da-kuk

A few weeks ago, we discussed our thoughts on how investors could build an All-Weather income portfolio. The point wasn’t to have a portfolio that could only go up – that is simply unrealistic at any reasonable level of risk taking. Rather, it was to ensure that the portfolio held a variety of assets where each could outperform in a different market scenario.

A few investors liked the concept but weren’t comfortable with preferreds and Business Development Companies so in this article we take a fund-only approach to building the All-Weather income portfolio.

Thinking About Possible Market Outcomes

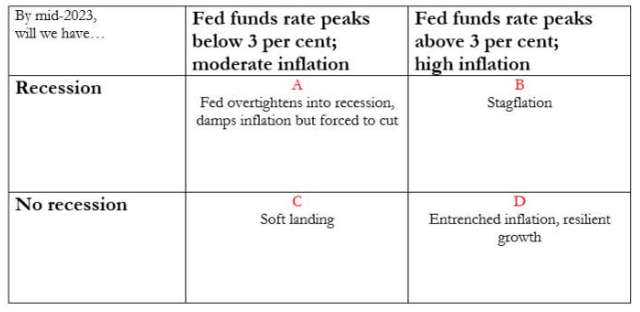

Let’s first refresh the motivation for the All-Weather Income Portfolio. To build a relatively resilient portfolio, i.e., one that holds some assets which can perform well in different market environments, we can consider the following matrix borrowed from Columbia Threadneedle which shows a number of possible economic scenarios over the medium term as a 2×2 matrix.

Clearly, this is not an exhaustive list, but it does a reasonable job of highlighting how the next 12 months could develop across the market and the broader economy.

Scenario A – Fed Overtightens, Causes Recession

In this scenario, the Fed tightens policy too much too fast which causes demand to drop sharply, economy to move into recession and inflation to fall. If this happens, we expect Treasury yields to move back lower to a level of 1-2% and credit spreads to rise.

In this scenario, holding higher-quality long-duration funds can make sense. The types of assets that can fit the bill here are municipal bonds, preferreds and investment-grade corporate bonds.

In the Municipal space we continue to favor the Nuveen High Yield Municipal Bond Fund (NHMAX), trading at a 5.5% yield. The fund is mostly allocated to unrated tax-exempt bonds and carries some leverage, however, even after the recent drawdown it has generated some of the best performance in the sector, even outperforming the tax-exempt CEF sector in total NAV terms over various time frames. The fund has recently been reopened to new investors.

In the preferreds sector we like the First Trust Preferred Securities and Income ETF (FPE), trading at a 5.62% current yield. The fund is actively managed and allocates across both retail and institutional preferreds. The majority of the fund is allocated to investment-grade securities.

Higher-quality corporate credit risk can make sense here as well as would taxable municipal bonds in a taxable account.

In this scenario we would avoid CEFs as their discount volatility can overpower whatever decent returns delivered by the NAV.

Scenario B – Stagflation

In this scenario, inflation remains persistent, causing interest rates to remain high while the economy enters a recession which pushes credit spreads wider as well likely driving credit defaults higher.

In this scenario, we like higher-quality floating-rate funds. The coupons of the securities held by these funds will increase over time as the Fed will be forced to raise the policy rate and keep it relatively high to keep a lid on inflation. And, as in the above example, the higher-quality profile of these securities should mean they will outperform if credit spreads move sharply wider.

We covered a number of higher-floating funds in an earlier article. Some of the funds worth highlighting again are the SPDR Bloomberg Investment Grade Floating Rate ETF (FLRN) with a current yield of 1.87%. That’s a low yield but it should rise closer to 4.6% as the Fed reaches its 3.6% expected terminal Fed rate.

For investors comfortable with CLOs, we like the Janus Henderson B-BBB CLO ETF (JBBB), trading at a 2.15% current yield and a 4.2% 30-day SEC yield which should keep rising another 2% or so as the Fed continues on its hiking trajectory.

Scenario C – Soft Landing

In this scenario, inflation peaks quickly grind lower, which allows the Fed to take their foot off the pedal, leaving financial conditions fairly supportive. Economic growth slows down but is not tipped into a contraction. Interest rates move lower and credit spreads range trade.

In this scenario, we like to hold medium-duration fixed-coupon securities ranging from high-yield corporate bonds to municipal bonds, depending on investor risk appetite. And because short-term rates will likely peak below the consensus level, holding bond exposure via CEFs can make sense as leverage costs will not rise to excessive levels. Currently wide discount levels across fixed-income CEFs also suggest this is an attractive area to add new capital.

- Nuveen Municipal Credit Income Fund (NZF), trading at 5.7% current yield

- Credit Suisse Asset Management Income Fund (CIK), trading at a 10.1% current yield

- Western Asset Diversified Income Fund (WDI), trading at 10.5% current yield

Scenario D – High Inflation / High Growth

In this scenario, inflation remains a persistent feature of the economy without causing growth to stall. Here, we expect interest rates to move higher but credit spreads to remain relatively resilient. In this market outcome, we like floating-rate lower-quality credit CEFs. These funds boast historically high yield levels which will benefit further from short-term rates moving further above current market consensus in this scenario. At the same time a robust macro picture should keep credit losses contained.

For this outcome we like:

- Apollo Senior Floating Rate Fund (AFT), trading at a 11.8% discount and a 7.9% current yield

- KKR Income Opportunities Fund (KIO), trading at a 11.5% discount and a 10.7% current yield.

Takeaways

The investment landscape over the medium term looks to be particularly uncertain. The global economy is still in the process of post-pandemic recovery, buffeted by continuing supply chain issues, localized lockdowns and a European conflict. To add to this, many central banks are in the process of hiking policy rates to deal with fairly persistent inflation. What the market will look like in a year’s time is impossible to predict.

This is why for some investors it can make sense to take an All-Weather approach and hold some assets that can benefit in various market outcomes. Obviously, the weightings of these outcomes don’t all have to be exactly 25% – it can make sense to tilt more to a “base case” outcome which can be different for each investor.

The other reason an All-Weather approach can benefit investors is by enforcing a measure of risk factor diversification on portfolios that are usually built bottom-up with investors acquiring assets individually that appeal to them, without regard to the likely tendency of these assets to behave in very similar ways in certain market outcomes.

Our own Income Portfolios hold securities across all these buckets with some variation due to yield constraints. This is something that has allowed us to reallocate resilient capital into more attractive securities over the past few months as markets have struggled.

Be the first to comment