4X-image

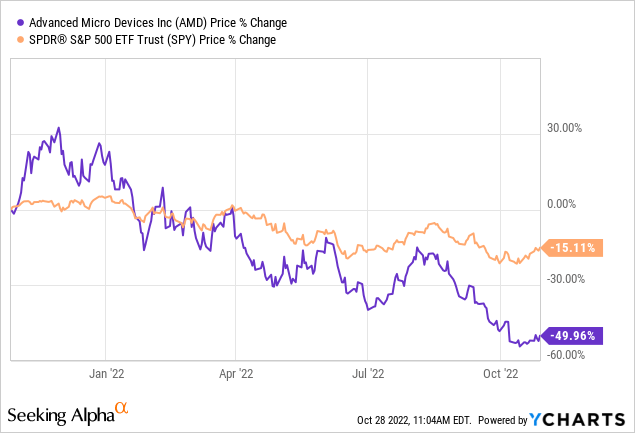

Very few of us expected that Advanced Micro Devices (NASDAQ:AMD) would perform as poorly as it did this year. Most of the stock’s poor performance has been due to systemic risk instead of idiosyncratic features. However, it’s likely that the market has overreacted, and we firmly believe Advanced Micro Devices stock to be in oversold territory.

Advanced Micro Devices is expected to release its third-quarter results on November 1st. Yet, our analysis assumes a long-term vantage point and classifies the stock as a strong buy regardless of the firm’s third-quarter results.

What Are Quality and Growth Stocks?

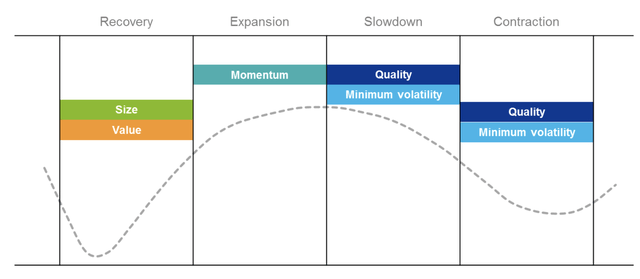

Much like business sectors, the stock market is parted into various categories. As observable in the diagram below, some of these categories include growth, value, high dividend, low volatility, quality, and momentum.

Seeking Alpha

Understanding these different segments (also known as factors) makes life a lot easier as an investor because they exhibit key correlations to various economic and stock market environments. For instance, a low-interest rate and high economic growth environment usually cause growth stocks to outperform, whereas a contracting economy will likely result in low volatility and high dividend stocks outperforming.

A segment that tends to outperform during uncertain market circumstances is the quality segment, as it’s associated with companies (and stocks) that exhibit strong balance sheets, above-normal profitability, and secular growth. The quality and growth segments are often intertwined, but there are subtle differences that will be explained throughout the article.

Factor Performance Vs. Economy (MarketWatch)

Key metrics indicate that Advanced Micro Devices can be considered both a growth and quality stock (elaborated upon later in the article). Thus, presenting it with a platform to outperform the market throughout most of the economic cycle. We’re well aware of the stock’s slump during 2022’s bear market. However, the velocity of this year’s market events needs to be considered, and we think the extent of 2022’s bear market was caused by much irrational thinking by investors due to once-in-a-lifetime systemic events such as the war in Ukraine, global energy shortages, and short supply of essential items.

Analysis of AMD’s Operations

I know that most of you are aware of baseline growth rates in the semiconductor space. However, I need to run over it again to set the tone for the rest of the operational analysis segment.

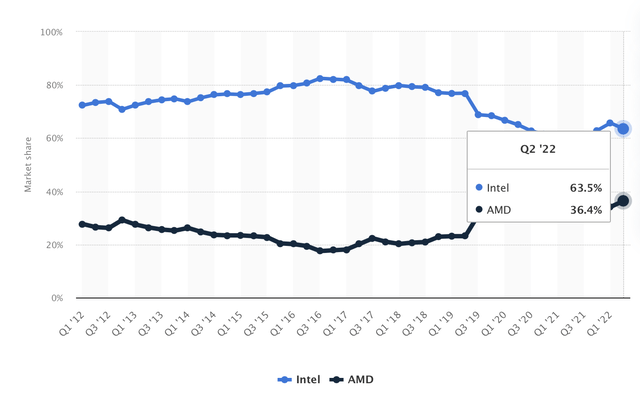

Advanced Micro Devices has certainly received industry-related support due to the significant growth in the semiconductor space. Prospects remain bright, with the GPU industry set to surge by 33.6% per year until 2027. In addition, Advanced Micro Devices owns much of the GPU and CPU markets, in turn providing it with the necessary bargaining power over suppliers and pricing power over consumers.

