aapsky

Whether we are analyzing airlines or the big defense players, the commercial aircraft manufacturers or suppliers, the recurring elements are the same: inflation with its specific ways to affect business and labor challenges. That makes it interesting to expand our scope, particularly on aerospace suppliers and see how these companies are managing, where the struggles are and what the opportunities are.

In this report, I will be adding Park Aerospace (NYSE:PKE) to my coverage analyzing its most recent earnings and comments. Where Park Aerospace is scoring some points is its willingness to present and provide a slide deck. The Park Aerospace presentation for the first quarter of FY2023 was huge with 58 slides. The slides were not what I would expect from a publicly traded company, but Park Aerospace put effort in getting the message across and said it carried over material from its Q4 presentation as those remain of interest today.

Park Aerospace: A Tiny Advanced Materials Expert

Park Aerospace is not a huge company measured by market cap so a brief introduction in place and neither is measured by headcount. When going through the slides and the transcript, I found that it contained a lot about how “We at Park” do things and also a clear message for corporate America. I wouldn’t say it was hostile, but it had things you normally don’t see in earnings discussions. The headcount of the company likely has to do with it. Park Aerospace is a company with just 106 employees, it is a company that takes pride in the products they produce, and given the pressures that are faced today, meeting targets requires the workforce to deliver which they actually are doing. If you run a company with 106 employees in a complex and competitive aerospace industry, I understand why Park Aerospace takes much pride in the way they conduct business.

The company specializes in developing and manufacturing advanced composites materials, used on aircraft structures, radomes and rocket nozzles as well as light weight assemblies and low volume tooling.

Shares of Park Aerospace are currently trading at $12.07 per share giving it a market cap of a little over $250 million. There is no meaningful price target for the company set by analysts as there is only one analyst who issues a buy rating and a $26 price target.

Park Aerospace’s Results Show Challenges

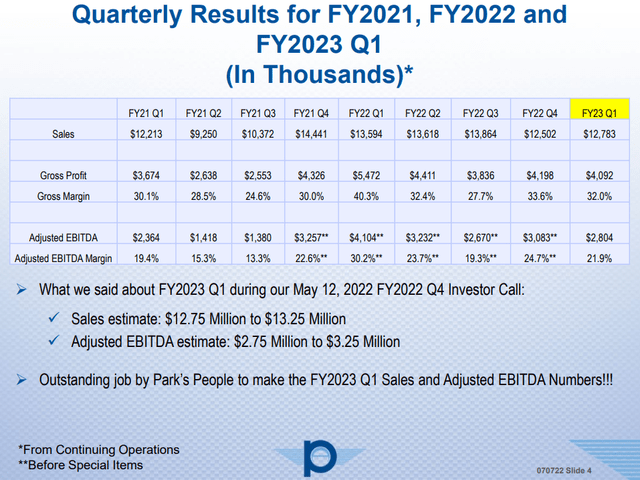

Park Aerospace Q1 FY2023 results (Park Aerospace)

Sequentially, revenues improved by 2.2% but profits fell by 10%. Compared to same quarter last year, revenues declined by 6% driven by lower military market sales while the mix drove gross and EBITDA margins down. The 32% reduction might seem like a big and possibly it is, but it is also caused by $1.25 million in sales not materializing during the quarter due to timing issues. In the absence of this timing related pressure, the decline would be 25% driven by mix. That also brings me to the first part that I have a hard time appreciating about Park Aerospace; the company overall has strong margins but it seems that the mix causes rather big swings to those margins due to its size and platform dependency. The company derives 66% of its revenues from its top 5 customers and 75% from its top 10 customers.

Overall sales and adjusted EBITDA came in at the lower end of what the company had guided for against higher than earlier anticipated missed shipments in Q1. The company is facing several headwinds related to the current macro environment. Inflation is driving up labor costs, logistics expenses, utilities and freight costs. Raw material costs have also increased though Park Aerospace can largely pass those increase costs through to their customers. In the supply chain, there also still staffing shortages and all combined that makes things challenging especially for the smaller suppliers. Park Aerospace sees that purchase orders are not always honored and that obviously is a big problem when you want to produce and deliver.

Guidance

For the second quarter, Park Aerospace is expecting $13.5 million to $14.0 million in sales, implying a 5.5%-9.5% sequential growth in revenues. No guidance for missed sales shipments has been given for Q2 2023, but assuming those will be zero, which is unlikely to be the case, the sequential revenue growth would largely be realized via release of missed sales shipments from the first quarter flowing to the second quarter. Year-over-year, the company is guiding pretty much for stable revenues to slightly higher revenues. Adjusted EBITDA of $3 million to $3.5 million is targeted, implying a significant sequential improvement and stability year-over-year. So, overall, despite challenges, it seems that Park Aerospace is more or less expecting results in line with those observed in the same quarter last year.

Platform Opportunities for Growth

GE9X turbofan (General Electric)

Next to the macro pressures, there are two program specific pressures. Park Aerospace provides composite materials for the nacelles and thrust reversers to Middle Rivers Aerostructure Systems for a variety of aircraft programs. One of those programs is the Boeing 747, which will be terminated later this year and on the Boeing 777X program for which Park Aerospace participates in the Fan Case Containment Wrap Program for the GE9X, but there could be some adverse impact as Boeing (BA) announced Boeing 777X production will be halted through 2023.

PAC-3 missile (Lockheed Martin)

While the current environment is tough for Park Aerospace, there isn’t only bad news. There also are significant growth opportunities due to expected changes in military spending habits. On Defense, Lockheed Martin (LMT) earlier commented that it expected the current geopolitical landscape to bolster defense spendings but an exact impact was not yet known. Surface-to-Air-Missile systems like the PAC-3 are expected to be high in demand and that is a benefit to Park Aerospace which provides ablative materials and RAYCARB C2®B used to produce to ablative materials.

Park Aerospace already has seen indications from original equipment manufacturers for increased demands for those products and expects that FY2023 as a result will be $13 million, up from $5.5 million in FY2022. So, that clearly is a growth driver that is expected to add 14% in revenues compared to FY2022.

Airbus A321neo (Airbus)

The other growth opportunities are in the commercial aircraft segment. The most significant one is one the Airbus A320neo where Park Aerospace supports the production of nacelles and thrust reversers for the CFM LEAP-1A. Targeted production rates for the Airbus A320neo program are 65 aircraft per month by summer 2023 and 75 aircraft per month by 2025. While the overall ability for Airbus (OTCPK:EADSF) (OTCPK:EADSY) to achieve those rates in a stable setting is in question, Park Aerospace has committed to supporting those plans. At a 57.3% market share for the LEAP 1A, the Airbus A320neo program would provide a $28.75 million revenue opportunity by 2025 which would start to ramp up earlier to meet the production targets for aircraft. With a current annual revenue of $53.6 million, the Airbus A320neo program would already account for over half of the company’s revenues while the C919 provides an unquantified growth opportunity. The Airbus A320neo is a significant growth opportunity, especially when we consider that all GE Aviation programs for which Park Aerospace provides to MLS generated $26.6 million in sales in FY2022.

Park Aerospace is also certified on Aero Design Labs’s Drag Reduction System for the Boeing 737 Next Generation, and while an exact revenue potential has not been given, with thousands of 737NGs in service today there is a significant potential to scale this program. Westjet and Delta Air Lines (DAL), which combined operate over 300 Boeing 737 Next Generation aircraft, are the launch customers for the drag reduction package which includes a reshaped wing-to-body fairing and could reduce the fuel bill by $12,000 per month for the Boeing 737-700 but is expected to yield even bigger savings for the bigger variants of the Boeing 737NG family.

Global 7500 business jet from Bombardier (Bombardier)

I recently discussed how Bombardier (OTCQX:BDRBD) (OTCQX:BDRAD) is going to offset lower small business jet production by higher production in the medium and large jet segments and is also working on developing a new business jet model. These models are the Global 7500 and Global 8000 for which Park Aerospace provides primary structures for the Passport 20 engines.

Conclusion

The Q1 FY2023 results certainly weren’t pretty, partially driven by timing of sales and late shipments to Park Aerospace. Next to that, Park Aerospace also saw the mix pressuring its margins. Due to the relatively small size of the company and its high dependency on some platforms or customers, we see that on margin level there is quite some fluctuation in the margins. An increase in diversification would make the strong margins from Park Aerospace even more appreciable, but especially in the private space segments things have not developed as intended. What does help is that Park Aerospace has a redundant factory, which it could utilize if growth opportunities arise, granted they can get the employees to perform the work.

The platforms for growth, not necessarily, diversification are there for military, commercial aircraft and business jet platforms. The current situation in Ukraine but also the tension involving China and North Korea increases demand for missile defense systems for which Park Aerospace is a supplier. In the commercial aircraft space, the Airbus A320neo offers a significant growth opportunity while drag reducing retrofits offer an unquantified revenue opportunity for the Boeing 737 Next Generation platform and increasing production for the Global 7500 and the future Global 8000 offer growth opportunities in the business jet segment.

While I believe that Park Aerospace could benefit from some current changes to the environment for defense budgets and there are some growth platforms, which in my view makes it a speculative buy, I do have to emphasize the speculative part of the rating. The reason is that Park Aerospace has not addressed how it deals with the current macro pressures and it seems that given their scale, they are just trying to make the most out of it and accept the current market and macro realities. Additionally, while we are given insights into which platforms offer growth opportunities, we have little information on which platforms are stabilizing or will even decline. So, we don’t know whether the growth opportunities will be met with any offsets. Lastly, while Park Aerospace has nice margins, its total return has been rather lackluster, so while Park Aerospace has growth opportunities, it certainly is not a walk in the park, not for investors, not for management and not for its employees. It is an investment that might pay off if projections materialize.

Be the first to comment