Sky_Blue

China’s pre-emptive moves to ease some COVID restrictions and support real estate developers are the reasons why the market chose to look through surprisingly weak domestic activity gauges.

China Slowdown

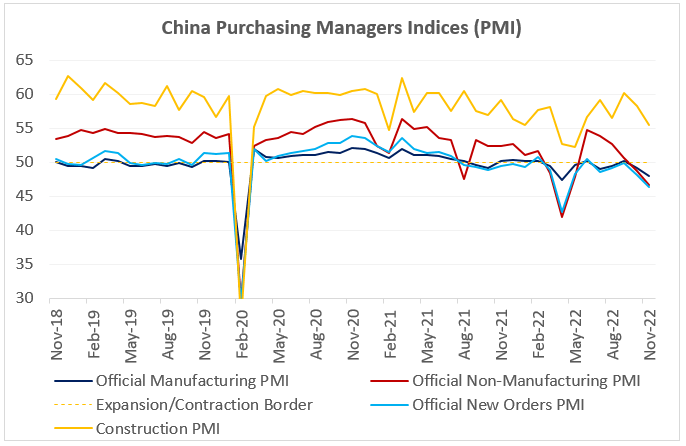

China’s domestic activity gauges for November were bad, no question about it. Most indices were well in contraction zone and deteriorating (see chart below). Even the construction PMI1 (Purchasing Managers Index) – which benefited from the earlier infrastructure stimulus – eased from 58.2 to 55.4. So, why is the market choosing to downplay the weakness? The answer is that authorities made several pre-emptive policy moves before the release, and, importantly, these initiatives address the underlying reasons of the slowdown – primarily real estate and re-opening.

China Real Estate Developers

The re-opening is still very tentative – the 20-point plan focuses on the optimization of the pandemic control, quarantine times, the frequency of testing and risk area delineations – but support for property developers looks more solid. The real estate package includes “stable financing” (the resumption of equity funding for listed companies, bond issuance, “reasonable” loan extension, relending facilities and absolving lenders from personal responsibility if something goes wrong), equal treatment of state-owned and private developers and mortgage support for homebuyers. Given the foregoing, it is not surprising that China’s High Yield/developers’ bonds staged a nice rally in the past week or so.

China Growth – Global Implications

One problem that China cannot fix on its own is weakening global demand – the new export orders PMI dropped to 46.7, which is the lowest level since May. “2023 Growth Cliff” is the most likely scenario for China’s main trade partners, and this underscores the importance of domestic pro-growth policies and orderly re-opening. Earlier reports about vaccination plans for the elderly and the easing of COVID restrictions in Guangzhou look encouraging, even though the progress will probably be slow and uneven (despite assertions that the anti-lockdown protests might turn out “stimulative”). The prospect of China’s domestic rebound – and commodity prices’ reaction to it – raises some interesting questions about (a) global disinflation and (b) growth spillovers in emerging markets (EM) (especially for commodity exporters). But this might be a story for Q2-Q3 next year. Stay tuned!

Chart at a Glance: China Activity Gauges – Still Sliding Down

Bloomberg LP.

1 We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment