sarawuth702

Investment Thesis

In a previous article, I explored the idea of Dollar General (DG) being a hidden play as a result of the transition to electric vehicles (‘EV’). But another company investors are likely less familiar with, Clean Harbors (NYSE:CLH), may also find itself in a favorable position as a result of the shift to EVs. Clean Harbors is an environmental and industrial services company offering waste disposal, recycling, transportation, field services, and much more, primarily to industrial and manufacturing companies.

Clean Harbors is one of the largest and most reputable names in the game and is often a go-to for large customers. As a former Environmental Coordinator for one of the nation’s largest electric utilities, I can attest to this personally. When the going got tough, we called Clean Harbors.

One of the services Clean Harbors offers is battery recycling, from small alkaline batteries to NiCad batteries to auto and truck batteries. As the world transition to EVs, eventually, all those “used” batteries will need to be packaged, transported, recycled, or disposed of. I believe it’s only a matter of time before Clean Harbors gets in the game. And it’s likely a sizeable opportunity.

Not Just About Disposal

The first rebuttal to this thesis I expect to hear is that EV batteries will be recycled, not disposed, so how will Clean Harbors benefit? Firstly, nearly all things in nature have a limited lifespan, even after recycling. Batteries are no different. Yes, it’s possible EV batteries will be re-purposed for at-home use, provide back-up power to businesses, etc… but, eventually, all those batteries will need to be dismantled where their non-recyclable or useless components will find themselves in a landfill or incinerator somewhere. Clean Harbors offers both these services.

Secondly, whether you’re transporting for recycling or disposal, batteries aren’t an item the US DOT simply allows you to drop in a mailbox or load on a truck. Ever heard of 49 CFR Parts 171-180? Probably not, but it’s the Code of Federal Regulation (‘CFR’) regulating lithium cells and batteries. It regulates storing, packaging, labeling, shipping, transport, record-keeping, you name it. In summary, the regulation exists to prevent battery owners, transporters, recyclers, and disposers from injury, setting fire to property, and irresponsible disposal. Federal transportation, recycling, and disposal regulations become so confusing and convoluted they conduce battery owners to call an expert to reduce risk and liability – enter Clean Harbors.

UN label for shipping lithium batteries (GHS)

Not A Do-It-Yourself Endeavor

For many large industrial and manufacturing companies, when it comes to environmental compliance, it’s usually a buy it, don’t build it decision. Meaning, the big boys use subcontractors who are experts in the field to ensure compliance with the law. In doing so, companies shift some risks and liabilities to those third-party contractors. This won’t entirely insulate the company from being sued or paying fines if a subcontractor violates the law handling the company’s property, but it does spread some of the risks around.

With ESG now at the forefront of many S&P 500 companies (check the investor deck of any of them), most simply will not take an environmental risk, which is why I think Clean Harbors will be top of mind when the time comes for EV batteries. I can nearly guarantee the General Motors (GM) and Fords (F) of the world already have a working relationship with Clean Harbors, probably for used oil recycling, hazardous waste disposal, and universal waste handling, just to name a few. It’d only be natural for those companies to partner with Clean Harbors for EV batteries as well.

That’s A Lot Of Batteries

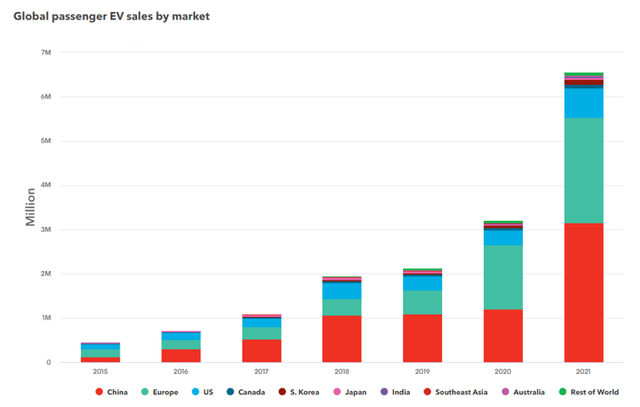

Investors should take most total addressable market (‘TAM’) estimates with a grain of salt; the same goes for EVs. Nonetheless, some studies indicate the cumulative size of the EV market from today to 2050 is north of $50 trillion. That represents about a 22% CAGR from today’s near $200 billion TAM… for the next 28 years. Whether $50 trillion is even remotely close is anyone’s guess, but it’s hard to argue with the trend considering the ever-increasing EV fleet traveling down the highway.

Global EV Sales (BloombergNEF)

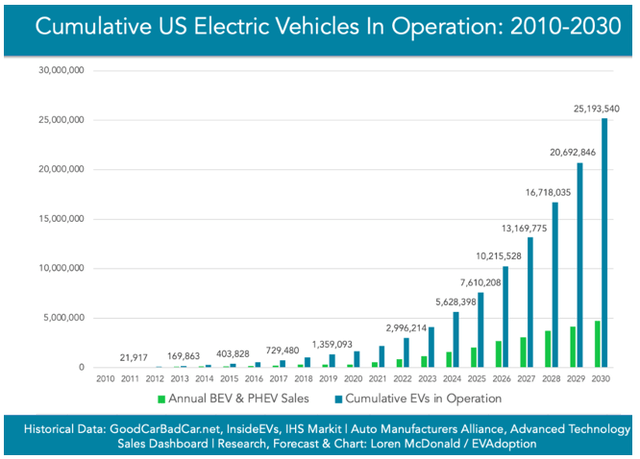

In the US alone, one study estimates there will be 25.2 million EVs on the road by 2030, all powered by a battery.

US EV Sales & Forecast (evadoption.com)

What’s The Opportunity?

We are in the infancy stage of EV adoption, so it’s very difficult to quantify the opportunity that may be in front of Clean Harbors. Some speculate EV batteries can last a decade or more, so we may have a few more years before early EV batteries near the end of their useful life. Nevertheless, I did come across an article that states it cost around $7,000 for Tesla (TSLA) to recycle one of its batteries. To be conservative, I’m going to cut that to $5,000 for this estimation.

Assuming there are 25 million EVs in operation by 2030 and which, at some point, each battery will need to be removed, packaged, transported, dismantled, recycled, and/or disposed of, that represents around $125 billion (25 million x $5,000) worth of batteries. Clean Harbors’ trailing twelve-month revenue is $4.6 billion. If Clean Harbors were to capture 5% or $6.3 billion of the US EV battery recycling and disposal market, their revenue easily doubles.

