DNY59

If you worry that we are headed into a recession, you are not alone.

The cost of nearly everything from gas to housing, food, fertilizers, and micro-chips is up significantly and it is starting to cause consumers to spend less money.

Meanwhile, central banks are attempting to get inflation back under control by hiking interest rates and turning QE into QT.

Adding fuel to the fire, Russia invaded Europe’s second largest country, Ukraine, and also caused a food and energy crisis for the rest of the world.

The pandemic is also still lingering around and while you may have forgotten about it, some countries like China are still following very strict policies that hurt their economy and that of the rest of the world.

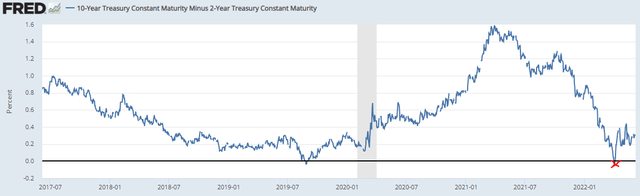

Oh, and I forgot to mention that we have actually already had 2 negative quarters of GDP Growth, which technically means that we are already in a recession. The yield curve also recently inverted, which has historically been a near-perfect indicator of a recession:

That’s a lot to digest!

The world bank believes that the rising gas prices are enough to trigger a global recession by itself, and that ignores all the other issues: the declining consumer sentiment, rising rates, war, food crisis, and pandemic lockdowns…

So we know that either we are in a recession or we are likely headed into one very soon:

How can you prepare your portfolio to shield yourself from painful losses?

Everyone has their own methods.

Some are loading up on Gold (GLD) and Silver (SLV), thinking that those will soar in a recession.

Others are betting heavily on currently discounted tech stocks (QQQ) and cryptocurrencies like Bitcoin (BTC-USD), which could rise in a recession as interest rates are cut again.

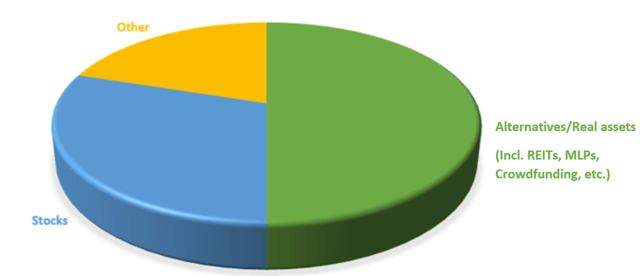

Personally, I am investing most of my wealth in recession-resistant real asset investments like farmland, apartment communities, warehouses, and grocery stores. I currently have up to 50% of my net worth invested in them:

High Yield Landlord

These investments are recession-resistant because they are vital to our society, whether the economy is growing or not.

You will need to buy food from the grocery and this food will require farmland to be produced and a warehouse to be stored. You will also still need a roof over your head… and other essential infrastructure that remains needed in recessions.

Moreover, the owners of these properties earn steady rental revenue, which typically does not change materially in a recession. Landlords are protected by leases, which may have multi-year terms.

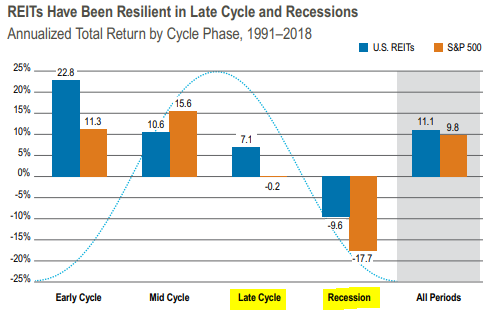

This explains why REITs (VNQ) have historically been strong outperformers during late cycles and recessions. Here are their average returns during recessions and late cycles vs. the S&P 500 (SPY):

NAREIT

You will note that this is the average performance of REITs, which include malls, offices, hotels, and other cyclical property sectors. If you remove those, the performance of REITs improves even further. So on average, REITs have historically declined by just 9% during recessions.

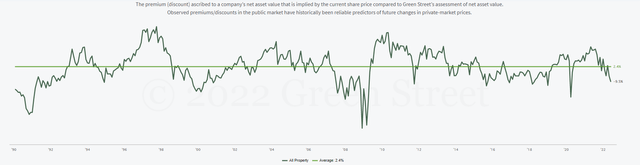

In comparison, they are today down by ~15% and as a result, their valuations are currently at a historic low, trading at large discounts relative to the value of the properties they own.

I believe that the low valuations coupled with their recession resistance should provide good downside protection in a recession as well as upside potential in a future recovery.

But don’t buy just any REIT.

There are over 200 of them, and as I noted earlier, some of them are more resilient than others.

At High Yield Landlord, we are mainly investing in defensive property sectors and focus on REITs with strong balance sheets, shareholder-friendly managers, and discounted valuations that provide margin of safety.

In what follows, we highlight two such REITs that we own in our Core Portfolio:

UMH Properties (UMH)

UMH Properties is a REIT that specializes in manufactured housing communities. If you fear a recession, this is a great property sector to consider because it provides affordable housing to blue-collar workers and retirees.

Often, there is no cheaper alternative and therefore, your residents are unlikely to move elsewhere in an attempt to save money during recessions.

On the contrary, you may benefit as people who live in traditional apartment communities move to your properties during recessions to cut down costs.

UMH Properties

Besides, in most cases, the owner of the manufactured housing community only leases the sites and the tenants must bring their own homes.

This increases the recession resilience of the property even further because:

- It is very expensive to move a home from one site to another, and therefore, the tenants are very dependent on your property.

- If tenants refuse to pay their site rents, the landowner may foreclose on their home and therefore, rent delinquencies are very unlikely.

- Most expenses related to the home itself are carried by the tenant and therefore, you are less impacted if a site becomes vacant.

UMH Properties

UMH Properties is particularly attractive because it has strong growth prospects and trades at a reasonable valuation.

When we last interviewed the CEO in early 2022 at High Yield Landlord, he noted that they have a path to ~50% FFO per share growth over the coming 5 years.

This growth will largely come from rent hikes, occupancy gains, new value-add acquisitions, the further development of existing communities, and savings in their cost of capital.

The company’s balance sheet is the strongest in its history with just a 20% LTV, and its growth prospects are also the best in many years.

