Diy13/iStock via Getty Images

Investment Thesis

Chesapeake Energy Corporation (NASDAQ:NASDAQ:CHK) is a natural gas company that’s very cheaply valued.

Earnestly, it’s difficult not to be bullish on this name, when the main topic of discussion is not whether or not investors will get a good yield, but in what form will the total yield arrive.

Indeed, CHK’s management noted during a recent conference call that one of CHK’s biggest troubles is figuring out how to best return capital to shareholders, calling it an ”awesome problem”.

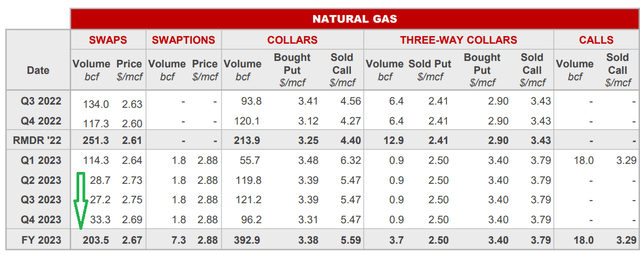

One negative detraction from the bull case is that CHK is substantially hedged for the remainder of 2022. But starting Q2 2023 its hedged book will improve dramatically.

Capital Allocation Policy, Good Problem to Have

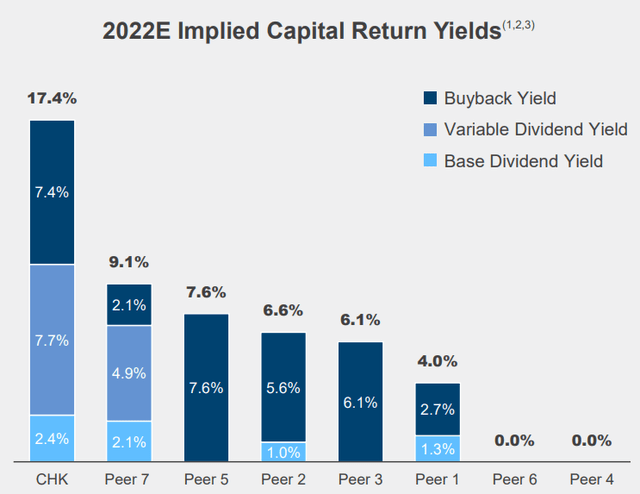

CHK prides itself in having a best-in-class shareholder return program. CHK uses a framework that looks to return to shareholders 50% of its free cash flows after its base dividend payout.

Incidentally, I believe that presently CHK’s total capital return is probably closer to 14% rather than the 17% it was at the time of the presentation above.

Next, I’ve maintained that natural gas companies that are not only paying lip service to return capital to shareholders, but actually have a clear capital allocation strategy, are getting more attention from the market and can be better rewarded for their lack of ambiguity.

Indeed, this is an issue that’s clearly worth discussing. Along these lines consider what CHK’s CEO Nick Dell’osso said at a conference call just last week:

[…] We’ve done the variable dividend for three quarters, the mode at which we return cash to shareholders has become as interesting of a topic to our investors as anything else we talk about. We love that. We love the debate about what’s the best way to return cash to shareholders, what an awesome problem to be discussing.

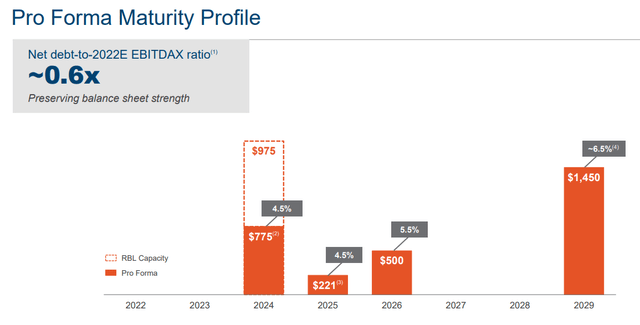

Obviously, one can only deploy these clear capital allocation policies, if the balance sheet is in a position that allows for the company to put its money where its mouth is.

As you can see above, CHK’s balance sheet has a 0.6x net debt to EBITDAX ratio. Thus reinforcing my argument that its balance sheet is now robust, with excess free cash flows going back to shareholders rather than creditors.

Hedged Position Should Improve in Q2 2023

Note above that CHK will see its hedges largely roll off in Q2 2023. Rather than being approximately 70% hedged as is presently the case, its business sees its hedges roll off on a go-forward basis.

That being said, during the Q2 earnings call CHK’s CFO Mohit Singh said,

The hedge strategy stays consistent through the cycles. Our view is that on a rolling eight quarter basis, you want to keep looking at hedging.

The quote above alludes to the fact that CHK will look to continue its path of hedging out natural gas prices. How much ultimately gets hedged out is a big question. But given that natural gas prices in the US are so high right now, this might not be all that bad for CHK’s investors.

CHK Stock Valuation — 6x This Year’s Free Cash Flow

CHK June Presentation

Back in June, CHK contended that at the current strip prices of approximately $6.50 mmbtu the company could see $14 billion of cumulative free cash flow from 2022 to 2027.

That figure probably needs some level of adjustment since natural gas prices have ticked higher to approximately $8 mmbtu. Obviously, there’s the question as to the sustainability of these elevated natural gas prices. And that’s part of the reason why its total dividend is so attractive.

Meanwhile, closer to the present, it looks increasingly likely that in 2022 CHK could see its free cash flows reach $2 billion. For this figure, I’ve assumed that H2 roughly mirrors H1 2022.

This would put the stock right now priced at 6x this year’s free cash flow.

The Bottom Line

Natural gas companies have been through a turbulent period for so long that investors simply struggle to believe in the sustainability of their fundamentals.

Further, it’s fascinating to see the discrepancy between WTI prices and natural gas prices. While WTI has largely rolled off lately, natural gas prices remain in extremely high demand.

The main reason for this is that oil is very easily distributed around the globe. Meanwhile natural gas has to get cooled off and shipped around the world out of an appropriate port. Making the arbitrage prices between natural gas prices in North America and the rest of the world remain very wide and adding a lot of support to near-term natural gas prices in North America.

All considered, paying 6x this year’s free cash flow is still very attractive.

Be the first to comment