Justin Sullivan

I think everyone here has heard about the FAANG stocks, as these big tech names have delivered impressive returns over the past decade. Whilst some of the companies have changed their name over that time, the letters represent Facebook/Meta Platforms (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google – or as it’s now known, Alphabet (GOOG, NASDAQ:GOOGL).

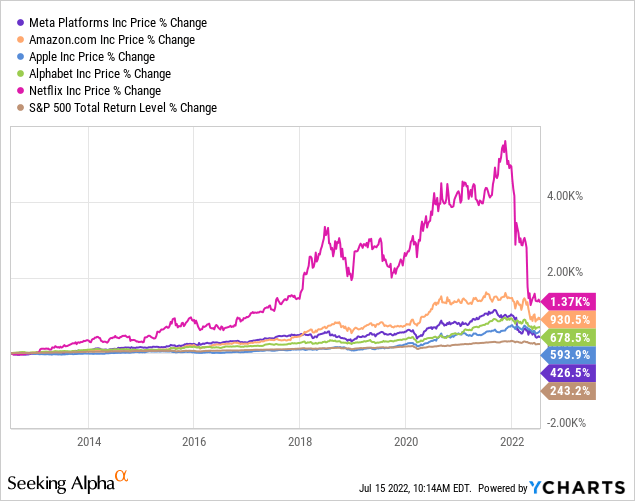

Any investors in these businesses since 2012 have been very well rewarded, with each company comfortably outperforming the benchmark S&P 500.

But investing is a forward-looking game, so which of these companies should see the greatest amount of success in the decade to come? Whilst you could make a compelling case for any, my pick is Alphabet, and I’ll tell you why.

Business Overview

Alphabet divides itself up into two core Google-related segments: Google Services and Google Cloud, with a further segment for Other Bets.

The products and platforms at the heart of Google Services include ads, Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. These are all services that we come into contact with every day; I’m currently using Google Chrome and Google Search to do a lot of the research for this article. The hardware products also offered by Google include the Pixel smartphones, Fitbit, Chromecast, and the Google Nest Cams and Doorbell.

Google Cloud is the company’s cloud platform & a challenger to the likes of Amazon’s AWS and Microsoft’s Azure. It also offers Google Workspace, which generates revenues from cloud-based collaboration tools for enterprises such as Gmail, Docs, Drive, Calendar, and Meet.

A snapshot of just some of Alphabet’s offerings (Google)

The final offering from Alphabet is the Other Bets section, which is essentially venture capital. It invests in emerging businesses at various stages of development with a goal for them to becoming thriving, successful companies in the medium to long term. The most well-known of these Other Bets is probably Waymo, an autonomous driving start-up.

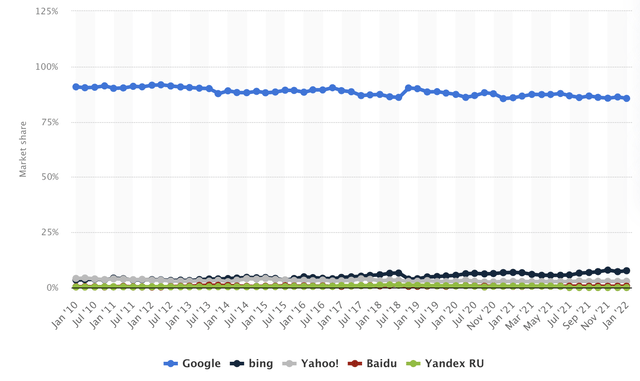

Alphabet has a strong business model across many of these different areas. In the search engine market, Google is the clear leader and has been for some time, with a global market share above 85% as of January 2022 according to Statista. When it comes to Search, Google has clear competitive advantages from its brand name as well as a technological advantage; its machine learning has outperformed all other “competitors” over the last decade.

