Sundry Photography

Editor’s note: Seeking Alpha is proud to welcome Adrian van der Vyver as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

We believe SentinelOne (NYSE:S) is an attractive long-term investment that should provide at least 100% return over the next 2 to 5 years due to:

- Revenue growth

- Execution ability

- Total addressable market

- Product superiority to legacy players

This is a high-risk play but with a very high return possibility. We also believe that SentinelOne doesn’t need to be the next CrowdStrike (CRWD) to be an attractive investment as the total addressable market is large enough for there to be many winners.

Company Overview

SenintelOne is a cybersecurity company that has developed an artificial intelligence extended detection and response (XDR) platform to enable autonomous cybersecurity defense. They have an impressive product suite that includes endpoint protection, an XDR platform, identity protection and cloud security amongst other offerings. Cybersecurity has become increasingly important given the rapid increase in cyber-attacks across the world.

The cybersecurity sector is extremely competitive which includes CrowdStrike and Palo Alto Networks (PANW). Each competitor differs in a way with what they are offering and how they go about providing the offer. CrowdStrike would be the closest public competitor in terms of product quality and business outlook. According to SentinelOne their total addressable market is vast for current solutions today and is expected to reach $40.2 billion in 2024.

SentinelOne listed on the NYSE in June 2021 raising $1.33 billion to use for their go-to-market strategy, strategic acquisitions, and product development.

Progress on revenues & profits

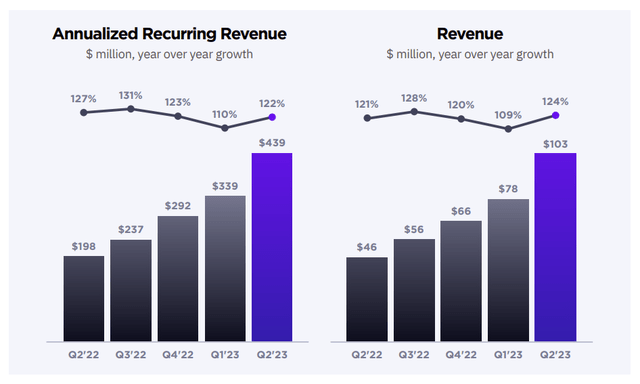

SentinelOne listed with a humble first reported quarterly revenue in Q2 2022 of $46 million. Over a year later the company reported its Q2 2023 quarterly revenue of $103 million. This is an impressive 123% y/o/y growth rate. The company’s ARR has grown from $198 million in Q2 2022 to $439 million – a 122% y/o/y growth. In the Q1 2023 earnings call CEO, Tomer Weingarten stated:

Our business has never been stronger, and we expect these positive trends to continue as we move towards $1 billion in ARR and beyond.

It appears that SentinelOne is on a similar path and has the ability to become a billion-dollar revenue business. This will be necessary to justify its current valuation as well as any future share price growth.

Q2 2023 Shareholder Letter (SentinelOne Investor Relations)

Gross Margin

SentinelOne’s profitability and margin have been a more contentious topic than its revenue growth.

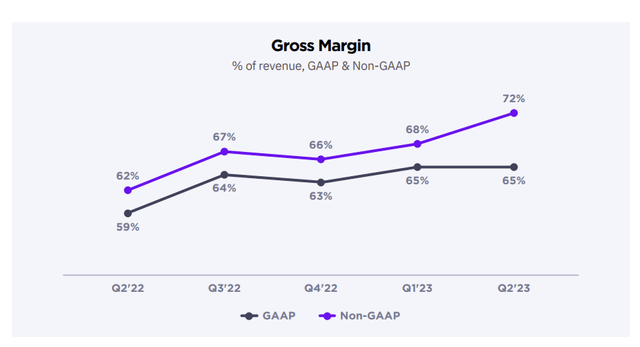

The company’s Non-GAAP gross margins were 62% in Q2 2022, which is uninspiring, to say the least. At the time, the reasons discussed for the margin disparity were that SentinelOne was pricing lower than competitors, smaller deal sizes, Scalyer migration duplication costs and the much larger propensity to spend on R&D and the investment in the cloud infrastructure.