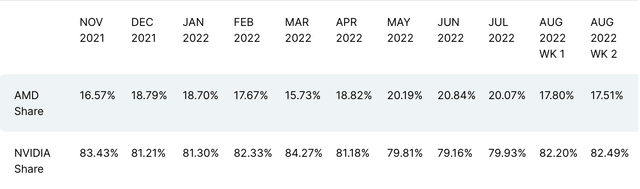

CPU Market Share (Statista)

GPU Market Share (WccfTech)

Let’s observe Advanced Micro Devices’ cross-segment growth to broaden the scope of our underlying business-related argument.

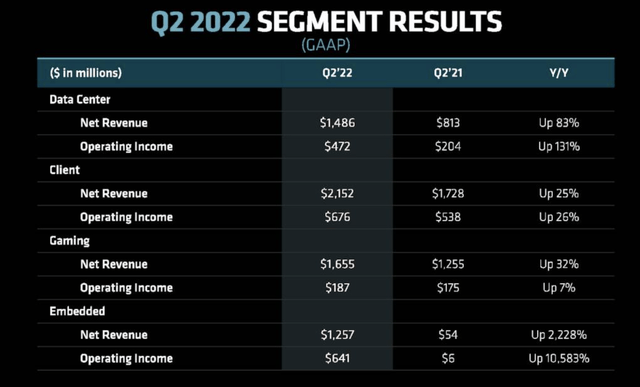

Advanced Micro Devices

Data Center

The data center space is forecasted to grow at a compound annual rate of 10.5% until 2030. However, Advanced Micro Devices’ 16% data center market share has allowed it to accelerate its segment revenue beyond the industry norm, with top-line revenue surging by 83% year-over-year.

The data center hype has dropped a bit as pandemic re-openings commenced and tangible life resurfaced. Nonetheless, apart from the existing drivers, namely cloud and crypto mining, domains such as automation and edge computing will have a significant role to play in the coming years.

One possible systemic headwind is the industry’s power usage. Sustainability and the political implications that come with it are something investors should keep in mind.

Advanced Micro Devices has various idiosyncratic features on its side. For example, Microsoft Azure has implemented the company’s MI 200 accelerators, in turn proliferating the company’s enterprise revenue. Furthermore, Advanced Micro Devices recently completed the acquisition of Pensando in a vertically integrated move to expand its enterprise offerings.

Client

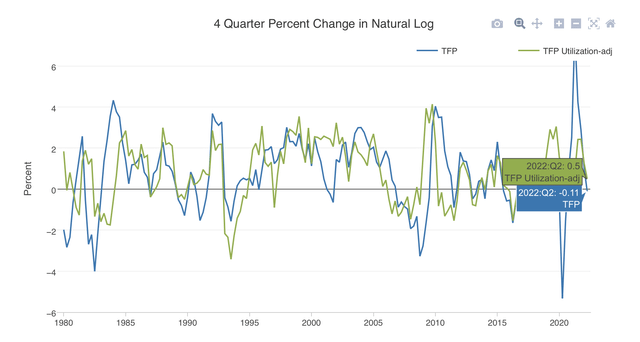

Advanced Micro Devices’ client segment is its ‘cash cow,’ and the division’s 25% year-over-year growth is certainly encouraging to see. We see sustainable growth ahead here, with Desktop PCs, notebooks, and commercial working stations demand proliferating in the past few years. The pandemic forced enterprises and individuals to digitalize as swiftly as possible, which is visible by observing TFP (GDP Growth attributed to tech) growth.

Total Factor Productivity (San Francisco Fed)

Advanced Micro Devices holds solid long-term relationships with downstream PC companies such as HP and Lenovo. Therefore, assigning latitude for further segmental growth.

Gaming

Gaming is an industry in an embryonic stage with plenty of embedded volatility. Therefore, a long-term vantage point needs to be assumed when assessing the segment’s prospects.

Gaming is growing at an illustrious rate, with GrandView Research anticipating a compound annual growth rate of 12.9% until 2030. From an anecdotal viewpoint, more individuals prefer watching eSports and other e-gaming events than actual ‘on-field’ events than ever before. Moreover, there’s a generational effect settling in. It’s seemingly much more acceptable for Gen Z individuals to spend time in front of a console than it was for previous generations. As such, don’t be surprised if sales go through the roof in the coming years.

Advanced Micro Devices’ gaming segment proliferated by 32% during its second quarter as it experienced support from semi-custom customer sales. In addition, Ryzen mobile processor sales are playing a big hand.

Advanced Micro Devices’ gaming division provides balance to the company’s revenue mix as it adds a longer-term prospect to its already matured segments, such as “Client”.