Global Search Engine Market Share (Statista)

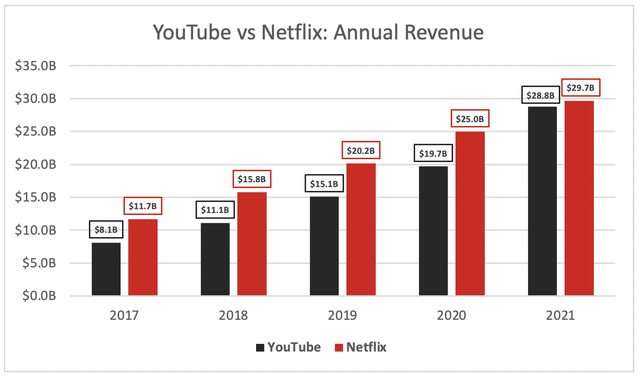

The company also acquired YouTube back in 2006 for a whopping $1.65 billion… which, given YouTube’s current performance, looks like an absolute steal! In fact, YouTube grew revenues to an impressive ~$29 billion in 2021, almost overtaking the pure-play streaming leader & fellow FAANG member Netflix.

Let’s not forget about Google Cloud; it may still be behind leaders Amazon and Microsoft, but has the potential to be a significant profit driver for Google over the upcoming years, as we have already seen with AWS and Amazon (& as I highlighted in a recent article). Google is still very much in the investment stage of its cloud infrastructure, and I think its future looks bright here too.

It’s undeniable that Alphabet has a bunch of brilliant businesses, with many dominating their core industries… but who cares? Exactly the same could be said for the rest of the FAANG stocks. So going on the assumption that all these companies have fantastic business models, what separates Google from the rest of the pack?

Financial Fortitude

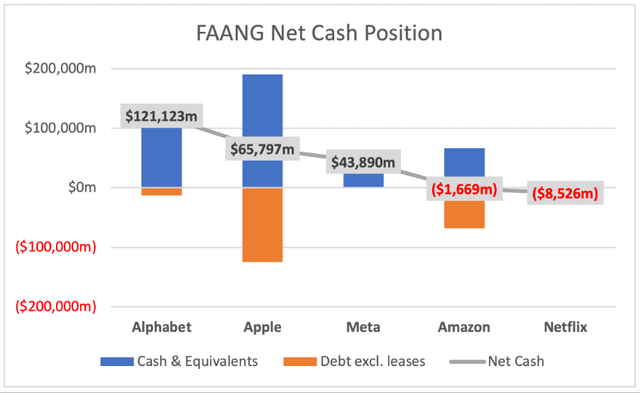

One of the biggest drivers for future growth when it comes to these FAANG stocks is their ability to diversify, try out new things, and explore exciting, innovative, and potentially life-changing technologies to create new revenue streams – but in order to do that, the companies must be both financially secure & also have a war chest of cash to spend. So, how do they stack up? Alphabet is in a league of its own, with almost double the net cash position of its closest FAANG competitor Apple.

This, combined with Alphabet’s constant attempts to find and develop the next ‘big thing’ to drive their business forward should be a winning combination for shareholders. The company even calls out its approach to “Moonshots” in its annual report:

Many companies get comfortable doing what they have always done, making only incremental changes. This incrementalism leads to irrelevance over time, especially in technology, where change tends to be revolutionary, not evolutionary. People thought we were crazy when we acquired YouTube and Android and when we launched Chrome, but those efforts have matured into major platforms for digital video and mobile devices and a safer, popular browser. We continue to look toward the future and to invest for the long term within each of our segments. As we said in the original founders’ letter, we will not shy away from high-risk, high-reward projects that we believe in, as they are the key to our long-term success.

So not only does Google have the culture to pull off these Moonshot attempts, but it has the cash on hand as well.

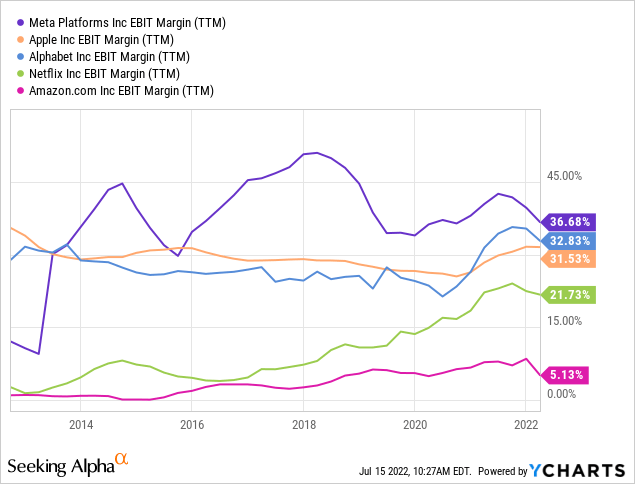

What about the business model itself? Is it designed in a way such that it will continue to generate value for shareholders? I personally look for strong margin profiles in any business that I invest in, and Google has consistently generated the second highest EBIT margins among any FAANG stock – second only to Meta, who I am not the biggest fan of for reasons that I mention in this previous article.

