Remy Steiner/Getty Images Entertainment

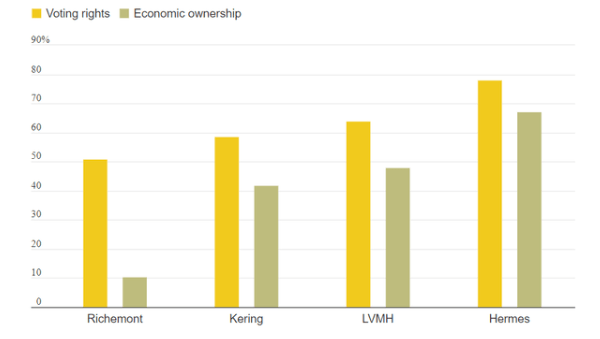

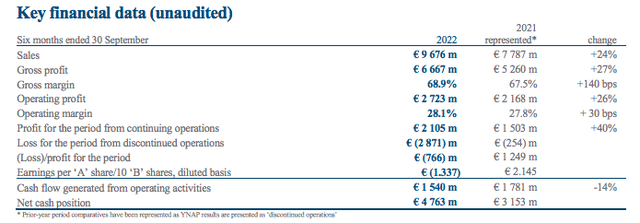

When we started to initiate Compagnie Financière Richemont (OTCPK:CFRHF) (OTCPK:CFRUY) with a publication called ‘Growth Will Peak In Q3‘, we were pretty positive about the company’s core business development. Indeed, looking at the recent results, we were right and the company impressed the financial community, reporting strong numbers as well as exceeding our initial sales growth estimates. As already emphasized, Richemont is a unique corporation with sales diversification, well-known brands, and strong margins. This is also coupled with a solid balance sheet; however, we explained how the company’s corporate governance controversy could not be unseen, and we follow up with a detailed article between Bluebell, a British activist fund, versus the Rupert family, which has over 50% of Richemont’s voting rights (Fig 1). Aside from the voting rights, the activist fund criticized the Richemont group on its e-commerce strategy with a clear point to refocus the company’s activities on its core business of jewelry and watches. In the quarter, Richemont agreed to sell a portion of YNAP to Alabbar and FARFETCH and discounted its operation with a non-cash write-off for a total consideration of €2.7 billion. For this reason, in H1, the company suffered a loss of €766 million for this negative one-off and without this effect, Richemont’s half-year profits reached €2.1 billion and were up by 40% on a yearly basis (Fig 2). Richemont will still hold 49.3% of YNAP and also will receive 12/13% of Farfetch’s new share capital to further align shareholder control interests.

Voting rights vs economic ownership

Source: Mare Evidence Lab’s previous publication

Richemont Financials in a snap

Source: Richemont H1-23 Results presentation (Fig 2)

As a reminder, in 2022, we decide to overweight the luxury sector and so far it was a good call. Today, we are back to analyzing the company’s latest development as well as the Swiss Watch industry.

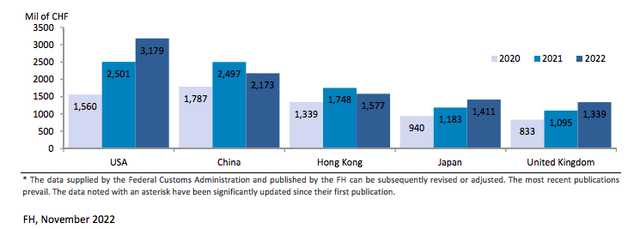

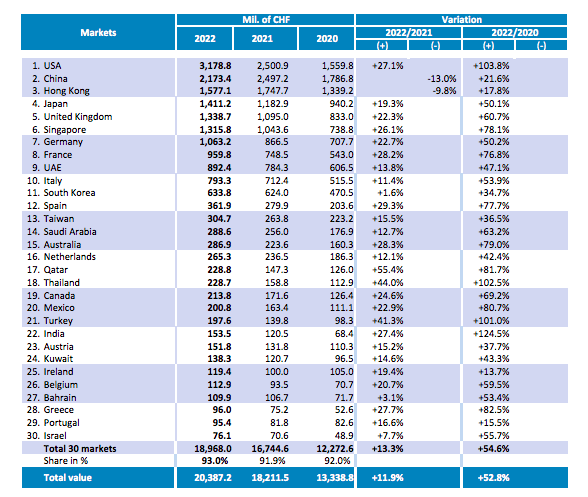

When the onset of the pandemic hit Swiss watch exports in 2020, manufacturers and retailers were skeptical of a recovery in the sector anytime soon. But, since then, a combination of growth and new trends has led to a new clientele. In January 2022, the FH Federation of the Swiss Watch Industry reported an unexpectedly swift recovery from its 2020 decline in exports driven by strong growth in the US and a continued upward trend in China. Last July, the FH reported that the first six months of 2022 saw an increase in the value of exports of almost 12% compared to the same period in 2021, bringing the total value of exports to CHF 11.9 billion. And these export figures, which represent wholesale activity between Swiss watchmakers and their network of international retail partners, continue to rise.

FH yearly data

FH GEO update

Source: FH November update

The half-year reports of luxury groups such as Richemont and LVMH confirm this revenue growth. Independent brands such as Rolex and Audemars Piguet do not share financial numbers, but high-end watch demand as well as those of the most recognized and established brands, today exceeds the market supply. The solid recovery has generated robust demand for the second-hand market and according to Deloitte, the second wrist market will grow by 75% in the coming years, with annual sales now at around CHF 20 billion will skyrocket to CHG 35 billion by 2030. This is very supportive of Richemont’s future accounts and product desirability.

Half-year results and Conclusion

Following the half-year results, it is evident that Richemont is reporting better numbers than competitors and is gaining market share. In detail, the company recorded a turnover of €9.6 billion and was up by +24% compared to last year. Going down the P&L, the luxury group posted an operating profit that beat estimates and reached €2.72 billion versus the €2.16 billion recorded in the same period last year. These positive performances were reported thanks to Japan, Europe and North America, up by 76%, 45%, and 22% respectively. Sales were also fueled by the Asia-Pacific improvement, which grew by 3%. As for the categories, the jewelry houses, including Cartier and Van Cleef & Arpels, show a 24% increase in sales and an operating margin of 37.1%. Specialist watchmakers such as Piaget or Vacheron Constantin report revenues of +22% and achieve an operating margin of 24.8%.

However, the company expressed caution regarding the future. “It is very difficult to make predictions about next year,” said Cyrille Vigneron, Cartier’s CEO. He also explained that “China should improve, but we don’t know the time. There are signs of a recession in the US and there will likely be an impact on Europe.” In addition, rising interest rates and inflationary pressures are potential erosion factors for the company’s clientele. For the above reason and despite the sales rebound, we continue to see Richemont as fairly priced. With higher earnings expected, the company is still trading at a 27 P/E ratio, in line with its historical average. Therefore, after a solid half-year report, we slightly increase our EPS 2023 estimates of €4.5, deriving a price target of CHF 115 per share and maintaining our neutral rating.

Be the first to comment