Embedded

Advanced Micro Devices’ embedded segment is experiencing distinguished growth with more than 2200% in year-over-year revenue growth. The segment holds much potential as its exposure to AI is vast. We see tremendous opportunity in embedded systems pertaining to AI as the time series, and GAN neural networks space is skyrocketing. Image and pattern recognition offerings have been central to the segment’s recent growth, with much of it being due to ancillary products of automation and live sports broadcasts.

Holistic Growth

Piecing it all together, Advanced Micro Devices has produced high short and long-term growth. In our opinion, the company exhibits a secular growth trajectory while also scaling its bottom-line earnings (discussed later). Thus, it provides us with enough evidence to place its stock in the “quality” and growth segments.

| 3-Y CAGR | 54.28% |

| 5-Y CAGR | 35.39% |

| 10-Y CAGR | 12.96% |

Source: Seeking Alpha

Factor-Related Metrics

Growth and quality stocks have plenty in common. For example, both stock categories emphasize earnings, secular growth, and scalability. However, as previously mentioned, quality stocks are characterized by established profitability, whereas growth stocks are associated with expected profitability. Essentially, quality stocks are mature-stage growth stocks.

Advanced Micro Devices stock exhibits numerous attributes of quality stock. For example, the company’s gross profit margin of 50.75% indicates that it has achieved economies of scale, thus, allowing it to assert pricing power.

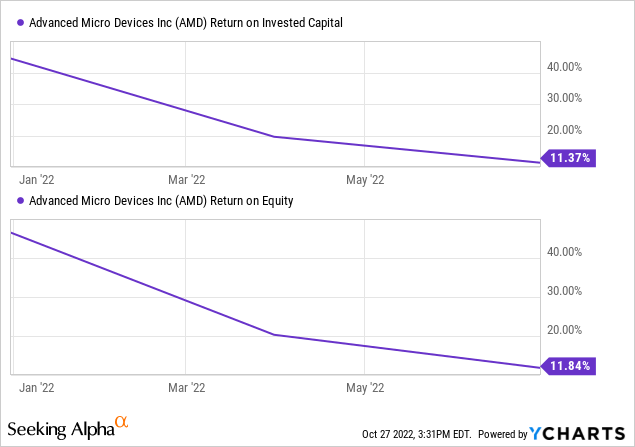

Furthermore, Advanced Micro Devices’ return metrics are top-tier. For instance, the stock’s 11.37% return on invested capital indicates that it monetizes its working capital efficiently, which is often due to successful product differentiation. In addition, Advanced Micro Devices’ return on equity of 11.84% communicates the company’s ability to pass through residual value to its investors.

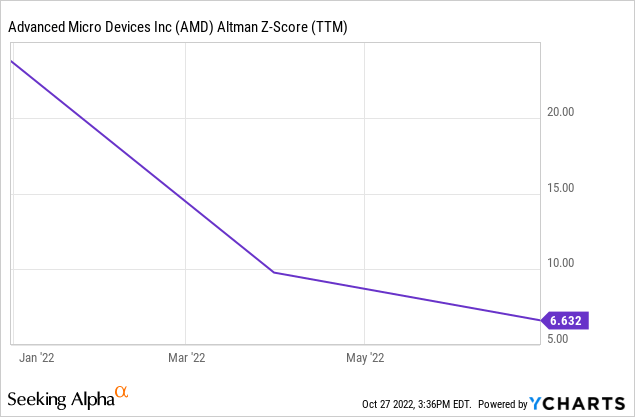

Furthermore, Advanced Micro Devices’ Altman Z-Score of 6.632 means the company’s balance sheet is very liquid, solvent, and robust. As previously mentioned, Quality stocks are generally associated with strong financial statements.

We consider Advanced Micro Devices as a “quality” stock because of its top and bottom-line scalability. In addition, key quantitative metrics provide substance to the argument and affirm our classification.

In a nutshell, we believe Advanced Micro Devices has pivoted out of a pure-play growth stock and into a combined growth and quality sphere.

Stock Price Reversion

Relative Valuation

Many neglect how helpful it is to compare a stock’s relative valuation multiples to their normalized 5-year averages. As investors, we often look at price multiples in isolation or relative to peer companies; however, mean reversion is often the name of the game in the financial markets.

Advanced Micro Devices stock is undervalued on a relative basis according to its price multiples. The stock’s current price-to-sales and price-to-earnings ratios are at 45.22% and 74.93% normalized discounts, respectively.

