1111IESPDJ/E+ via Getty Images

Pricing Power Can Outgrow, Outlast Inflation

Market Overview

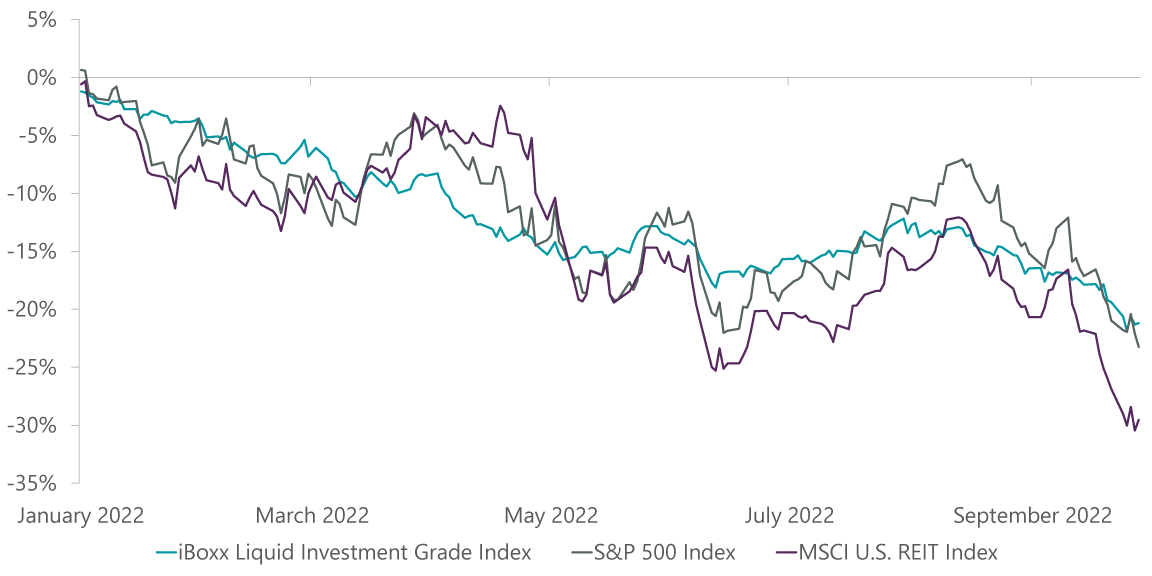

The third quarter was another tough period for capital markets. Diversification, typically a reducer of volatility, provided no succor. All major asset classes fell, with the third-quarter declines representing an extension of what we have seen all year (Exhibit 1). The ClearBridge Dividend Strategy, though still down much less than the market year to date, trailed its market benchmark in the third quarter.

Exhibit 1: Stocks, Bonds and REITs Under Pressure in 2022

As of Sept. 30, 2022. Source: ClearBridge Investments, Bloomberg Finance.

While many factors contribute to market movements, this year’s broad declines are primarily attributable to two intertwined factors: inflation and rising interest rates. In the years following the global financial crisis, growth was low, inflation non-existent and investors wondered whether we had entered an era of secular stagnation. Interest rates in the U.S. spent a decade at all-time lows and in many other countries interest rates were negative! Just a few years later, inflation is at 40-year highs and interest rates are surging. COVID-19 changed so many things about the world, the economy included.

COVID-19 shutdowns reduced global productive capacity, which in hindsight had already suffered from years of underinvestment. As the economy re-opened, consumers — flush with stimulus money and armed with zero-interest financing — spent prodigiously and pushed up prices of items in short supply (cars, houses, hotel rooms, etc.).

A few trenchant observers sounded the alarm on inflation in early 2021, but Wall Street and the Fed believed it to be transitory, underappreciating the stickiness of the problem and the magnitude of interest rate increases needed to fix it. Earlier in 2022, investors began to appreciate that inflationary headwinds were more than just temporary, but they still did not grasp the full scope of the problem. After a large selloff in the second quarter, equity markets bounced sharply this summer as investors still clung to hopes that the worst was behind us.

