Evgenii Mitroshin

Article Thesis

Devon Energy (NYSE:DVN) will report its third-quarter earnings results on Tuesday after the market closes. The company benefits massively from the current energy crisis and is well-positioned for strong profits in both the remainder of this year and beyond. Investors can expect that Devon will continue to return a large amount of cash to them, primarily via its fixed+variable dividend model. Shares are inexpensive, although not the cheapest among energy equities.

What Can Investors Expect?

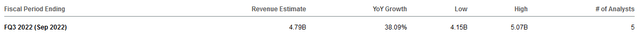

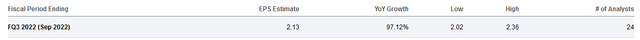

Analysts are forecasting a big increase in both Devon Energy’s revenue as well as its earnings per share for the third quarter, relative to the comparable quarter one year earlier:

A 38% revenue increase is expected, while earnings per share are forecasted to grow considerably more, almost doubling year over year. The higher earnings per share growth forecast makes sense, due to several key reasons. First, Devon Energy’s expenses do not grow in line with its revenue. When the company is now generating considerably higher revenues per barrel, but its costs per barrel are up only slightly, then a large additional gross profit is generated that leads to outsized operating earnings growth. Meanwhile, the company has also paid down debt over the last year, which reduces its interest expenses, thereby having a positive impact on Devon Energy’s net profits. Last but not least, Devon Energy has also been buying back shares, which reduces its share count. As a result of that, each remaining share’s portion of the company’s overall profits grows, thereby allowing for earnings per share growth to be higher than the company-wide net income growth rate. Between these factors, it’s not surprising that Devon Energy’s earnings per share are expected to grow quite a lot compared to one year ago.

When we compare the forecasted revenue and profit to Devon Energy’s results one quarter ago, i.e. in Q2 2022, then we see that both the company’s top line and its bottom line are expected to decline, as revenue totaled $5.6 billion in Q2, while Devon’s earnings per share totaled $2.59 during the second quarter. In other words, revenue and earnings per share are expected to decline by 14% and 18%, respectively. This time, operating leverage is working against Devon, which is why profits are forecasted to decline more than Devon’s sales.

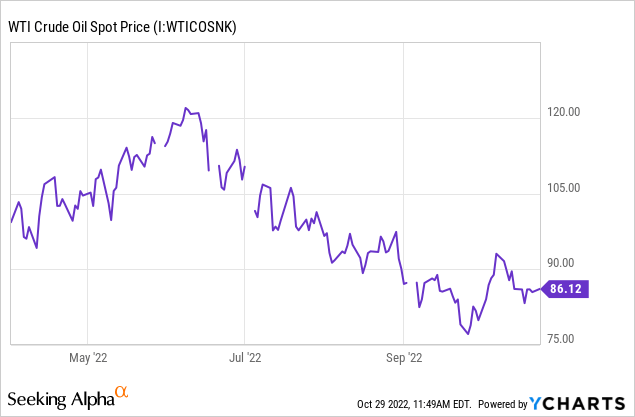

The sequential decline can be explained by the fact that oil and gas prices have pulled back from the highs that were hit during the second quarter, although it should be noted that they remain at attractive levels well above the longer-term average:

Energy prices soared to a very high level in Q2, as WTI crude oil briefly breached $120 per barrel. Since then, oil prices have pulled back, which explains why Devon Energy has most likely generated lower revenues in Q3 compared to Q2. That being said, even the $80 to $100 oil prices in Q3 were highly attractive for energy investors, as most oil companies, including Devon Energy, are highly profitable at those levels.

Some energy companies have reported their Q3 results already, including the two supermajors Exxon Mobil (XOM) and Chevron (CVX). Analyst estimate beats were the standard among the energy companies that have reported so far, thus it would not be too surprising to see Devon Energy beat analyst estimates as well. A decline versus the second quarter is still very likely due to the fact that oil prices had pulled back — from an extraordinarily high level to a still high but more sustainable level.

