MicroStockHub/iStock via Getty Images

Introduction

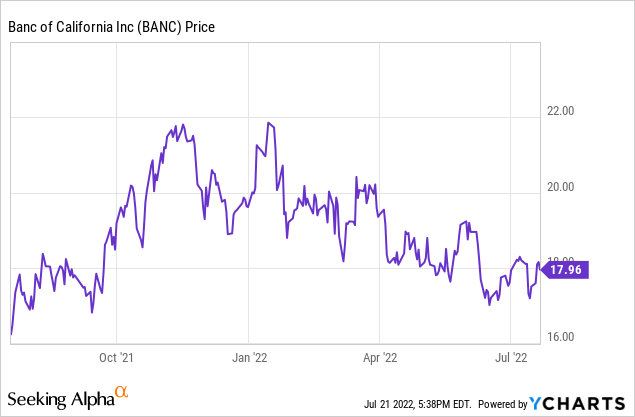

In June, I discussed the performance of Banc of California (NYSE:BANC) which posted a spectacular earnings report for the first quarter. Unfortunately the very strong earnings were caused by non-recurring items but I also was positive about the bank’s decision to call its preferred shares. I argued that not having to pay out a preferred dividend would have an immediate and positive impact on the EPS. The Q2 results have now been published and BANC’s EPS was quite satisfying. And perhaps more importantly: The fall-out caused by the higher interest rates came in lower than I had expected so that’s an additional bonus.

The earnings result remains strong

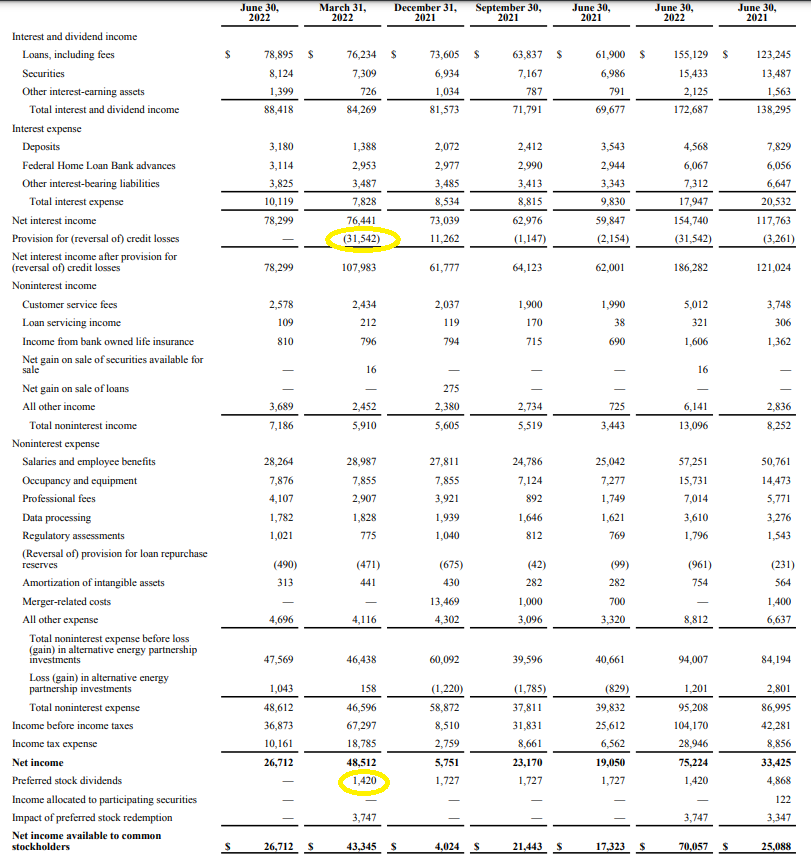

In the second quarter of this year, Banc of California saw its net interest income increase again for the fourth consecutive quarter. What’s interesting is that the interest income increased by approximately 5% to $88.4M while the interest expenses were also starting to increase albeit at a lower (absolute) number than the interest income increase. The total net interest income increased by approximately 2.5% to $78.3M. That’s fine as investors should know the gains from increasing interest rates will only be realized over time (two to three years) and rate hikes don’t mean banks will see an immediate overnight earnings boost.

