svet110

The coal industry has undergone a minor renaissance over the past two years as the global supply of most energy products has dwindled. The thermal coal price has risen to over $400 per ton from roughly $50 per ton two years ago. There was a sizeable initial rally in coal last year as the crude oil and natural gas shortage began to grow. However, global demand for coal has surged a great deal more in 2022 as Europe’s dependence on Russian natural gas is tested. For now, the generally disliked energy source is Europe’s best hope at keeping the lights on over the coming months, likely creating a larger global coal shortage.

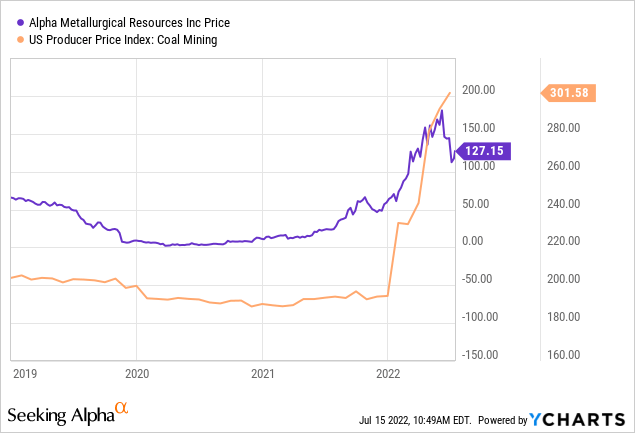

U.S. coal stocks have risen dramatically over the past two years. Before 2020, many coal companies were nearly bankrupt and struggled with chronically negative profit margins. At the time, it seemed there was ample reason to believe the coal depression was ending as valuations had reached extreme lows, and it appeared the U.S. shale boom was ending. I covered this opportunity in late 2019 in “Contura Energy: The Company To Buy If Coal Prices Have Bottomed.” Since then, Contura has risen by over 1,400% and has rebranded to Alpha Metallurgical Resources (NYSE:AMR), signifying its shift to metallurgical coal. See below:

Since 2019, Alpha Met. has gone from the edge of bankruptcy to being a significant player in the metallurgical coal market. Despite its 14X gain, the stock’s valuation remains low, with a forward “P/E” of only 1.2X. That said, its prospects have weakened in recent months as the global economy has slowed, causing demand for metallurgical coal to decline dramatically. Metallurgical coal is used for steelmaking, and steel is highly cyclical. While thermal coal prices remain near all-time-highs, international coking (metallurgical) coal prices have dipped recently, though they are still two-to-three times above normal levels.

Metallurgical Coal Demand To Fall With Steel

China utilizes around half of the world’s steel but has seemingly completed its industrial transition, meaning its long-term demand for steel may have peaked. As recently detailed in “U.S. Steel: Negative Earnings Likely, But Undervalued In The Long Run,” the ongoing decline in China’s overgrown construction industry may cause a long-term and potentially permanent decrease in China’s demand for steel. Of course, many nations worldwide still have yet to experience industrialization, but for now, global skyscraper construction has likely peaked. That said, India remains a vital area of industrial growth, and India is one of Alpha Met’s largest export countries.

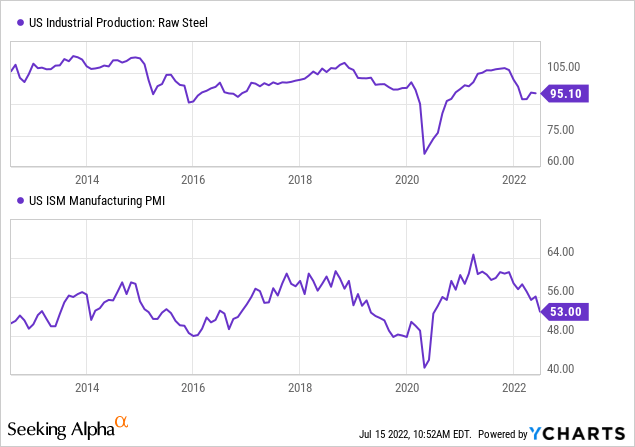

Further, the U.S. manufacturing economy is slowing at a rapid pace. Historically, there has been a strong correlation between the U.S. ISM Manufacturing PMI (a leading indicator of GDP growth) and U.S. steel production. The Manufacturing PMI has been on a sharp decline since 2021 and may soon reach contraction territory (below 50), indicating a sharp decline in steel production. See below:

We’ll likely see sharp, lasting declines in demand for metallurgical coal in the future. Thermal coal remains strong, but unfortunately, Alpha Met. has shifted its production from primarily thermal coal to almost entirely metallurgical coal. The company is now the most significant domestic metallurgical coal producer and exporter, but this may mean it’s overly exposed to a cyclical asset as construction demand wanes. Most likely, this will bring a sharp negative move in AMR’s earnings; however, its low valuation may now account for that change.

