on the company.

TUI AG – Revisiting the company

TUI is down – really down. Compared to where the company was years ago, the share price today for a portion of TUI is less than €2/share, reflecting just how far the company has fallen.

From dropping massively ahead in COVID-19 to the various issues and ESG dimensions following, to moving into a conflict environment for its core geography, the company has gone from being a dividend-paying positive business to a business with an ongoing pre-tax loss on a consistent basis.

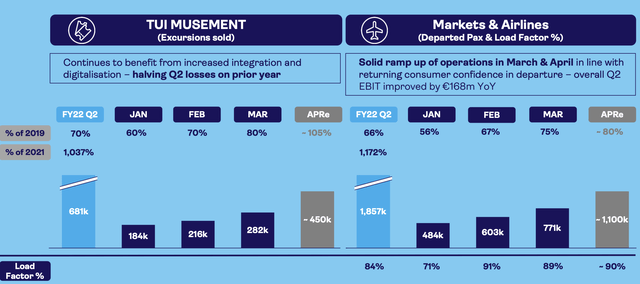

The issue isn’t specifically ‘demand’ or top-line trends. For the latest results, TUI operated at 71% of ongoing capacity, which is ahead of expectations with an 84% load factor with nearly 2M customers for 2Q22. This is a recovery of 1.7M more than during COVID-19 induced 2021 YoY.

The company’s Hotels and Resorts segments delivered their third successive positive quarter since the pandemic started, and despite the EBIT loss, the company is FCF-positive at €1.2B on a quarterly basis, which is a €2B improvement due to WC improvements and operational improvements.

TUI was saved by the German government during the worst of it. It’s also gone to lengths to start paying back these financial assistance packages, with the first €700M hand-back in April, leaving the company with the liquidity of nearly €4B after the payback.

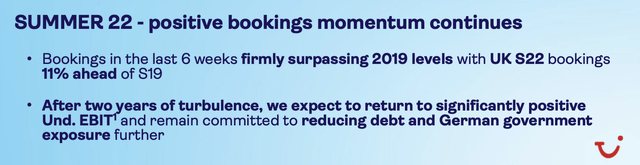

The summer bookings, despite the war, have been very positive as well.

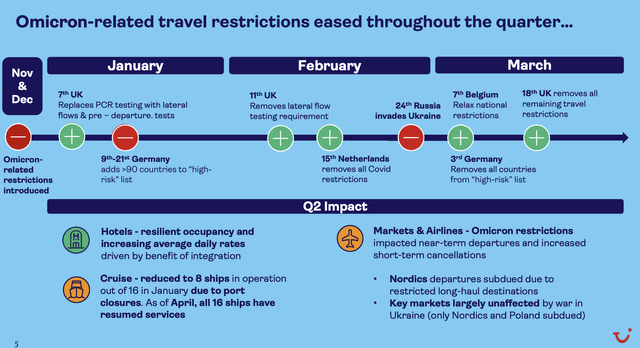

These positive trends are largely related to how COVID-19 trends have wound down during this year in line with increased geopolitical tension and other, more relevant worries in most of the world.

Looking at the company’s financial reporting, this lead to a very strong operational recovery, with occupancy trends improving significantly to 91% of 2019 results, meaning nearly normalized for Hotel & Resorts. The cruise segment is far slower in normalizing. 1Q22 January Cruise occupancy was 59% – but for 2Q22, that number rose to 90%, which on a 2Q22 basis comes to 71% of 2019. The interest in travel and confidence from the consumer side is returning.

Amusement and market and airlines are still down, but the trend is very clear.

TUI is largely a play on UK and Germany as home markets. And remember, when it comes to fundamentally look at these markets, TUI is by far the first choice for most travelers. Its offerings and availability are superb compared to most. The company operates a fully vertically integrated holiday model, with the company seeing its share of customers to the company’s hotels and resorts rising by 2-5 pts in Germany and UK, between pre-COVID-19 and Post-COVID times. The times have seen many smaller players go bankrupt, leaving TUI as one of the solid plays around here.

The company is using every available lever to expand its partnerships, lighten its asset loads, enhance digital-first and expand to never-before-seen areas for TUI as a company. This has given results, as the company, as mentioned, it’s lightening its own asset load in favor of third-party solutions. This somewhat lessens the company’s control but improves its finances. As long as it is done in a controlled and strategic manner, I view this as a net positive. And this seems to be the case at this time.

My stance about some clear trends are:

- All of the company’s segments are seeing improved results and recoveries, with Cruise being the worst affected. Hotels & Resorts delivered positive EBIT for the third consecutive quarter despite the ongoing Ukraine-Russian war.

- Operational improvements are expected for the full year, with potential EBIT either skirting close to or going positive.

- Cash flow trends are superb, with working capital improvements from customer bookings.

- The company’s liquidity, even after paying back €700M in government assistance, is excellent, with €3.8B in available liquidity.

- TUI is well-prepared for the typical seasonal swing in winter (because the company is typically more summer-heavy).

- net debt is now down to below €4B

- The company’s improvement program is on track to deliver €400M in cost improvements by 2023

So things are really looking quite good insofar as improvements for the company’s go. The issue is that these improvements are from a truly low level, with company-wide negative EBIT still being a “thing” at this time. We need far better visibility for improvements before we can start considering this company anything but a risky play. There are suggestions in the share price, given today’s market trends, that we might have seen the company’s valuation trough around 2-3 months ago when the price was below €1.33.

3Q22 results confirm the ongoing recovery, with the company basically being able to deliver a breakeven result (almost). If you take operational disruptions out of the equation and de-impair the company’s results, the company’s results were actually positive and profitable. Hotels are already more than €100M in positive EBIT, and the rest of the segments are following after.