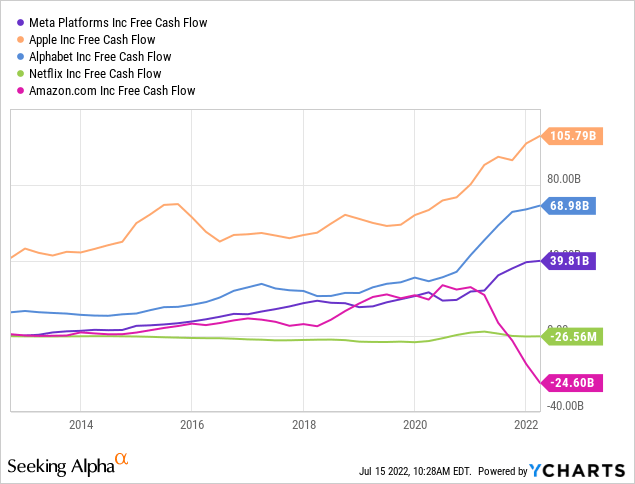

Combine these high margins with an already insane cash balance, and you get a business that will not only continue to print cash, but is also in a ridiculously strong position to take risks and reinvest in any opportunities for growth – such as Google Cloud. If we also take a look at free cash flow in absolute terms, Google is also the second best of the FAANGs – this time second to Apple.

It’s clear that Google has one of the best financial profiles of any FAANG stocks, but what does the future hold for this tech behemoth?

Growth Opportunities

Whilst the past and present have made Alphabet the company it is today, and helped to build out a fairly impenetrable moat, the exact same can be said for many other FAANG stocks. The question now is whether or not any of these FAANG businesses can continue their history of impressive growth, because this is what will be needed to keep shareholders happy.

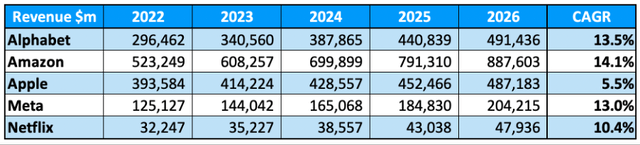

I believe that Alphabet has a number of tailwinds in its back for the decade ahead; secular growth in digital advertising (Google Search), secular growth in streaming (YouTube); secular growth in cloud computing (Google Cloud), and many more growth stories that Alphabet is involved in. Yet a number of investors will make the very same case for all the other FAANG stocks, so let’s take a look at what the analysts believe will happen over the next 5 years, courtesy of TIKR.

In terms of revenue growth, Alphabet comes out in its apparent favorite position – second best, this time behind yet another different FAANG competitor, Amazon. Whilst the difference between Alphabet, Amazon, and Meta is small in terms of the expected CAGR, I think this demonstrates that growth is certainly still there for these companies & they have an opportunity ahead. Apple, one of the stock market’s darlings, is certainly not expected to grow at a similar rate to these companies – so perhaps we will start seeing a change at the top of the FAANG?