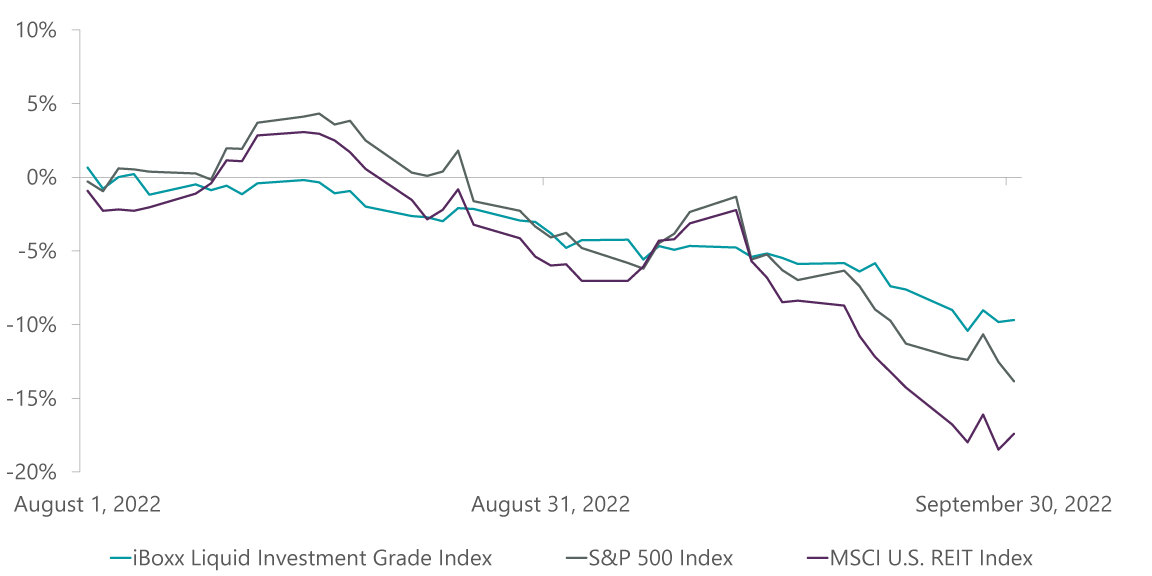

Those dreams were put to bed in late August, however, when Fed Chairman Powell made plain the Fed’s determination to defeat inflation, despite it bringing “pain to households and businesses.” His sobering remarks called investors to attention and sparked a September swoon (Exhibit 2).

Exhibit 2: Markets Respond to Fed’s Determination to Raise Rates

As of Sept. 30, 2022. Source: ClearBridge Investments, Bloomberg Finance.