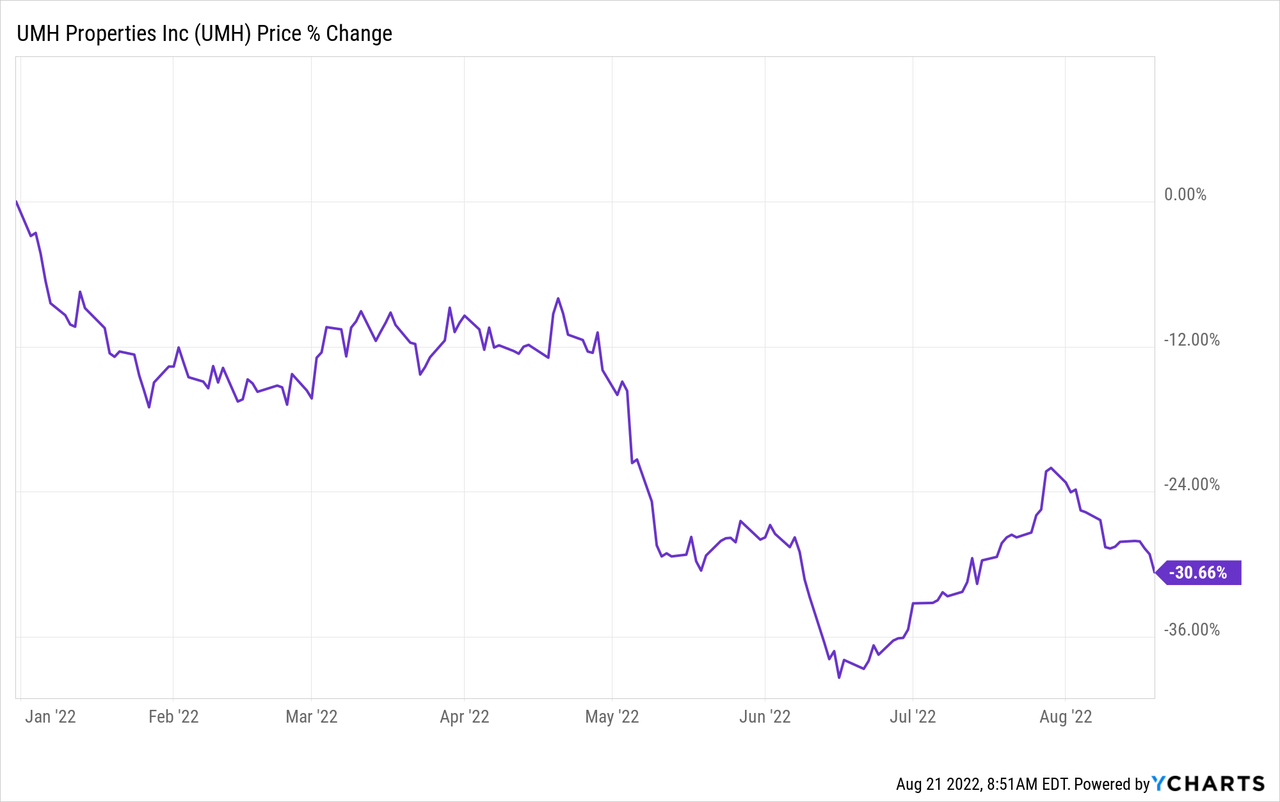

Despite that, the share price of the company dropped heavily as the market sold off earlier this year:

We think that it was fairly valued at its peak and that it is undervalued today. Following the recent dip, it is priced at 19x FFO and an estimated 20% discount to NAV. As it recovers, it offers 30% upside potential, and while you wait, you earn a 4.2% dividend yield that’s growing. It was actually hiked earlier this year, despite the sell-off!

That’s very attractive coming from a recession-resistant REIT in today’s uncertain world.

STORE Capital (STOR)

STORE Capital is a REIT that specializes in triple net lease properties. In case you are not familiar with net lease properties, there are single-tenant retail properties that focus in most cases on service-oriented businesses like restaurants, grocery stores, car washes, pharmacies, etc.

National Retail Properties

Spirit Realty Capital

We call these properties “net leases” because their lease is structured in a way that’s very favorable to the landlord:

- The lease term is very long at 10+ years in most cases.

- The rents are pre-determined for the entire duration.

- The rents go up each year by ~2% in most cases.

- The property expenses are all covered by the tenant.

- The properties typically enjoy high rent coverage.

As a result, the cash flow is highly consistent and predictable and since net lease REITs are well-diversified, they are highly resilient to recessions.

This explains why their dividends have historically kept on rising even during recessions. The two largest net lease REITs, Realty Income (O) and National Retail (NNN), have managed to hike their dividends for ~30 years in a row.

