JHVEPhoto

John Malone is an independent director of Warner Bros. Discovery (NASDAQ:WBD). Many investors know that he is far more than that.

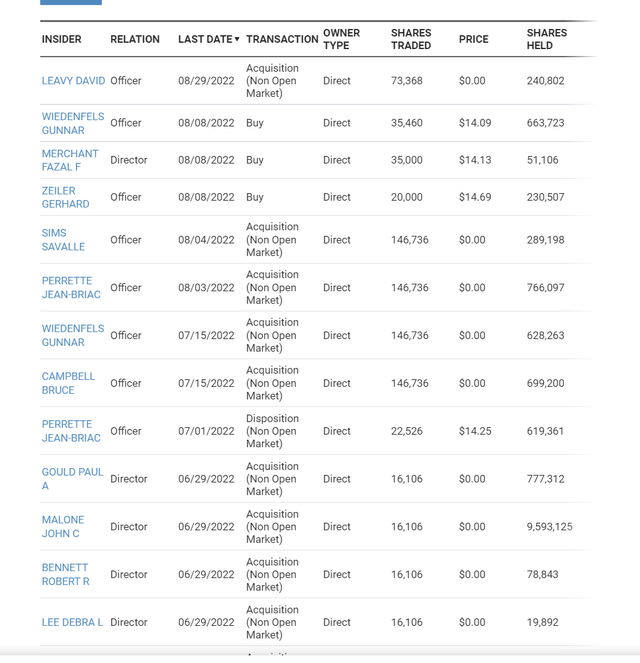

Warner Bros Latest Insider Activity (NASDAQ Website November 21, 2022)

As shown above, he is one of the largest shareholders of the company. What was disclosed in his latest interview was that he sold puts as a vote of confidence in the latest acquisition. The reason that is a vote of confidence is that he noted that the lower stock price was an excellent possibility. But even knowing that he was willing to purchase stock by selling puts.

He noted he did not yet file in relation to those puts he sold. But that is going to happen. So that is in addition to the activity seen above which shows a lot of people who know about the business purchasing shares one way or another.

One of the advantages of being an individual investor is that often times the position that investor establishes will be far smaller than that of John Malone. So, it is often easier to invest at a lower price and unload at a higher price than the larger investor.

However, in that same interview, John Malone cautioned that this is not something that will happen overnight.

Finances

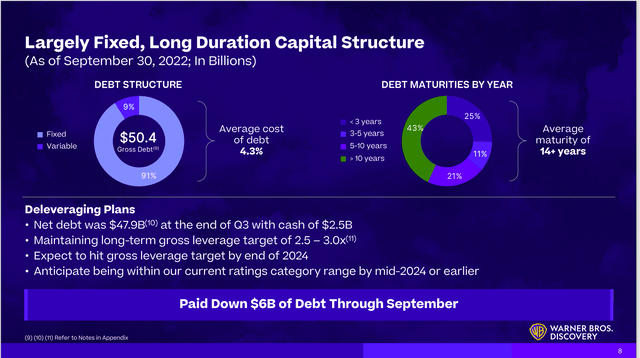

He backed up that assertion by noting the debt structure of the acquisition.

Warner Bros. Discovery Debt Duration Guidance (Warner Bros. Discovery Third Quarter 2022, Earnings Conference Call Slides)

One of the first things discussed in the interview was that in planning the acquisition, the debt structure needed to be such that management had time to resolve any issues both known and unknown about the coming acquisition. Plans were made in case there were some surprises when management actually got control of the acquisition.

John Malone stated that the situation actually was worse than estimated once management actually was able to review operations. But the debt structure shown above gives management plenty of time to work out the issues and then some. It is not that management expects to take, for example 14 years to turn this acquisition around. Instead that room is there for all those wonderful things that Mr. Market happens to throw at you when you wake up in the morning thinking everything was resolved last night when you went to bed. Sound financing (for some of us anyway) is to put financing in place that is roughly twice as long as the time you think you need.

Now, should investors notice changes a lot sooner? Absolutely! But you have to know where to look for those changes.

Free Cash Flow

One thing John Malone noted was that the company had free cash flow. This latest quarter muddied that idea for a lot of investors. But it was caused by a lot of acquisition related events.

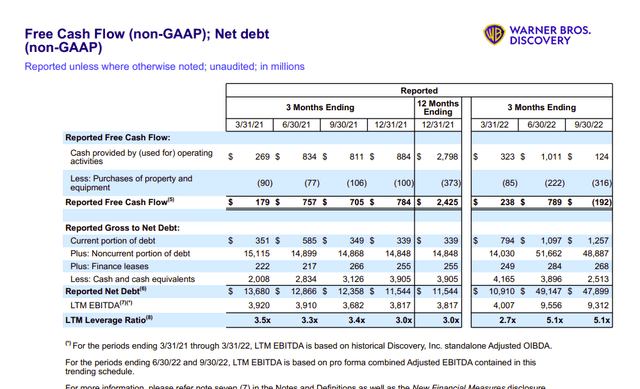

Warner Bros. Discovery Free Cash Flow, LTM EBITDA, And LTM Leverage Ratio Calculations (Warner Bros. Discovery Non-GAAP And Other Schedules That Reconcile To GAAP)

Mr. Market hit the panic button the minute free cash flow dried up. But a lot of non-recurring expenses should have been expected by the market along with the adjustments that go with it. There is very likely to be a large sigh of relief the minute free cash flow reappears after the non-recurring expenses decline.

But as Mr. Malone implied, one quarter of negative free cash flow does not wipe out the whole year. The free cash flow of the legacy assets likely continues and that does provide some “wiggle room” should there be extra cash requirements necessary due to the condition of the acquisition compared to where management believes things need to be (and how fast they need to get there).

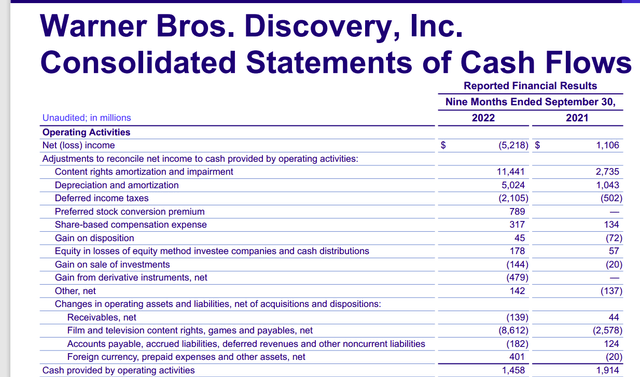

Warner Bros. Discovery Cash Provided By Operating Activities Part Of Cash Flow Statement Third Quarter 2022 (Warner Bros. Discovery Earnings Press Release Third Quarter 2022)

Mr. Malone noted that the cash flow was “pretty good”. He thought that investors would see that decent cash flow “in time” or something like that. What is hiding the cash flow generation currently is the $8.6 billion paydown of the “Film and Television Content Rights, Games, and Payables net” account shown above in the current fiscal year. There are also likely some nonrecurring expenses on the income statement. Before the combination, Discovery had no such unfavorable account balance swing that used most of the cash flow generated.

This is in addition to some merger related expenses (with explanations) shown elsewhere in the current press release and the 10-Q. To me, that means that operations generated at least $10 billion in the first 9 months to pay that account balance down and still have some cash flow provided by operating activities. Annualizing that figure to about $13 billion (very roughly) means that cash flow is already greater than one-fourth the gross debt figure listed earlier. So, at least to me, Mr. Malone has a point that there is likely to be some decent cash flow once the financial statements “clean up”.

While Mr. Market panicked at the low free cash flow figure of the current quarter, Mr. Malone is watching the cash generated while assuring investors that management is focused upon getting that cash flow to free cash flow once the merger related costs go away. It goes without saying that long-term, management probably is aiming for a lot more cash flow than that. But that cash flow appears to be more than enough to support the debt even at this early stage.

