Delta Air Lines Airbus A350-900 aircraft. viper-zero

The end of 2022 will bring an end to the Covid era, one of the most disruptive periods in a century of U.S. aviation history. While passengers decided months ago that they were returning to the skies, the books will close on December 31, 2022 on the year in which Covid no longer became an excuse for airline business performance. Eighteen months ago, I wrote in this SA article that Delta (NYSE:DAL) would execute the strongest recovery plan in the U.S. airline industry. ‘Delta Air Lines Is Executing The Strongest Recovery Plan’ with three strong quarters of demand and two quarters of improving profits and the promise of yet another in the fourth quarter, it is worth looking not just at what Delta learned during the past three years but also what it did well and whether my article provided valuable investor insight.

Several summary statements could be made about the Covid era but some of the most notable could include that the pandemic dragged on far longer than any originally predicted, that government aid succeeded at stabilizing the airline industry as has never occurred after crises that were far shorter than Covid in duration, that the travel demand destruction that many predicted simply has simply not occurred, and that the balance of the U.S. airline industry hasn’t been as favorable for legacy and global carriers as it is now.

Delta’s strategies for navigating the Covid pandemic were decisive and, based on the roadmap that they provided just weeks into the pandemic, they largely reached their goals. They did a better job than the industry of managing costs and maximizing the revenue that did fly including by blocking middle seats longer than any other airline. Delta controlled costs well but lost a lot of their unit cost advantages because of the inefficiencies of their operation. They actively sought out ancillary including from their relationship with American Express and that revenue came through better for them than for other airlines. Tens of thousands of Delta employees took retirement or left the company under generous severance packages, allowing them to rehire new employees at lower wage and benefit costs. The employee turnover, however, resulted in significant operational inefficiencies which cost them the ability to regrow this summer – but they saw significant improvements in unit revenue growth. And, as I noted would be the case at the onset of the pandemic, Delta is stronger relative to both its low cost and global/legacy carriers than it ever has been.

Delta, most importantly has achieved its goal of using the pandemic to restructure its business to increase its financial performance after the pandemic, become more efficient, and widen its competitive advantages. In this article, I will share the components that will drive Delta’s improved margins and increase its valuation, esp. regarding its operations.

New Pilot Contract, More Pilots

First and most critical for Delta to determine its future strategy is to sign a new contract with its pilots. Delta is expected to have 14,500 pilots by next summer, the second largest pilot workforce in the U.S. and world and slightly below American with more than 1000 new pilots added between the summer of 2022 and next summer. Delta pilots have been working under a contract that became amendable just before the Covid pandemic began; the pandemic halted progress on a new contract but the sides have been under federal mediation for months. As of Friday night, December 2, 2022, Delta pilot union leaders have revealed that they have reached an agreement in principle. While there is no assurance that the entire union leadership will accept the proposed agreement or send it to the pilots for a vote – or that the rank-and-file pilots will ratify it, American and United’s attempts at a contract provide the basis for establishing what the legacy carriers might be willing to pay.

The significance of a new pilot contract is that it essentially will set Delta’s labor costs for the life of the contract and perhaps for several years beyond. Delta’s pilots are the only large unionized group, unique among large jet airlines worldwide but it is precisely because Delta is careful not to give an advantage to its unionized pilots that it is essentially negotiating with its pilots for the pay and benefits it will offer to its non-union employees including its approximately 25,000 flight attendants, which recently were given boarding pay, a first among U.S. airlines; most of Delta’s non-contract employees have received modest pay increases over the past three years, unlike the unionized pilots.

DAL ALPA AIP JL memo (airline pilot forums.com)

Delta pilots are looking for the same double digit increases in compensation to help them overcome record U.S. inflation but also want to correct several quality-of-life issues which they believe has degraded their careers. First, Delta’s inefficient operations over the past two years – driven by Delta strategies to “downgrade” as many pilots as possible to lower paying positions to reduce costs has resulted in a very long timeline for restoring capacity and for getting pilots retrained (and new pilots trained) on their desired aircraft. The result has been that some pilots flew very little if at all for months at a time during the pandemic while others were repeatedly rerouted during schedules that they bid in order for the airline to staff the operation and recover from inevitable irregular operations. Delta pilots want better protection for the schedules they bid and better pay when the company is forced to reroute them, disincentivizing scheduling practices that are harmful to pilot quality of life. Delta’s willingness to pay flight attendant boarding pay represents an attempt by the company to address QOL issues with economic solutions although pilots do not receive pre-flight or post-arrival pay even though they also have responsibilities that start before the aircraft door is closed and pay starts.

In addition, Delta pilots are once again looking for stricter limits on the amount of flying that Delta can “send” to its partner airlines, many of which are in parts of the world where labor costs are lower and yet Delta has revenue sharing joint ventures with a number of those airlines. Delta and its pilot union have used formulae in the past which the pilots believe still give too many opportunities for Delta’s international partner airlines to add flights which Delta can sell to its customers rather than operating those same flights on Delta operated aircraft.

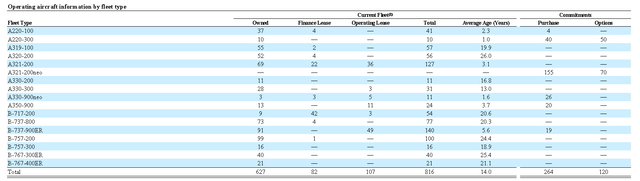

Delta ALPA pilot agreement (AeroCrewNews/Facebook)

As I noted in my recent Seeking Alpha article about the labor situation at American Airlines, Delta will probably be the first of the big 4 U.S. airlines to sign a new pilot contract given that United’s pilots roundly rejected the contract its negotiators and pilot leadership sent out for a vote, resulting in the removal of dozens of pilot leaders and negotiators, while American’s pilot leadership rejected the company’s offer before it ever went out for a vote. The significance of being first among large airlines to get a new pilot contract is notable given the labor shortage which has created intense competition among the big 4 airlines for pilots that are ready to move up to the large airlines. While most of the pilot contracts are expected to have “me too” clauses that allow pilot groups that sign first to note be “leapfrogged” by later contracts at other airlines, the need for pilots just among the big 4 airlines is expected to outstrip supply for at least the next few years. Airlines continue to redeploy capacity that was cut during the pandemic even as demand worldwide continues to return and likely exceed pre-pandemic levels within the next few years. In addition, the big 4 airlines have historically paid more than smaller airlines, making them more attractive to new pilots and resulting in greater attrition from low-cost carriers as well as regional carriers.

Delta recently signed a new contract with its pilots at Endeavor, its wholly owned regional carrier that operates approximately 175 Bombardier regional jets, or about half of the regional jets Delta contracts for across its system. Regional airlines throughout the U.S. have had to dramatically increase pilot pay to slow attrition and to incentivize pilots to begin their flying careers at regional airlines rather than in other sectors such as corporate aviation or the air cargo segment of the industry. The Endeavor contract provides for substantial increases in pay and significantly reduced the gap between regional carrier and mainline pilot pay; mainline pilots will certainly try to use those large pay increases to justify similarly large increases in mainline pay.

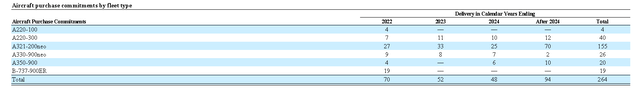

A Growing International Fleet

The second major leg of Delta’s growth strategy surrounds its fleet strategy. Delta used the pandemic to eliminate several fleet types including its domestic McDonnell Douglas MD-88s and -90s and its small 737-700 subfleet as well as its long-range Boeing (BA) 777-200ER and – LR aircraft. It also retired about a dozen of its B767 widebody jets and reduced its B717 short-haul fleet but is “un-retiring” dozens of those aircraft to help provide small aircraft feed that is proving to be more cost-efficient on the B717 than on regional jets at higher pay rates. As for December 31, 2022, Delta will have replaced all of the aircraft by unit number that it operated pre-pandemic although all of the replacement aircraft it has acquired are larger and more efficient than the aircraft that were retired.

Replacement aircraft including new Airbus (OTCPK:EADSY) A220, A321, both of which are domestic models and A330 and A350 aircraft, both of which are widebody medium to long-range aircraft. Delta also acquired used Boeing 737-900ER aircraft, augmenting the fleet it acquired just years ago new from Boeing, as well as used Airbus A350s; Delta is in the process of inducting those used aircraft into service although many of them will not operate with Delta-standard interiors.

While Delta once had an exclusive supplier contract with Boeing, all of Delta’s new aircraft order book has been provided by Airbus for the last several years with that distinction broken this year with a Delta order for 100 Boeing 737 MAX10 aircraft. Although Delta acquired Airbus aircraft with the Pan Am transatlantic assets in 1991, it wasn’t happy with that model. Airbus tried unsuccessfully to place the A330-200 at Delta but the two parted ways until Delta merged with Northwest which was a major Airbus customer although it was also a launch customer for the Boeing 787. Delta liked the economics, performance, and customer attractiveness of the A330-300s, the nearly 300 seat widebody, that was the backbone of Northwest’s transatlantic fleet. Delta later added to NW’s 30 plus fleet of A330s and then pushed Airbus to design a re-engined version of the A330 with engines similar to what is found on the B787. Delta is now the largest operator of the A330-900 which sports a sister Rolls-Royce engine to one that is offered on the B787.

Delta’s interest in the A330-900 came as Delta realized it did not need an all-new fleet featuring Carbon Fiber Reinforced Polymer technology – which is lighter than traditional metal aircraft but also considerably more expensive. The Airbus A350 and Boeing B787 have at least 50% CFRP content with the A220 narrowbody and the upcoming B777X also featuring large percentages of the lightweight but strong material. Boeing’s only current production widebody is the B787 family. Delta’s interest in the A330-900 allowed Airbus to also offer the A350-900 which was designed after the B787 and thus is slightly larger – leading to better economics – and better performance on some metrics. Domestically, Delta’s interest in increasingly larger domestic narrowbody aircraft led Delta to the Airbus A321 which has been larger than the largest Boeing 737 model for years; Delta ordered a fleet of former generation powered A321s in addition to a similar amount of Boeing’s 737-900ERs. When new engine technology became available, Delta chose the A321NEO which promises more seats and a longer range than any Boeing 737MAX model. The deciding factor in each of Delta’s decision to choose Airbus over the comparable Boeing model came down to the maintenance contracts which Delta Tech Ops, Delta’s maintenance division won, to service and overhaul the engines on every Airbus aircraft that Delta has on order – reducing Delta’s costs and bringing in up to $1 billion in high margin revenue from servicing other airlines’ aircraft.

Delta Air Lines fleet 31 Dec 2021 (ir.delta.com) Delta aircraft commitments 31 Dec 2021 (ir.delta.com)

The Airbus-Delta chapter appears set to enter a new chapter with an order for the A350-1000, the largest and longest range aircraft that Airbus currently produces. Delta’s President told a number of Delta employees, including its pilots, several months ago that Delta was ready to acquire a fleet of 20 or more A350-1000s and had asked the Delta board for approval. The rumor grew cold but has undoubtedly been linked to negotiations for Delta’s pilot contract. Aside from the executive comments, there are many reasons to believe that an A350-1000 order from Delta is likely.

- Delta is the only one of the world’s ten largest airlines that does not operate a large twin engine or quadjet aircraft; Delta operated a fleet of Boeing 747 aircraft until 2018 when federal regulations grounded the jet for Delta and United, the other remaining scheduled U.S. airline passenger operator of the 747.

- The A350-1000 provides 10-15% more capacity for minimal incremental costs due it being a part of the same aircraft family as the A350-900, of which Delta already operates more than 20 copies and has more than two dozen more units due for delivery in the next few years.

- Unlike most other aircraft families, the A350-1000 has greater range and better performance than its smaller sibling, the -900, allowing Delta to add more ultra longhaul routes and improve the ability to carry passengers on some of its longest routes such as from Atlanta to Seoul and Los Angeles to Sydney as well as new routes that the company could start, esp. to/from Asia.

- Airbus’ sales of the A350-1000 have been far below that of the B787-10, the largest model of that family (which has considerably less range) and also of the Boeing 777X, the new generation powered version of Boeing’s large twinjet which has not even entered service.

- Airbus is still smarting from a public dispute with Qatar Airways, the launch customer of both models of the A350. The Doha-based airline claims that their A350s have suffered from degradation of the coverings on the aircrafts’ surfaces which has made those aircraft unsafe. Airbus and Qatar Airways are still litigating the case but Airbus unilaterally cancelled the airline’s remaining orders for not just A350s but also A320 family aircraft which the airline also had on order. Further, Airbus has built five A350-1000s for Qatar Airways which have not and will not be delivered and which are now stored in France awaiting placement with another airline.

- Delta’s relationship with Airbus – which will result in Delta being the largest operator for at least three current Airbus model families – has undoubtedly resulted in deep conversations about placing not just those five aircraft but more than a dozen additional A350-1000s which were reserved for Qatar Airways. In addition, United Airlines is in the process of deciding on its massive widebody aircraft replacement and growth order and could choose the B787 over the A350 even though United has a firm order for 45 of the European-made aircraft but is also one of the largest operators of the B787 family.

There are competitive implications of any aircraft order and that is true for this likely order for the A350-1000 by Delta. International air travel has come out of the recovery as strong if not stronger than it was pre-pandemic. In addition, there is less long haul low-cost capacity touching the U.S. than there was pre-pandemic as a result of failures of major airlines like Norwegian Air. Further, U.S. airlines fared much better during the pandemic than legacy/global carriers in other parts of the world due in part to the fact that U.S. domestic demand never fell as far for as long as it did in other parts of the world. Even compared to its two primary U.S. global competitors, Delta’s long haul international fleet is more fuel efficient. In addition to its new generation aircraft, the Delta A330-300 burns 15% less fuel than the B777-200ER; American and United both operate more than four dozen B777-200ERs in international service. The A350 in either version burns at least 20% less fuel than the larger B777-300ER that American and United both operate; because AAL and UAL acquired their largest 777s recently, they will have a cost disadvantage for more than a decade unless they write down those assets.

Delta and United seem most keen on building their international route systems and are developing their hub networks to support new international flying. During the pandemic, Delta became the largest airline by revenue at both Boston and Los Angeles, hubs where Delta had been the second largest airline pre-pandemic. Delta grew its transatlantic network to nine destinations from Boston last year and is certain to continue to grow its operation there. At New York JFK airport, Delta seems keen on adding service to several cities in Asia, a continent which Delta does not currently serve, even though United’s hub in New Jersey supported service to more than a half dozen cities in Asia pre-pandemic, some of which have been restored. Delta is nearing completion of a new terminal complex at Los Angeles that will nearly double the number of gates to which it has access; they are already scheduling additional flights to Europe from the Southern California hub next summer. Some industry analysts note that Delta has available aircraft time based on its summer 2022 widebody fleet to add more international service and that also could be announced soon with approval of a new pilot contract.

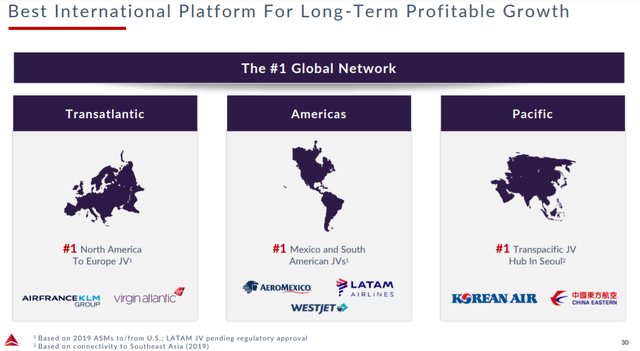

Stronger and Deeper Partnerships

Delta’s international growth has been closely tied to its international partners for a number of years and that is likely to only accelerate. Delta invested in more than a half dozen foreign carriers before the pandemic and suffered roughly $2 billion in write-downs as three of those partners restructured – but all of the partnerships survived. In Europe, London-based Virgin Atlantic managed to obtain financing to keep operating, including additional assistance from Delta, and both have benefitted from the increase in demand that has pushed the peak season to Europe well much later into the fall than normal. In Asia, Delta partner Korean Airlines continues to try to get its merger with Asiana airlines over the finish line but Delta and Korean are still expected to grow even as S. Korean and global regulators push for ensuring that a larger Korean Airlines would not raise fares and limit competitors’ ability to enter the market. Delta deepened its relationship with Korean Airlines to help extend its network into more cities in Asia while Delta’s Tokyo presence was restructured from being a connecting hub to one where Delta now serves just the local Tokyo market as the largest foreign carrier at Haneda airport.

