Dr_Microbe

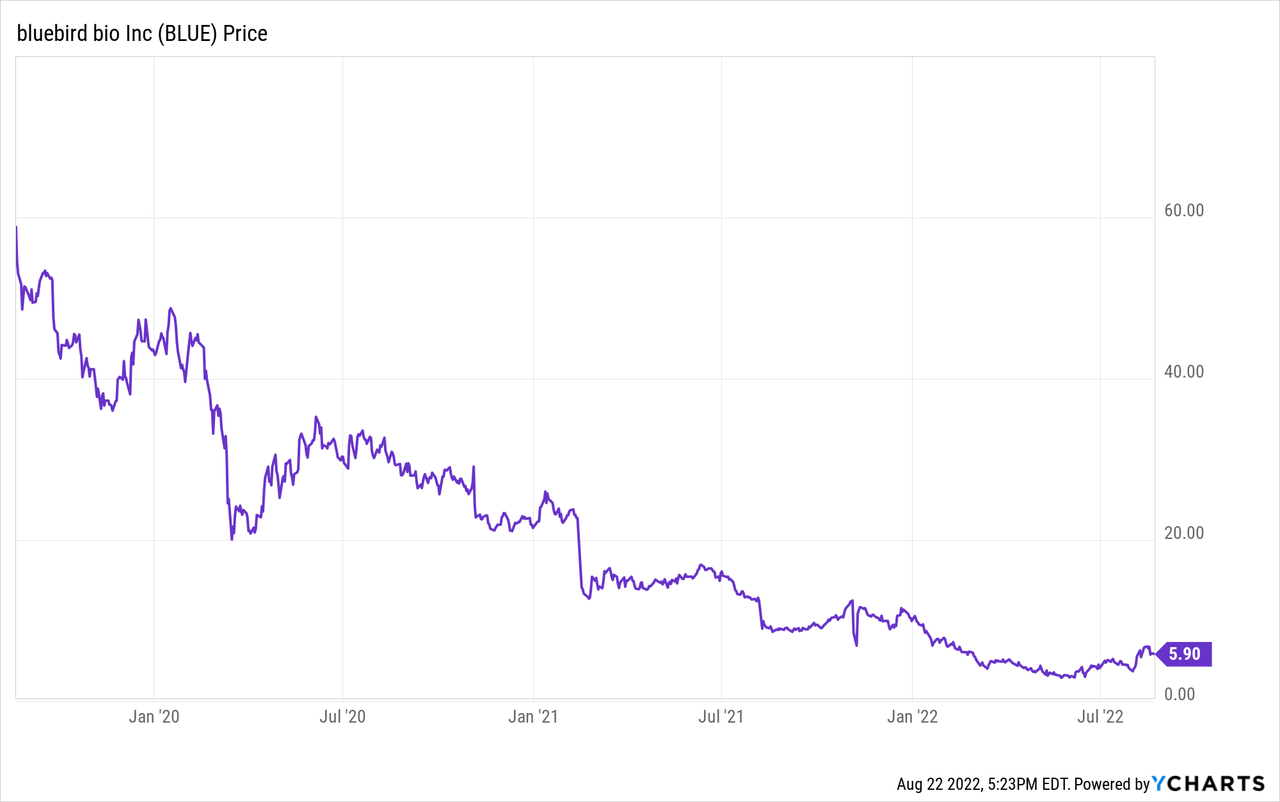

bluebird bio (NASDAQ:BLUE) is a commercial stage biotechnology company specializing in gene therapies. It spun off 2seventy bio (TSVT) in November 2021, and with it the promising revenue generator Abecma, which is partnered with Bristol-Myers Squibb (BMY). bluebird is a good example of investor overexuberance in the biotechnology field. It hit a peak stock price of just over $150 in March 2018. On Friday, August 19 you could buy it for under $6.00 per share, and its 52-week low was $2.87. Despite the price crash bluebird has certainly shown it can develop a gene therapy, get regulatory approval, and market it. This article will review bluebird’s current commercial therapies and its pipeline. I will then evaluate whether the stock is likely to be a good buy at the current price for long-term investors. Before delving into the commercial and pipeline opportunities I will review Q2 results.

bluebird bio Q2 2022 Results

Revenue was a mere $1.5 million in Q2 2022. The net loss was $100 million or $1.36 per share. That was a great improvement over year-earlier numbers of a net loss of $242 million or $3.58 per share, which reflected the state of the company before the 2seventy bio spin off.

Cash and equivalents ended at $173 million. Unless Zynteglo revenue ramps far more quickly than I would expect, or expenses are deeply cut, bluebird will need to raise funds again. Given the low stock price, that could result in substantial dilution of current stock. Recently the company has been raising cash through at ATM (at-the-market) mechanism, including $8 million in the balance just listed.

bluebird bio Commercial Therapies

The FDA approved Zynteglo (beti-cel) on August 17, 2022, for beta-thalassemia. It had already been approved by the European Union in 2019. The therapy is a form of genetic engineering in which stem cells are removed from each patient and modified by a virus to carry healthy copies of the beta globin gene. The cells are then injected back into the patient. The expectation is that they will produce healthy red blood cells for the remaining life of the patient. In trials 89% of patients achieved independence from blood transfusions following the therapy. You can find more at Zynteglo prescribing information.

While that appears to be wonderful for patients, the wholesale cost has been listed at $2.8 million. One could argue that over the lifetime of a patient this would be less expensive than transfusions or Bristol-Myers’ Reblozyl, which costs about $3,700 per dose, and must be given every 3 weeks. I will be surprised if insurers cover Zynteglo, given the upfront costs. Estimated cost of Reblozyl is $64,000 per year, so it would take about 44 years of therapy to balance costs against Zynteglo. A factor to Zynteglo’s advantage might be doctor costs, since Reblozyl requires continuing trips to doctors, but Zynteglo patients should be cured for life.

bluebird bio Platform and Pipeline

Next up in the bluebird pipeline is eli-cel for cerebral adrenoleukodystrophy, which has an FDA deadline or PDUFA date of September 16, 2022. In June eli-cel received a unanimous positive vote from an FDA advisory committee, which makes approval highly likely. However, the company and the FDA has not yet resolved a clinical hold. bluebird believes that materials in its license application will resolve the issues raised in the clinical hold.

Lovo-cel, formerly called Lenti-Globin, for sickle cell disease is in a partial clinical hold with the FDA. Despite that bluebird plans to submit a BLA for lovo-cel in Q1 2023.

bluebird bio’s platform is based on gene therapy. It has a second sickle cell therapy in a Phase 1 trial. It has not disclosed other preclinical work or disease targets, but given the large number of genetic diseases, it could generate an extensive clinical pipeline and commercial portfolio over time.

BLUE Stock Valuation

Valuing bluebird bio is particularly difficult. Clearly its gene therapies can work and receive regulatory approval. It appears that Abecma, spun off to 2seventy bio, is already producing significant revenue, while Zynteglo has not, at least in Europe. I expect bluebird to have more success where its gene therapies treat diseases with no other good, less expensive treatments available. I also think Zynteglo could compete better with Reblozyl if its price were lowered. The strategy could also be to mainly treat patients who do not respond to Reblozyl.

The dilemma for investors (and healthcare providers, patients, and insurers) is the one-time nature of gene therapy, and the high development costs that need to be recovered. While I would be delighted to see revenue ramp significantly, my expectation is for a slow ramp of Zynteglo and likely for eli-cel. That means bluebird will be selling stock to raise cash from time to time. What would be better for everyone is for a large pharma company to buy it out. In the longer run, with more therapies brought to market, it should become profitable. Its current market capitalization is under $500 million. That may be a fair balance between the present crunch and some possibly glorious future.

Conclusion

In this case I do not have a recommendation, which I guess amounts to a Hold. As quarters roll by, we can watch to see if insurers will pay for Zynteglo and then eli-cel and lovo-cel. We can see how well the capital raises go. We can see if anything comes out of the preclinical pipeline that signals a clearer revenue prospect. And we can hope that one of the large pharmaceutical companies sees the opportunity and offers to buy bluebird bio.

Given all that, I have added both BLUE and TSVT to my watch list. I may be adding them to my portfolio at some point in the future, pending more data, including price moves.

Be the first to comment