Banc of California Investor Relations

The total non-interest expenses remained stable at approximately $41M resulting in a pre-tax income of $36.9M and a net income of $26.7M. That’s substantially lower than the $67.3M and $48.5M respectively but keep in mind the bank was able to reverse a $31.5M provision for credit losses in the previous quarter which provided a non-recurring profit boost.

As expected, the impact of retiring the preferred shares had a positive impact on BANC’s bottom line. Whereas the bank had to cough up $1.4M in preferred dividends in Q1, there were no preferred dividends payable in the second quarter, and considering there are now just under 60 million shares outstanding, this basically boosts the EPS by $0.02/quarter and almost $0.10 per year. So although there was a one-time cost of $3.75M associated with the repurchase of the preferred shares, paying this premium was well worth it as the payback period is less than three quarters.

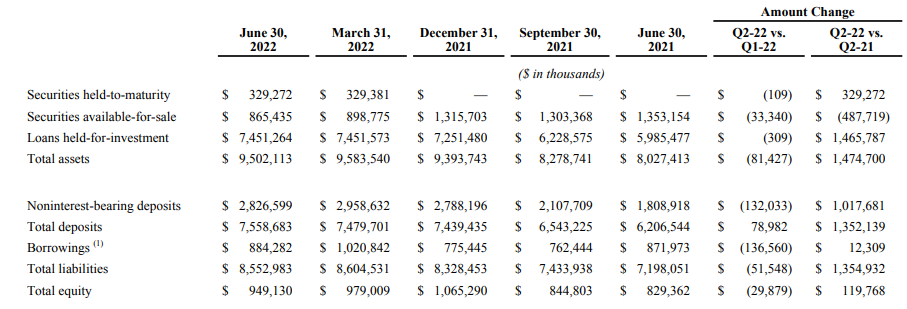

The impact of increasing interest rates on the securities portfolio seems to have stabilized

After the bank reported its Q1 results, I wasn’t sure what to think of its securities portfolio. I generally like it when banks have a percentage of the asset base allocated to cash and securities, but there’s a difference between securities held to maturity and securities available for sale. The latter needs to be marked to market in the books, and as interest rates are increasing, the trading value of those securities decreases. Whereas the opposite created unrealized gains, a decrease in the value of these securities results in increasing unrealized losses (and lower unrealized gains) which weighs on the book value of a bank, but has no impact on the income statement.