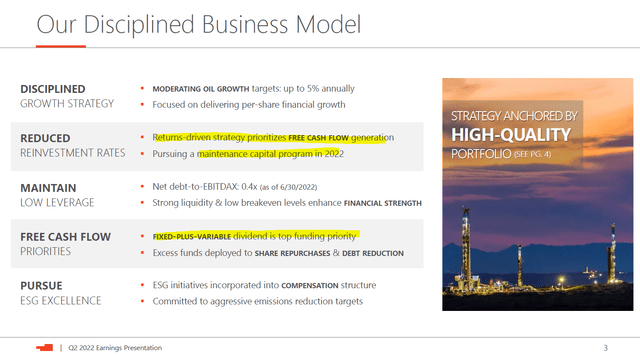

Eyes On The Shareholder Return

Like many other energy companies, Devon Energy has moved to a free cash flow-focused business model where shareholder returns are a key element of the company’s strategy. In the past, especially prior to the 2015-2016 oil price crash, many companies had been chasing production growth at all costs, even when that meant that they were not generating any free cash flow. Following said oil price crash that changed, and the pandemic has made energy companies even more aware of the importance of free cash flow generation. Production growth is not a key goal of most energy companies any longer, and that also holds true for Devon Energy — which is a good thing, as empire-building and chasing business growth have not necessarily resulted in shareholder value generation in the past.

In the above slide, Devon Energy showcases some of its priorities. During the current year, Devon Energy seeks to maintain production levels and has sized its capital program accordingly. In future years, Devon Energy might opt for some growth, but not at a high rate — the maximum is set at 5% annually, but on average growth will likely be lower.

The combination of strong operating cash flows and reluctant capital spending results in hefty free cash flows that the company can use in different ways. In general, free cash flow can be used for M&A, dividends, buybacks, and for net debt reduction (either by adding to a cash balance or by paying down debt). Devon Energy has set the focus on dividends, with buybacks and debt reduction getting smaller free cash flow allocations on top of that. M&A is not an important pillar of the company’s strategy, although Devon Energy has recently made a minor acquisition when it bought out Validus Energy to add to its Eagle Basin exposure. At just 3% of Devon’s market capitalization, that takeover wasn’t very meaningful, however.

Devon Energy’s free cash flow totaled $2.1 billion during the second quarter, as just $600 million of the company’s $2.7 billion in operating cash flow was reinvested. For the current year, Devon Energy is forecasting free cash flows of $6.5 billion. That’s less than what we get to if we annualize the Q2 number, but due to the fact that oil prices were lower both in Q1 and Q3, and likely will be lower in Q4, relative to Q2, it makes sense that annual free cash generation is not as strong as the pace during the second quarter. But even $6.5 billion of free cash flow is quite attractive for a company that is valued at $50 billion — that makes for a 13% free cash flow yield.

The first priority for that is the company’s fixed dividend, which currently stands at $0.18 per share per quarter. That costs the company only $480 million per year, however, or around 7% of this year’s expected free cash flow. In other words, another $6 billion in free cash is available for other purposes. The largest allocation of that will go to Devon’s variable dividend, which totals as much as 50% of Devon Energy’s surplus free cash flow — or up to $3 billion this year. Not surprisingly, the dividend yield including those variable dividends is pretty compelling — Devon Energy has paid out $3.82 so far this year — annualized, that’s around $5.10, which would result in a dividend yield of roughly 6.7% with shares trading at $76. Due to the variable nature of the majority of those dividend payments, investors have to live with some ups and downs in their quarterly income, dependent on factors such as oil and natural gas prices during the period. Nevertheless, it seems likely that Devon Energy will pay out a combined dividend yield of more than 5% per year going forward — potentially way more than that — as long as oil prices remain elevated.

The remainder of Devon’s free cash is then used for debt reduction and buybacks. Both of those are sensible — debt reduction shifts value from debt holders to equity investors over time and leads to lower interest expenses, and buybacks increase cash flow per share and earnings per share, all else equal. Buybacks also make the dividend safer over time as a lower total amount of cash is needed to maintain the same dividend at a per-share level. As Devon’s balance sheet improves and its net debt declines, it is likely that additional cash will be shifted toward either dividends or buybacks over time.

Takeaway

Devon Energy benefits from the current energy crisis as prices for both oil and natural gas are elevated. Due to ESG mandates, production cuts from OPEC, sanctions against Russia, and recovering demand following the pandemic, it seems likely to me that energy markets will remain tight and that prices will remain elevated. Devon could thus be generating strong earnings and cash flows well beyond 2022.

The third quarter will be strong, although not quite as strong as what Devon reported for the second quarter. That being said, Devon will continue to offer attractive shareholder returns, primarily via dividends. With shares trading at a 13% free cash flow yield, DVN is pretty inexpensive. Due to the fact that shares have run up in recent weeks and since some other energy names are even cheaper, I wouldn’t call shares a buy, however.

Be the first to comment