Earnings Outlook For Alpha Metallurgical

According to the company’s latest investor presentation, last quarter, the company sold coal for around $189/ton and exports at $297/ton at an average overall price of $243/ton. Comparatively, it’s produced coal at around $107/ton, giving it a solid $100+ profit per ton sold. U.S. “High Vol B” metallurgical coal prices ranged from $300 to $500 last quarter but have since declined to $285 today. Alpha Met’s, selling prices appear to be below the “High Vol B” index, so we can only estimate with a high margin of error. That said, the ~30% decline in metallurgical coal prices suggests a nearly 50% decline in Alpha Met’s profit per ton from ~$136 /ton ($243-$107) to $70/ton (0.7 X $243 – $107). Again, there are uncertainties within that estimate, but overall, it appears the decline in coking coal prices should push AMR’s Q3 profits down by 40-50% of Q1’s level.

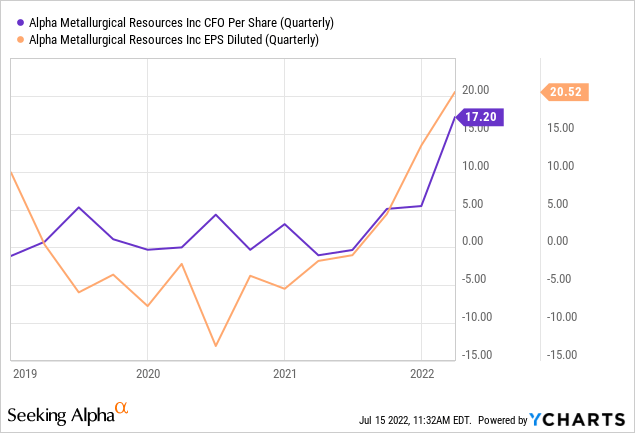

The firm generated an EPS of $20 last quarter and a cash flow per share of $17.2. These figures were well-above normal levels in-line with the rise in coking coal prices from 2020 to early this year. See below:

Given my expected margin reduction, it seems Alpha Met’s Q2/Q3 EPS is more likely to be around the $8-$12 range. Analysts are currently pricing in an earnings decline for the company, but not as large as seems likely given the decline in metallurgical coal prices.

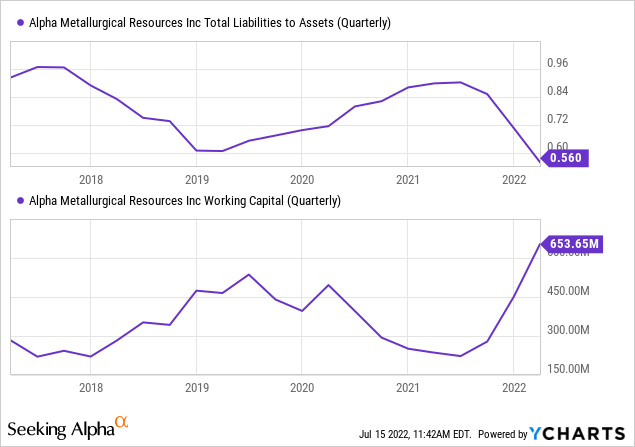

If we assume prices remain constant, I expect the company to deliver an EPS of $36 to $48 over the next year. While not as strong as the current $99 forward estimate, this still gives AMR a very low forward “P/E” of 2.5X – 3.4X. Even if its earnings fell by 75% of Q1’s levels, it would seem to have a low valuation, particularly in light of its solid reserves and dramatically improved balance sheet quality. See below:

The company has used its strong earnings season to reduce debt and improve its working capital supply. Last month, the company made a $99M prepayment on its term loan, eliminating its remaining term loan balance. The company also authorized a $600M share repurchase program, giving it a ~26% capital return at today’s market cap – though I expect this figure to decline with its earnings.

The Bottom Line

Overall, my view on Alpha Metallurgical is similar to my outlook on U.S. Steel. The company’s valuation is extremely low, even if we account for a sizeable potential decline in earnings. The metallurgical coal and steel industries are likely headed for another difficult period. However, as with U.S. Steel, Alpha Met. has a recent history of coming out of difficult periods learner and more efficient, improving its long-term competitive edge. For long-term investors, this makes Alpha Met. a decent play, particularly considering the demand for metallurgical coal will always exist (as long as the steel is used) even if thermal coal is eventually retired. Investors should not expect its stellar Q1 earnings to persist, but I do not believe the stock is overvalued, even with a 50-75% potential decline in long-term profits.

However, AMR may be best avoided for risk-averse investors looking to avoid potentially significant short-term declines. I think the consensus analyst EPS outlook for AMR seems a bit high given the quickening economic shift, giving the stock a high earnings revision risk. It is risky to try to catch “falling knives,” and, given its large price boom, I can imagine many AMR owners may be looking to take profits. Of course, AMR also has a higher short interest of 8.7%, and more short sellers may look toward the company. As such, I am officially neutral on the stock as it appears at a decent risk of declining further despite its low valuation.

Be the first to comment