DAL International Airline Partners (ir.delta.com)

Delta’s partnerships in Latin America are some of its newest but have been both more turbulent while also offering more potential to grow. Delta has been a distant third in Latin America where American has dominated air service to the region. Delta invested in and signed a joint venture with Aeromexico (OTC:GRPAF) before the pandemic but that airline filed for organization under U.S. bankruptcy laws, successfully reorganizing and emerging from bankruptcy in the spring of 2022. LATAM Airlines Group (OTCPK:LTMAY) which has subsidiaries in a half dozen countries in S. America, was Delta’s largest foreign airline equity investment which the Atlanta-based airline made just weeks before the pandemic that crushed global air travel demand. While Delta and Aeromexico are expected to eventually collaborate to serve the U.S. to Mexico and Central America regions while Latam and Delta will add routes to deep S. America. The two airlines just announced their first new route under their new joint venture – Los Angeles to São Paulo, operated by Latam. Delta already serves a half dozen destinations in Central America from Los Angeles and the new route to Brazil is expected to support additional Delta flights to Asia. The big prize in the U.S. to Latin America market is Miami, an airport where American operates its largest hub to Latin America. Notably, American is the only U.S. airline to operate hub in fast-growing Florida which also has an enormous Latin community.

Expanding Revenue and Earnings

While Delta has not provided investor guidance for the summer of 2022, communications to its pilots indicate that Delta intends to operate more capacity than it did in 2019, pulling forward its earlier estimates of when it would return to pre-pandemic levels of capacity. For most of 2022, Delta flew approximately 82% of its pre-pandemic capacity, the least amount of restored capacity of the big U.S. airlines. Delta operated very inefficiently this past year which means that it was already staffed for a much larger operation than it actually operated. Given that Delta is generating earnings that are expected to exceed analyst estimates, the increased revenue should drop directly to its bottom line.

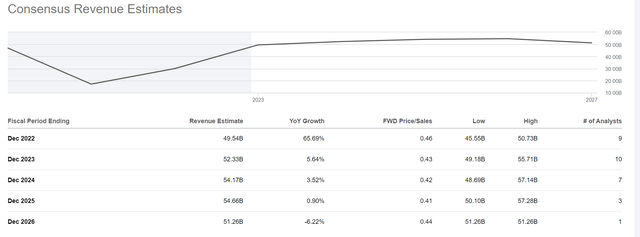

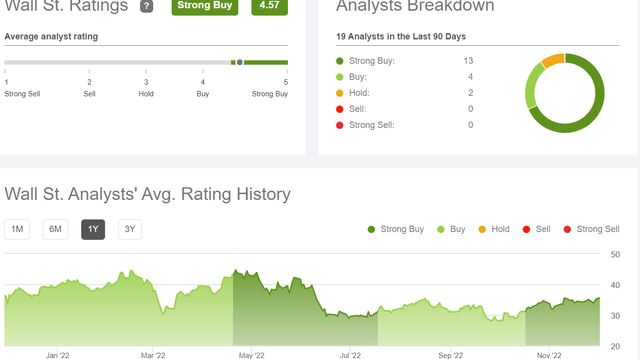

DAL annual revenue estimates (Seeking Alpha) DAL EPS estimates (Seeking Alpha) DAL Wall Street rating Dec 2022 (Seeking Alpha)

Delta’s stock price has failed to significantly return to pre-pandemic levels even though revenue is approaching those levels and earnings will soon follow. Delta’s goals to reduce its debt appear to be much more likely given a significant earnings boost.

Summary

A new potential contract has been reached between Delta and its pilots, accelerating growth, likely resulting in the addition of a new order for Airbus’ largest in-production aircraft. Its international partner airlines weathered the pandemic and are now stronger as a result of the restructuring that some of them performed. Delta’s revenue and earnings could very soon start accelerate beyond current analyst estimates.

Be the first to comment