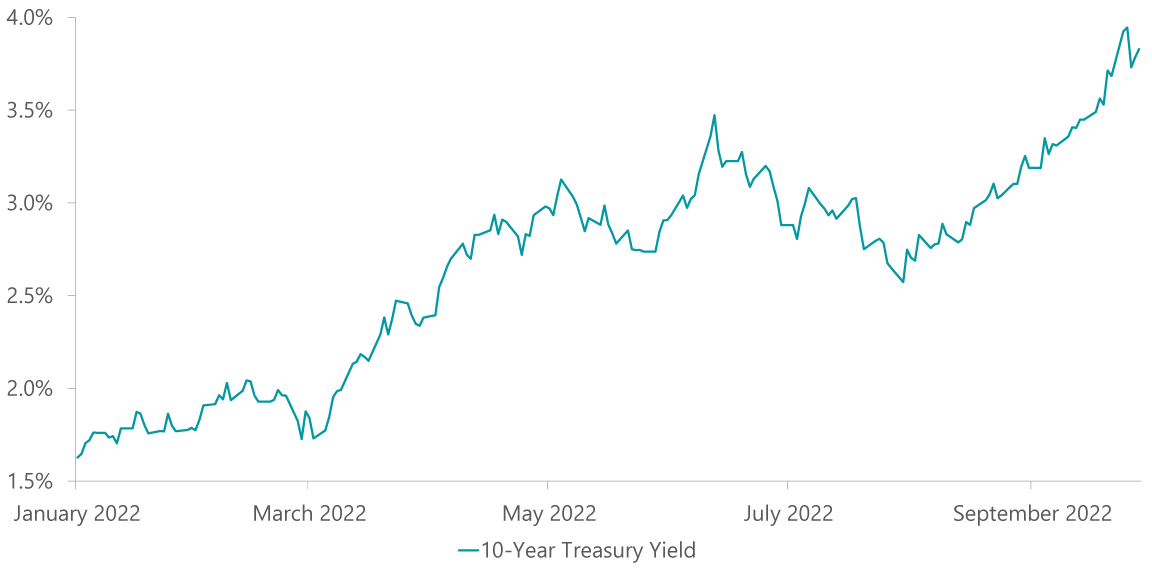

After warning of investor complacency for many quarters, we think the Street is finally starting to digest the significance of the headwinds we face and the impacts they will have on the economy and the market. Interest rates, which have risen steadily throughout the year, rose sharply in September (Exhibit 3).

Exhibit 3: 10-Year Treasury Yields Spike in September

As of Sept. 30, 2022. Source: ClearBridge Investments, Bloomberg Finance.

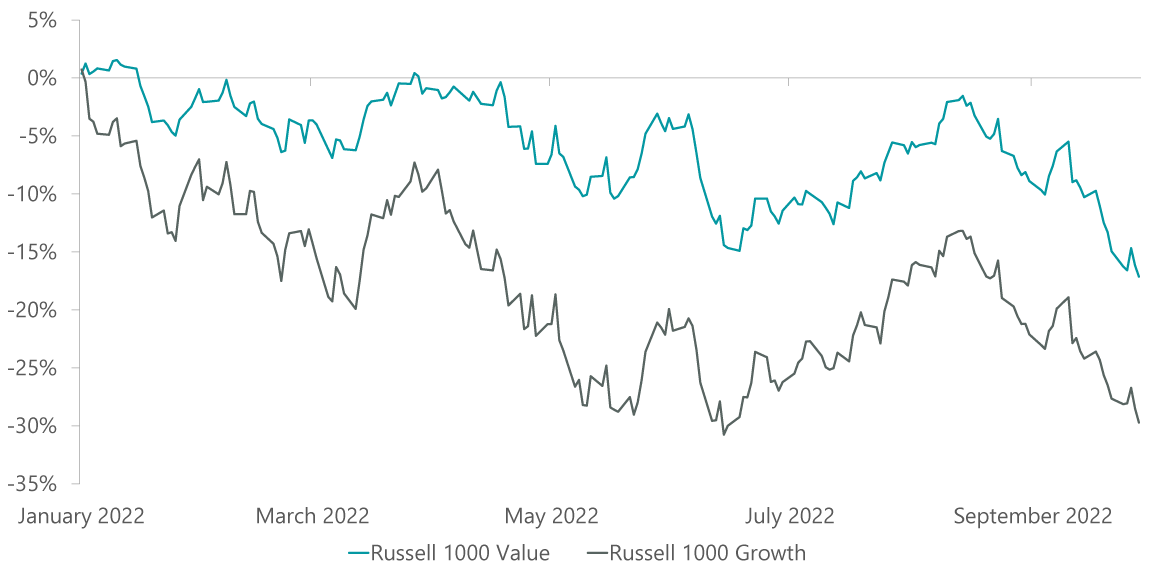

Dramatically rising rates weigh on asset prices by increasing the discount rate used to calculate the present value of future cash flows. We have discussed this dynamic in many of our recent quarterly commentaries. While rising rates impact the value of all assets, they mostly impact the price of assets whose value is derived from cash flows far into the future, such as high-multiple growth stocks and long-duration bonds.

The impact of rising interest rates can be observed in the disparate performance of investment styles. Over long periods of time, value and growth tend to deliver similar performance. At some points in the cycle, however, their returns can differ starkly. In 2020, for example, when work-from-home growth stocks like Zoom (ZM) and Amazon.com (AMZN) soared, growth outperformed value by 3,600 basis points! This year, as rising interest rates have pressured high-multiple growth stocks, value has outperformed growth by 1,300 basis points (Exhibit 4).

