Seiya Tabuchi/iStock via Getty Images

Thesis and the 2022 CHIPs Act

On August 9, President Biden signed the 2022 CHIPS act into law. Both the U.S. and China now recognize the competition in the chip space is not only a matter of business and profits but also a crucial matter of national security. Under the heightened tension, the CHIPS Act aims to bring semiconductor manufacturing and research back to the U.S. and also to reduce U.S. dependence on China and Taiwan.

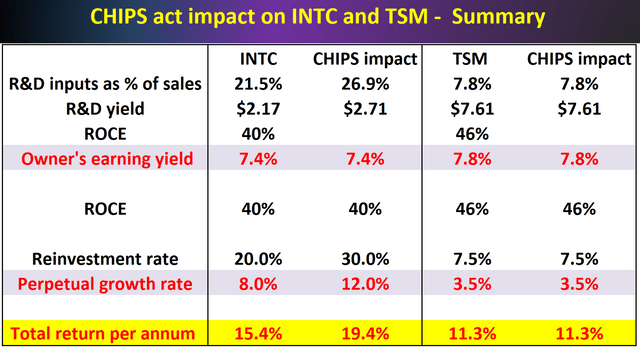

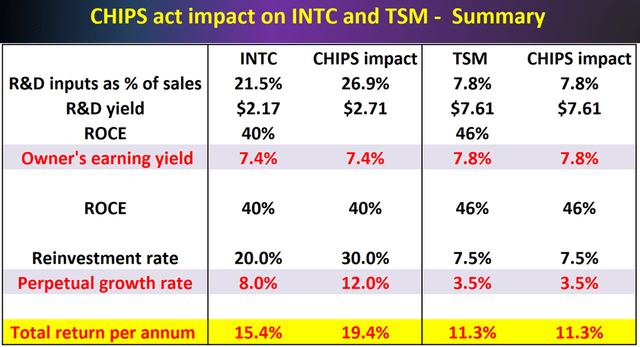

Under this broader context, this article will analyze the impact of the CHIPS act on two chip stocks: Intel (NASDAQ:INTC) and Taiwan Semiconductor Manufacturing (NYSE:TSM), one domestic and one overseas. And the thesis is quite straightforward – INTC will be a major beneficiary from the act, while TSM not only won’t be able to benefit too much but also would suffer headwinds on multiple fronts. The following table summarizes the potential impact of the act on INTC and TSM. As seen, I anticipate the CHIPS act to boost both the effective R&D yield and also the reinvestment rate for INTC substantially. Even though TSM can receive some benefits from the act (for example, its $12 billion investment in the new plant in Arizona may benefit). However much of such tangible benefits will be canceled off by the stronger competitiveness of U.S. players under the Act. And, overall, I anticipate a negligible boost for TSM on either the R&D front or the reinvestment rate front as you can see from the table below. All told, I expect the CHIPS act to boost INTC’s total return potential from about 15.4% per year to about 19.4% per year. While in contrast, I do not expect TSM investors to feel too many benefits (although admittedly, its 11.3% projected annual return is already quite solid).

