grandriver/E+ via Getty Images

Credit Card Networks and Issuers

Credit card networks, such as American Express (AXP), Discover (DFS), Mastercard (MA), and Visa (V), differ from credit card issuers, which are the banks, credit unions, and fintech companies that are loaning you money for purchases you make using your credit card.

It is the credit card issuer who approves your card, sets a credit limit, charges interest and fees, and offers card benefits. Two of the four major credit card networks, American Express and Discover, are also card issuers.

Below is a list of the credit card issuers having the largest purchase volume, which is the net amount charged to credit accounts. In 2021, the seven largest credit card issuers had $3.5 trillion in purchase volume, which was 25.6% higher than that of 2020.

| Financial Institution | Purchase Volume in Billions |

| Chase (JPM) | $950.47 |

| American Express | $867.59 |

| Citi (C) | $482.60 |

| Capital One (COF) | $454.96 |

| Bank of America (BAC) | $413.97 |

| Discover | $182.13 |

| U.S. Bank (USB) | $165.71 |

| Wells Fargo (WFC) | $138.59 |

| Barclays (BCS) | $79.54 |

| Synchrony (SYF) | $65.77 |

The debts owed to credit card issuers, or outstanding receivables, are considered assets, and as of 2021, the top issuers had approximately $933 billion in outstanding receivables, with American Express having the highest year-on-year growth of 21.80%.

| Financial Institution | Outstanding Receivables in Billions |

| Chase | $154.30 |

| American Express | $115.30 |

| Citi | $107.87 |

| Capital One | $98.03 |

| Bank of America | $92.57 |

| Discover | $74.37 |

| U.S. Bank | $40.09 |

| Wells Fargo | $34.77 |

| Barclays | $22.12 |

| Navy FCU | $21.76 |

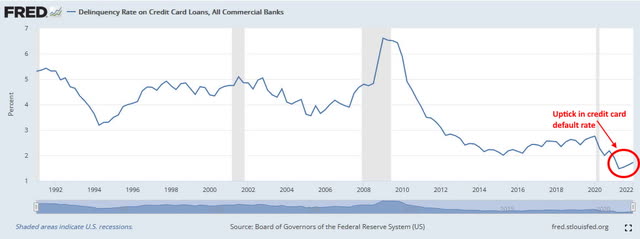

Credit Card Defaults

In June 2022, according to the U.S. Bureau of Labor Statistics, the inflation rate was 9.1%, with the biggest increases coming from gasoline, up 11.2%, electricity, up 1.7%, and groceries up 1%. The cost of living is rising faster than wage growth, and this means that consumers are literally making ends meet by putting necessities onto their credit cards.

According to the Federal Reserve Bank of New York’s Center for Microeconomic Data, in the first three months of 2022, credit card balances showed a $71 billion year-over-year increase, rising to $841 billion.

Included as part of their second-quarter earnings releases, Chase, Citi, and Wells Fargo all increased provisions in case of credit losses. Bank of America released fewer of its reserves than it had done during the same period last year, and during Q2 2022, Goldman Sachs allocated $667 million in case of credit losses. Goldman’s co-chief investment officer of multi-asset solutions, Maria Vassalou, said in an interview that “as long as interest rates increase and incomes in real terms go down, you will see an increase in leverage, you’ll see an increase in borrowing from households, and as that happens you’ll likely to see more defaults.”

Miller Tabak + Co. chief market strategist Matt Maley put it even more succinctly in that same article: “…the only reason why consumer spending is holding up is that people are going further into debt to do it. And that can’t last forever.” And Chief Investment Officer at Bokeh Capital Partners, Kim Forrest, put the focus on JPMorgan Chase, which she described as having a large credit card base.

In a July 19, 2022, press release, the S&P/Experian Consumer Credit Default Indices showed a Q2 2022 seventh consecutive rise in the default rate, and while the auto loan default rate rose by one basis point to 0.62%, and the first mortgage default rate was up two basis points to 0.38%, the credit card default rate climbed by six basis points to 2.55%.

Delinquency rate on credit card loans (St. Louis Federal Reserve)

A Tipping Point

Bank stocks were trading higher on July 19, 2022, because higher revolving credit interest rates are expected to boost earnings over the next two quarters. However, according to Bankrate.com, as of July 13, 2022, the average credit card interest rate stood at 17.13%. Most credit cards have a variable interest rate that is tied to the prime rate which is determined by the Federal funds rate. When the Federal Reserve raises the Federal Funds Rate as it has done repeatedly lately, credit cardholders typically see the increase within one or two billing cycles.

According to Experian, one of the three credit reporting agencies along with Equifax and TransUnion, in June 2022 Americans carried an average credit card balance of $5,221. In order to remain in good standing with your credit card issuer, you must make a minimum payment toward your balance each month. This amount is based on your card’s interest rate and the current amount you owe.

Included in the Credit CARD Act of 2009 was the legal requirement that credit card issuers provide a “minimum payment warning” on each monthly bill that states the total time it will take to pay off your credit card balance, and the amount of interest you’ll pay if you only make minimum payments each month.

Consumers who are trying to keep food on the table, a roof over their heads, and gasoline in their gas tanks, who then see their credit card balances balloon and the time to pay off their balances extend into decades might choose to do what many homeowners did in 2007 and 2008 – and that is default on their credit cards. Sociologically, a tipping point occurs when members of a group dramatically change their behavior by adopting a previously rare practice. In 2007 and 2008, two things happened:

- Many Americans found themselves underwater on their mortgages, meaning that the amount they owed on their mortgage was greater than what their home could be sold for.

- Adjustable rate mortgages (ARMs), where initial interest rates were low but reset higher, increased monthly payments to unsustainable levels, and due to cratering house prices, homeowners couldn’t use their home’s increased value to refinance to a fixed-rate loan.

The response of many homeowners was, “I’m outta here,” and many walked away from their mortgages. This, in turn, precipitated the subprime mortgage crisis and the Great Recession. On July 26-27, 2022, the Federal Open Market Committee is scheduled to meet, and it is anticipated that it will raise the Federal funds rate by 75 basis points, or three-quarters of a percentage point. It is estimated that those carrying credit card balances will be forced to spend an additional $4.8 billion on interest in 2022 alone.

With climbing interest rates, increasing balances, and soaring minimum monthly payments, will cardholders do what mortgage holders did in 2008 and just walk away by filing for bankruptcy? While credit scores take a significant hit following a bankruptcy, they can be repaired in just three years by making consistent payments. However, banks most exposed to credit defaults may take a lot longer to recover.

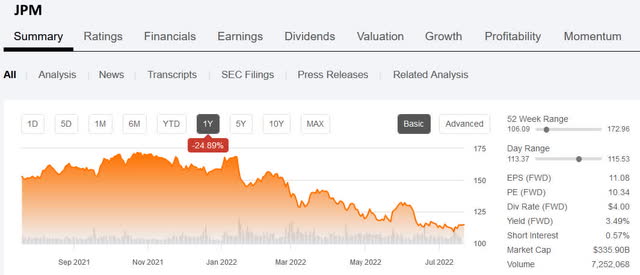

Bank Stocks

JPMorgan Chase 1-year price chart (Seeking Alpha)

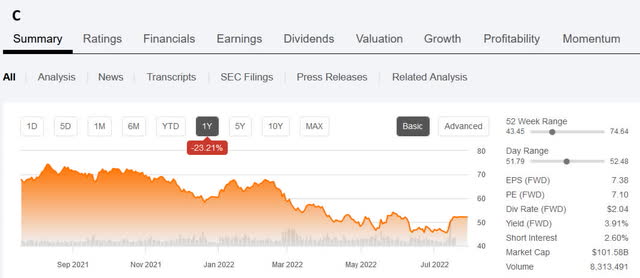

Banks with the most exposure to credit loss include Chase, which is trading close to its low for the year. While Citigroup experienced a bump in July 2022, its price has since leveled off.

Citigroup Inc. 1-year price chart (Seeking Alpha)

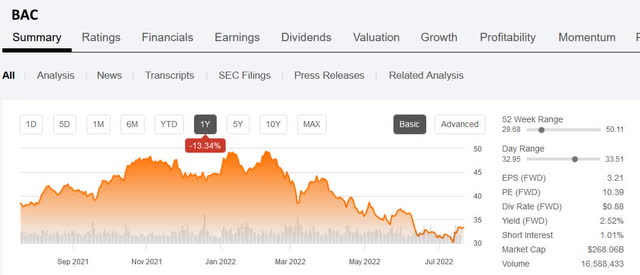

As has been pointed out, Bank of America’s Q2 2022 good performance was due to its consumer bank, which includes credit cards. However, Bank of America’s net charge-off ratio climbed from 0.16% in Q1 2022 to 0.23% in Q2 2022. The bank also substantially increased its provision for credit losses from $30 million to $523 million.

Bank of America 1-year price chart (Seeking Alpha)

Bank ETFs

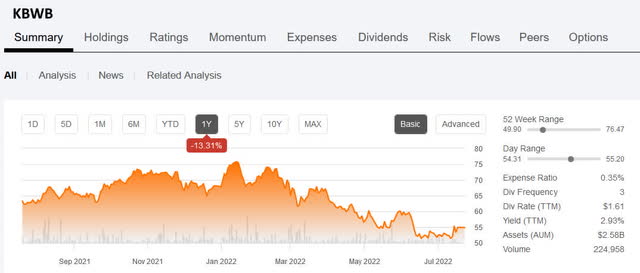

The effect of credit delinquencies and defaults could be felt even more by bank exchange traded funds (ETFs) that contain a basket of companies in the banking and financial sector. These include Invesco KBW Bank ETF (KBWB), which tracks the KBW Nasdaq Bank Index, and its top three holdings are Wells Fargo & Co., PNC Financial Services Group Inc. (PNC), and Bank of America Corp.

KBWB 1-year price chart (Seeking Alpha)

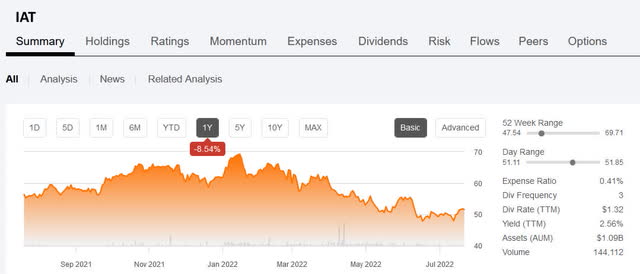

iShares U.S. Regional Banks ETF (IAT) tracks the Dow Jones U.S. Select Regional Banks Index, and its top holdings are PNC Financial Services Group, Truist Financial Corp. (TFC) and U.S. Bancorp (USB).

IAT 1-year price chart (Seeking Alpha)

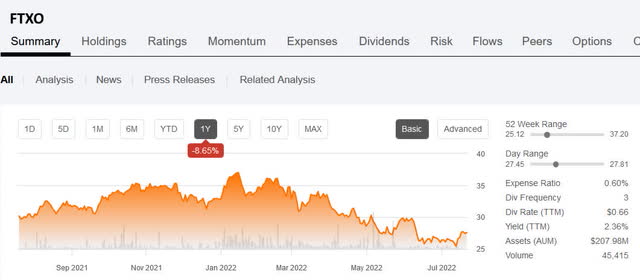

The First Trust Nasdaq Bank ETF (FTXO) tracks the Nasdaq U.S. Smart Banks Index, and its top holdings are Popular Inc. (BPOP), the Virgin Islands, Citizens Financial Group Inc. (CFG), and Regions Financial Corp. (RF).

FTXO 1-year price chart (Seeking Alpha)

Bottom Line

Despite the fact that in Q2 2022 banks’ net interest income increased and bank earnings were strong, the possibility of rising credit defaults poses a risk to bank stocks and bank ETFs. This increased risk has been telegraphed by banks during their recent reporting as an increase in provisioning.

Whether or not the U.S. experiences a recession in the latter half of 2022 or early in 2023, it’s clear that cardholders will have an increasingly difficult time paying their credit card balances. Only time will tell whether they’ve reached a tipping point.

Be the first to comment