Pgiam/iStock via Getty Images

Citigroup (NYSE:C) is a conviction buy for me in the medium term. I have been following this ticker and trading it for the best part of a decade. The playbook in the past was to buy it at a deep discount to tangible book and sell when it reaches ~1 – 1.1x tangible book. This time though it is different, I am now a long-term holder of Citi as I believe it will outperform the other large banks in the next 3 years.

I have been there and seen all the mishaps and have been calling many of them in real-time. I was also a vocal proponent (right here in SA as early as 2016) for a strategic shift and called on management to dispose of the global consumer bank. This call (which was very logical strategically) was finally accepted and executed by Citi’s new management in 2021.

Why is it different now?

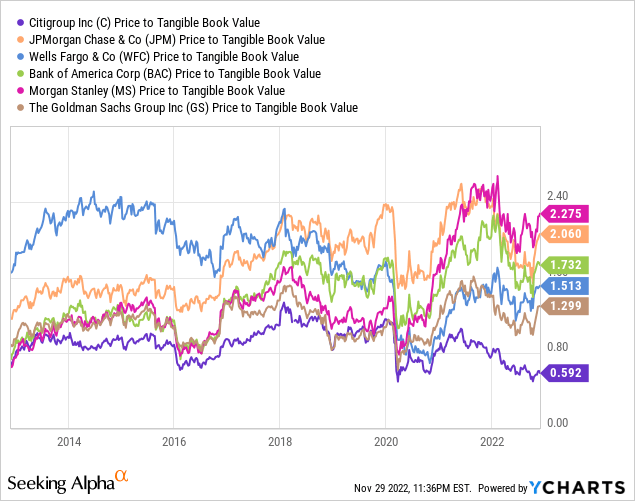

Citi has been a perennial underperformer when compared to the other large U.S. banks. And it has been valued accordingly on a relative basis in terms of price to tangible book value as well as on price/earnings ratios.

The valuation difference has been and still remains stark but what is the root cause for this?

Firstly, it is about the business model post-GFC. Citi’s board and management team has made several strategic errors in terms of its business model and capital allocation decisions.

Citi elected to sell its wealth management unit Smith Barney in a deal that made Morgan Stanley (MS) what it is today, a wealth management powerhouse. Citi also decided to focus on international consumer banking, believing that EM economies will deliver much higher GDP growth rates than the U.S. and thus provide better returns for banks operating there. Back home, it decided to focus primarily on the credit cards business believing it to be a high-ROE business. Citi also doubled down on its global investment bank and specifically on the then-lucrative FICC trading business.

Some of these key decisions following 2008/2009 GFC defined what Citi has become today. In retrospect, it clearly didn’t turn out well at all. The focus on the global consumer bank has proven to be misguided. Citi’s operations in many jurisdictions were sub-scale with higher funding costs and could not compete effectively with leaner local and regional players. Even where Citi had scale, it was handicapped by being a U.S.-domiciled G-SIB bank with higher capital, liquidity, and a cost structure. So the global consumer banks delivered very mediocre results at best and in fact hurt the overall franchise by indirectly increasing the complexity of the firm and most importantly its regulatory capital requirement. In other words, by virtue of Citi owning Banamex Mexico (and various other global operations), it increased the capital requirements in Citi’s corporate and investment bank and hurt its competitiveness. This really defied economic logic but Citi’s management team was seemingly not ready to act as yet. The hope from the prior management team was that the returns from these businesses will somehow mushroom higher and justify the additional punitive capital costs – that however, never materialized.

On the home front, competition in the Cards space intensified given many banks (and increasingly FinTechs) attacked this space. The returns from this business were also disappointing considering that the risks of unsecured lending weighed heavily on Citi’s CCAR submission and in turn, worked to increase its firm-wide regulatory capital ratios higher.

The corporate and investment bank (“ICG”) remained the crown jewel and delivered decent low to mid-teens ROE despite being starved of investments, higher capital requirements, and the somewhat secular decline in trading income (which reversed in recent years).

As such, Citi’s CEO at the time, Mr. Corbat focused his attention on cost management and in effect ended up starving the bank of crucial investments. Mr. Corbat was determined to get to a RoTCE of 12% as per his stated targets and as revenue disappointed, he resorted to cost-cutting. It didn’t take long for that strategy to backfire in the form of operational near misses (e.g. the Revlon inadvertent payment), and lack of investment in the business which culminated in the Fed’s Consent Orders that accelerated Mr. Corbat to exit from his job. In my view, the Fed’s Consent Orders are the best thing that happened to Citi – it really forced it to get its house in order.

Where are we now?

The strategy outlined (and executed) by Jane Fraser is designed to fix all these issues. Post-restructure Citi is beginning to look a lot more like its peers JPMorgan (JPM) and Bank of America (BAC). The U.S. franchise remains a strategic challenge (but more on this later).

It was a brave but necessary decision to sell the global consumer bank and pivot to a wealth management business. This is all designed to reduce Citi’s regulatory capital requirements which in turn supports the ROE generated from the rest of the franchise and notably ICG.

Citi is investing heavily in the businesses (TTS, wealth management, commercial banking, investment banking) and as importantly (if not more so) in controls and operational resilience. This bank is being completely rewired and digitized with modern cloud-based technology architecture. All processes and controls are reassessed and updated for robustness, resilience, and operational efficiency. This goes far beyond addressing the action points in the Consent Order, it is also about the cost efficiency of the firm. I fully expect it to pay dividends in terms of cost efficiency in the years to come. This is a multi-year and multi-billion investment that is badly needed.

In short, Citi is not cutting any more corners. At the end of this restructuring, Citi will become a simpler, smaller, and safer institution with lower capital requirements and best-in-class operational and cost efficiency.

The thorn in Jane’s strategy

I mentioned before that Citi is beginning to look a lot more like its peers JPM and BAC. However, there is one big divergence and it is the U.S. consumer bank.

Unlike Citi, which is a predominantly monoline cards products franchise, both JPM and BAC are benefiting from a multi-product and national branch presence in North America. This enables these banks to gather sticky deposits at a very low cost and also deliver much more diversification in their income profile.

Citi, on the other hand, is hugely disadvantaged. The deposits it gathers in ICG are much less sticky as rates go up (Citi has to pay more to keep them). This is one key problem remaining with Citi’s existing business model.

I assume once Citi sells Banamex Mexico and satisfactorily addresses the Fed’s Consent Orders, Jane may address this weakness in the business model. This may involve an inorganic acquisition of a regional player.

Final Thoughts

At less than 0.6x tangible book, Citi is a no-brainer given the deep and meaningful restructure it is going through. Citi has a number of crown jewels businesses that are absolutely world-class (TTS being a prime example with an ROE of ~30% and an annuity-like profile). All that it needs is good management. Jane is proving herself by making difficult decisions early in her tenure. This has a high probability of success.

Citi will likely operate with sustainably lower regulatory capital requirements and release massive amounts of capital to be distributed back to shareholders.

Citi remains on my conviction buy list.

Be the first to comment