Source: Author based on Seeking Alpha data

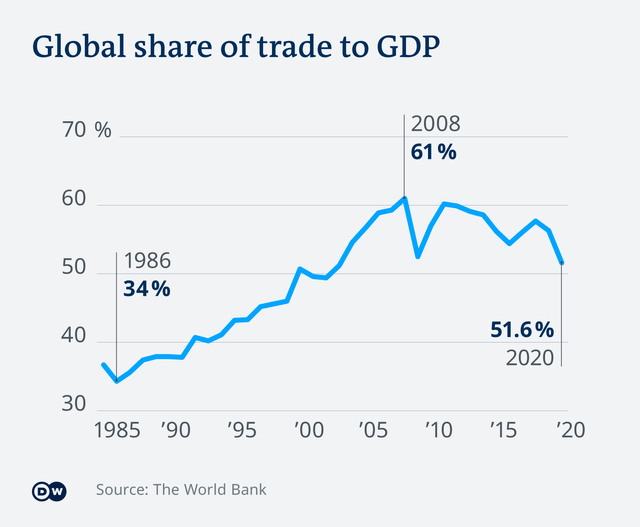

Although the full impact will take a few years to fully materialize and the path can be nonlinear. The chip space has developed into a complicated and intricate ecosystem by now. And TSM is currently the world’s largest contract chipmaker and an integral part of the ecosystem. However, I see the passing of the CHIPS act as the turning point of the ecosystem. Putting it under an even large context, I see it as a key episode, and also kind of a logical episode, in the deglobalization process that has been ongoing for more than a decade already. As you can see from the following chart, globalization, as measured by the ratio of exports to global GDP, peaked in 2008 at 61%. It has been declining steadily since then, and the decline was exacerbated by the recent China-U.S. tension, the pandemic, and the Russian/Ukraine war. All told, the ratio retreated by almost 10% since 2008, equivalently rewinding the globalization process back to where the world was around 2000 or so.

And the reminder of this article will attempt to explore such futuristic and nonlinear impacts in more detail.

Source: The World Bank

INTC and TSM: R&D expenses and CHIPS act impact

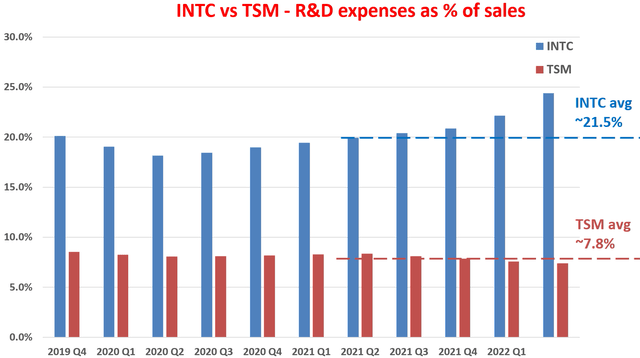

Let’s first see the R&D expenditures of INTC and TSM (on a quarterly TTM basis), so we can put the scale of the act into perspective. The next chart shows the R&D expenses of INTC and TSM over the past few years. As seen, both have been consistently investing in R&D. However, INTC has been investing a lot more heavily. On average, it has been spending about 21.5% of its total revenue on R&D efforts. Furthermore, its spending has been increasing gradually also in recent years. It used to be about 18% in 2020, and then gradually climbed to about 24.5% currently. In contrast, TSM has been also spending only a fraction of what INTC does. It on average spends about 7.8% of its sales in recent years on R&D, about 1/3 of INTC. In absolute terms, INTC’s R&D expenses are about $17.8B TTM, and TSM’s about $4.6B TTM.

Depending on your perspective, such contrast can be good or bad for either player. For example, you will see next that although (or because) TSM spends much less on R&D, it derives a much higher R&D yield than INTC. But on the other hand, you can argue that since INTC spends so much more, it stands to benefit a lot more from the CHIPS act. The CHIPS act indeed includes a budget of $200 billion for research grants. Therefore, the act provides more than 11 years of INTC’s R&D budget. And we will explore such impacts in the next section.

Source: Author based on Seeking Alpha data

INTC and TSM: impact on R&D yield

After contextualizing its scale, now let’s assess its impact. First, let me clarify that this is more of a scenario analysis. The management themselves does not know the precise impact yet as you can see from the following Q&A exchange during INTC’s recent earnings release (abridged and emphases added by me). But in investing, it is always better to be approximately or even just directionally right than precisely wrong. Having a scenario analysis is often sufficient to profit – it prepares us to be ready to act if the scenario does materialize.

Questions from Randy Abrams (Credit Suisse): A multi-part question…. Also want to task a bit more of the CHIPS Act, how it changes your approach to the business. And for David, if the capital offsets assume some of the U.S. benefits and how it could impact the tax rate?

