imaginima

Tulsa, Oklahoma based ammonia and petroleum partnership, Magellan Midstream Partners, L.P. (NYSE:MMP) has not been a great investment option for investors over the last few years. Nevertheless, the company has a track record of growth, profitability and superior capital allocation. The company is trading at attractive multiples and enjoys significant FCF and dividend yields. With significant competitive advantages, the partnership is a great long-term investment.

Poor Stock Market Performance

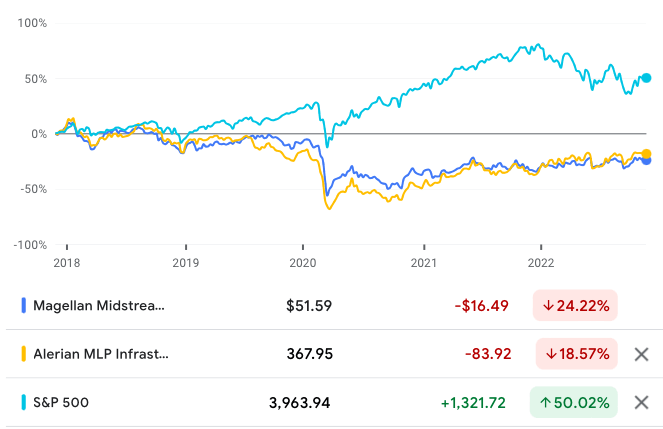

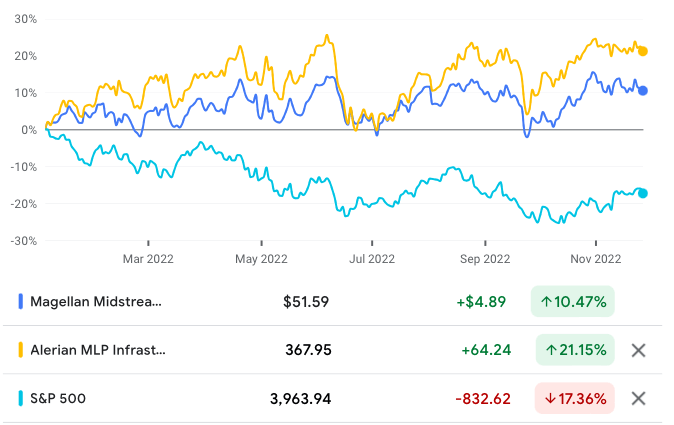

In the last five years, Magellan Midstream’s share price has declined by 24.22%, while the Alerian MLP Infrastructure Index (AMZI) has declined by 18.57%, and the S&P 500 (.INX) has gone up 50.02%.

Source: Google Finance

In the year-to-date, Magellan Midstream share price has appreciated 10.47%, while the Alerian MLP Infrastructure Index has risen by 21.15% and the S&P 500 has declined 17.36%.