Long Term View

A major investor like John Malone tends to buy big bargains and then hang on for big gains. He does not get involved in a big project like this to make 20%. His idea of a bargain is probably closer to tripling his money in five years. That would be a roughly 25% compound return for those five years. There is no guarantee he would make it. But even if he falls short, he is going from his cost basis. Investors can now get on board for roughly half the cost of Mr. Malone. That is not a real common opportunity.

The one thing he does not spend a lot of time on right now is the stock price. That is in contrast to a whole lot of comments I get. He is focused firmly on the reason for the acquisition and making that reason happen. The only reason I personally will consider selling is if that story changes materially. So far it has not. The interview appears to imply that nothing that involved the decision for this merger as so far materially changed.

Another Billionaire

Back in 2018, Comstock Resources (CRK) was in a rough spot. In stepped Jerry Jones, owner of the Dallas Cowboys, with more than $600 million (in properties to reorganize the company. The company issued more than 88 million shares which was a lot more than the shares outstanding.

This allowed the company to bid on some bankrupt properties and begin an acquisitions strategy. Jerry Jones later invested another $475 million for 50 million shares to enable the large Covey Park transaction in which Denham Capital joined the board. The total invested by Jerry Jones in various transactions exceed $1 billion. More acquisitions were made and the company in its present form hardly resembles the troubled company that existed before the cash infusion and all the acquisitions. More importantly, the prices he paid for his shares depending upon all the transactions (more than noted here) were between $6’s and $7’s per share.

Comstock Resources Five Year Common Stock Price History And Key Valuation Measures (Seeking Alpha Website November 23, 2022)

Once Jerry Jones invested beginning in August 2018, and continuing well into 2019, the stock of course dropped. Natural gas prices were heading the wrong way. In the meantime, I picked up 100 shares only because I have more of these ideas than I do money. Also, I believed that Jerry Jones was onto something. As I stated above, most of these wealthy people make well decisioned bets to make big gains. They are not there for 20% gains as they cannot get into or out of their positions easily.

But if you check back now, the investment of Jerry Jones has more than doubled and is well on its way to tripling. There is likely to be a lot more returns coming down the road from stronger natural gas prices.

Yet back in 2019 and 2020, there were a lot of comments about “if I can just get out at $8” or some price along the way that allowed them to breakeven. This is a pattern I have seen many times. The stock goes down in this case to slightly more than half of what Jerry Jones paid and small investors panic. Many of those same investors will sell during the recovery and then celebrate a breakeven or 20% gain.

In the meantime, Jerry Jones will hang on and probably sell his shares (if he sells them at all) when he thinks the market cycle is in a place that it is a good time to sell. He never worried about the lower stock price the way small investors often do (if my comments section is any indication).

The Future

John Malone is not worried about the lower stock price. He mentioned he sold puts as a sign of support for management. But most of the comments I get are focused upon that lower stock price combined with “it will never go higher” or “glad I sold this dog”. Most will not be interested in the stock until long after the easy money is made. Stocks climb a wall of worry. That has been going on long before I was born, and it continues because some human habits never change. It is what makes contrarian investing so hard.

Obviously not everything John Malone does will work out. The debt load repayment definitely represents a potential future risk at this time. So individual investors need to do their homework and have a comprehensive plan before they get in. John Malone himself noted that this turnaround will take time. But he figures obviously that he has the time to give.

What a potential investor does not want to do is invest and then ask “what do I do now that the stock went down?”. The whole interview and the experience of Jerry Jones shown above is that the beginning is volatile, and both investors (who are billionaires) would wait it out. They are both far more concerned if the assumptions that led to the investment in the first place have changed.

Institutions panic just like small investors because both are people. Except that an institution can drive the price to irrationally low levels without a material change in the original investment idea. I have been through that a few times (the last time with Antero Resources (AR) hitting 3/4 before the runup to the current price).

Contrarian investing can be nerve wracking. It can also be very rewarding. The current stock price of Warner Bros. Discovery does indicate a higher risk level. So, the question remains if you agree that John Malone did his homework correctly and will come out a winner. Just do not expect a runup in the stock price “next week” as he pretty much stated this turnaround will take time.

Be the first to comment