Answers from Dave Zinsner (INTC CFO): … we have not assumed any CHIPS Act money in 2022. Our expectation is there’ll be a process and that process will take us into 2023 before we start receiving money from CHIPS. So not assumed in 2022, although, we’re assuming that we will see some in 2023. As you point out, the CHIPS Act or the bill that was passed is a combination of grant money and in tax credits, I think it’s a little early to determine exactly how all that is administered and makes its way into our P&L. So we’ll table that until that becomes clearer to us exactly how things shake out and we’ll give you more color once we have a better assessment of that.

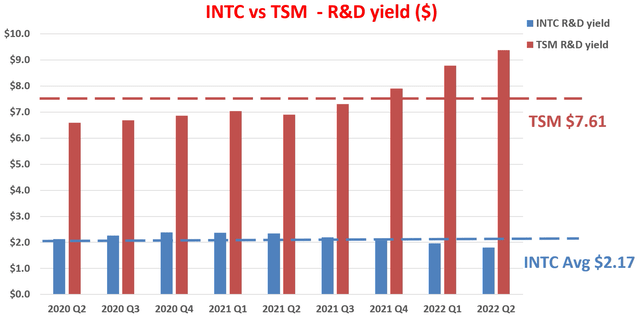

Against this backdrop, I will present my scenario analysis below. Here we will use a variation of Buffett’s $1 test on R&D expenses to assess the impact. The method is detailed in our earlier articles. As you can see, the R&D yield for INTC has been healthy with a long-term average of $2.17. And the R&D yield for TSM is simply superb, with an average of $7.61. To put things under perspective, the average R&D yield among the overachieving FAAMG group is about $1.9. And Apple (AAPL), which is in its own category, boasts an R&D yield of “only” $4.70, about 1/3 lower than TSM.

Source: Author based on Seeking Alpha data

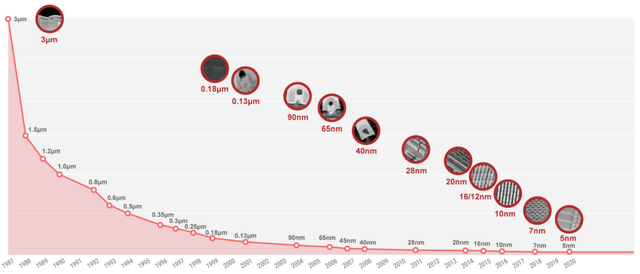

Part of the reason for TSM’s superb R&D yield is its concentration and focus on manufacturing, and part of it is just its sheer technological lead. INTC IFS is scheduled to start with a 22 nm process, then followed possibly by a 14 nm process, and the 7 nm process will only come online years out. In contrast, TSM has already matured the 7 nm technology back in 2018 and even the 5 nm process in 2020.

However, as aforementioned, the CHIPS act is the turning point in my view for domestic players to narrow the gap. With the tax credit and research grants provided in the CHIPS act, I am projecting INTC R&D yield to go up by at least 25%. The benefits will come from two directions. Firstly, the tax credit will effectively reduce their real R&D expenses without changing the outputs. Secondly, the research grants will pay for a good portion of their R&D in the coming years (we are easily talking about a decade here as analyzed above). With these boosts, the projected R&D yield would be in the range of $2.7 for INTC, still a far cry from TSM (assuming TSM can keep maintaining its current yield, which is a big assumption in my mind). But a $2.7 R&D yield is already a remarkable level benchmarked by the FAAMG stocks.

Source: TSMC

INTC and TSM: impact on profitability

The CHIPS act will also boost INTC’s profitability too, again at least from two directions. Firstly, they will receive substantial subsidies from the act to pay for their CAPEX. Therefore, their free cash flow will expand. Especially in the case of INTC, it is expected to receive a large sum towards its foundry initiatives. The size of the subsidies is uncertain at this point and varied from $3B to $20B, but is expected to be sizable as quoted in the following reports (abridged and emphases added by me). Secondly, the CHIPS act will effectively boost their reinvestment rates and help fuel growth.