Exhibit 4: Growth Stocks Bear Brunt of Rising Rates

As of Sept. 30, 2022. Source: ClearBridge Investments, Bloomberg Finance.

Given the large declines in the market, some measure of the world’s challenges are now reflected in market prices. Unfortunately, we think there may be more volatility in the quarters ahead before the market bottoms and begins rising anew. The Fed is now clearly focused on taming inflation and interest rates are likely to continue moving higher. Rising rates will slow economic activity, which at a minimum will reduce earnings growth rates and likely end in a recession.

Our positioning remains broadly consistent, with overweights to materials and energy and underweights to higher-multiple areas of the market in the consumer discretionary and information technology (IT) sectors we think are vulnerable to further multiple compression in a higher interest rate environment.

As always, we focus on companies with strong competitive moats, high margins and returns, recurring revenues, pricing power and growing dividends. Our emphasis on investing in companies with pricing power has enabled our portfolio companies, such as aggregates producer Vulcan Materials (VMC), a top contributor in the third quarter, to admirably offset rising costs seen across the economy.

We continue to see strong results from our energy overweight, where we are focused on natural gas. Companies like EQT (EQT) and Chesapeake Energy (CHK), while smaller positions, have contributed meaningfully in a tight energy market. Even as commodity prices have come in recently, structural undersupply continues to give us confidence in the outlook for these companies.

We have focused our valuation discipline to reduce exposure to higher-multiple stocks most at risk of multiple compression in the current environment. Along these lines, while we remain constructive on the high returns on invested capital Ecolab (ECL) earns in its core business, over the years its diversification has diluted this segment’s importance, and we feel less comfortable defending the position at current valuations.

Seeing better opportunities elsewhere in the materials sector, we exited our position in Ecolab and added to copper producer Freeport-McMoRan (FCX), which supplies a much-needed resource for the energy transition, and specialty chemical company Linde (LIN), which has historically held onto pricing gains it has achieved following increases in energy costs. We think this pricing power should protect profitability during the acute inflationary phase and potentially lead to margin expansion when cost pressures abate.

Linde also continues to be well-positioned on hydrogen and carbon capture with contract-backed project capex likely accelerating in the medium term as the recently passed Inflation Reduction Act rolls out.

A volatile market can offer attractive opportunities to the patient investor, and we have our pencils sharpened for good entry points in favored companies. In the third quarter we added General Motors (GM), finding shares overly discounted due to skepticism over earnings in a down cycle. While a slowing economy will clearly impact automotive demand, inventories and production are well below long-term averages, mitigating the risk of cyclical declines.

Further, the company is at a technological inflection point we believe is underappreciated as it readies several electric vehicle product launches and scales its automated vehicle offering, Cruise.

Amid the current market and geopolitical tumult, we believe the ClearBridge Dividend Strategy remains a good place to be. Our current dividend yield provides income support in volatile markets and our dividend growth provides a meaningful offset to inflation and rising rates.

Portfolio Highlights

The ClearBridge Dividend Strategy underperformed its S&P 500 Index benchmark during the third quarter. On an absolute basis, the Strategy saw positive contributions from one of the 11 sectors in which the Strategy was invested for the quarter: the materials sector. The IT and communication services sectors, meanwhile, were the main detractors.

On a relative basis, stock selection and sector allocation detracted from performance for the quarter. In particular, stock selection in the energy, communication services, industrials, financials, IT, consumer staples and health care sectors as well as an underweight to the consumer discretionary sector detracted. Stock selection in the materials sector and an energy overweight, meanwhile, proved beneficial.

On an individual stock basis, the main positive contributors were Vulcan Materials, Chesapeake Energy, EQT, Waste Management (WM) and Ecolab. Positions in Comcast, Raytheon Technologies (RTX), Verizon (VZ), Microsoft (MSFT) and Enbridge (ENB) were the main detractors from absolute returns in the quarter.

|

Past performance is no guarantee of future results. Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment