SimonSkafar/iStock via Getty Images

Article Thesis

Renewable energy or green economy companies are oftentimes either unprofitable or trading at very high valuations. For income and value investors, many of those picks aren’t compelling choices. Brookfield Renewable Partners (NYSE:BEP)(NYSE:BEPC) of the Brookfield Asset Management (BAM) family is a renewable energy company that offers a compelling dividend yield, however. On top of that, the company also has strong growth potential and world-class management. Shares have pulled back over the last year and are now trading at a reasonable valuation, although they aren’t especially cheap yet.

Many Green Economy Stocks Aren’t Great Choices

When it comes to investments where ESG narratives play a huge role, my experience is that more traditional factors for stock selection, such as valuation, dividends, and profitability, are oftentimes discarded. This is why unprofitable companies are able to garner a lot of attention when they are labeled “green”.

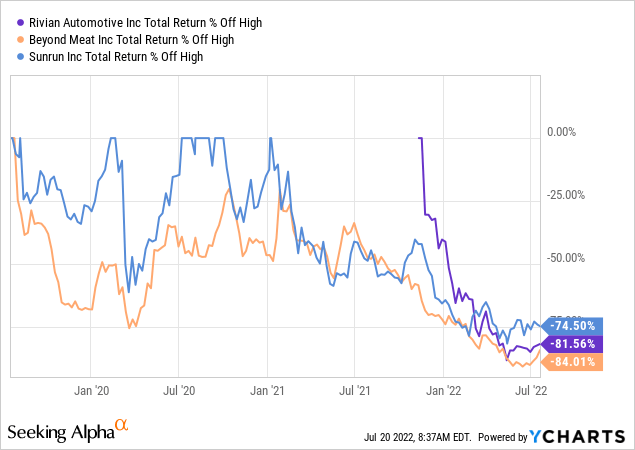

The above chart shows a couple of examples: Rivian Automotive (RIVN), an EV company that IPO’d at an absurd price; Beyond Meat (BYND), a non-meat meat company; and Sunrun (RUN), a solar business. All of these companies received a lot of attention, and they all destroyed massive shareholder value when they dropped 75%-85% from their highs as the respective bubbles burst.

Investing solely on the basis of something being “green” isn’t a good idea, I believe. Too many business models in this space are structurally unprofitable, and those that are viable are oftentimes trading at way too high valuations. But that doesn’t mean that everything that is “green” or renewable must be bad, one just has to look closely to find the good picks. Brookfield Renewable Partners is one such strong pick, I believe.

Why Brookfield Renewable Partners

Brookfield Renewable Partners combines many of the good things one traditionally wants from a company, while at the same time being green. The company has excellent management, a viable business model, is highly profitable, has a strong track record, a lot of growth potential, and last but not least, it offers a sizeable and growing income stream.

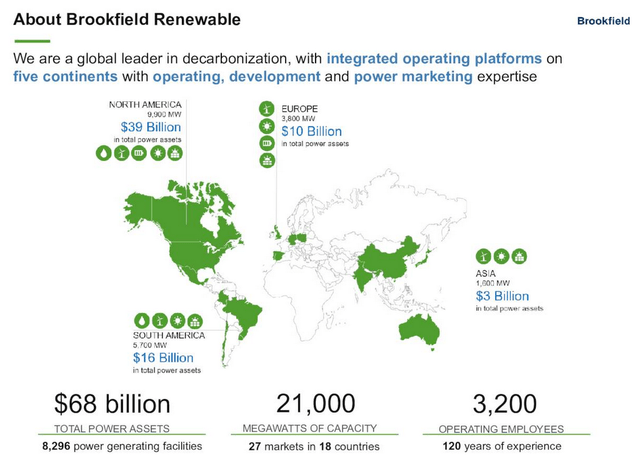

The following chart shows BEP’s global asset network:

With close to $70 billion worth of power assets, BEP is a leading renewable energy powerhouse in the world. It operates in many markets around the world, with the Americas being the most important geographic market. The company currently controls 21 GW worth of capacity, but it plans to grow that amount massively over the coming years. According to a recent investor presentation, available here on Seeking Alpha, BEP has another 62 GW worth of capacity in its pipeline. This is almost 300% of what the company currently owns, meaning that BEP could increase its asset base to four times the current footprint if everything in its pipeline were to come to fruition. That will likely not happen, or at least not in the near term, as some deals may fall through. But still, this data point showcases the massive growth potential for Brookfield Renewable Partners over the coming years.

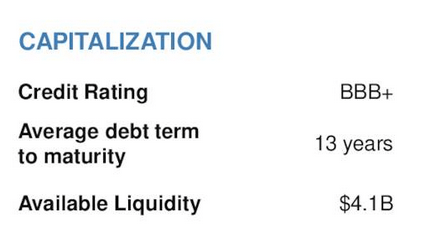

BEP, a publicly-listed daughter of real asset specialist Brookfield Asset Management, has major advantages when it comes to getting deals. First, through its global footprint and reputation, it can source deals more easily than many of its smaller peers with less scale and fewer connections. On top of that, BEP’s large size and successful track record give it advantages when it comes to capital costs, relative to smaller, lesser-known competitors that might have a harder time accessing bank debt at favorable rates. Its favorable access to capital is showcased by the following slide:

BEP presentation

With a BBB+ rating, which is solidly in the investment grade group, default risk is pretty slim. This is why debt holders are willing to lend BEP money for long periods of time without demanding overly high interest rates. With a 13-year average time to maturity, BEP’s management has also smartly locked in rates for a pretty long time in recent years, when interest rates were still very low. With rates rising substantially so far this year, the locked-in rates are an advantage. In fact, BEP could be a significant inflation beneficiary in the current environment: Its real assets, such as wind farms or hydroelectric power stations, should grow in value due to inflation, as replacement costs rise and as the electricity these assets generate becomes more valuable. At the same time, inflation has a deleveraging effect on BEP, as debt gets inflated away on a real basis. BEP currently has billions of dollars in available liquidity (not all of that in cash), which means that the company is always ready to pounce on opportunities when they emerge.

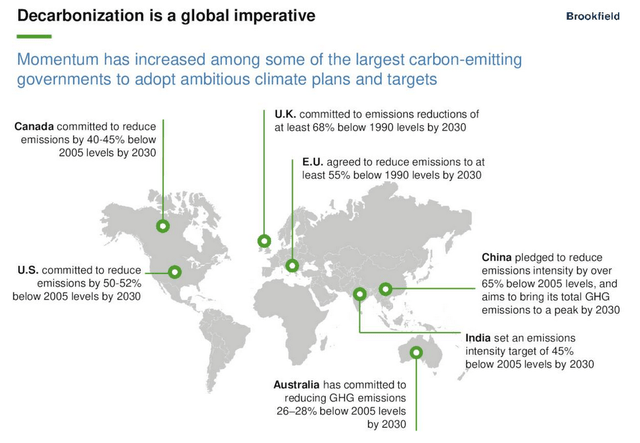

Over the coming years and decades, renewable energy is a high-growth, high-value market. There is a need to invest trillions of dollars (BAM’s estimate is $150 trillion through 2050) in order to meet the carbon-reduction goals of governments around the globe, such as the following ones:

Many countries around the globe, including some of the largest economies, have committed to hefty carbon reduction goals. The US, for example, wants to lower its emissions by at least half through 2030, and some other countries are even more aggressive. Whether these goals will be achieved or not is not certain yet, but it is clear that there will be a huge global effort to get there. This means that trillions worth of solar and wind parks, new transmission assets, storage, and so on will have to be built out, which makes for a huge market opportunity for BEP. Naturally, not all of those assets will be attractive to investors. But BEP’s high-quality management will be able to identify the best opportunities and jump on those while passing on the less valuable investments – the same principle BEP has been following since the company was created.

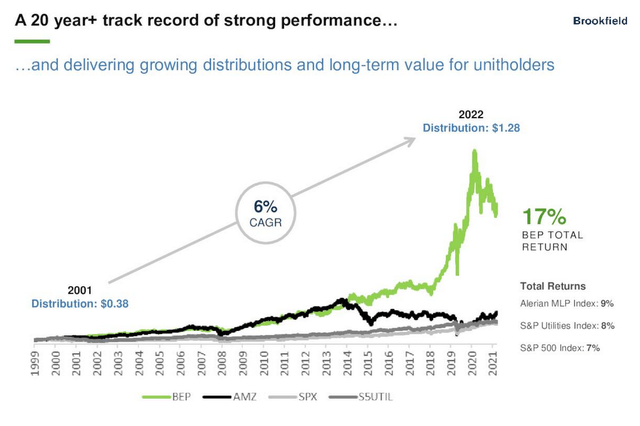

Investors, of course, can’t live off decarbonization alone – they want profits, cash flow, dividends, and share price appreciation. Brookfield Renewable Partners is able to deliver on that front, unlike many other green companies:

Since the company went public more than 20 years ago, BEP has delivered a hefty 17% annual total return – that is, for comparison, on par with Microsoft’s (MSFT) total return over the same time frame. BEP more than doubled the annual return of the broad market (SPY) and the utility industry (XLU). This was driven by a combination of dividends, dividend growth, earnings growth, and multiple expansion, which led to share price gains. BEP is now trading at a higher valuation than 20 years ago, which is why multiple expansion will likely not be a tailwind for total returns going forward. But even without that, the longer-term total return outlook is compelling.

Today, BEP offers a dividend yield of 3.5%. If BEP’s dividends are raised by 6% a year in the long run, in line with the past, then investors could expect total returns to approximate 9%-10% over time. BEP’s management is guiding for a 5%-9% annual dividend growth rate, thus future income growth could be slightly ahead of the historic growth rate. At 7%, the midpoint of the guidance range, the total return outlook improves to 10%-11%.

BEP’s management is forecasting total returns in a 12%-15% range, thanks to forecasted FFO per share growth of 10%+, which would be even better, of course. Since the company has beaten that in the past, the chances for BEP to hit that goal aren’t especially bad. But it wouldn’t even be needed to make Brookfield Renewable Partners a compelling long-term pick. Even a 10% annual return from a low-risk, recession-resilient income growth play would be very satisfying, I believe.

Due to the impact of weather on some of BEP’s production assets, results can be somewhat lumpy on a quarter-to-quarter basis. For example, if one quarter is windier in a specific region than average, then BEP’s wind assets will produce more electricity, and thus higher revenue and profit. BEP’s normalized FFO during the first quarter was $0.45 per share, which comes out to $1.80 annualized. With shares trading at $36 today, that makes for a 20x FFO multiple. That’s not ultra-low for sure, but it is also not overly expensive when we consider the company’s excellent track record, the green economy exposure, the massive growth tailwinds, and the hefty 18% growth rate in the most recent quarter. I would love to buy BEP at 15x FFO, of course, but I do believe that at 20x FFO, shares are still reasonably valued. If BEP continues to execute well, and if FFO per share growth continues to come in at a solid level, paying 20x FFO now will still result in compelling long-term returns.

Risks To Consider

Thanks to BEP’s strong management, successful track record, and healthy balance sheet, I don’t think company-specific risks are large here. But investors may want to consider some macro risks.

First, the growth of renewable energy investments depends, at least to some degree, on support from governments around the world, via favorable regulation and/or subsidies. Should ESG narratives lose steam, that could negatively impact the growth outlook for renewable energy, which would have an adverse impact on BEP.

Second, even though BEP is not especially expensive, it still benefits from the ESG investment theme. Should investors lose interest in ESG narratives, multiple contraction could lead to a lower-than-expected share price performance. BEP is not as exposed as some other ESG stocks that trade at way higher valuations, but there would most likely still be an impact if the global investment community becomes less interested in ESG-friendly or green investments, due to whatever reason.

Takeaway

In many cases, buying green companies, or companies that claim to be green, means that investors have to accept that there aren’t any dividends and that profits will be paltry or nonexistent. In BEP’s case, investors can have their green cake and eat it, too. Investors get ESG-friendly, green energy exposure, and at the same time, they get everything one traditionally wants from an investment: A solid business, strong growth, a growing income stream with a nice yield, great management, and a reasonable valuation. BEP is one of the best “green” picks in the world, I believe.

Be the first to comment