Hedge fund managers are very serious about their returns. ajr_images

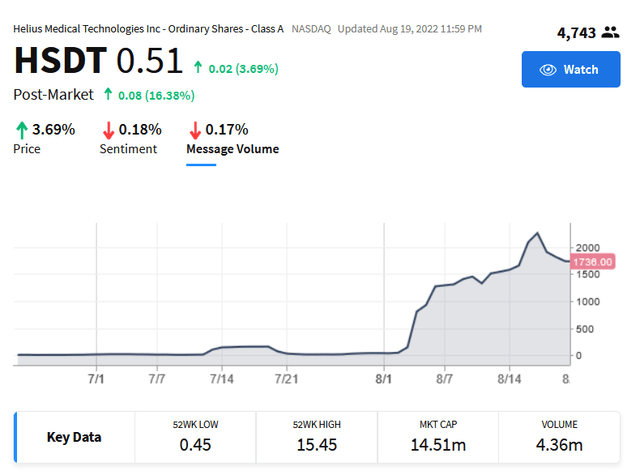

Helius Medical Technologies (NASDAQ:HSDT) is a tiny microcap with a $14.51m market capitalization that $100m in volume has transacted through in the past month. Incredibly irregular trading behavior underlies the stock price while the business itself appears poised for a turnaround.

After a recent equity raise resulting in $16.4m cash and no debt the company is trading at a P/B of 0.69x and is currently a net-net situation. Cash burn from the last two quarters suggests a $4.15m quarterly burn rate with the company. Market launch of their Portable Neuromodulation Stimulator or PoNS device in the US was in Q1 which builds on their previous launch in Canada in 2019. They are first to market with a novel device leveraging insights in neuroplasticity to improve gait deficit for those suffering with multiple sclerosis. Cash on hand should fund commercialization efforts through the year.

Structural elements related to cost-to-borrow fees suggest a short squeeze is very likely in the coming two months. With underlying fundamentals seeming to improve at the company, the stock trading below book value, and building retail interest in the name it’s possible a short squeeze could be quite abrupt and over 100%.

Helius Medical Technologies The Company

From their website we can see a quick overview of the company in their words:

Helius Medical Technologies, Inc., (“Helius”), is a neurotech company in the medical device industry, focused on neurological wellness. Helius’ origin stems from the early 1990s, and the pioneering work in neuroplasticity at the Tactile Communication and Neurorehabilitation Laboratory, (“TCNL”), at the University of Wisconsin-Madison. This work led to the development of the investigational Portable Neuromodulation Stimulator (PoNSTM), delivering neurostimulation via the tongue which has been shown in clinical studies to improve the effectiveness of physical exercises in people with neurological symptoms from disease or trauma such as mild-to-moderate traumatic brain injury.

They went public in 2014 via a reverse merger with Canadian company NeruoHabiliation, then listed on the Toronto Stock Exchange (TSX) in 2016, and finally listed on the NASDAQ in 2018. Their lead PoNS device was approved in Canada in late 2018, FDA authorized in March 2021, and also authorized in Australia in November 2021. Commercialization efforts have been ongoing in Canada while efforts in the US began just this year.

Results thus far have lagged hoped for results per management’s commentary.

Turning to our Canadian activities. Since 2019, PoNS has been authorized for sale in Canada for chronic balance deficit due to mild-to-moderate traumatic brain injury and subsequently for the treatment of gait deficit due to mild-to-moderate symptoms from MS. We now have 41 authorized PoNS clinics in Canada, up from 37 at the end of 2021. In addition, we currently have small trial programs with a few insurance carriers in Canada evaluating the benefit of PoNS therapy which we hope will lead to coverage by some or all of those carriers in the near future.

Having said that, while we have gained valuable data from our patients in Canada, some of which we’ve used to achieve FDA authorization in the U.S., our sales have not reached the levels we have targeted. We are currently evaluating additional measures and alternatives to achieve greater market adoption in Canada.

Revenue for the quarter was reported at $119k which is up 68% YoY though with operating expenses at $3.5m there’s a long way to climb to profitability. We can note the pricing data management broke out in the quarterly call as well: “The established U.S. list price for PoNS device is $25,700 comprised of a onetime cost of $17,800 for the controller and $7,900 for the mouthpiece.”

From this pricing it implies that they sold four devices in the quarter. That leaves a lot of potential runway for the company as they develop their commercialization efforts. It also may suggest that they are struggling to sell their product especially in light of commentary regarding Canada above. Management is working to expand insurance coverage of their device while also building expertise in physical therapists to actually use it. Their expectation is that revenue will grow sequentially over the quarters as their commercialization efforts start to drive sales.

Management has also announced a telehealth, e-commerce, online pharmacy initiative slated for later this year. Through this they are building a direct-to-consumer channel via ponstherapy.com. The strategy is described here:

Another hurdle to PoNS use will be lessened when we roll out our telehealth, e-commerce, online pharmacy initiative later this year. ponstherapy.com is an increasingly robust site but we expect the direct-to-consumer e-platform to be a game changer for physicians and patients. Once live, the platform will be immediately available in all 50 states and will include a network of fully licensed providers with e-prescribing capabilities. Currently, it could take a patient several weeks to set up an appointment with their neurologist or primary care physician. Through this site, patients will have the ability to match with practitioners and make appointments online, shrinking the 4-week window to as low of 24 hours. In addition, the online store will give patients the option to have the PoNS device delivered directly to their door.

This should provide another vehicle through which the company can generate revenue. I think it’s additionally strategic given it provides the company a digital platform which can be leveraged beyond the single device down the line.

All in all, the company is poised to expand their commercialization efforts in the coming quarters and with cash on hand expected to fund them throughout the year it’s merely a question of how much revenue they will generate moving forward, if any.

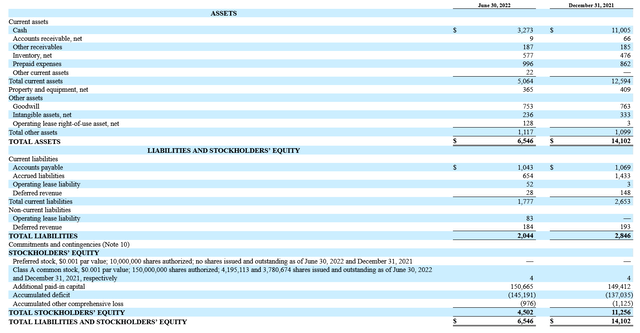

Helius Medical Technologies Financials

Let’s look at the balance sheet first. This is from their latest 10-Q filed on August 15th.

We need to make some immediate adjustments due to their $18m stock price offering from August 5th. Net proceeds were $16.4m which we’d add to the asset side of the equation bringing total equity value to $20.902m. With the current market cap of $14.5m and net current asset value of $19.42m the company is in a net-net situation.

A five quarter average cash burn comes in at $3.72m. With current cash at $19.673m that would imply 5 more quarters of cash on hand assuming no revenue growth.

Meme Stock Potential: The Anatomy of A Short Squeeze

With a bit of context laid about the company, let’s shift gears a bit and talk about why this is potentially a meme stock in the making.

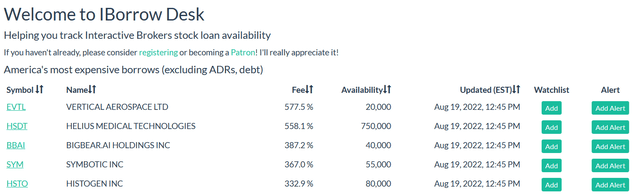

Cost to borrow is a metric which tells potential short sellers what the cost annually is to short a particular stock. This article highlights that “The typical fee for a stock loan is 0.30% per annum. In case of short supply, when many investors are going short on a stock, the fee may go up to 20-30% per annum.”

Compare that with HSDT’s current cost to borrow fee which is 558.1% and according to iBorrowDesk is the second most expensive in the US currently.

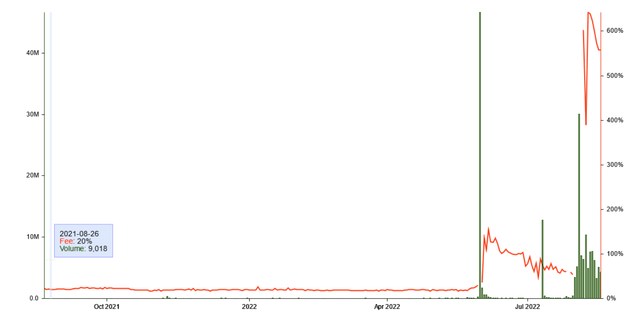

Current fee rates compare to the cost to borrow fee being around 18-20% most of last year for HSDT.

August 9th is when the fees jumped – the day after they closed on their $18m public offering. The offering brought $16.4m in cash to fund ongoing operations while they attempt to ramp up revenue. It also increased shares outstanding from ~4m to 28.179m with an additional 36m warrants outstanding exercisable at $0.75.

With the cost to borrow at 558% that implies a very steep return hurdle for those short the stock. What it means is that for those with a short position to return a profit in the next year the stock would need to go to zero. The actual cost to borrow is charged daily and given going to zero is only 100% upside we can gauge that not only does the company need to go to zero to be a profitable short position, it needs to do so before the next three months to be profitable.

|

Annualized cost to borrow |

558% |

||||

|

HSDT goes to 0 implied return |

100% |

||||

|

Months until HSDT goes to 0 |

1 |

2 |

3 |

4 |

5 |

|

Annualized Return Implied |

1200.00% |

600.00% |

400.00% |

300.00% |

240.00% |

Is the stock price likely to go to zero in the next three months? From the looks of it, not at all. Instead we can observe the company just raised $16.4m in cash. Quarterly cash burn was $3.7m in Q2 and $4.6m in Q3 so it’d take something beyond the ordinary to cause an impact here.

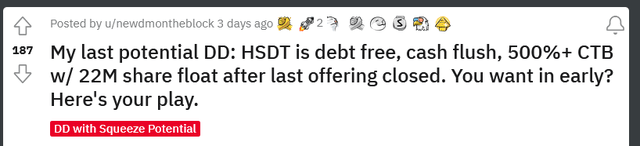

Meanwhile on the other side of this trade you’ve got the meme crowd looking to send this thing through the roof. Let’s consider some data here. Three days ago HSDT was posted in the Reddit r/SqueezePlays.

The thesis is basically that given the low current valuation of the company coupled with a first to market device with no competitors, the cost-to-borrow could drive a short squeeze. And with low float retail investors could themselves cause this to happen.

These types of posts are as much a call to action as they are a due diligence note. The action to many was clear: buy and hold. From a review of the comments I calculated around 32 new investors with around 70,900 shares bought. While admittedly not a huge amount of shares, I do think it’s a data point in reference to building retail momentum. Another data point is HSDT’s popularity on investing app Webull rated at number 22 overall on the app on August 20th.

Chart of HSDT popularity in Webull

Additionally we can see a huge uptick in message volume on HSDT’s StockTwits page in August.

HSDT StockTwits message volume chart

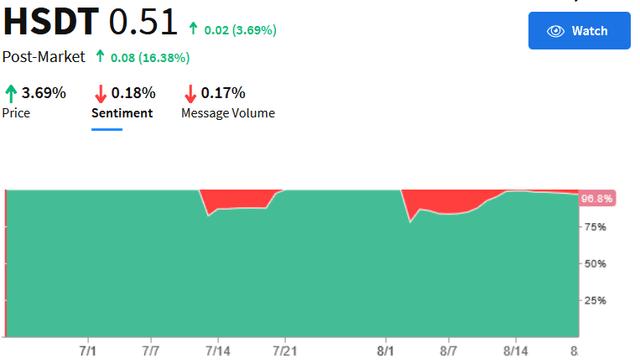

The sentiment has been overwhelmingly positive.