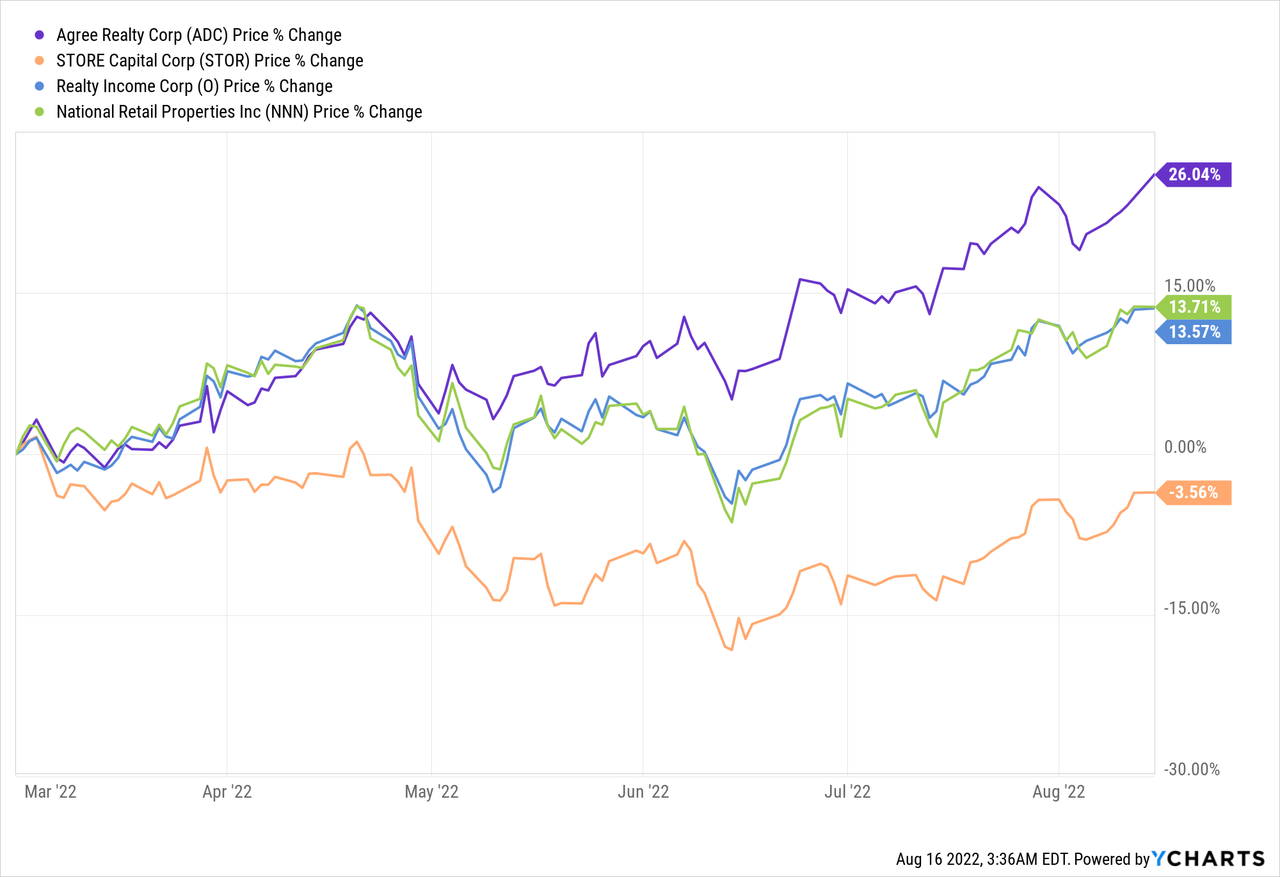

Not surprisingly, as investors began to fear a recession, they rushed to net lease REITs for safety. It caused them to rise significantly, with the exception of one net lease REIT: STORE Capital.

We believe that this is an opportunity.

