owngarden

By Michael Lai, CFA, Portfolio Manager, China Equities, Franklin Templeton Emerging Markets Equity

Positive catalysts, such as the anticipated easing of both COVID-19 restrictions and geopolitical tensions, paired with policy loosening, may help the Chinese equity market recover, according to Franklin Templeton Emerging Market Equity’s Michael Lai. He shares his latest outlook and where he finds investment opportunities.

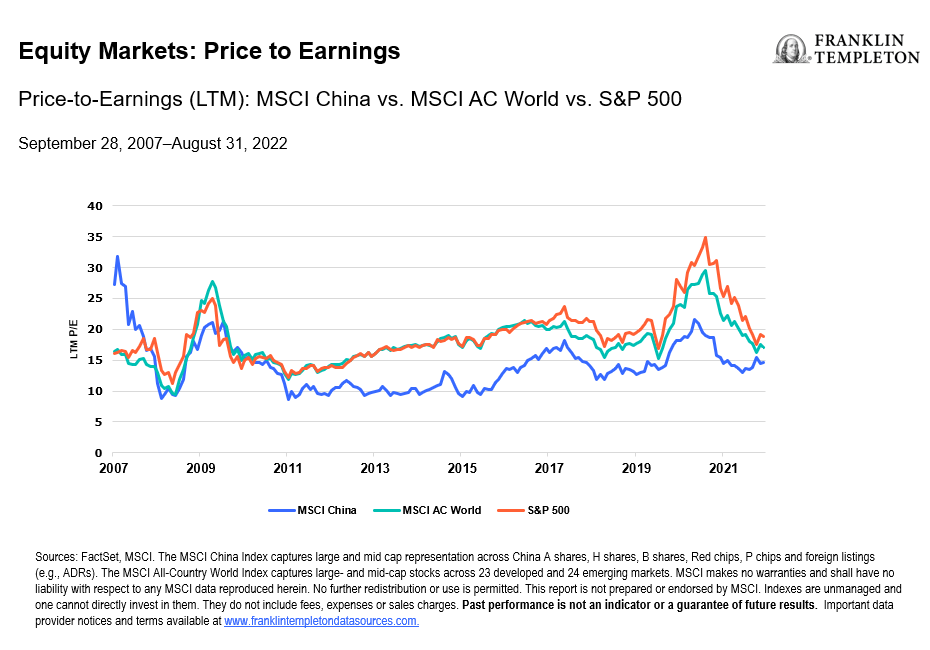

In our analysis, investor sentiment and valuation in Chinese equities are currently at unsustainable lows. As such, we are positive on the relative case for the Chinese equity market’s prospects as we move into the latter part of this year. While we can expect the realization of some degree of slowing growth, policy tools are available to underpin the economy so it should not be fully derailed.

P/E Ratio (FactSet, MSCI)

Positive catalysts for market recovery

We have identified several positive catalysts that could help China’s market recover. These include an easing of zero-COVID restrictions, a reduction in geopolitical tensions and clear evidence of no further tightening in the regulatory environment. We see reasons for optimism in each area. The government is likely to continually adjust COVID-19 policies—driving greater economic resilience and flexibility in the face of localized restrictions—and utilize flexible policy tools. We anticipate stabilization in earnings revisions, and a regulatory shift toward implementing previously announced policies vs. incremental new tightening measures.

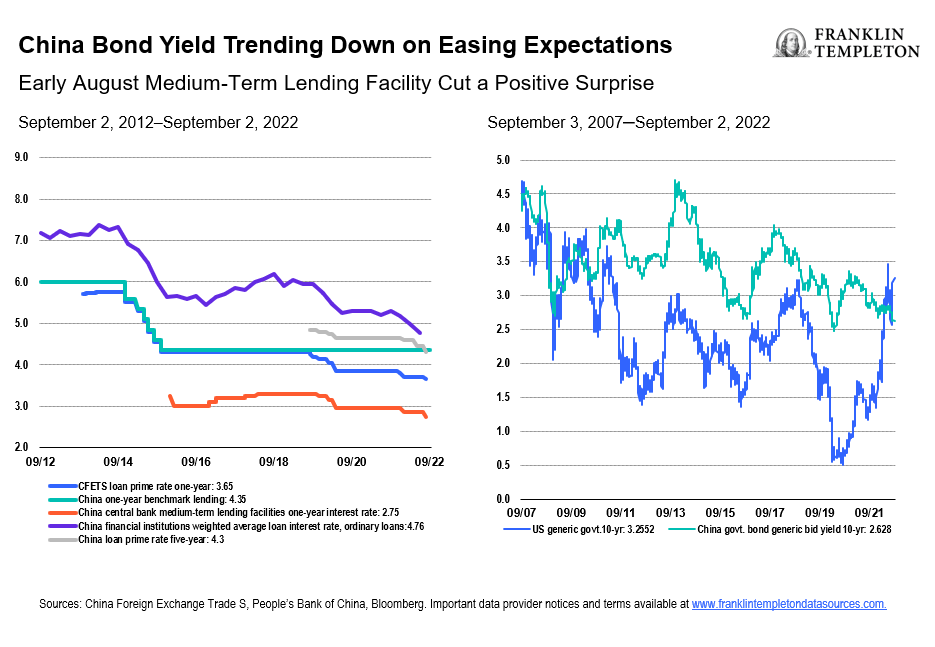

As seen in the charts below, monetary policy in China has followed a different trajectory from the United States and other major central banks, as interest rates in China have been trending lower, with 10-year yields in the United States now higher than in China for the first time in over a decade.

Bond Yields (China Foreign Exchange Trade S, People’s Bank of China, Bloomberg)

Opportunities arising from government long-term goals

We believe areas aligned with the government’s long-term goals offer the most opportunities for investors. Common prosperity, for instance, could expand the aggregate size of disposable income and support social welfare as lower-tier cities remain a large untapped market for many consumer products and services. Green development, with orderly decarbonization to avoid disruption to economic growth, should enable Chinese companies to secure global leadership in supply chains spanning from new energy vehicles (NEVs) to solar.

In our view, sectors with high exposure to NEVs, solar, wind power and energy storage have upside potential due to strong NEV growth momentum, high energy prices, the ongoing Russia-Ukraine war and government subsidies. In addition, gaining independence from imports through domestic substitution in key technologies, such as semiconductors, represents a huge growth opportunity with strategic benefits. Putting this in context, China imported over US$400 billion in semiconductors in 2021.

Other opportunities can be found in high-quality internet companies that have seen valuations crash, yet they have vast amounts of cash on their balance sheets, are improving their cost efficiencies and are returning cash to shareholders.

Sectors and companies where we see risks

In our opinion, risks exist in industries characterized by oversupply and excess leverage (such as property developers) and restricted earnings growth and returns to shareholders (such as utilities managed for public benefit, not for minority investors). We see companies with weak cash flows that are reliant on fundraising to support business operations as vulnerable due to a lower risk appetite. We also expect sectors with high consumer exposure to be under pressure in the next few quarters due to low consumer confidence and weak demand.

We will continue to search for opportunities in the Chinese equity market as we actively manage our portfolios based on bottom-up company research and top-down macroeconomic and policy monitoring. We retain long-term optimism towards China’s market.

What Are The Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. Investments in fast-growing industries like the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment