onurdongel/E+ via Getty Images

Investment Thesis

Farfetch (NYSE:FTCH), a global luxury fashion platform, was a pandemic winner as the company benefited from the shift from physical retail to online retail. Its share price was once up 900% from its pandemic low back in March 2020. However, the company got caught in the high-growth stock sell-off, and its share price is now down over 90% from its all-time high early last year. Despite the tailwind from the shift to e-commerce which provides a huge TAM (total addressable market), the company is highly exposed to the macro environment and is facing tough competition. Growth is slowing and it is yet to be profitable, therefore I rate the company as a sell at the current price.

Farfetch is a UK-based company founded back in 2007 by current CEO José Neves. It aims to transform the $300 billion luxury industry through the seamless merger of both offline and online shopping and to become the global platform for high-end retail. The company offers brands from NIKE (NKE) to the likes of Gucci, Prada, and more. It has a rather complex business model with multiple revenue streams which include fulfillment services revenues, 1st party platform revenues, 3rd party platform revenues, brand platform revenues, and in-store revenues.

To quickly explain it, 1st-party platform revenues are sales generated directly from its own inventory. 3rd party platform revenues are the take rate that it charges for every sale made by 3rd party boutiques on its platform. Brand platform revenues are revenues generated under its own brand online and in-store revenues are sales of its inventory in-store.

Market Opportunity

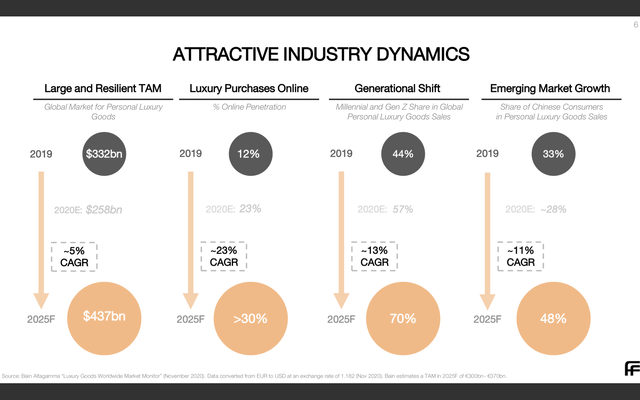

Farfetch operates mainly in the mid to high-end fashion e-commerce market. The market is huge and is continuing to grow as brands and boutiques are moving from physical retail to digital retail. The pandemic further accelerated the shift as customers can only shop online during lockdown periods. According to Statista, the e-commerce share of personal luxury goods sales worldwide is currently 10% and is forecasted to increase to 25% in 2025, representing a 2.5 times growth over the period. According to Farfetch, the global market for personal luxury goods is expected to increase from $322 billion in 2019 to $437 billion in 2025, representing a 5% CAGR (compounded annual growth rate).

China is also another big growth catalyst as the share of Chinese consumers in personal luxury goods sales is expected to grow from 33% in 2019 to 48% in 2025, representing an 11% CAGR. Besides, as the company focuses heavily on the luxury end, its average ticket size is also higher than most e-commerce platforms. Farfetch is now also expanding its focus beyond just fashion and into spaces like Beauty, which presents a big opportunity. These expansions allow the company to leverage its current user base and increase their spendings.

Stephanie Phair, CCO, on Beauty expansion:

We continue to expect Beauty to be a significant driver of customer engagement and acquisition, enabling us to attract a new base of luxury customers and expand their share of wallet. We believe that this will also help us build stronger relationships with brands

Competition

Despite the huge TAM, the luxury online retail space is very crowded. Farfetch faces a lot of competitors like Mytheresa (MYTE), Revolve (RVLV), The RealReal (REAL), Matchesfashion, Mr. Porter, Selfridges, Lane Crawford, and more. The problem I find in this space is that companies are struggling to find a competitive advantage against others. This is essentially a perfect competition market structure where all companies are near-identical products and services with no entry barrier. It results in Farfetch not having any pricing power. As a buyer myself, I shopped at all of these websites before. I never stick to either one of these platforms blindly, instead, I always compare the prices and go for the one that is cheapest. In my opinion, Farfetch needs to find a way to differentiate itself and increase brand loyalty, or else it will get overwhelmed by competitors soon.

Macro Risks

The current uncertainty regarding the economy is likely to post significant headwinds on Farfetch, which is already showing some effect on their latest quarterly results. Being a consumer discretionary company, Farfetch is heavily exposed to the macro economy. As inflation continues to march higher now being at 8.6%, consumers’ confidence and spending power are dropping quickly. The economy is weakening and companies are already halting hiring or even laying off employees. As a result, consumers are now much more reluctant to spend on non-essential items because they need to spend and save more for staple items like groceries. GMV (gross merchandising volume) is likely to drop throughout the year with demand decreasing. Supply chain blockage is also increasing Farfetch’s logistics and fulfillment costs, which is affecting its bottom line.

Besides, the geopolitical environment regarding the lockdown in China and the war in Russia/Ukraine is also significantly impacting the business as it has a strong presence in both countries.