Valuation

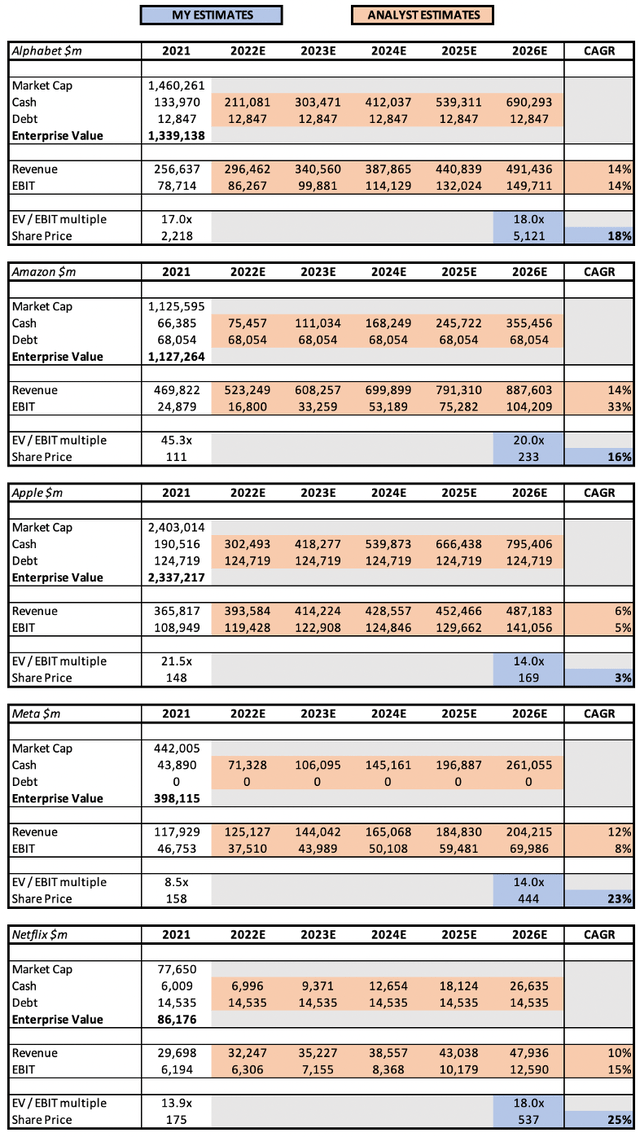

Let’s get down to valuation, because at the end of the day these are all different companies with different paths ahead, and therefore they should all have different valuations. I’m going to use a slightly simplified version of my standard valuation model to get a rough idea of the individual valuations of these businesses compared to their 2026 potential.

In case it’s tough to see from the model, these are the results for the share price CAGR through to 2026:

- Alphabet: 18%

- Amazon: 16%

- Apple: 3%

- Meta: 23%

- Netflix: 25%

In terms of EV / EBIT multiples, I believe that 12x represents an appropriate multiple for a stable business, and a 16x multiple represents an appropriate multiple for a stable-yet-growing business. Amazon gets a higher multiple due to the potential for EBIT margin expansion, Apple gets a lower multiple due to its lower growth rates, and Meta gets a lower multiple due to the risk associated with both its image as a business & the attempted metaverse shift.

According to my model Meta and Netflix are providing the best return, but why is this? Because I feel like these companies are currently most at risk of failing to achieve their growth rate. Meta is facing a real public relations challenge, and the move into the metaverse feels like a long shot that HAS to work for the company, otherwise it could face a difficult future. Netflix is similarly risky right now, as it has been hemorrhaging subscribers and investors are awaiting a turnaround. I don’t believe that risks of these levels exist for Alphabet, Amazon, or Apple. This explains why both Netflix and Meta are currently trading at valuations that appear to be way below fair value – the market is smart, and prices in this risk.

What’s The Conclusion?

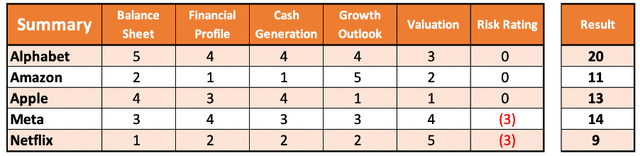

I’ve taken a look at Alphabet with respect to the other FAANG stocks, but how do I conclude which is the best of the bunch? Well, I’ll try and do it in a methodical manner – by ranking each company in each category out of 5, and then seeing who gets the top score.

Whilst all the FAANG stocks excel in one or two particular areas, Alphabet is the only one that has strengths across the board. I don’t claim to state that this simplistic ranking system provides an exact forecast of the success of these FAANG stocks – I personally prefer Amazon as an investment over Apple or Meta. But what it does show is that Alphabet appears to be a much more well rounded business.

All of the companies above are fantastic in their own right. Yet I believe that Alphabet is truly in a class of its own, and will prove to be the best FAANG stock over the upcoming decade.

Be the first to comment