Pgiam/iStock via Getty Images

SoFi Technologies (NASDAQ:SOFI) is a fintech stock, and one that is a leader in the space that it operates in. SoFi has evolved significantly over the last decade, and over the last year the action in the stock suggests that the Street does not know how to value it, or which sector it belongs in. Some weeks, SoFi trades with little to no earnings tech stocks. Other weeks, it seems to trade with the banks, and more so than other fintech type stocks. We have been bullish on the stock since it dropped under $8, and really liked the stock when it put the near term bottom in under $5. But it has been a grind, and the stock has quickly become one that is a massive battleground. Frankly, we believe investors need to buckle up, because the company is set to report earnings on August 2nd, 2022, and we expect a massive move. In this column we discuss the recent action, revisit Q1 results, and share our expectations for the key results in Q2. Let us discuss.

Current look at the stock and some important news items

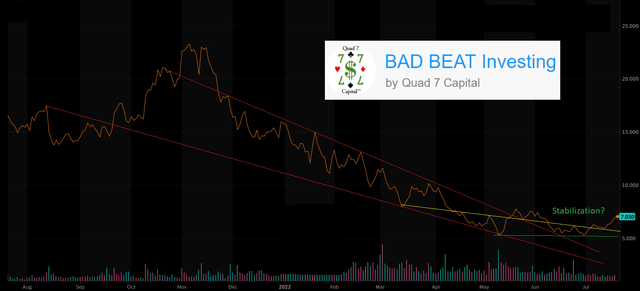

We have liked the stock since it dipped under $8 and loved it since it bottomed, but share prices have been pretty range bound of late. The chart is pretty ugly, though the stock has stabilized somewhat:

There was also some anxiety from the Street over a recent filing to do a shelf offering of up to $1 billion. While it is unclear if any sales had been done, there was confusion over what it could mean:

We may, from time to time, offer and sell, in one or more series or classes, up to $1,000,000,000 in aggregate principal amount of our common stock, preferred stock, debt securities, warrants and/or units, in any combination, together or separately, (collectively, the “securities”) in one or more offerings in amounts at prices and on the terms that we will determine at the time of the offering”

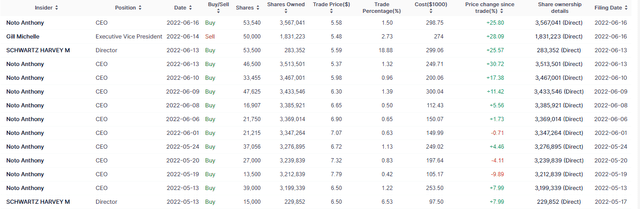

Depending on how this is done, it could be dilutive to shareholders, as EPS could suffer. On a positive note, there has a ton of insider buying over Q2:

People sell stock for all sorts of reasons, but buy them for only one. We think these volumes are very positive news.

The Q1 headline results

In the first quarter, top line growth accelerated and the company saw record adjusted net revenue of $322 million, up 49% year-over-year from the same prior-year period. This also was well above the high end of management’s guidance of and it beat consensus estimates slightly. Adjusted EBITDA of $8.7 million also was at the high end of expectations and this was the seventh consecutive quarter of EBITDA growth.

Q2 results headline results forecast

We will be looking to see if loan growth demand faltered during a period of ‘rate shock’ for borrowers, or if inflationary pressures are also leading to reduced demand or ability to repay loans. Housing data has been abysmal recently, and rates for all loans have jumped. We want to see if higher rates, plus a lower cost of funds combines to expand margins. We believe that based on Q1 trends in conjunction with management forecasts, if loan growth is hampered, they will still grow heavily, just at a lower rate, we could see a top line of $340-$360 million (accounting for a reduced growth rate in new loans of 5-10% vs Q1). If margins expand, we think the company still loses money on a per share basis, but approaches breakeven. Depending on where they land, a loss of $0.11 to $0.01 is where we are targeting, or $0.06 at midpoint. We believe the company continues to take market share.

Q1 loans and margins

We expect loan growth despite the continued extension of the student loan repayment moratorium. While the moratorium has been extended through August 2022, recall that management has assumed it will be extended all year for its 2022 guidance. Back in Q1 growth accelerated across all three reporting segments. There was also record personal loan originations. Margins were mixed in lending. The lending business saw $133 million of profit, stemming from a 54% margin, up from 52% margins a year ago. Some of this was from less lending demand, but overall dollar volume was still up 71%.

For Q2, we see a lighter demand overall, but expect dollar volume from a year ago to be up at least 50%, and we are anticipating margins to come in at 53-56%. Less than this range would be a surprise given the cost of funding has come down. We will closely watch this.

Expect the tech platform growth to continue in Q2

Remember what the company said when it closed its deal for Technisys:

SoFi plans to leverage the combined technological capabilities of Technisys and Galileo to create the only end-to-end vertically integrated banking technology stack that can uniquely support multiple products”

So SoFi’s tech platform is growing and is a great source of future revenues. In fact in Q1 revenue of $61 million in the quarter was up 32% from last year. We anticipate a similar or higher rate of growth in Q2 year-over-year. The new acquisition is simply going to create cost saving synergies. By purchasing this cloud based company, SoFi will create new fintech products that meet consumer needs, and while initial investment is required pressuring margins, it will result in money saved. Longer-term margins should expanded as the synergies combined with Galileo, will fuel revenue growth and margins should improve after the initial ramp up investment.

Keep in mind that Galileo has in Q1 saw a 58% year-over-year increase in accounts. When Q2 is reported we could see over 120 million. In terms of profit margin, we expect some pressure here in Q2 due to heavy investment in building out the platform. In Q1, profit was $18.2 million on 30% margins. This is down from a year ago, which had 34% margins. The company indicated it is still investing heavily so a sub 30% margin is possible here in Q2, but we stand by the assertion that margins bottom out this year and then increase as cost savings and synergies align.

Financial services likely to still lose money

The financial services segment in Q1 saw $23.5 million of revenue for Q1. The revenues are still growing, with 7% sequential growth. We expect a similar degree of quarter-over quarter growth here. The SoFi Invest product as well as SoFi Money products have led the charge, though with a horrible stock market and even worse action in cryptocurrency in Q2, we would not be surprised if there is a flat sequential quarter. On a margin basis this segment is ramping up and spending to grow. As such, losses were $49.5 million in Q1 and we expect losses in Q2 as the company continues to grow its credit card business versus and expanding expected credit loss reserves. Since this company is operating much like a bank, and other banks have expanded reserves, it stands to reason that the company would do the same.

Why the stock will move sharply

This stock has some massive short selling. The short interest is quite high, around 18% at last check. If we see better than expected results and/or guidance, we could see a huge short covering rally. However, earnings and/or guidance that leave something to be desired could see added short selling pressure and desperate longs abandon ship, sending the stock back possibly to the $5-$6 level if it is real ugly. Why? Sadly, we are still rather overvalued. The stock is extremely expensive relative to a legacy bank. However as a tech stock, valuation is not as horrible as peers or other no earnings, high revenue growth type stocks. Keep that in mind.

SoFi is has seen strong margins on its loans, and lending rates going higher is a big positive at least on earnings per loan. Rates going up improves margins, especially when you consider the company has its bank charter. If the company puts out a strong guidance on both revenue and adjusted EBITDA, we think you see a rally as well. But if they narrow the outlook, or are losing share, expect pain.

We also want to see what is going on with stock-based compensation as well. Every share issued to attract talent increases the float. Shareholders are being watered down. While many companies do this, you could see the company having ongoing losses on a per share basis even if adjusted EBITDA expands, or very little earnings on positive net income. It is a problem to monitor, although we do believe in the early public stages of this company we prefer to look at cash flow metrics and adjusted EBITDA, both of which have been incredibly positive.

Take home

Expect fireworks after Q2. Long-term investors may wish to purchase some put contracts as insurance, or those looking to expand their holdings may wish to sell puts for income, and if assigned, it lowers the cost basis. We expect strong volatility on the report. If there is upbeat guidance, a short squeeze is likely. A miss or downward revisions could trigger longs to abandon ship. We fully expect a double-digit percentage move one way or the other, though longer-term we like the company’s prospects.

Be the first to comment