Furthermore, the stock’s EV/EBITDA multiple is at a 66.85% normalized discount. We believe the EV/EBITDA multiple is essential in this instance as Advanced Micro Devices expenses a lot of its research & development.

| Price-to-Sales | 3.69x |

| Price-to-Earnings (Non-GAAP) | 15.30x |

| EV/EBITDA | 16.61x |

Source: Seeking Alpha

Technical Analysis

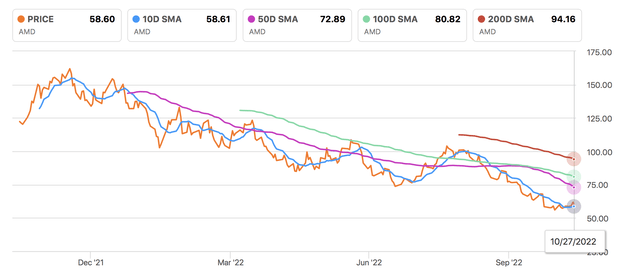

We looked at Advanced Micro Devices’ moving averages to further dissect a past price versus current price argument. The stock trades below its long and short-term moving averages, presenting investors with a potential “buy the dip” opportunity.

Seeking Alpha

Embedded Risks

Business-Related Risks

First, let’s discuss the elephant in the room: the risk that semiconductor stocks face concerning China. I want to take a more holistic approach.

We think Chinese-U.S. relations are breaking down because China feels it has industrialized enough to assert its global dominance instead of adhering to international policies it didn’t construct. For the past few decades, China has supplied the U.S. (among many western nations) with valuable goods and labor arbitrage that benefitted both parties. In more recent times, China’s consumer base has strengthened, and much of the nation has industrialized. Thus, we’ve witnessed a turnaround in some industries where many countries export value-added goods, such as semiconductors, to China.

However, China’s industrialized to a point where the U.S. and Europe feel threatened by its strength. Conversely, China has grown in confidence, and based on President Xi’s latest anti-capitalist rhetoric, China’s drifting away from the free market attitude it upheld in previous decades.

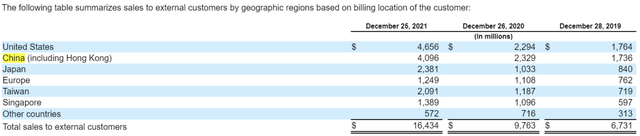

The implications for Advanced Micro Devices are twofold. First of all, Biden’s push for chip export restrictions leaves Advanced Micro Devices at risk. The company has significant end-market exposure to China, with approximately 25% (table below) of its business deriving from the region. Moreover, Advanced Micro Devices has recently built out various tangible growth initiatives in the region with data center exposure and a supply deal with NIO (NYSE:NIO). Therefore, the company’s exposure to potential revenue loss if trade relations exacerbate.

Seeking Alpha; AMD 10-K; Joe Albano

Secondly, Advanced Micro Devices’ supply line is inextricably linked to China, and a decay in trade relations could dent Advanced Micro Devices’ upstream efficiency, in turn hurting its profit and loss statement.

Stock-Related Risks

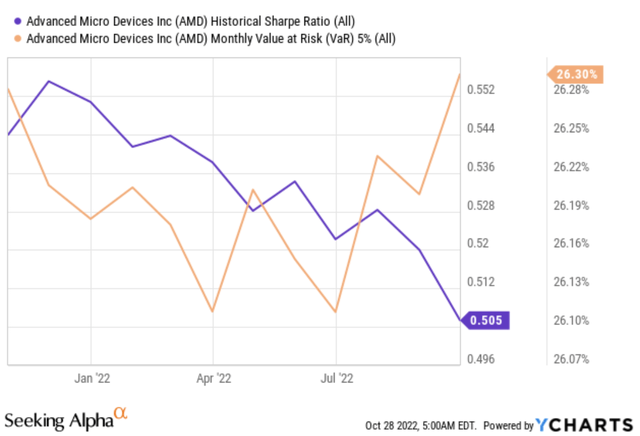

Advanced Micro Devices possesses a few market-based risks. The stock’s Sharpe Ratio has drifted below one, implying its excess return stacks up unfavorably to its market volatility. In addition, Advanced Micro Devices’ 5% monthly VaR (value at risk) suggests the stock could lose more than 26.30% of its market value in 5% of its traded months, which is at the higher end of the spectrum.

Seeking Alpha

Concluding Thoughts – IS AMD Stock a Buy, Hold, or Sell?

We’re betting on mean reversion and market segmentation. After careful consideration, we decided to assign a strong buy rating to Advanced Micro Devices stock. Based on its key influencing variables, the company exhibits high-quality features, namely robust financial statements, scalability, and favorable return metrics. It’s possible that the firm’s quality could coalesce with a potential stock market pivot to bring the asset back up to its long-run fair value. Although risks persist, the market has likely priced most of it, and we’d like to believe investors will phase some positives in soon.

Be the first to comment