Management has made progress and in Q2 2023 the company achieved a 72% Non-GAAP Gross Margin. CrowdStrike, the nearest competitor when it was at a similar stage, had a Non-GAAP Gross Margin of 76% in Q3 2022. SentinelOne management has stated that the long-term Non-GAAP Gross Margin target is 75% to 80% plus. This would be in line with CrowdStrike’s Q2 2023 Non-GAAP Gross Margin of 78%.

Note: the differential between GAAP and Non-GAAP Gross Margin in Q2 2023 was a 5 percentage points related to an inclusion of Amortization of acquired intangible assets from the Attivo acquisition not present in previous analysis as the acquisition was closed in Q3.

Q2 2023 Shareholder Letter (SentinelOne Investor Relations) Q2 2022 Shareholder Letter (SentinelOne Investor Relations)

Net Margin

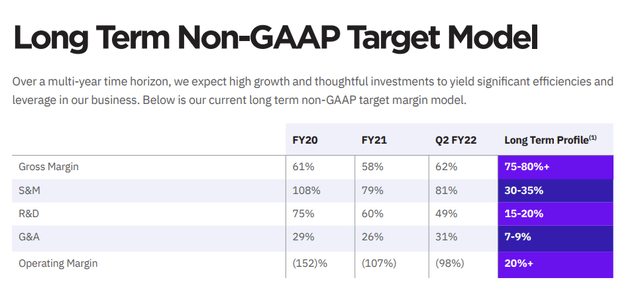

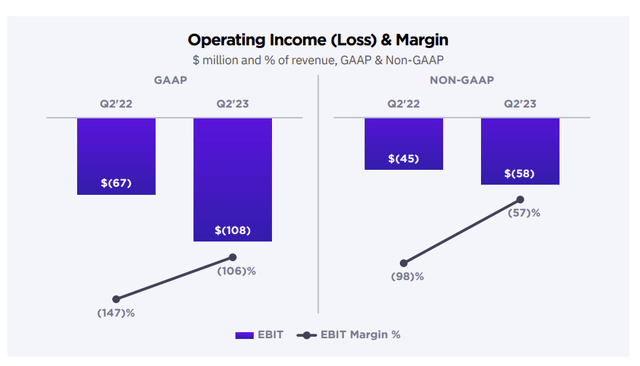

SentinelOne’s operating loss and margin are other areas of concern. In Q2 2022 the loss was $45 million with a negative margin of 98%. This improved in Q2 2023 to a loss of $58 million with a negative margin of 57%. Management stated the following in the Q1 2023 earnings call:

If you consider our fiscal ’23 guidance, we’re on track to deliver an average of about 30 percentage points of operating margin expansion each year since fiscal ’21. If one extrapolates this further, we could be on a path to operating profitability in fiscal ’25. On a quarterly basis, we could see positive cash flow generation even sooner.

Management’s long-term target is 20%, which we would consider extremely healthy and supportive of a future share price growth if management continues to meet its targets.

Q2 2023 Shareholder Letter (SentinelOne Investor Relations)

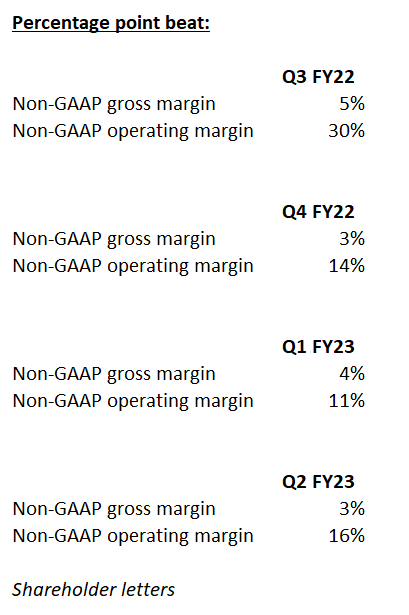

We performed an analysis of quarterly guidance of the last 4 quarters and compared that to the actual results in the quarter. The actual Non-GAAP gross margin beat is between 3 and 5 percentage points and the Non-GAAP operating margin beat is 11-30 percentage points.

SentinelOne Investor Relations

The fact that management has acknowledged that the margins of the company need improvement and the fact that they have a credible forecast history provides comfort and makes us believe that they will continue to grow to their long-term targets.

Valuation

Quantitative

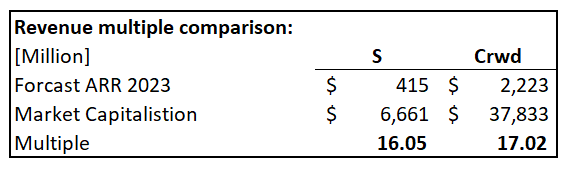

At the time of writing this article SentinelOne has a share price of +/- $23 per share and a market capitalization of $6.66 billion. This is down 70% from an all-time high of $78.49 per share in 2021. The air has been taken out of the growth hype and growth-related stocks in 2022 as a result of rising interest rates, the threat of recession, etc. From a quantitative perspective, we have performed a revenue multiple comparison (Price to Sales Ratios) with CrowdStrike. As can be seen below SentinelOne’s multiple of 16x is fairly similar to CrowdStrike’s 17x. Given that CrowdStrike is 5x in size and SentinelOne receives a similar revenue multiple suggests to us that if SentinelOne can continue its revenue growth targets and margin improvements over the longer term it could grow into a similar-sized company in terms of market capitalization.

Seeking Alpha (S) and (CRWD) financial data

SentinelOne also has $1.2 billion in cash and cash equivalents as of Q2 2023, and this provides a significant runway for expansion. If we remove the cash & cash equivalent from the market capitalization then the multiple of the remaining business is 13x vs. CrowdStrike’s 16x.

If we push this thought experiment further we can see according to NYU Professor Aswath Damodaran’s data – which collates sales-to-price ratios of 375 listed global System & Application Software companies – that the average price-to-sales ratio is 12.44x. Where in the life cycle these companies are will be different but this gives a good idea to the average across a varying degree of maturities of what one can expect the price-to-sales ratio to be.

Even if we discount SentinelOne in the future for being less profitable or less effective at capturing market share than CrowdStrike we can at least see a future market capitalization of $12 billion – $15 billion which would be a 180% – 225% return on the current price. The time period on this could be 2 years to 4 years, which is still a respectable annualized return.

The $12 billion – $15 billion market capitalization valuation is derived as follows: SentinelOne’s quarterly revenue growth for 9 quarters since April 2020 has been an average of 21%. We have assumed that the average quarterly growth over the next 9 quarters will be half of that due to the revenue base getting larger. At an 11% average quarterly revenue growth rate for 9 quarters, SentinelOne is expected to have $1 billion in ARR by Q4 2025.

We have assumed going forward based on CrowdStrike’s current multiple as well as Professor Aswath Damodaran’s data that a revenue multiple of 12-15x is likely to be present in Q4 2025.

If the revenue is $1 billion in Q4 2025 and we assign a revenue multiple of 12x to 15x, the valuation range should be $12 billion to $15 billion in +/- 2 years from now, and hence a 180% – 225% return on the current price, excluding the effect of time value of money.

At this stage, it is very difficult to do an accurate valuation of the future cash flows given the high level of uncertainty. We, therefore, believe that the best way to value this company is to consider the qualitative factors and assess the ability of the company to continue growing and the growth of the total addressable market.

Qualitative

We see the cybersecurity market to continue growing and also show strength during any possible economic downturn. Cybersecurity is a non-discretionary expenditure. This is supported in SentinelOne’s Q2 2023 result call, as CEO Tomer Weingarten said the following:

Demand is strong, and we remain extremely well positioned. At the same time, enterprises across all sectors of the economy are being impacted in different ways by evolving macro conditions. Like other software companies, we’ve seen some signs of cost consciousness and prudence around IT budgets. This has resulted in marginally longer sales cycle and more budgetary approvals. The impact has been quite modest so far. The risks of not being protected by a leading security solution are too costly.

CrowdStrike’s CEO George Kurtz echoed the same sentiment in the results call:

Moving to our markets, the competitive environment remains favorable and our win rates remain consistent. We continue to see strong demand even as organizations responded to macroeconomic conditions. For CrowdStrike, this primarily manifested in the form of increased levels of required approvals on some deals as companies evaluated investment priorities, which can extend the time it takes to close deals. However, cybersecurity is not a discretionary line item. Cybersecurity is a priority for CIOs, CEOs and CFOs and Boards of Directors, and our value proposition resonates strongly with these stakeholders.

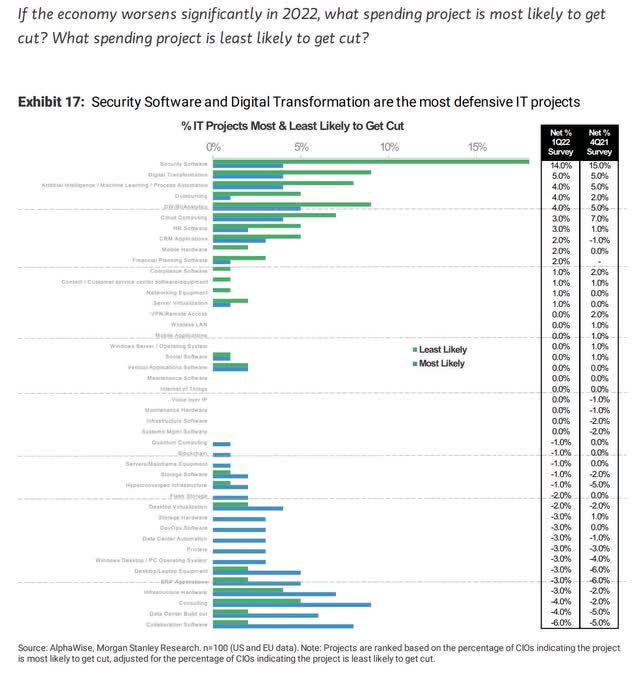

This is further supported by a survey of CIOs which shows that security software IT projects are least likely to be cut.

Is IT Spending Back for the U.S. and Europe? | Morgan Stanley

We, therefore, believe that the stickiness and inelasticity of cybersecurity will make investing in SentinelOne desirable given the current macroeconomic conditions. The continued allocation of budgets towards cybersecurity is also clear and favorable for SentinelOne.

Why SentinelOne is a Good Buy

SentinelOne has a high valuation of $6.6 billion. This is a risk if they don’t meet their revenue growth targets and improve profitability. A similar case study exists of CrowdStrike which grew into a billion-dollar revenue company and is valued at over $36 billion. We do not believe SentinelOne needs to be the next CrowdStrike to still provide an attractive return to investors.

What Are the Risks

Valuation

SentinelOne with a market capitalization of $6.6 billion is currently valued high given its revenue size and poor profitability metrics. If you invest in this stock, you have to have faith that the company will continue to meet its revenue growth and margin targets. There is therefore always the risk that there will be misses and this could rapidly dent investor sentiment. This is somewhat offset by the fact that the company has been regularly beating its forecasts and stated in the Morgan Stanley Investor conference in 2021 that every quarter they hit their expected targets and their growth curve has been constant.

Sales strategy

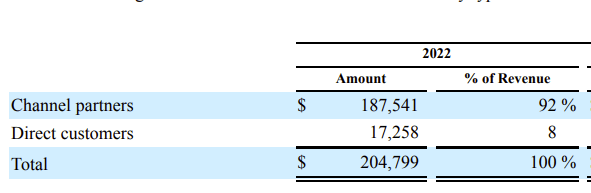

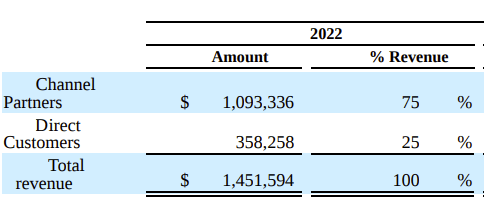

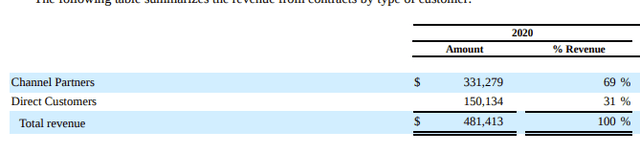

Another risk is SentinelOne’s go-to-market strategy. CrowdStrike has proven that rapid growth is possible and sustainable but their go-to-market strategy has been different. CrowdStrike has a very large direct sales team that directly sells and assists channel partners in sales. SentinelOne on the other hand substantially uses its partner-supported go-to-market strategy.

