naphtalina/iStock via Getty Images

Not sure if anyone has really noticed this outside of our membership, but we have been stepping up and buying financials to start July. We know there is a growing divide right now between smaller regional and community banks and the massive cap big money banks of the world. The larger, more complex banks have complicated balance sheets and have their proverbial fingers in a lot of pies. Many of these enjoyed successes and now pressure from investment banking. They also have more stringent capital requirements, and internal investment, while the more regional type banks are enjoying the benefits of still healthy loan demand and are benefitting right away from higher rates on their net interest rate spreads.

As we know, both major banks and smaller ones have seen their stocks hammered the last few months, along with the broader market. It has caught some investors off guard because interest rates are on the rise and that is good for banks. But that is in the longer run. In the short run of the rate hikes, there is an immediate “rate shock” that hits borrowers and can slow demand temporarily, along with costs and adjustments made to structure loans to benefit from said higher rates. It takes a couple of quarters to work out. We know there has been a lot of concern regarding the rate spreads between what a bank pays on deposits vs. lends out, but some banks are starting to enjoy the benefits.

Citizens Financial Group, Inc. (NYSE:CFG) is one of those banks, and we think the stock is a buy.

CFG stock crushed

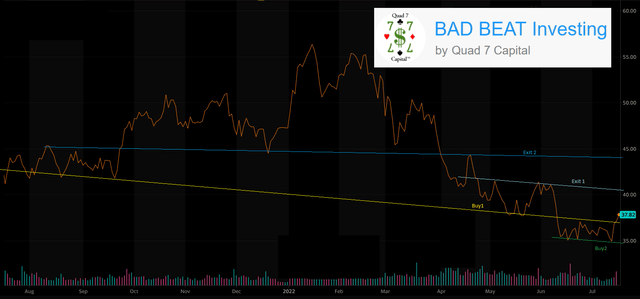

While the market threw a fit in general, financials were hit particularly hard especially when fears of recession started building. But we think this action is creating an opportunity, and the stock appears to be bottom-forming.

We like purchasing the stock here, about 10% lower for a complete position, and starting to shave it in the $40’s for traders. Investors should be buying this up now.

Why we like Citizens Financial

We see the stock as offering sufficient value, future growth, a nice dividend. That is what we do. We find beaten down stocks and sectors and profit heavily from the rebound. We believe that, as the next few quarters roll on, these higher rates are going to be a big windfall for the banks. We think you can start to buy some of these beaten-down names. We want to own quality banks as interest rates are rising, and profit from the big increase in net interest income that will be realized as time moves on.

As rates rise, the bank will have more earnings power potential, as this temporary slowdown in originations as a whole will not last. Essentially, the spread on money it lends its customers relative to what it pays out on interest on deposits will widen, feeding the bottom line ultimately. While there have been concerns on the economic front that have hurt lending short term, we believe the banks will enjoy a big windfall in coming quarters.

We like this bank and its operations, and the recent acquisition of Investor’s Bancorp helped grow the bank. With the pull back from much higher levels, we think that you want to own shares that now yield over 3.20% and wait for the turnaround. In this article, we discuss recently reported performance and why we like the bank ahead of Q2 earnings this week.

Citizens Financial just announced Q2 earnings

In the just-reported second quarter, the bank saw a big increase in the deposit and loan base. Much of this was from the acquisition, although for the most part deposits and loans were rising organically before this. Still, the earnings power of the bank is impressive. Revenues jumped in Q2, with Citizens bringing in $2.0 billion. These revenues of $2.0 billion were a 24% increase year-over-year. One issue that had impacted many regional banks had been high loan loss provisions in 2020 and some of 2021 with the COVID crisis. The provision for credit losses was $202 million in the recent quarter, rising from $3 million in Q1. This included a $145 day one CECL provision expense for Investors Bancorp acquisition

M&T Bank (MTB) saw its net income narrow to $364 million or $0.67 per share, while on an adjusted basis they brought in $595 million or $1.14 per share, up from $1.07 per share in Q1. This was well above consensus expectations, beating them by $0.12. It was a strong quarter, even with some rate shock impacting demand somewhat for loans.

Deposits and loans

We will reiterate that having more deposits on hand helps fund more future loans. If we look long-term, having deposits ready to deploy will be a being benefit when the spread eventually widens on what the bank pays interest on for deposits compared to what it collects on loan fees and interests. That said, total deposits were $178.9 billion at the recent quarter-end, $150.6 billion a year earlier and $158.8 billion at the end of Q1 2022.

There was also loan growth like we saw with the growth in deposits, the acquisition of Investors Bancorp will help. Loans were $156.2 billion at the end of Q2 2022, compared with $122.6 billion a year ago, and $131.3 billion at the start of Q2 2022.

Asset quality

With loans rising tremendously we like to have a sense of asset quality. In short, we need to ensure the bank did not acquire assets that are nonperforming. Well in Q2 net loan charge-offs were $49 million, which is much improved from $78 million Q2 2021. Thus, net charge-offs were 0.13% and 0.25% in the second quarters of 2022 and 2021. Nonaccrual loans totaled $839 million at the end of Q2 2022, up from $779 million a year ago, and $789 million at the end of Q1 2022. So even though the amount increased, as a percentage, nonaccrual loans were 0.54% of total loans compared with 0.60% a year earlier. The allowance for credit losses jumped as well with more loans on the books. They totaled $2.15 billion or 1.37% of loans outstanding at the end of Q2, compared with $2.08 billion or 1.70% a year ago. In short, asset quality has improved.

Efficiency ratio and returns improving

Citizens Financial is still a pretty highly efficient bank. When we examine larger banks we like to see around a 60% efficiency ratio or better. Well, the adjusted efficiency ratio was 58.2% compared to 64.3% in the sequential quarter, and is improved from 60.9% last year. This is a very strong result. On top of that both the return on average assets and equity improved significantly The return on average assets increased to 1.08% vs. 1.03% in the sequential quarter. The return on average equity is also trending higher and we see it starting to stabilize in the second half of 2022. But in Q2 it came in at 10.06% vs 8.75% in Q1 2022.

CFG stock valuation is still attractive

The valuation of Citizens here is attractive. You should consider buying bank stocks when they are near (or even below) book value, but this is a very rare occurrence. The bank’s stock is $37, falling in recent months, but starting to rebound, and we think it may have bottomed, market chaos notwithstanding. That said, these share prices are now above tangible book value. Tangible book was $29.14, falling from $33.95 last year, one of the only blemishes on an otherwise solid quarter. We think CFG shares would be much more attractive at $33-34, but we believe you can start buying as the banking sector looks to bottom out this year.

A great dividend and big repurchase program

The bank also pays a dividend and the stock is currently yielding 4.2%. The dividend paid was just raised another 7.7%. The payout is now $0.42 quarterly and is considered safe based on the payout ratio metrics. The Board also authorized a repurchase program of up to $1.0 billion of common stock. This is a big increase of $545 million above the $455 million of capacity remaining under the prior $750 million January 2021 authorization. We like it.

CEO commentary

The bank is in fine shape, despite the recent contraction. Chairman and CEO Bruce Van Saun stated:

We were pleased to deliver strong results in the second quarter, which featured the completion of the Investors Bancorp acquisition. We have navigated well through a period marked by higher than expected inflation, and the Fed’s aggressiveness in raising short-term rates and tightening liquidity. Our capital, liquidity and funding position remains strong – we are funding attractive loan growth and have raised our dividend. Our fee businesses are proving to be diversified and resilient, and our credit metrics all remain very favorable. We look forward to continuing our momentum in the second half.”

They were well funded, growing loans, and their credit metrics are solid.

Final thoughts

Asset quality is improving, and we expect shares to rally as interest rates rise into 2023. Earnings are up. The dividend has been hiked. A big repurchase program. Stock is closer to tangible book than it has been since the COVID crash. We think you start buying this one.

Be the first to comment