Source: Google Finance

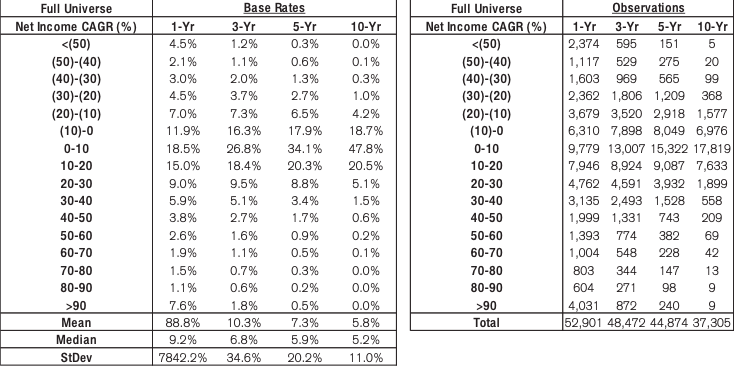

Strong Financial Performance

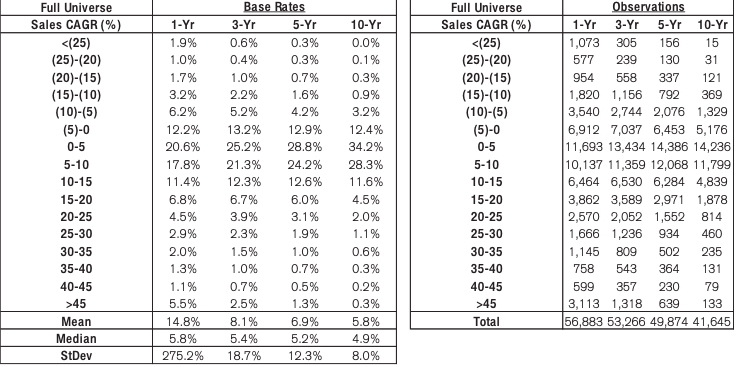

Revenue rose from $2.5 billion in 2017 to $2,73 billion in 2021, at a 5-year revenue compound annual growth rate (CAGR) of 1.74%. According to Credit Suisse’s The Base Rate Book, 28.8% of companies in the 1950 to 2015 period enjoyed a similar level of growth. In the first nine months of the year, the partnership earned $2.34 billion, compared to $1.924 billion in the same period in 2021.

Source: The Base Rate Book

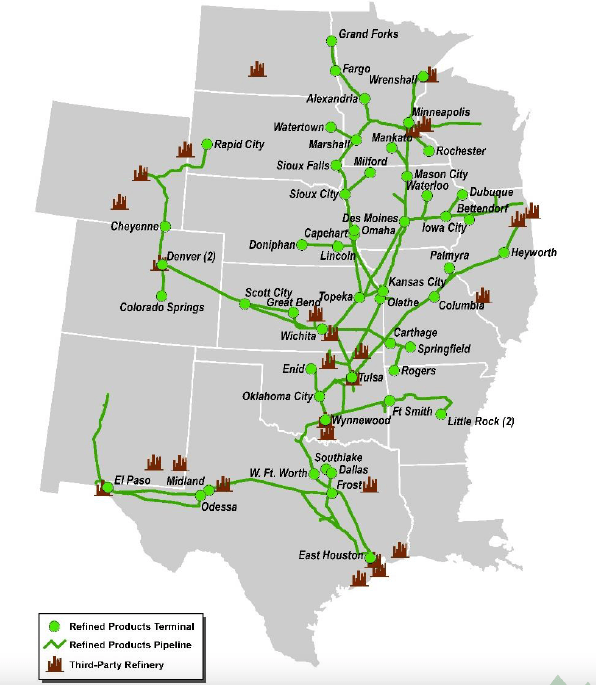

As a midstream company, Magellan Midstream earns revenue through the transportation and storage of ammonia and petroleum products from upstream producers to downstream refiners and then from downstream refiners to end users. Magellan Midstream owns the longest refined petroleum products pipeline system in the United States, with nearly half of the country’s refining capacity, and the ability to store over 100 million barrels of petroleum products such as gasoline, diesel fuel and crude oil.

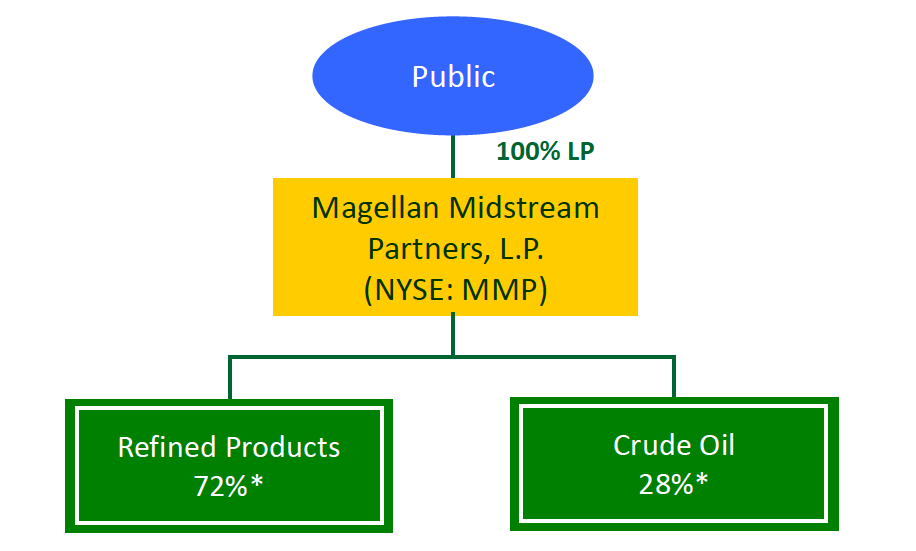

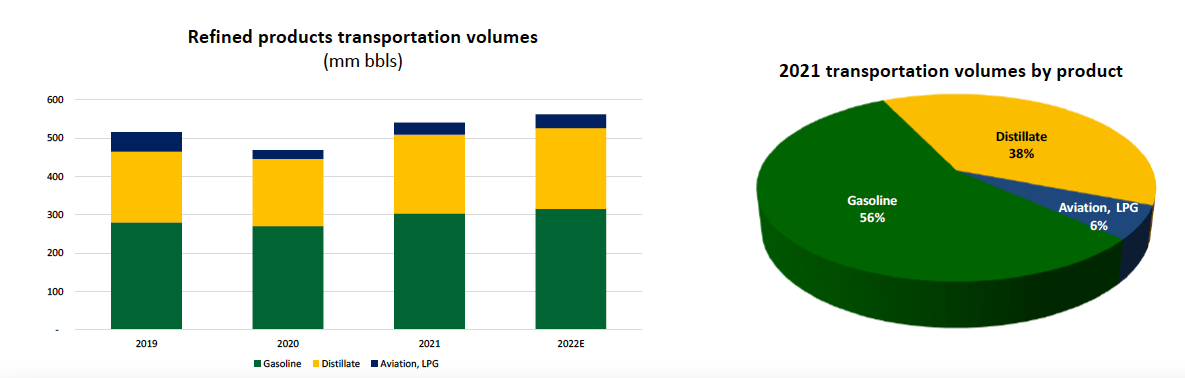

The company operates through two segments: refined products and crude oil. The refined products segment operates the partnership’s 9,800-mile refined petroleum products pipeline system with 54 terminals and two marine storage terminals. The crude oil segment which operates the partnership’s 2,200 miles of crude oil pipelines, a condensate splitter and 39 million barrels of aggregate storage capacity, of which around 29 million barrels are used for contract storage. In Q3 2022, the company’s refined products segment was responsible for about 72% of revenues, while the crude oil segment responsible for the remainder (28%).

Source: 2022 Investor Overview

Revenues are driven by two factors: pricing per barrel and volume transported every year. Volumes have been fairly stable over the last few years, growing at around 2.6% a year since 2014. Stability and growth have also characterized the company’s revenue per barrel, which has grown at around 3% per year.

Source: 2022 Analyst Day

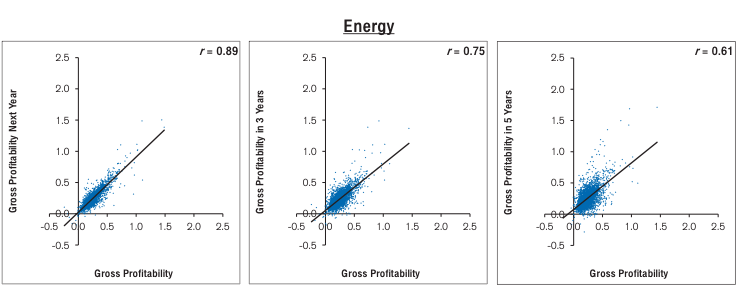

Gross profitability declined marginally from 0.175 in 2017 to 0.172 in 2021. This is below the 0.33 threshold that Robert Novy-Marx’ famous paper, “The Other Side of Value: The Gross Profitability Premium”, found marked out a company as attractive. Gross profitability is highly persistent, with a correlation, r, of 0.61 over five years. in the nine months of the year, gross profitability rose to 0.18.

Source: The Base Rate Book

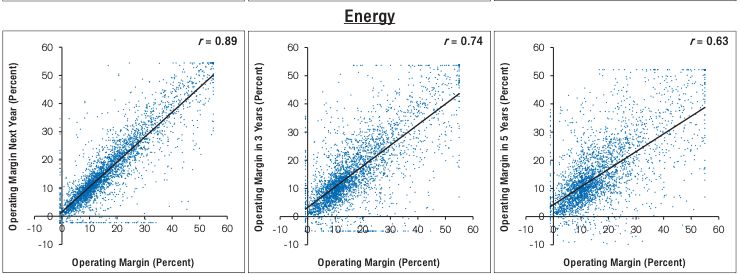

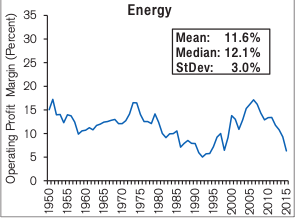

Operating margin declined from around 44.2% in 2017, to 40.5% in 2021. Operating margin further deteriorated in the first nine months of the year, declining to 36.6%. Operating margin is highly persistent, with an r of 0.63 over a 5-year period.

Source: The Base Rate Book

In the 1950 to 2015 period, the mean operating margin in the energy industry was 11.6% and the median operating margin was 12.1%. The nature of midstream partnerships allows them to be more profitable than upstream and downstream firms.

Source: The Base Rate Book

Net income has risen from $869,531 million in 2017 to $982 million in 2021, for a 5-year net income CAGR of 2.46%. According to The Base Rate Book, that gives us a base rate of 34.1% of firms. In the year-to-date, the company earned earnings of $849.4 million, compared to $738.8 million for the same period in 2021.

Source: The Base Rate Book

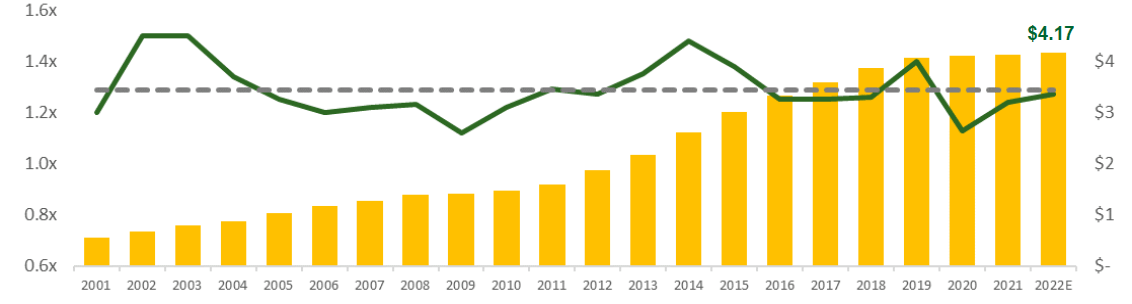

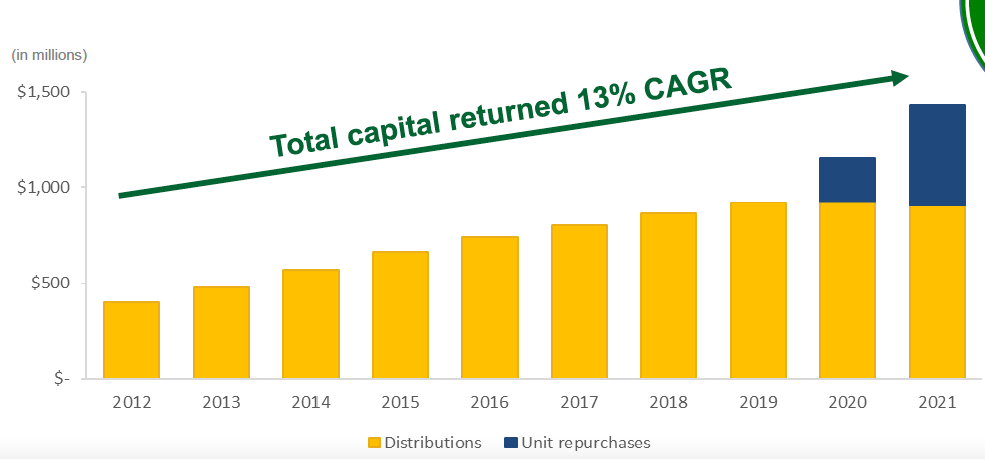

Magellan Midtsream’s business generates a lot of free cash flow (FCF), with FCF rising from $572.56 million in 2017, to over $1 billion in 2021, at a 5-year FCF of 12.84%. In the first nine months of the year, the company earned $934.18 million in FCF. The economics of the business has allowed it to distribute significant amounts of cash flow to its shareholders, with distributions growing at an 11-year cash distribution CAGR of 7.49%. Since the company’s initial public offering (IPO) in 2001, the company has delivered 20 consecutive years of growth in cash distributions.