SentinelOne believes its partner ecosystem helps magnify its market presence, significantly extending the reach of its own sales and direct customer engagements. In addition to its Value Added Reseller partners, it believes partnering with and enabling Managed Security Service Providers, Managed Detection and Response Providers, and Incident Response Firms unlocks significant scale in collaboration with its internal sales teams. SentinelOne does not compete with its partners. All of these partnership ecosystems aim to really unlock parts of the TAM that some of the other vendors can’t really reach, and that gives SentinelOne the belief that it has a very sustainable advantage to unlock growth over time.

According to SentinelOne’s 10-K Annual Report for 2022, 92% of revenue generated is through channel partners. In comparison, CrowdStrike’s 2022 annual report states their revenue generated through channel partners is 75% and in their 2020 annual report it was 69%. As it stands we cannot criticize SentinelOne’s growth strategy as their metrics remain good. There is however a question mark over whether this is the right strategy and whether it leads to sustainable revenue growth at higher levels of revenue.

Sentinelone 2022 10-K Crowdstrike 2022 10-K Crowdstrike 2021 10-K

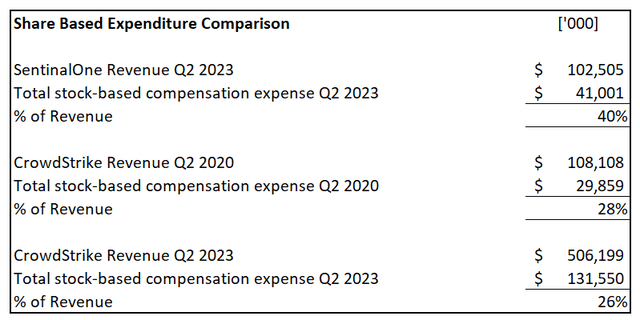

Share-based expenditure

SentinelOne Investor Relations

SentinelOne also has an extremely large stock-based compensation as a percentage of revenue. The company has a current stock-based compensation as a percentage of revenue of 40% whereas the same figure for CrowdStrike at a similar revenue size was closer to 28%. This is a significant difference and one would expect the cash burn rate to be lower if you are issuing shares to employees instead of cash salaries. Unfortunately, based on our analysis this isn’t the case as SentinelOne does not have better operating free cash flow metrics than CrowdStrike at any stage.

The difference in expenditure structure seems to be a matter of timing and expense philosophy. It is also clear that management is weary of their stock-based compensation as it was specifically commented by CFO, David Bernhardt in the Q1 2023 earnings call:

Yes. I think stock-based comp is obviously something we’re focused on. If we look at ourselves as a percent of the operating expense, we’re in line with our peers. If you look at us in terms of percentage of revenue, it’s something we expect to decline over time as we achieve scale. Obviously, we’ve been hiring into revenue, and we’re seeing that start to dissipate over time where we’ll fall within industry norms. So it’s something we’re very cognizant of. We pay attention to it. But yes, I think Tomer hit it right. Employees are coming here because we’re a destination because we’re going to offer a lot of value to employees over a four-year period. And this is unfortunate what’s happened recently with the stock performance in the entire market, but we believe if we continue to execute, we’ll ride out of this very strong.

From this comment, it is clear that SentinelOne has taken the strategy to throw the kitchen sink at product and market execution and has not been conservative in expenditure. That said, we draw comfort from the fact that management is cognizant of this fact and also that they expect to head towards industry norms once they hit scale.

Conclusion

Based on the size of the total addressable market the company plays in, their superior product position, and their current ability to execute on revenue growth, we believe SentinelOne is an attractive investment opportunity that should pay off handsomely over the next 2 to 5 years.

Be the first to comment