José Neves, CEO, on Macro Headwinds:

Specifically, there are three key developments that impacted our Q1 results and outlook. One, the war in Ukraine and our suspension of operations in Russia; two, the recent COVID-19 outbreaks and related recessions in Mainland China; and three, a double-digit decline in markdown GMV as the transition of the marketplace towards being predominantly full price accelerated.

Moving to China, our second largest market, the rise of COVID-19 cases against the backdrop of a zero COVID policy increasingly impacted our growth trajectory. The majority of our Mainland China business consists of cross-border sales from Europe to Tier 1 cities, such as Shanghai, which serves as a major cross-border hub. And as such, we experienced significant disruptions in our delivery operations for the China market.

Financials and Valuation

Farfetch reported its first-quarter earnings last month and it is quite a disappointment. The company reported revenue of $514.8 million, up only 6% YoY (year over year) from $485.1 million. Gross profit was $230.5 million, up 4.5% YoY from $220.1 million while the gross profit margin dropped by 70 basis points. The worst-than-expected revenue increase is largely attributed to the macro headwind the company facing currently. GMV (gross merchandising volume) increased by 1.7% YoY from $915.6 million to $930.8 million.

Profitability is showing no improvement, adjusted EBITDA loss widened from $(19.5) million to $(35.8) million, an 83.7% increase YoY. Diluted EPS went from negative (0.28) to negative (0.37). The company posted a negative operating cash flow of $(336.7) million, compared to $(282) million a year ago. This is a problem as the operating cash flow margin is now negative (65%). The company’s balance sheet is healthy with around $1 billion in cash and $750 million in debt but it needs to figure out a way to improve its profitability.

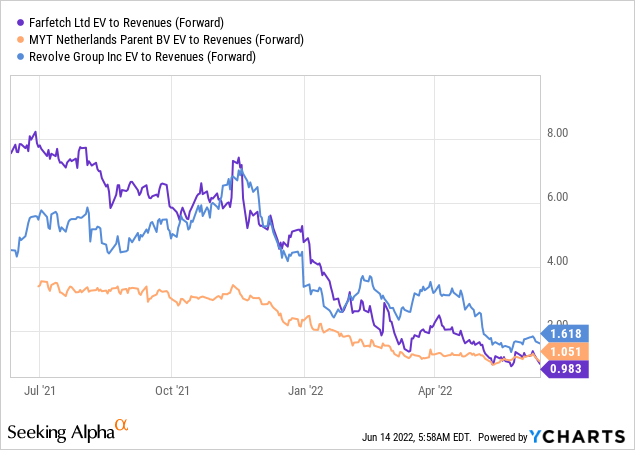

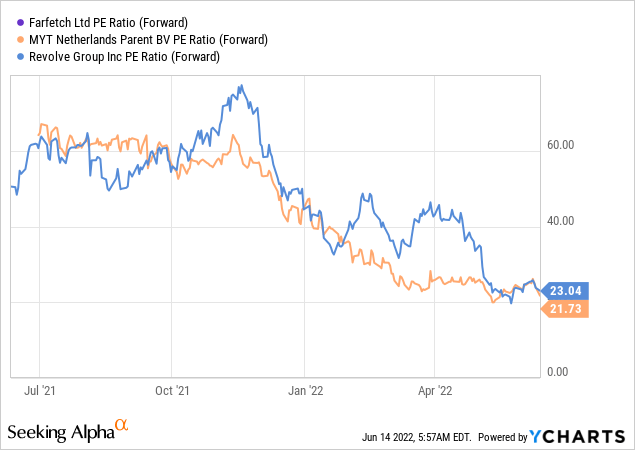

Farfetch is currently trading at an fwd EV/sales ratio of 0.98 (I am using the EV/sales ratio as the company is still not profitable with negative cash flow). This is slightly cheaper than public competitors like Revolve and Mytheresa as you can see from the chart below. However, I believe the most decisive factor here is profitability. Both Revolve and Mytheresa are profitable with an fwd P/E ratio in the low twenties (as shown in the second chart), while Farfetch is still posting a net loss. This is critical as profitability is valued heavily during uncertain times. Revolve is also growing quicker with the latest quarterly revenue up 58%, compared to Farfetch’s 6.1% increase. Therefore I don’t think Farfetch’s valuation is attractive when compared to its peers.

Conclusion

In conclusion, I believe there are currently too many problems surrounding Farfetch. The company has a large TAM with tailwinds from the shift from physical retail to online retail but it is also facing a lot of competitors. Most of its competitors are able to offer similar if not identical products and services which reduces Farfetch’s pricing power. More importantly, the company is facing tough headwinds from the macro-environment. This includes the Russia-Ukraine war, Lockdown in China, a high inflation rate, and a weakening economy. It is significantly impacting the company’s performance as shown in its latest quarterly earnings. I believe these headwinds will persist and will continue to weigh on the company’s performance. The current valuation is also not attractive compared to its peers which are profitable and are growing faster. Therefore I believe Farfetch is a sell despite the stock down over 90% from its all-time high.

Be the first to comment