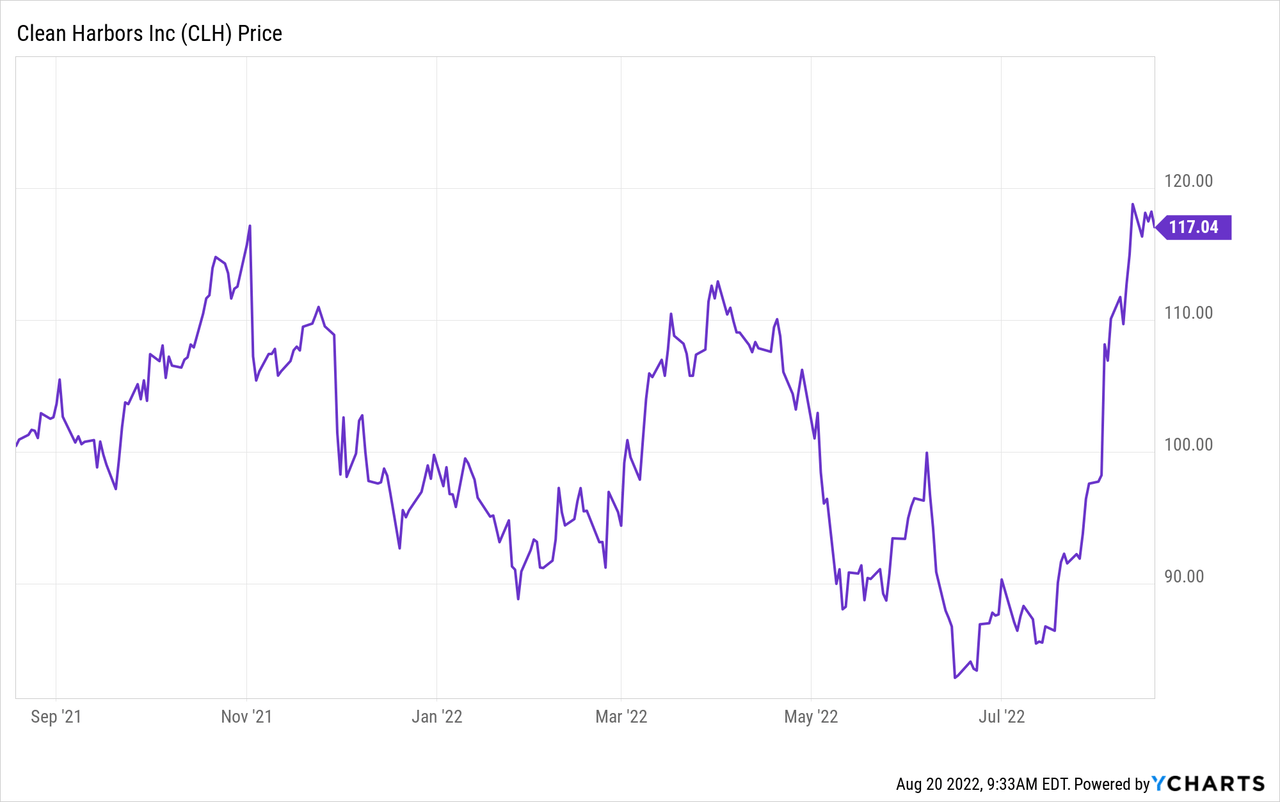

Valuation

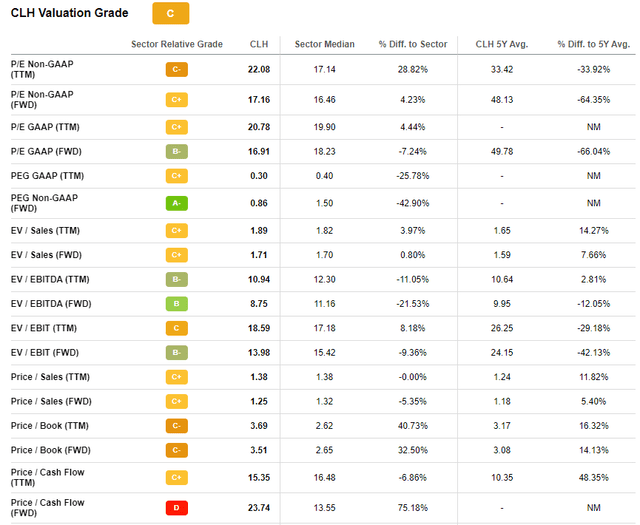

At $117 per share, Seeking Alpha has a valuation grade of C on Clean Harbors. I think shares are about fair price if not overvalued, but admittedly, I’m not interested in Clean Harbors as a potential holding until I hear more from the company on the EV front. I like Clean Harbors as a business, but past financial performance has been spotty, with consistently inconsistent margins and earnings. I prefer investments that are predictable, and Clean Harbors doesn’t always offer that. I’m not a buyer until I hear more from management and see some EV-related revenue on the topline.

Risks

The EV battery transporting, recycling, and disposal market could be a game changer for Clean Harbors, but success is not guaranteed. These risks pose a real threat to this investment thesis.

Clean Harbors stays on the sidelines

To my knowledge, Clean Harbors hasn’t publicly stated their intention to take part in the EV battery recycling and disposal market. Obviously, their electing not to participate negates this thesis altogether.

Increased competition

All indications are that the EV market will have an enormous TAM in the not-so-distant future. Money attracts competition, and there are already numerous start-ups in the EV battery recycling business. One of these new companies, existing auto manufacturers, or peer competitors could steal what market share may be available to Clean Harbors, greatly reducing the financial impact the EV market may have on their business.

Improved battery lifespan and lifecycle

Battery technology is constantly improving, and it may only be a matter of time before the industry experts re-revolutionize EV batteries. Improved technology may further increase battery lifespan as well as recycling and disposal options. Advancements in these areas are likely to erode revenue away from battery recyclers over time. Perhaps the whole concept is a flash in the pan.

Conclusion

EVs are on the cusp of reinventing the world of transportation, but at some point, those batteries will meet their maker. Depleted EV batteries will need packaged, transported, dismantled, recycled, and/or disposed at some point. Clean Harbors seems like a natural fit for auto manufacturers because they’re highly reputable and likely already have relationships established with numerous major companies.

Do I recommend buying Clean Harbors in today’s market and without having visibility into their EV plans, if any? No, but if Clean Harbors were to put a plan together to take part in the EV market, I would be very interested to hear what they have to say. If you’re looking for an alternate way to play the transition to EVs, consider putting Clean Harbors on your radar. You never know what opportunity may await.

Be the first to comment