BobGrif/iStock via Getty Images

More than 15 months ago, Advanced Emissions Solutions (NASDAQ:ADES) or “ADES” initiated a review “to assess a range of strategic alternatives to maximize shareholder value“.

With close to $4 in cash per share as of the end of Q2, no long-term debt and close to $90 million in annual revenues from its EBITDA-positive Activated Carbon (“AC”) business, market participants likely expected the company to either find a buyer for its Red River Plant which ADES acquired in late 2018 from private equity for $75 million or an outright sale of the company at a substantial premium to the current share price.

Unfortunately, management decided to go in the opposite direction by merging with Arq Limited or “Arq”, an emerging environmental technology company that converts coal mining waste into a micro-fine carbon powder (“Arq Powder”) for use in environmentally sustainable products.

Company Presentation

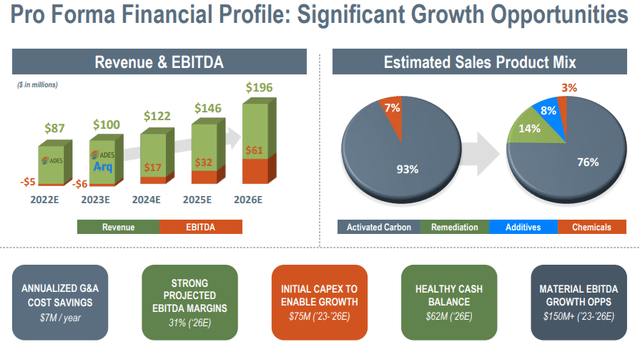

While Arq has constructed a $80 million processing plant in Kentucky with the ability to process over 100,000 tons of mining waste per year and received investments from Peabody Energy (BTU), Vitol and Mitsubishi (OTCPK:MSBHF), the company doesn’t appear to generate any revenues as of this point.

In fact, the combined business will require an estimated $75 million in additional capex over the next couple of years to “enable growth“.

Company Presentation

As a result of the merger, Adjusted EBITDA is expected to be negative in both 2022 and 2023, before turning positive again in 2024.

By 2026, the company expects the combined business to generate almost $200 million in annual revenues at EBITDA margins north of 30%.

But due to material, near-term capex requirements and expectations for the company to lose money in both 2022 and 2023, ADES will likely have to deploy the majority of its cash hoard going forward.

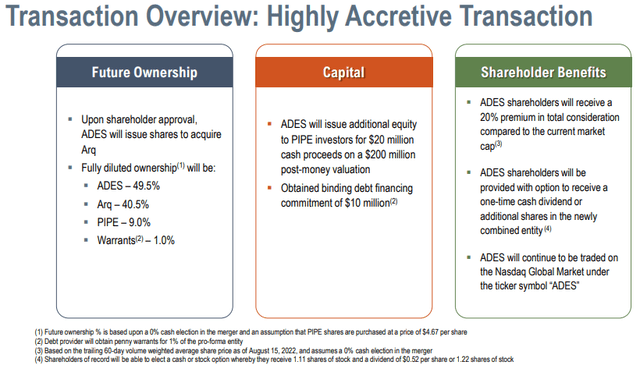

Given this issue, it is not exactly a surprise that the company has agreed to raise an aggregate $30 million in new equity and debt following the completion of the merger.

While there’s nothing wrong with a company trying to reinvigorate growth by investing in adjacent market opportunities, the Arq merger does not create the immediate value anticipated by shareholders after ADES launched its strategic review last year.

In fact, legacy ADES equity holders will own less than 50% of the combined company.

At least, shareholders will be able to elect a cash or stock option whereby they receive 1.11 shares of stock and a dividend of $0.52 per share or 1.22 shares of stock of the combined company.

While ADES has yet to provide additional merger information in a form S-4 filing with the SEC, the proposed transaction apparently represents a big change to the investment thesis.

Instead of pocketing some decent near-term capital gains, legacy ADES shareholders will become owners of an emerging technology company with substantial execution risks.

Given this issue, Monday’s 40% sell-off in the shares doesn’t exactly come as a surprise as disappointed value investors are heading for the exits.

Bottom Line

The proposed merger with Arq Limited won’t result in instant value creation for legacy ADES equity holders as widely expected after the company initiated a strategic review last year.

It might take a number of weeks and additional selling pressure for the ADES shareholder base to change in a way that would enable an approval of the proposed transaction in the upcoming special shareholder meeting.

At least in my opinion, the proposed Arq merger adds considerable uncertainty to the ADES story and exposes legacy equity holders to material execution risks.

At this point, I would advise ADES shareholders to vote against the proposed transaction as it is hard to believe that the Arq merger represents the best way for shareholder value creation available to the company after a 15-month strategic review.

Be the first to comment