Fierce Electronics: Intel has said previously it hopes to receive as much as $3 billion for each new fab it builds in the U.S. and has noted the $3 billion per fab is a cap in the legislation… Reuters quoted one unnamed person saying Intel that might get $20 billion with CHIPS Act plus $5 billion or $10 billion under the FABS Act…

Bank of America: Intel could see between $10B and $15B worth of the $52B in assistance over the next 5 years… The company is also benefiting from the European Union’s CHIPS Act, as the company looks to spend an estimated $88B over the next decade in building manufacturing plants on the continent.

Despite the range of the above variance, there is little doubt that INTC, and then followed by other domestic players such as Texas Instruments (TXN), is likely to take the largest slice of the pie. As a result, TSM’s Arizona plant is anticipated to be a lower priority in receiving funding from the act. And for whatever the benefits it does end up receiving, it’s likely to be canceled off by the stronger competitiveness of U.S. players provided by the act indirectly such as tax credits, sponsored fundamental research, trade restrictions, et al.

To further assess the impact on profitability, I will use the metric of ROCE (return on capital employed). The metric is detailed in our earlier articles and a brief recap is provided below:

When we think of long-term growth (like in 10 years or more), the growth rate is “simply” the product of ROCE and reinvestment rate, i.e.,

Long-Term Growth Rate = ROCE * Reinvestment Rate

ROCE is the most important metric for measuring profitability because it considers the return of capital ACTUALLY employed. In this analysis, I consider the following items capital actually employed A) Working capital (including payables, receivables, inventory), B) Gross Property, Plant, and Equipment, and C) Research and development expenses are also capitalized.

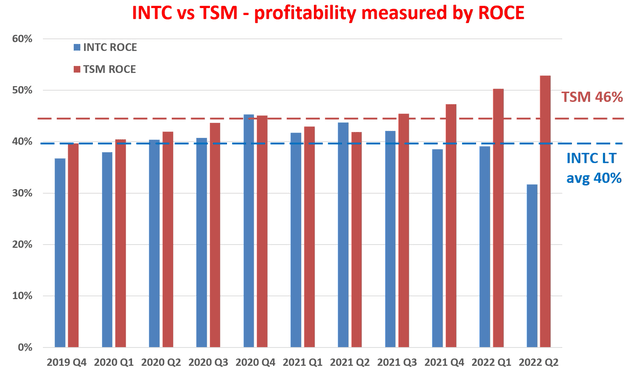

Based on the above considerations, the ROCE of INTC and TSM over the past few years is shown below. As seen, both INTC and TSM were able to maintain an overall consistent ROCE over the past. INTC’s average ROCE has been about 40% in recent years, with narrow fluctuations between 35% and 42%. And TSM’s ROCE is a bit higher. Its average ROCE has been about 46% in recent years, a whole 6 percent above INTC. And its current ROCE is about 53%, about 7% above its average, and almost a whopping 20% above INTC’s 33%. Although, despite the relative differences, their long-term ROCE is very competitive even when benchmarked against the FAANG stocks, whose average ROCE is somewhere between 45% to 55% in recent years.

With these ROCE results, we will further quantify the impact of the act next.

Source: Author based on Seeking Alpha data

CHIPS act – final results

In summary, the CHIPS act is expected to boost INTC’s profitability in two directions – expansion of free cash flow or boost in reinvestment rates. Here, to avoid double-accounting and also to be on the conservative side, I will only consider one of the two benefits – the boost in reinvestment rates. INTC has been reinvesting at a rate of 20% before the passing of the act. And my estimate is that the subsidies from the act will boost its reinvestment rates to 30%. In contrast, I anticipate no boost for TSM for the reasons detailed above and expect its reinvestment rate to remain at about 7.5%, consistent with its historical average.

With the above fundamentals, we come back to the table that I used to open the article. The table summarizes the anticipated impacts of the act on INTC and TSM. As aforementioned, as long-term business owners, our long-term return on investment (“ROI”) is determined by two things. The first is the owner’s earning yield (“OEY”). And second, the perpetual growth rates.

And my key takeaways are:

- Both offer attractive OEY given their currently compressed valuation (INTC at 13.5x FW PE and TSM at 12.8x FW PE). And the CHIPS act does not directly impact their OEY.

- The act is anticipated to boost INTC R&D yield by 25% at least.

- More importantly, the act is also anticipated to boost INTC’s perpetual growth rates. I anticipate an effective reinvestment rate of 30% for INTC with the subsidies in the act for its fab investments. As a result, its long-term growth rates are estimated to be 12% (40% ROCE * 30% reinvestment rate = 12%).

- And I do not expect the act to benefit TSM’s ROCE or reinvestment rates. As a result, I expect TSM’s growth rate to remain at 3.5% (46% ROCE * 7.5% reinvestment rate = 3.5%).

- All told, both are projected to provide a total return in the double digits. However, INTC shareholders are expected to see a large boost from the CHIPS act, and the boost is anticipated to be about 4% per annum.

Source: Author based on Seeking Alpha data

Final thoughts and risks

To reiterate, my main argument here is the CHIPS act is the beginning point for a fundamental change in the global chip ecosystem. The goal of the CHIPS act is to shore up the competitiveness of domestic chip players, especially on the manufacturing front. With heightened global geopolitical tensions, I see the change comparable to the tectonic shift of globalization (or deglobalization) since 2008. Specific to INTC and TSM, I see INTC as the direct and major beneficiary of such a tectonic shift, while TSM unfortunately the collateral casualty. To wit, I expect the CHIPS act to boost INTC’s total return potential from about 15.4% per year to about 19.4% per year, and I do not expect such a boost for TSM. Admittedly, TSM’s 11.3% projected annual return is already quite solid. However, I do not see it sufficient to justify the risks as detailed next.

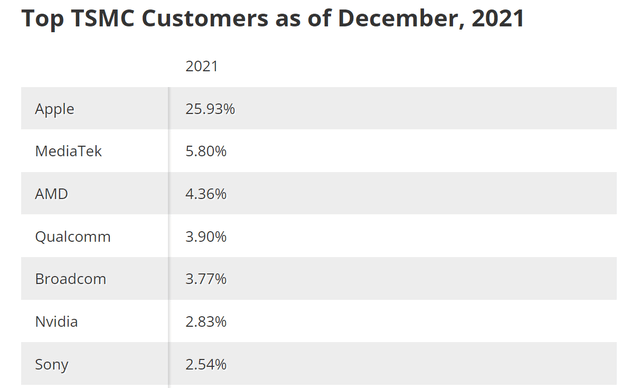

Finally, risks. Both stocks do face some risks too. For INTC, it not only has to compete with overseas players such as TSM, it also has to compete with domestic players in both the CHIPS and fab space. The CHIPS again might give it an edge against overseas players but won’t help too much for its competition domestically. Although I see more severe risks for TSM. TSM’s top clients are almost all U.S. companies. As seen, its top 6 clients are all U.S. companies with the exception of MediaTek. Such concentration creates tremendous risks under the current geopolitical tensions. Even worse and far more scary, top thinkers are actually contemplating the possibility of the China invasion of Taiwan. According to Citi analyst Christopher Danely, Intel’s CEO Pat Gelsinger said he doesn’t think the invasion will happen in the next five years. To me, the timeline is of course only speculation. However, the fact that top analysts and executives are thinking about such a possibility is already a sign of unfathomable risk.

Source: Tom’s Hardware

Be the first to comment