Source: November 2022 Investor Overview

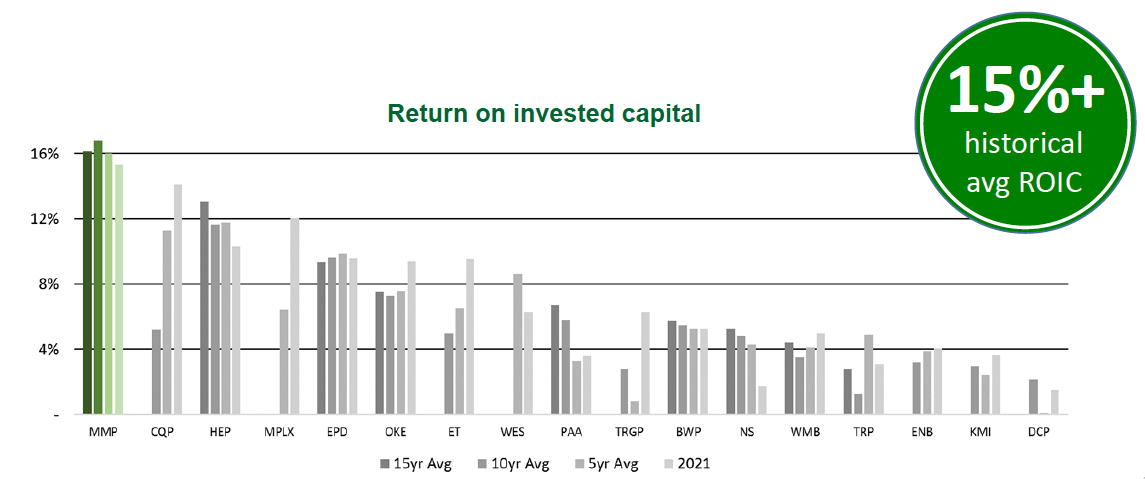

The company’s capital allocation has been exceptional. Magellan Midstream boasts an average 15-year return on invested capital (ROIC) of 15%, which is best-in-class among midstream partnerships. The average ROIC of the 2,000 largest firms in the United States is 9.4%, according to New Constructs.

Source: November 2022 Investor Overview

The energy industry as a whole is renowned for its poor capital allocation. This image is well-earned and a result of the tendency of the industry to grow assets during periods of expansion, leading to an inverse relationship between asset growth and future returns. This capital cycle has made the sector a poor investment over the last decade, as the excesses of the boom era has been followed by an era of bankruptcies, and capital exits. That image is changing, as managers have become more focused on returns and profitability and as the industry has consolidated in the wake of the 2008 and then 2014 busts. That is true also of midstream partners. What makes Magellan Midstream unique is not that it is now earning an appreciable ROIC, it is that the partnership has done so since its inception. Quality capital allocation is in the DNA of the company. They have avoided the asset growth excesses of their peers in boom times, not ramping up their indebtedness, or issuing new equity, or wildly expanding their capital expenditure. ROIC has been their North Star.

Limited Pipeline Supply

Although, theoretically, it is possible to build new pipelines, the supply of pipelines should be seen as fairly inelastic. This is due to two factors: firstly, the cost of building new pipelines is prohibitively high, and secondly, a combination of pressure from ESG investors and government positioning, has made it hard to build new pipelines.

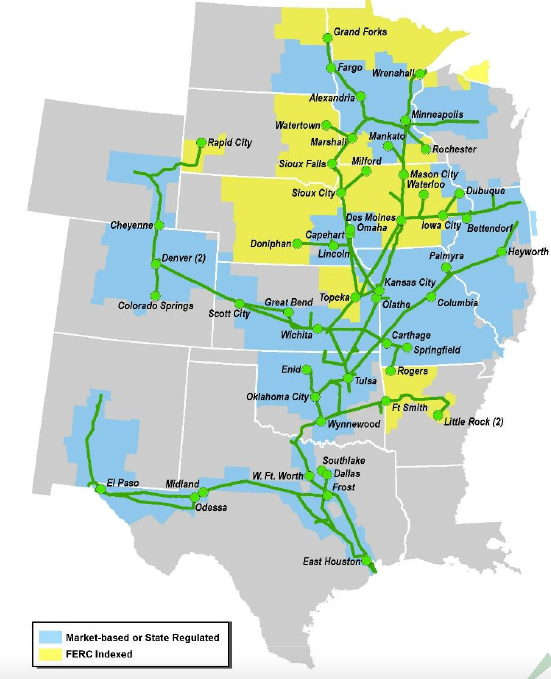

As we noted earlier, the partnership has the longest refined petroleum products pipeline system in the United States, at 9,800 miles with 54 terminals and 47 million barrels of storage. The partnership has access to almost half of the country’s refining capacity, including Midcontinent, the northern tier, and Gulf Coast refineries.

Source: March 2022 Analyst Day

This demand-driven supply system allows customers to transport products to the most profitable parts of the country. Indeed, the open stock system allows customers to inject product into the system at one end and to draw from it from another. The breadth of the partnership’s footprint and its supply capabilities lend to it enormous competitive advantages.

Revenue Model De-Risks the Business

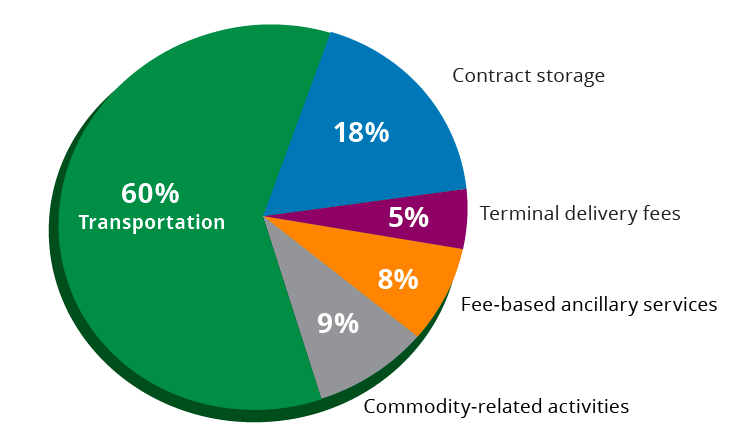

Midstream partnerships often earn fee-based revenue rather than earning revenue from the crack spread. These fees are attractive because they de-risk the business somewhat, providing reliable, recurring revenues. This is true of Magellan Midstream, which is largely a fee-based business, with such activities comprising 85% of operating margin in Q3 2022.

Source: Investor Fact Sheet

Given that the company is largely a fee-based business, it is not susceptible to the volatility that characterizes businesses whose revenue model is built upon commodity prices. Revenues are, as we discussed earlier, driven largely by fees x volumes. A portion of revenue is on a “take or pay” basis, through which customers commit themselves to a long-term relationship with the company, in which they pay for a fixed volume and a minimum guaranteed sum regardless of volumes.

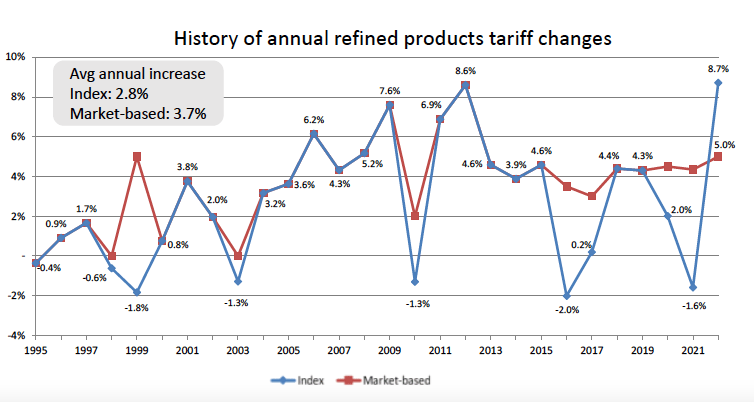

In addition, 70% of the refined products pipeline tariff revenue come from markets which the Federal Energy Regulatory Commission (FERC) deems workably competitive, or subject to state regulations, while 30% are from markets deemed less competitive and so, subject to FERC’s indexation methodology. When the FERC index is low, market-based designation is important. Having revenues governed by those two methodologies lends flexibility to the company. Magellan is able to set the price it needs to earn an acceptable rate of return in its competitive markets.

Source: March 2022 Analyst Day

The average annual increase in index-based pricing is 2.8%, whereas in market-based increases are 3.7%. With supply-chain disruptions continuing and an era of inflation ahead of us, tariff changes are going to have a strong upward volatility.

Source: March 2022 Analyst Day

Valuation

Magellan Midstream has a price-earnings multiple of 12.05, compared to the S&P 500’s PE multiple of 20.65.

Over the years, pessimism about midstream partnerships has grown; and this is reflected in the company’s FCF yield, which has risen from 3.5% in 2017 to 10.6% in 2021. In the year to date, reflecting rising valuation, the company’s FCF yield has fallen somewhat to 8.6%. That is far in excess of the 1.5% FCF yield.

The company also has a dividend yield of 8.07%. Cash that is not distributed to unitholders is used to repurchase shares. In 2021, the company returned $1.4 billion to unitholders, and since 2012, the partnership has returned $8 billion to unitholders. capital has been returned to unitholders at a 10-year capital return CAGR of 13%, between 2012 and 2021.

Source: March 2022 Analyst Day

The company represents great value for investors.

Conclusion

Like many energy firms, Magellan Midstream’s share price has performed terribly poorly over the last few years. However, in the year-to-date, the stock market performance has been strong. The company has a track record of profitability and growth. In addition, the partnership has significant and sustainable competitive advantages. With attractive valuations and a history of returning cash to unitholders and large equity repurchases, Magellan Midstream is a very attractive investment option for investors.

Be the first to comment