If it hadn’t been for 2020, it would have become a record year overall. The effects that impacted TUI were outside the company’s – any travel company’s ability – control.

However, the message from TUI at this time is that things are coming back, things are returning to growth, and there’s visibility for profit going forward – company-wide.

This company has been an absolute horror show in terms of how the effects of the Pandemic, the MAX scandal, the war, and other things have come in. It’s tough every single factor that could affect a travel company came together and decided that it’s time to beat down these companies to levels not before seen.

The clear picture that I want to leave you with after spending 3 hours studying the company’s financials and doing due diligence in terms of valuation and results, is that things are slowly recovering. This company is likely to deliver positive GAAP as early as next year, and in case of outstanding winter trends, should technically have the ability to technically deliver positive GAAP this year as well.

My forecasts and calculations show the potential for a break-even year is close – and other analysts agree with me on this, with my stance being that 2023 will likely be GAAP-positive.

There comes a time when the sheer size of an organization, its number of customers, and its business is severely undervalued to a degree that is no longer relevant even in a very conservative thesis.

When the potential for return becomes so high, it would be foolish of you to ignore such a possibility.

Have we reached that point with TUI?

Valuation for TUI AG

The answer to that question is a resounding “maybe”.

I am not a risk-oriented investor. I take great pains to avoid downside risks, in fact. TUI has, for several years, been a very bad investment, and the numbers are crystal clear here.

But here are a few more things I consider to be core to the thesis – and foundations to my thesis.

- TUI AG’s business model is intact and thriving.

- Travel isn’t going anywhere.

- The trend for TUI is positive in a way where it’s hard to see a negative potential impacting the business results from here on out – things have already been as “bad” as they’re going to get.

- TUI is at heart, a dividend-paying company.

These can be looked at from the latest results and trends. If these points are considered, then only one logical conclusion is realistic, as I see it.

TUI AG will eventually go back up.

And that reversal, dear reader, has the potential to be absolutely massive. We’re talking quadruple-digit returns if the company normalizes. The company’s road to improvement goes beyond results. S&P recently upgraded the company’s credit rating. TUI now holds B- and B3 from S&P and Moody’s, both with “stable” outlooks. These ratings are up from CCC+.

At its heart, this is not a play I’m comfortable going into with my current risk tolerance and with alternatives available on the market today. The potential for ups and downs is still there – even if my conclusion is that the inevitable eventual result is that things go up. For investors with higher risk tolerance, this offers a potential return of over 500% in a 10-year timeframe.

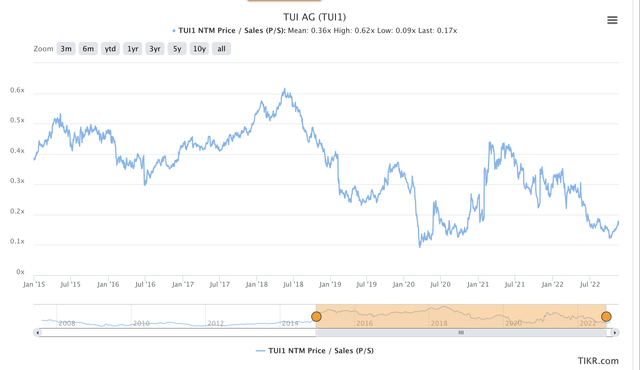

You cannot argue that the company is attractively priced. The company typically trades at a sales multiple of 0.35-0.62x, with a recent of 0.17x.

TUI valuation (TIKR.com/S&P Global)

Because the company currently sports negative earnings, there is little sense in looking at such multiples. But we can state that the current average price targets and analysts’ forecasts all point in one direction, up. 6 analysts look at the company with ranges starting at €1.6 and going to €2.1, with an average of €1.84. That’s a 10% upside from today’s share price of around €1.65.

I believe with a high degree of conviction that investors in TUI today, will be very content with their return potential in 10 years. Even if more headwinds come the company’s way, I believe that the sheer undervaluation that the market applies to this company’s cash flow and revenues makes this an attractive play provided your risk tolerance is up to the task.

For me, it’s a question of compatibility – and such an investment, like any non-yielding turnaround investment, is not compatible with my fundamental portfolio structure.

If I had $10,000 or $100,000 that I could throw into an investment with the expectation of wanting a “turnaround” investment with a 500-1000% RoR potential, then TUI would be relatively high on that list, but this is not my M.O when it comes to current investing.

However, in applying any sort of valuation methodology, my estimate for the company’s value, and taking into consideration the normalization trends, it’s irresponsible to go below €1.75 here. DCF, NAV, and normalized SOTP valuations, taken in context, all show the company to have the likely potential for a turnaround.

For that reason, while it’s not a compatible play for me at this time, I still rate TUI as a “BUY” here. I don’t see the potential for significant downward pressure here unless something materially changes in the current macro. While possible, and while the risk here is very high, I view the upside as equally high.

As such, is a speculative “BUY” for me, with a decent short-term and potential high long-term upside.

Thesis

My thesis for TUI is as follows:

- TUI AG is one of the most appealing travel companies in all of Europe. Unlike many of its peers, it has survived and is generating positive FCF following several grueling years.

- I believe the combination of current bottom-level valuation combined with a relatively well-established current trend of normalization only has one logical eventual outcome – an upside. However, the risk inherent to such an investment makes it incompatible with my current conservative portfolio.

- Still, as a speculative position, I cannot rate TUI anything but a “BUY” here. The company’s cash flows are “too good” long-term, and the company’s turnaround seems to be working.

- My PT is €1.75 – but keep in mind that this a speculative and high-risk play.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment