Michael Vi/iStock Editorial via Getty Images

PagerDuty (NYSE:PD) is a IT operations company at its core providing value through an extensive software platform. It is looking to make things easier for enterprises and smaller businesses. Valuations have been hit hard in the technology space over the past 3 months, in particular since the start of the 2022. The market has seen a significant rotation from these software stocks to things that benefit from inflation such as commodities. This has given a great buying opportunity for long term oriented investors, who can improve future returns by taking some more moderate risk. Businesses can use PD to organize workflow, determine who is on call and detect anomalies in their systems or applications. The platform is seamless an easy to use which provides a great value proposition for larger enterprises, but does create a specific product market fit.

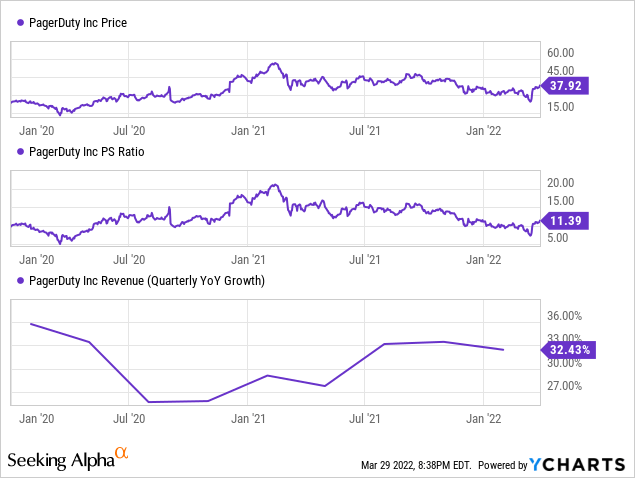

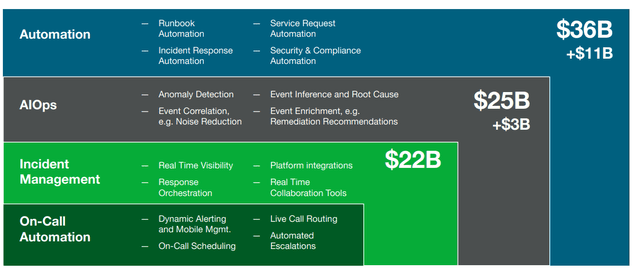

Trading at just over 11x trailing sales with over $266m in shareholder equity the stock is nearly as cheap as it was in March 2020. However, the business actually has more momentum than it did in late 2019 through accelerating digital transformation. Automation and incident management are large and growing quickly. These areas are essential in keeping mission critical systems running and preventing costly technical issues. Below you can see a breakdown of the total addressable market PD is going after – with more potential expansion in adjacencies possible from acquisitions in the next few years. The company has also had improving results in the past year, culminating in a very strong third quarter.

Fiscal Q4 Results

PagerDuty has continued to put up a very impressive set of results with strong growth in both revenue and billings. The stock reacted quite positively to Q4 results and especially strong calendar 2022 guidance. Quarterly billings of $105.9M were quite strong, with the full fiscal year billings of $321.6m, a strong 29.55% growth over last year. As the first indication of an increase in usage based revenue, having an acceleration in billings growth is a good sign of better revenue quarters to come. The net retention rate of customers has accelerated now to 124% from 121% in the prior year quarter. Part of the weakness last year is attributed to pause on spend due to Covid-19, but by Q2 2021 that was starting to wane. The past 3 quarters have had strong net retention of 126%, 124% and 124%. The company is particularly interested in the enterprise segment as complexity in IT and systems is where PagerDuty provides value to organizations. They have increased research and development spend over the past year and reduced marketing spend as a % of sales. The marketing % of revenue went from 63% last year to 50% for the full year of 2021. This shows that they are increasing productivity in their sales team as well as focusing more on additional capabilities for the PD platform. The company posted initial guidance of a 28-30% growth rate for calendar 2022, with increasing efficiency leading to decreasing losses. This is especially impressive with a standard beat and raise guidance indicating another year of 30+% recurring revenue growth for the year. Plus after adjusting for stock-based awards the company should approach break even this year with profitability in fiscal year 2024.

On the less bullish side, the customer count has struggled to grow over the past year with only 7.4% growth over last year. The company ended the year with 14,865 customers, but a large portion of the ARR coming from the top 20% of those customers. The slow growth is partially because PD has been focusing on growth inside its large enterprise accounts. However, without an acceleration in customer growth it does make the market size after 2022 harder to pinpoint. Management did point out that mid market and large enterprise customers grew 13%, showing PD tending to spend less money marketing to the small business segment. The reality is the product is one to help solve enterprise complexity so the larger the organization the more useful they would find PD. The company does continue to see significant growth ahead with hiring in Q4 the highest in the company’s history. Companies above 1 million in annual revenue, a high watermark for many software companies, was up an impressive 65% y/y to 43 customers. For a small cap company this is impressive growth and shows the product does have a good market fit for large enterprise. Customers above $100,000 in ARR were up a solid 39% showing strong growth and continued move to only enterprise customers over 1000 employees. Management pointed out they averaged $20,000 ARR for customer now across the entire customer base, showing how important those large customers are.

Rundeck, a company which was purchased in September 2020 has been an outperformer when combined with their Amazon AWS partnership. They call this ‘process automation’ now and as a cloud product allows easier trialing for customers. PagerDuty paid $100 million to acquire it and it has been very beneficial in order to strengthen their bond with the 1000 pound Gorilla in the cloud space. PagerDuty is now offering through Rundeck a fully managed cloud based offering through AWS. This kind of offering has been proven to be extremely popular with other services like endpoint protection and other security offerings. Having a direct relationship with Amazon has immense value for PD as noted by CEO Jennifer Tejeda as “Customers can retire AWS committed spend on PagerDuty licenses, and now the AWS sales force can also retire quota against PagerDuty consumption.” This reduces friction and helps give AWS representatives a reason to sell PD to a larger audience. While management says that Rundeck hasn’t been a huge needle mover for the strong 124% net retention rate, they have seen success increasing spend from Zscaler (ZS) using the product. Considering the aim to add large enterprises, this is a big initial win for PagerDuty. They see this product as a way into large organizations such as this where they can expand over time.

Conclusion

While PagerDuty doesn’t have the pedigree of other more expensive software companies, the large TAM and solid enterprise customer base give room for growth. Those PD sells to are many of the large and growing companies of the world with increasingly disparate environments. The company will continue to grow strongly among more complex customers, with customer growth the best metric to watch going forward to show increasing adoption. The company continues to see improvement in losses, preventing the need for any additional dilution in the next few years. At only $3.4 billion US market cap, the company has great potential for growth and could be purchased by a larger organization down the line. The company is a great purchase at this valuation with increasing potential for 2022 gains.

Be the first to comment