Banc of California Investor Relations

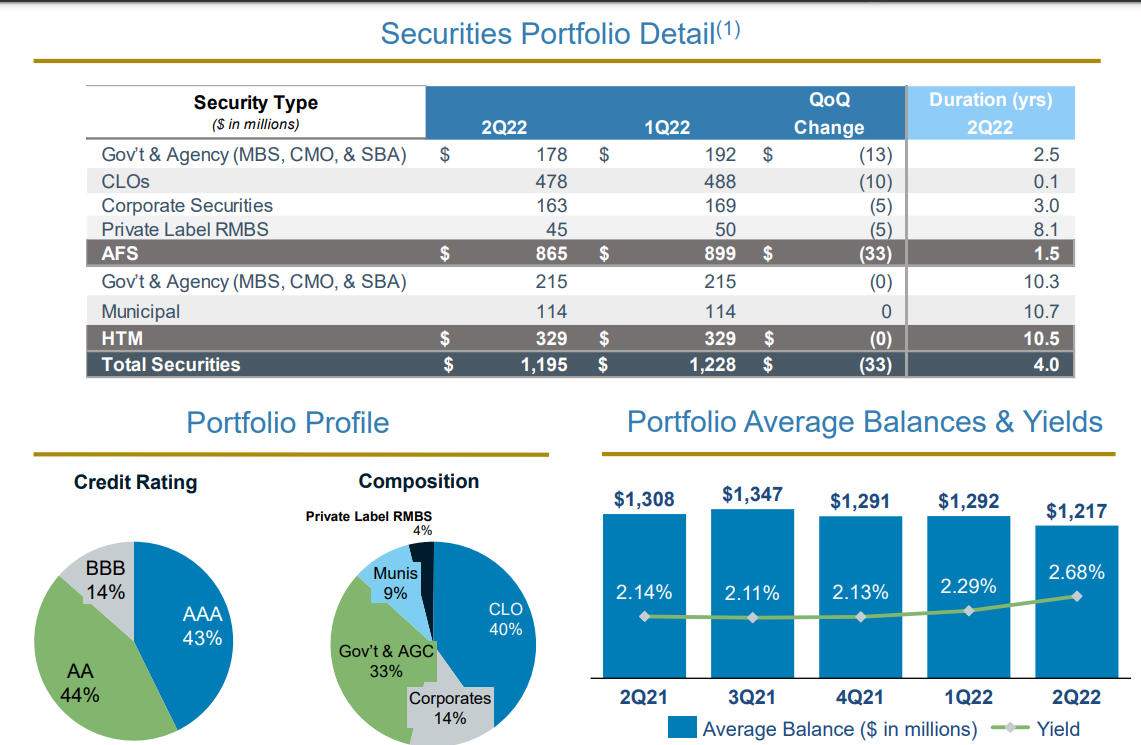

As you can see above, the bank has been consistently reducing the amount of securities available for sale (‘SAFS’) and this has helped to shield its book value from sudden value decreases. As you can see, the total value of the securities portfolio didn’t change that much, but BANC also invested in securities held to maturity which aren’t held to the same mark-to-market standards.

Banc of California Investor Relations

There still was a negative impact in the second quarter as the bank mentioned unrealized losses of $21M on the SAFS portfolio while the remainder of the $33M value decrease was caused by some of these securities maturing. While we can never rule out additional value decreases, I think the worst is behind us and that makes the current premium of approximately 30% to the tangible book value of $14.05 very manageable.

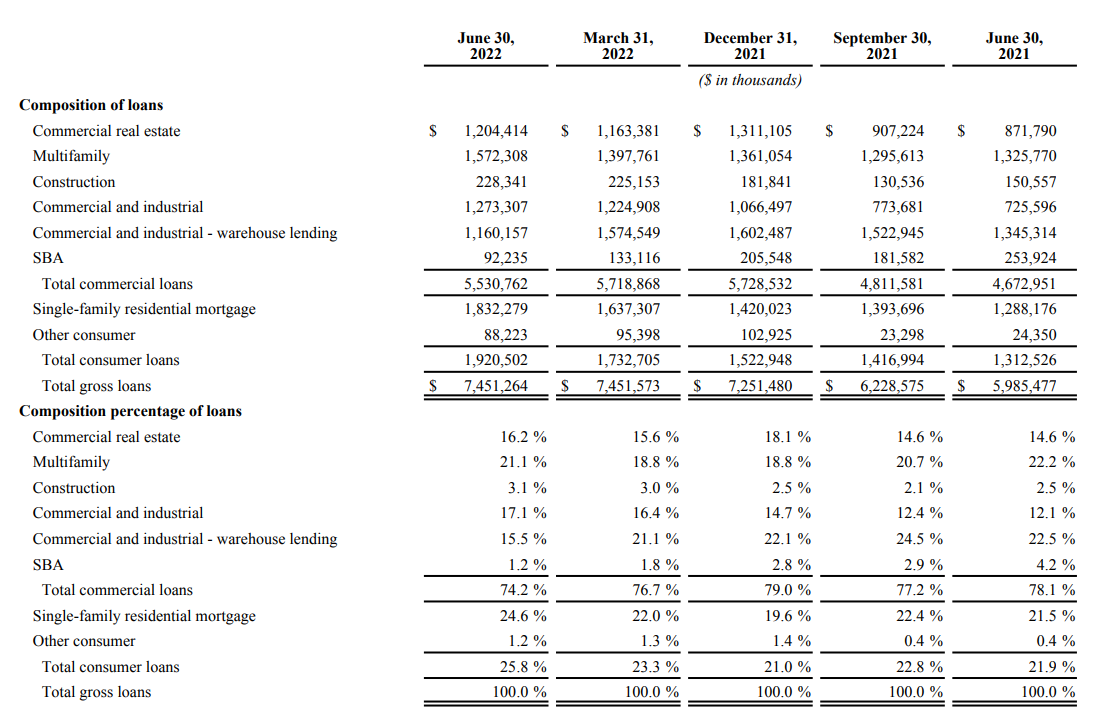

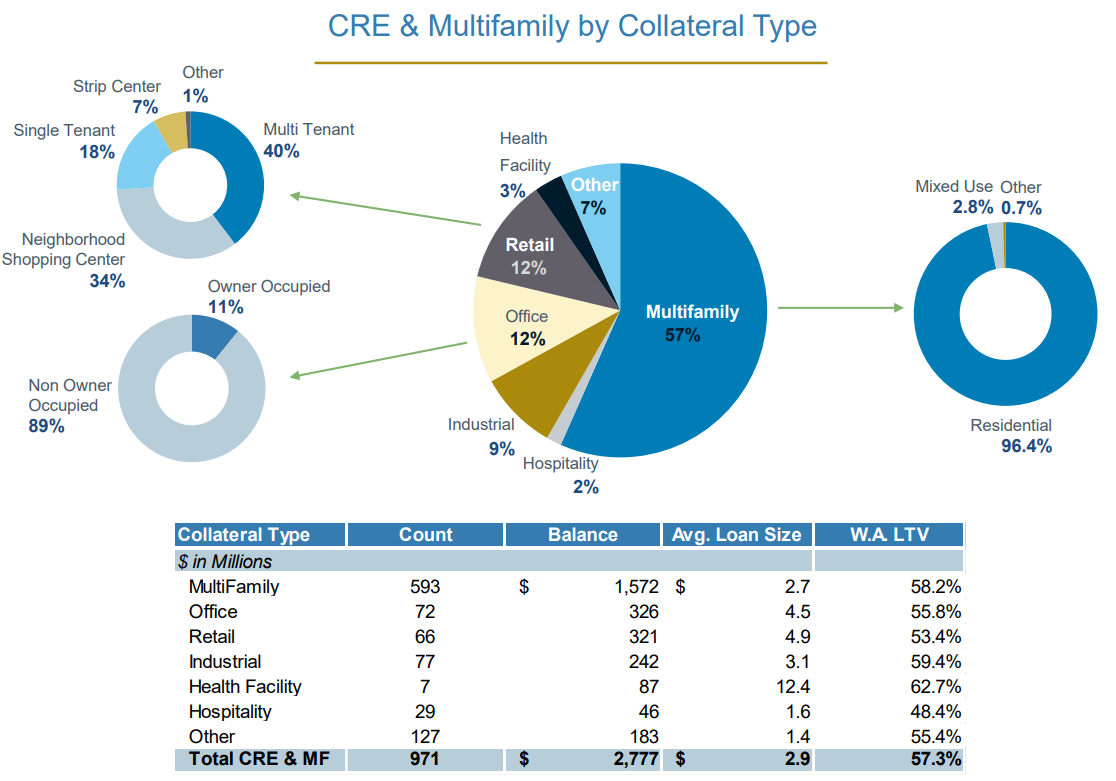

I also still like BANC’s loan book. Sure, a substantial portion of the loan book (37.3% to be precise) consists of commercial real estate and multifamily related debt.

Banc of California Investor Relations

While this could be an issue, Banc of California is doing a good job in being as transparent as possible and its Q2 presentation clearly mentions the average LTV ratio of this portfolio is less than 60%. This basically means the almost $2.8B in loans is backed by about $4.75B in assets. So even if some of these loans would go sour, I like the odds of BANC recouping the majority of its investment.