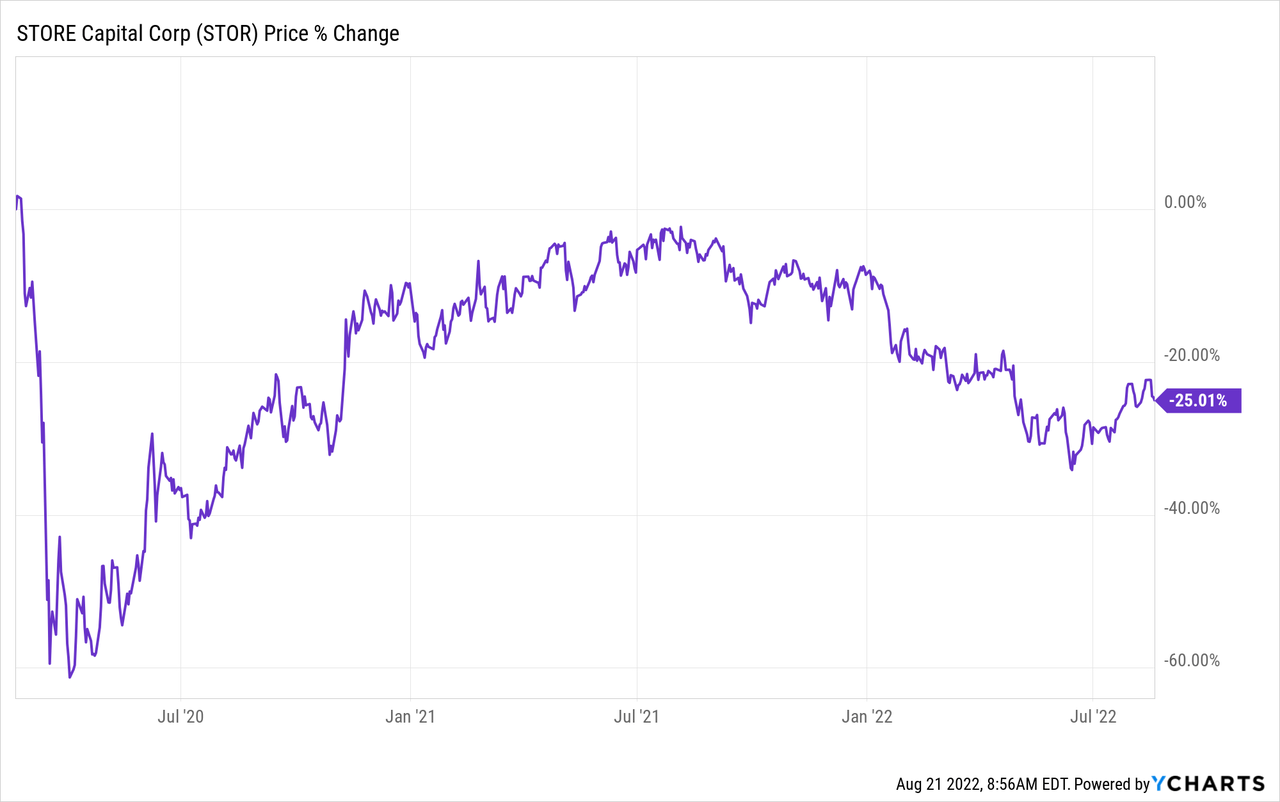

Unlike other net lease REITs, STORE is today still priced at a large 25% discount to pre-covid levels, even as other net lease REITs have already fully recovered:

STORE failed to recover because it is falsely perceived to be materially riskier than its other net lease peers.

Yes, it is true that STORE focuses on the middle market and therefore, most of its tenants are mainly smaller companies that aren’t investment-grade rated.

But what STORE lacks in its tenant’s corporate credit quality, it more than makes up by structuring safer leases with its tenants, and this appears to have been ignored by the market.

- STORE requires its tenants to disclose the property-level profitability

- STORE focuses on properties with high rent coverage.

- STORE gets master leases with its tenants, limiting their ability to close down and stop paying rents at underperforming properties.

- STORE has true triple net leases with no force majeure clauses

- STORE has exceptionally long leases at 17 years.

- STORE has larger rent hikes in its leases, which makes up for potential issues at a few individual properties.

The pandemic was the worst possible crisis for STOR and not even that could break it. STOR actually hiked its dividend by 3% in 2020, which was one of the highest dividend growth rates back then.

So you can imagine that a regular recession won’t have much of an impact on its performance. To prove this point: consider that STOR actually hiked its guidance in the last quarter and guided for nearly 10% FFO per share growth in 2022.

STORE is not just surviving, it is thriving. It is actually growing faster than most of its peers in today’s environment, and yet, it trades at a much lower valuation. Currently, it is priced at just 13x FFO, which is exceptionally low for a REIT of this quality that’s growing at such a rapid pace.

We expect 40% upside and while you wait you earn a 5.3% dividend yield. I think that this is one of your last chances to buy STORE at below $30 per share as it offers some of the best risk-to-reward in today’s market.

Bottom Line

My portfolio has grown over the years and I want to do my best to preserve it during the next recession and possible bear market.

I am sure you feel the same way.

The key here is to avoid companies that have cyclical cash flow, high leverage, and unsustainable valuations as those will likely suffer the most downside.

REITs are the opposite today. They earn defensive cash flow from long-term leases, their balance sheets are the strongest ever, and their valuations are temporarily discounted.

This is why I am mainly buying REITs in today’s environment and UMH and STORE are two examples that I hold in my portfolio.

Be the first to comment