Teamjackson

By The Valuentum Team

Tailwinds from the surge in e-commerce demand during the worst of the COVID-19 pandemic are fading, though over the long haul, the proliferation of e-commerce will likely continue given the convenience such offerings provide (from being able to quickly compare prices to having products delivered straight to your front door). Cloud computing operations and digital advertising services are also supported by incredibly powerful secular tailwinds as cloud computing becomes the norm in the IT space while digital advertising continues to gobble up market share from other forms of advertising (liner TV, radio, newspaper).

For these reasons, we view Amazon Inc’s (NASDAQ:NASDAQ:AMZN) growth runway as firmly intact. Should shares of Amazon tank to the low end of our fair value estimate range or below (sub $100 per share) in the event multiple global crises (the European energy crisis, the slowdown in the US housing market, China’s slowing economic growth, the Ukraine-Russia crisis) cause US equity markets to collapse, Amazon is worth considering as a capital appreciation idea.

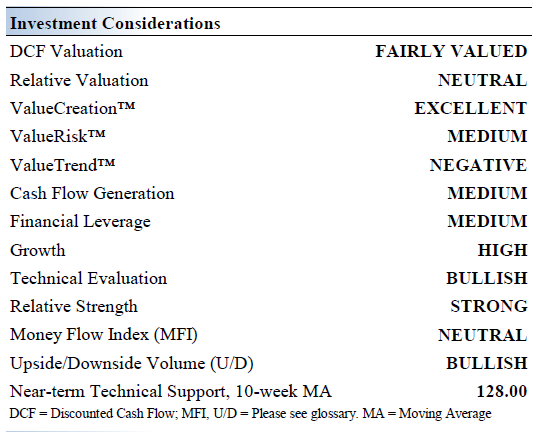

Amazon’s Key Investment Considerations

Image Source: Valuentum

Amazon is truly a special entity. Its expansive business profile includes its namesake e-commerce platform, on-demand cloud services provider AWS, online pharmacies, shipping, digital advertising, physical grocery stores, co-branded credit card agreements, video streaming services, and more. Amazon is aggressively growing its shipping operations, highlighting its ability to grow across numerous verticals. Its Amazon Prime service is steadily becoming a big player in video streaming on the back of its original content investments.

Its Amazon Prime service boasts an impressive membership base. The company recently announced a sizable increase in its Amazon Prime subscription price across several European markets after previously boosting Amazon Prime subscription pricing in the US.

The company’s Amazon Web Services [‘AWS’] segment is an incredibly important part of Amazon’s business. Revenue growth in the segment is outpacing overall company growth, and AWS accounts for a substantial percentage of the tech giant’s operating income. Furthermore, Amazon’s (likely lucrative) digital advertising business has grown at a robust pace in recent years.

Back in 2017, Amazon acquired Whole Foods for ~$13.7 billion to support its grocery business. This acquisition enabled Amazon to meet surging home food delivery demand during the worst of the COVID-19 pandemic via same-day or one-day delivery services in many domestic metropolitan markets. In 2020, Amazon launched its online pharmacy to further disrupt the brick-and-mortar retail space. Amazon is reportedly contemplating launching department stores in the US to assist in its efforts to grow its apparel and appliance sales.

However, Amazon also knows when to scale back its operational focus. The company recently announced it was shutting down its telehealth business. Job cuts are expected to be part of this process. Amazon has a lot of moving pieces and the company has been effective at expanding into new verticals.

Amazon split its stock 20-1 in June 2022, a move that was announced in conjunction with the firm approving a $10.0 billion share buyback program in March 2022. While stock splits have no impact on the fair value of a company’s shares, they can make its stock more affordable for retailer investors (with the idea being that growing the potential investor pool can, along the margins, improve a company’ stock price).

Earnings Update

On July 28, Amazon reported second quarter 2022 earnings that beat consensus top-line estimates though missed consensus bottom-line estimates due to a large non-operating charge (a special item). Its GAAP revenues rose by 7% year-over-year to reach $121.2 billion with sales at AWS up 33% in the second quarter. Growth in sales at its ‘North America’ segment often a decline in its ‘International’ segment’s sales (excludes the performance of its AWS segment) in the second quarter as its North America segment represents ~60% of its total sales. Its advertising services generated $8.6 billion in sales last quarter, up 18% year-over-year.

Amazon’s GAAP operating income faced pressure from rising operating expenses, which more than ate into its revenue growth. Last quarter, Amazon posted $3.3 billion in GAAP operating income, down 57% year-over-year. Its GAAP operating margin declined by ~405 basis points to reach 2.7% in the second quarter of 2022. However, recent moves to hike the subscription price of its Amazon Prime service in the US and Europe along with efforts to scale back in some areas (such as shuttering its telehealth service) should help Amazon improve its profitability going forward. Furthermore, growth at its lucrative AWS and digital advertising businesses should further enhance Amazon’s profitability metrics over the long haul.

Due to a large special non-operating charge in the second quarter, Amazon posted -$0.20 (negative $0.20) in GAAP diluted EPS. Share repurchases saw Amazon’s outstanding diluted share count decline by 1% year-over-year last quarter. The company plans to steadily buy back its stock going forward, and please note that Amazon does not pay out a common dividend at this time.

We caution that Amazon is contending with sizable inflationary and supply chain hurdles that will likely last for some time, which are pressuring its gross margins and driving up its operating expenses. The strong US dollar seen of late is weighing negatively on its top-line performance. Keeping those hurdles in mind, Amazon has done a solid job navigating various exogenous shocks.

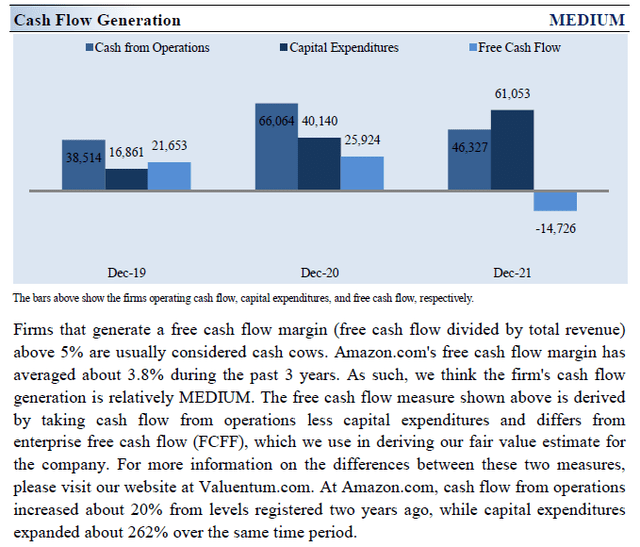

Amazon generated negative free cash flows (defined as net operating cash flow less capital expenditures) during the first half of 2022 due to large working capital builds holding back its net operating cash flow generating abilities while its capital expenditures are expanding aggressively (its logistics operations are capital-intensive). The company’s cash flow profile is lumpy. Amazon generated $21.7 billion and $25.9 billion in positive free cash flows in 2019 and 2020, respectively, and negative $14.7 billion in free cash flow last year. Its annual capital expenditures have grown from $16.9 billion in 2019 to $61.1 billion in 2021.

Looking at Amazon’s balance sheet, the firm exited June 2022 with a net cash position of $2.7 billion and had no short-term debt on the books. However, we caution that the firm had ample operating lease liabilities on the books at the end of this period to be aware of. Amazon repurchased $6.0 billion of its stock in the first half of 2022 and leaned on its balance sheet strength to do so.

Amazon’s Economic Profit Analysis

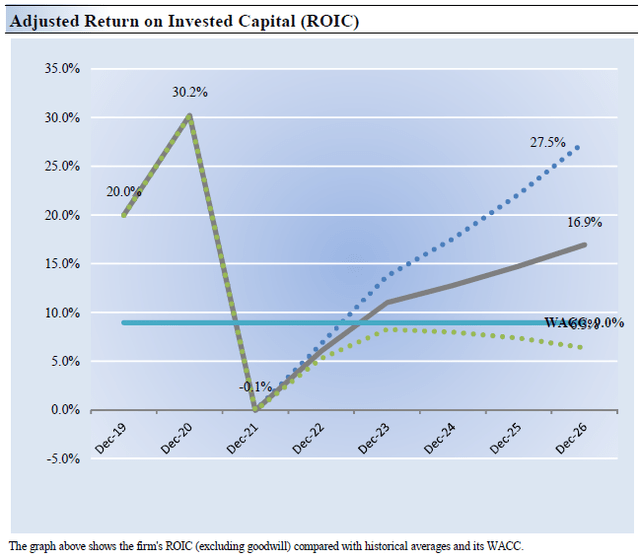

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Amazon’s 3-year historical return on invested capital (without goodwill) is 16.7%, which is above the estimate of its cost of capital of 9%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Amazon’s ability to generate shareholder value is expected to improve over the coming years.

Amazon’s Cash Flow Valuation Analysis

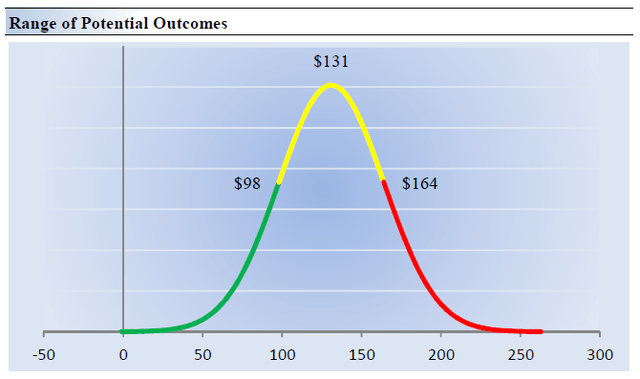

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think Amazon is worth $131 per share with a fair value range of $98.00 – $164.00. Our fair value estimate is highly sensitive to our long-term/mid-cycle operating margin assumptions. For example, a one percentage point change in our mid-cycle operating margin assumption results in a ~$250-$300 per share change in Amazon’s fair value estimate. Shares of Amazon are trading near our fair value estimate as of this writing, though still represent a potential capital appreciation idea at the right entry point.

The near-term operating forecasts used in our enterprise cash flow models, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 14.1% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 26.4%. Our model reflects a 5-year projected average operating margin of 6.3%, which is above Amazon’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 8.3% for the next 15 years and 3% in perpetuity. For Amazon, we use a 9.0% weighted average cost of capital to discount future free cash flows.

Amazon’s Margin of Safety Analysis

Although we estimate Amazon’s fair value at about $131 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Amazon. We think the firm is attractive below $98 per share (the green line), but quite expensive above $164 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Long-term investors might be well-rewarded for patience if Amazon’s shares dip below $100 each, the low end of our fair value estimate range.

Concluding Thoughts

Amazon is a stellar enterprise that’s performing quite well in the face of major headwinds. That includes rising labor/wage costs and freight expenses driving up its operating expenses while pressuring its gross margins, with geopolitical tensions roaring in the background. In our view, Amazon’s profitability metrics should improve over the coming years as its revenue growth “normalizes” after putting up banner performance in 2020 and 2021. Should shares of AMZN decline materially, that would represent a prime entry point for a company that houses ample capital appreciation upside potential over the long haul.

Be the first to comment