Banc of California Investor Relations

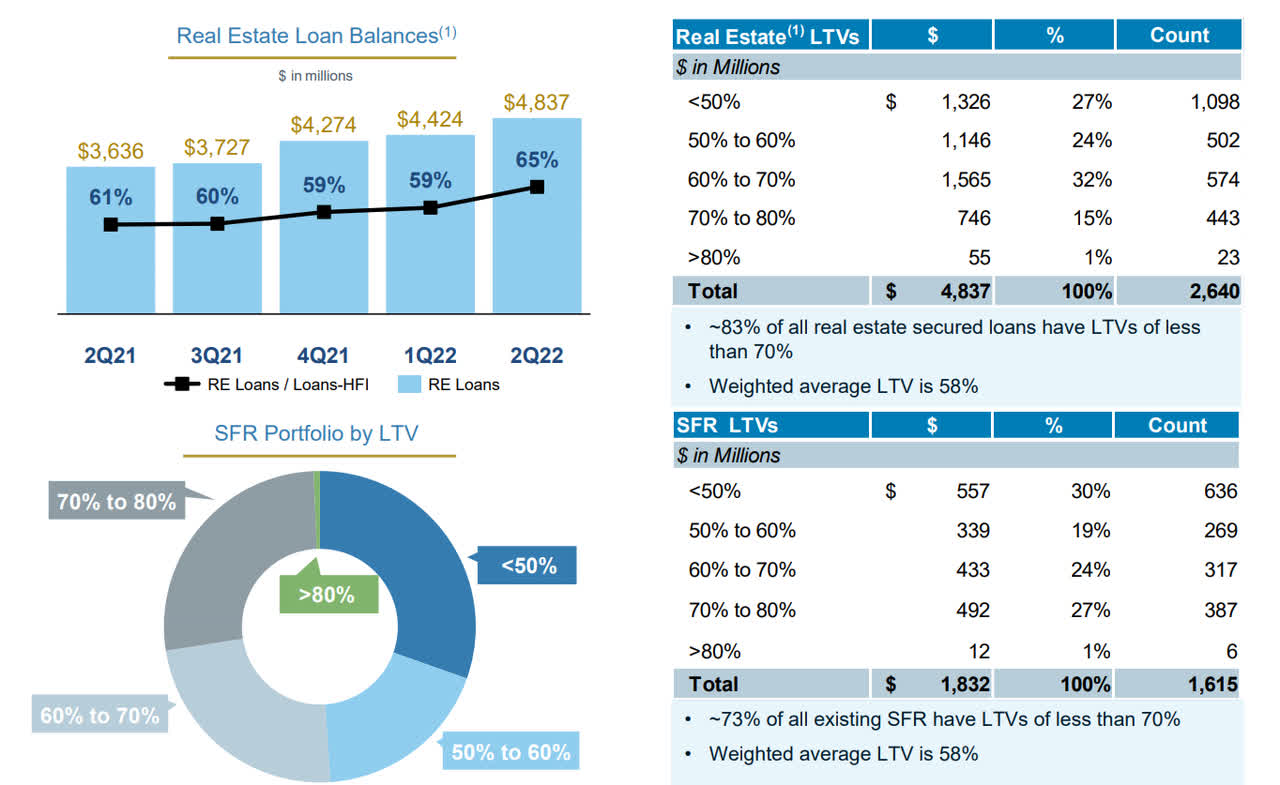

And we can extrapolate these numbers to pretty much the entire real estate portfolio (including construction loans and residential real estate mortgages). As you can see below, the average LTV ratio throughout the portfolio is just 58% and in excess of a quarter of the loan book has an LTV ratio of less than 50%. And in the residential mortgage portfolio (‘SFR’ below), almost half of the loans have an LTV ratio of less than 60% while only 1% of the loans has an LTV ratio exceeding 80%.

Banc of California Investor Relations

Investment thesis

When I last discussed Banc of California in June I was on the sidelines to see how hard the impact of the interest rate increase would hit BANC in the second quarter. The “damage” seems to be very reasonable and as BANC is currently trading at just 10X earnings and at just 1.3 times its tangible book value, I think this could be a good time to dip my toe in the stock. I like the robust balance sheet and the relatively low LTV ratios in the real estate portfolio. There are currently $44M of loans classified as non-performing (a decrease of $10.1M QoQ of which half is explained by non-performing loans starting to perform again) and within excess of $90M in loan loss provisions on the balance sheet I think the risk is well covered.

As the bank is paying a quarterly dividend of just 6 cents, the yield of 1.35% makes BANC unattractive for income-oriented investors. But the high retention rate helps BANC to keep its balance sheet safe. I’m in no rush, but the robust balance sheet and earnings profile make Banc of California attractive at the current prices and I may initiate a long position in the next few weeks.

Be the first to comment