Evgenia Parajanian

While EV charging continues to garner more interest and government funding, Volta (NYSE:VLTA) still doesn’t have a workable business plan for the short term. The company has lost most key executives despite what previously amounted to a promising business model in EV charging stations. My investment thesis remains Neutral with the stock trading at $2 now, but Volta could keep falling.

The Good

Volta has an intriguing business plan to utilize EV charging stations for digital advertising. The company doesn’t even currently charge for the electricity used to charge vehicles and the business doesn’t technically need a customer to charge an EV in order to generate advertising revenue.

The model struggles because Volta forecasts needing to spend $110 to $130 million on capex this year alone in order to install new charging stations. The upfront cost and lack of cash is what’s causing the problem for the company.

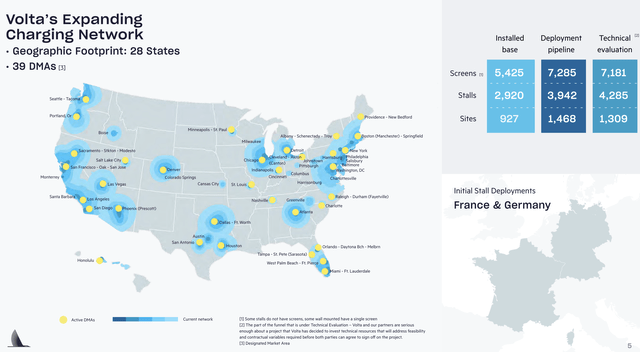

Volta added 372 stalls during Q2’22 for a record stalls connected in one quarter, up 180% from last Q2. The company now has 2,920 stalls and 5,425 screens connected with most stalls having 2 screens.

Source: Volta Q2’22 presentation

The EV charging station company has an impressive contracted pipeline of 3,942 stalls with 7,285 screens providing far in excess of 100% upside to the current base. Volta has another 1,309 sites under technical evaluation with 4,285 stalls providing a total opportunity of up to 8,227 stalls in the works.

The Volta Media Network continues to expand work with larger brands as the network gains scale with each new install. The additional stalls will make the media network in more demand due to a higher reach and the ability to target people right prior to a purchase decision as they enter stores.

The Bad

The problems with Volta were summed up by the interim CEO on the Q2’22 earnings call. Vince Cubbage had the following to say about a capital raise:

But as it relates to the debt, we said on our May call that we were starting a process. And shortly after saying that and starting that process, both our CFO and GC roughly left the company. And Drew and Brandt stepped in. We’re very, very focused on this. The process is well underway. We’re very optimistic that we will complete the capital raise on the time line that we have. We think that it will be well received in the market.

While the interim CEO sounds bullish on a capital raise, not many investment funds want to invest in a company with a completely new management team. Volta ended June with a cash balance of only $105 million, precariously below the capex target for 2022 at ~$120 million.

The company desperately needs a cash infusion to build out the current stalls in the pipeline, but the economic environment and the new management team should scare off most institutional investors. Not to mention, the financials remain bleak. For Q2’22, Volta reported revenue of $15.3 million, but the company still had an adjusted EBITDA loss of $33.4 million. The current cash hardly covers the operating losses, much less the large capex needs.

Those aren’t the financials attracting new investments. The Q3’22 guidance does support revenue growth with a target of reaching $17 to $18 million leading to $70 to $80 million for the year.

The consensus analyst target has revenues jumping to $30 million for Q4 with a dip back to $22 million in Q1’23. Volta is now forecasting a business more in tune with the digital ad market where seasonality is very strong, especially considering a media business targeting retail outlets such as Kroger (KR) and Walgreens (WBA).

A big concern is that Volta has to produce a massive boost in media revenues in order to hit the aggressive Q4’22 targets. Analysts are leaning towards the company only reaching $70 million in annual revenues with a requirement for media sales to at least double from the $11.2 million reported in the June quarter.

Not to mention, the company only generated $12.0 million in quarterly revenues last Q4 with media revenues of just $8.6 million. The company would need to produce up to 200% growth in media sales while having an interim CEO and replacing the CFO.

If Volta doesn’t hit these revenue targets, the company risks larger losses while already needing significant funding to build out the EV charging network. The stock valuation is only a minimal $335 million setting up a scenario for material dilution in the event of needing to raise equity to finance the ongoing losses and large capex.

Takeaway

The key investor takeaway is that Volta faces a cash crunch while having an inexperienced interim management team. Investors are best watching this stock from the sidelines until the terms of any debt or equity financing are provided, and new executives are hired to restructure the business.

Be the first to comment