HSDT StockTwits message sentiment chart

Yet if we take a look at the volume overall it seems clear this isn’t just retail moving this. Something is though. Consider that since the beginning of August 141.989m shares have exchanged hands – meaning the entire share count has been traded over five times in just fifteen trading sessions. Average volume has been 9.46m shares per day or 34% of shares outstanding. Of note is that volume jumped significantly in August and prior to that five month average daily volume was only 615k shares or around 14% of shares outstanding during that time.

The average opening price during this month was $0.71 which given the total 141.989m shares that have traded implies $100m has transacted through this $14m market cap stock. The stock started the month at $0.83, saw highs of $2.76, and is now trading for around $0.51.

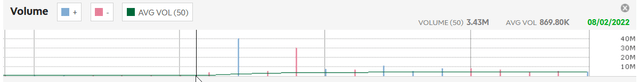

What does all of this mean? Well I note that the volume spike seems to have started on August 2nd with 3.43m shares trading, above the 869k fifty day average volume. This was just two days before they filed for their $18m public offering. The day before the filing 40m shares traded hands. The day after the filing another 30m traded hands.

HSDT one month volume chart from TD Ameritrade

What’s surprising about these volume numbers is that this is before the additional 24m shares from the offering hit the market. The filing itself references that as of June 30th there were only 4.195m shares outstanding. This suggests that volume combined the day before and after the filing saw the total share outstanding change hands over 16x in just two trading days.

It wasn’t retail that seemingly knew about news of the stock offering pricing and trading around it. Someone did though. Whoever knew about the stock offering pricing news could have also done some math to evaluate what the cost-to-borrow post offering would be so this trading strategy is likely multi-pronged. The first prong of the strategy I’d say was trading around the filing itself back on August 4th. The second prong of the strategy is related to the potential short squeeze and is supported by a company with an improving fundamental runway making this a long term trading vehicle.

All of this suggests to me that some group of folks with insider knowledge are using the stock price as a trading vehicle right now. Given the structural elements of the high cost-to-borrow rate and improving fundamentals in the business a short squeeze seems imminent – one that this group likely anticipated. It’s also possible that retail investors are being intentionally digitally mobilized through things like Reddit, Stocktwits, and Webull creating a compounding effect and meme stock potential which ultimately supports downside risk for this possible group.

So my assumptions so far are:

-

Someone or group had insider knowledge of stock price offering inclusive of date and terms. I extrapolate this from the surge of volume before and after the date of the filing itself. Trading Opportunity #1

-

If we assume the above insider knowledge someone would also have been able to gauge the cost to borrow post offering. For reference, the cost to borrow jumped from around 50-60% before the offering to 603% immediately after. With the company just raising capital and their product hitting the markets, this cost to borrow is untenable so shorts will be forced to cover. Trading Opportunity #2

-

Optionality: weaponize retail army for meme stock potential to support downside.

Someone could have sketched this strategy out with insider knowledge. I’m not implying that there is any particular wrongdoing that has happened in terms of stock price manipulation – to that end it’s entirely possible but also unclear to me. I’m also not suggesting that insiders as in staff or executives themselves are the ones driving this. What I am trying to do is develop a hypothesis which accounts for the huge jump in volume that HSDT has witnessed this past month which is truly beyond normal. Given what I’m seeing it seems to me that someone knew this was coming and has taken steps to ensure there are structural supports in place for their trading context.

And in my opinion it’s poised to work. Again, structurally speaking shorts will be looking to cover unless they believe the stock price is going to zero within two months. It would be a shocking turnaround in news for this to materialize so even for those that maintain a short thesis for the company over the long term (>1 year) the economics are going to force them to cover. Coupled with what seems to be building retail momentum the short squeeze might be sharp.

For reference, on August 2nd the stock closed at $0.64 only to open on August 3rd at $2.00 and close at $1.58, jumps of 212% and 147% respectively. Since then there’s been building discussion on StockTwits and Reddit regarding the name which likely means in a squeeze scenario there will be more holding through it making it harder for shorts to cover then earlier this month.

An important detail which limits the upside potential here is that the filing not only increased the share count it also introduced 36m warrants exercisable at $0.75 a share. As the stock price appreciates above the $0.75 mark then what should happen is those warrants will likely start to be exercised causing dilution. Despite this, I expect the squeeze to be rather volatile and quick so it’s likely that the stock will jump above this $0.75 in a trading period before warrants really have the time to be exercised and brought into play.

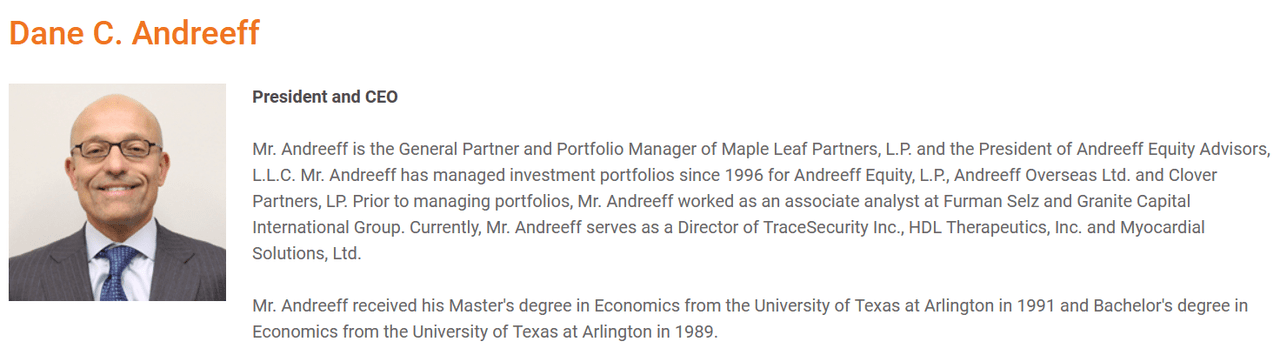

CEO Dane Andreeff Also Runs a $2b Hedge Fund

I’ve made some assertions above regarding people with insider knowledge using HSDT stock as a trading vehicle. Fortunately we don’t actually have to look far to imagine how this might actually be feasible. Case and point: CEO Dane Andreeff.

HSDT company website

Andreeff has been associated with the company since 2017 where he started as a board member. He was appointed interim CEO in 2020 and had the interim component lifted in 2021. As noted in the bio he is also the general partner and portfolio manager of Maple Leaf Partners.

Maple Leaf Partners, LP is a hedge fund founded by Mr. Andreeff, where he has been employed since 1996. In 2003, the fund was seeded by Julian Robertson’s Tiger Management and later grew to over $2 billion in assets under management. Julian Roberston is a US billionaire retired hedge fund manager who now seemingly invests in funds run by his former staff – the so called Tiger Cubs. Robertson is sometimes referred to as “The Father of Hedge Funds” and his Tiger Management is known as one of the best performing hedge funds of its generation.

What we know is that Maple Leaf Partners owned 189,416 shares and Andreeff himself owned 352,496 shares according to their April 2022 proxy. Totaled, that is only 1.9% of shares outstanding. Of note is that this percentage was much higher before the 24m share offering totaling 13.9%. To me this translates to Maple Leaf Partners having a lot of flexibility to trade in HSDT stock and with an estimated $2b in assets it’s likely they can find the liquidity.

While perhaps Maple Leaf Partners may not be trading around the name, imagine how many deep-pocketed relationships are implied by Andreeff’s connection to Tiger Management. If we consider the Tiger Cubs hedge funds group as a whole I calculate forty hedge peers to Maple Leaf Partners — that’s a lot of potential relationships with likely deep pockets to tap into.

Beyond Andreeff there’s the board which has some high net worth folks involved. For instance there’s former chair of the board Blane Walter. He’s a partner at Talisman Capital Partners which is a venture capital firm tied to $128.5m in funding in 2020-2021. Current chair of the board is Paul Buckman who can boast that “In addition to having raised in excess of $500M in private capital, the combined exit value of those companies in which Mr. Buckman has served as either CEO, Director or Co-Founder is approximately $2.8B.”

And finally, I note Ed Straw on the board who is the founder and managing partner of Osprey Venture Partners and chair of Odyssey Logistics which has grown from $40M to $1.5B during his tenure.

From this review it seems to me there are a lot of folks involved with deep pockets and potential interest in the stock itself. To me that further builds out plausibility that there could be a more underlying group of investors driving the stock price action. Again, I’m not directly saying that executives or the board themselves are involved here – I just think it’s not hard to imagine amongst this constellation of relationships that insider knowledge might have gotten out. Especially given the spike in volume which really catalyzed the current retail interest.

Summary

With the company trading as a net-net, incredibly high cost-to-borrow fees, and building retail momentum I think it’s likely a short squeeze will happen in the next two months at the latest. It could happen much sooner. Given the dynamics of the stock it seems like there’s meme stock potential here for a violent and perhaps sustained short squeeze.

I believe that investors are offered downside protection given the company is already trading below cash value. Additionally, the structural elements related to the 558% cost to borrow are likely to drive a short squeeze. The only way to short HDST currently and profit is by the stock price going to zero within the next two months. In any case that this does not happen, those short the stock right now will start to lose money and at a very high rate.

Because of these two components of undervaluation and high cost to borrow there’s an asymmetric opportunity presented. Shorts will need to cover meaning buying back shares on the market, this will drive the stock price upwards and drive a reversion of the cost to borrow fee to more rational levels. What makes this asymmetric is that even if someone thinks the company does not have good growth prospects over the long term, the unlikelihood of the company going bankrupt in two months combined with already depressed valuation makes the cost of shorting untenable. No new shorts are likely to be signing up for that with the recent equity raise and current shorts are going to have to deal with this by buying shares themselves to cover.

Given that this is a bit more of a trade setup with downside protection offered through fundamental analysis, the upside is a bit difficult to gauge here. What I will say is that I suspect that a short squeeze is likely to happen sometime in the next two months and buying in at levels today should ensure a profit to anyone who thoughtfully engages with that price action. Whenever the short squeeze occurs I expect the volatility to be huge so bear in mind if you are interested. With severe irrationality shown in meme stocks like GameStop (GME) and Bed Bath & Beyond (BBBY) it could be that the stock price firmly separates to the upside from fundamentals.

I’d say this is a strong buy at current levels to hold until at least the next quarterly call. If my thesis is wrong and no short squeeze occurs there’s downside protection given current undervaluation and the quarterly details can give me information about what to do next. If I’m right, I’ll monitor the short squeeze and make my best judgment about when to sell into it.

Risks

If you have read this far and it isn’t clear to you by this point let me be clear in stating that this is a pretty risky thesis overall. Do your own due diligence here; do your own due diligence always. The thesis requires not just an understanding of the company but also an understanding of the underlying stock market mechanics which are driving price action. If you don’t feel comfortable with both of those things then this is not a good investment for you, no matter what the returns are.

That said, let me outline some specific risks that I note.

-

The company is not profitable. Cash burn is a real thing which may be built into the stock price already mitigating the downside protection.

-

The short squeeze that I’m hypothesizing may not happen.

-

Dilution is a long term issue with the name due to consistent stock offerings and warrants. There could be further dilution risks with further market offerings down the line if the company is unable to generate revenue.

-

If the stock price remains below $1.00 they may face a NASDAQ delisting notice.

-

If I’m correct that there is a broader group using HSDT as a trading vehicle it’s likely that interests are not aligned. While this may be beneficial in regards to driving a short squeeze, it is not encouraging to from a long term buy-and-hold perspective.

Be the first to comment