Jean-Luc Ichard

In mid-2011, the common shares of Microsoft Corporation (NASDAQ:NASDAQ:MSFT) were trading in the low- to mid-twenties.

As I wrote in my international-selling book, Build Wealth With Common Stocks:

Did I calculate, at the time, through discounted free cash flow analysis and other complex assumptive formulas that Microsoft compounds as a fourteen-bagger eleven years later?”

No, although my perception was the market undervalued the stock, in general, despite its legacy Windows and Office software, strong fundamentals, solid balance sheet, and other positive areas of the operation. The activist investment community was taking issue with the chief executive officer at the time, Steve Ballmer, and I figured he would resign, retire, or get replaced at some point.

Thus, I initiated a position in our family portfolio at a dividend-adjusted $20.51 a share, thinking it is going up more than down over the long term. To be sure, my perception was driven by a real-time cognitive analysis of the company and its stock instead of an assumption-driven specific future price target.

As of the writing of this report, MSFT was trading at $286 a share, almost fourteen times our cost basis, adjusted for splits and dividends. The holding’s total return has outperformed the S&P 500 by over 1,000 basis points during the same period.

As further shared in my book:

A dominant market share held by a significant player within an industry attracts faithful customers regardless of employee morale or CEO popularity. Nevertheless, poor-performing C-Suites sometimes produce value opportunities. In other words, buy the common shares of wonderful companies when trading at sensible prices, no matter the chief at the time of purchase.

In other words, thoughtful investors take advantage of the suddenly out-of-favor enterprise as an opportunity to add shares of a persistent quality business at a temporary bargain price. And if you were a lucky MSFT shareholder at the time, Satya Nadella was named Microsoft’s new CEO in February 2014.

In this updated primary ticker research report, I put Microsoft and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation, and downside risk.

The resulting investment thesis:

Under Nadella’s leadership, Microsoft is once again the dominant technology player it was under co-founder Bill Gates. However, despite being a fundamentally solid, low downside risk enterprise, the stock price currently appears at a premium valuation.

My current overall rating: Hold, based on a bullish view of the company and a neutral view of the stock.

Unless noted, all data presented is sourced from Seeking Alpha and YCharts as of the market close on August 21, 2022; and intended for illustration only.

Crushing the Market Under CEO Nadella

MSFT is a dividend-paying large-cap stock in the information technology sector’s systems software industry.

Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Microsoft Corporation was founded in 1975 and is headquartered in Redmond, Washington, USA.

My value proposition elevator pitch for Microsoft:

The reigning king of productivity software whether business, personal, cloud, or desktop.

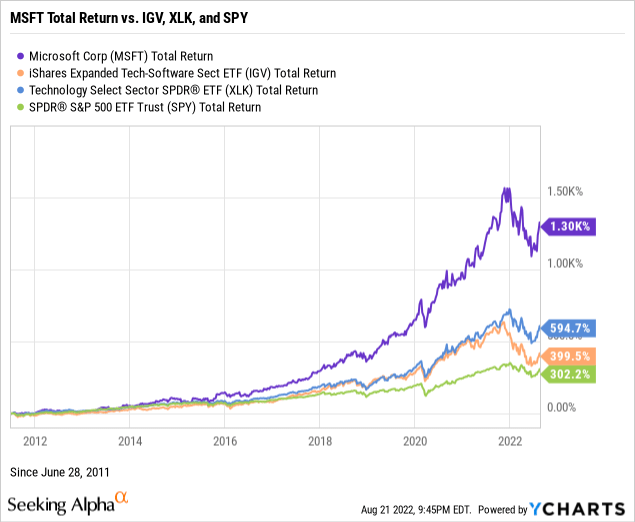

The chart below illustrates the stock’s performance against the iShares Expanded Tech-Software Sector ETF (BATS:IGV), the Technology Select Sector SPDR ETF (NYSE:XLK), and the SPDR S&P 500 Trust ETF (NYSE:SPY) since adding the shares to our family portfolio in June 2011.

Ultimately, investing in individual common stocks should aim to beat the benchmark indices over time. For example, MSFT has doubled and tripled the returns of its industry, sector, and market during the past 11 years, the largest runup coming after Satya Nadella was named CEO in early 2014.

My value proposition rating for MSFT: Bullish.

MSFT Yield on Cost Trouncing the 10-Year

As part of your due diligence, average the total shareholder yields on earnings, free cash flow, and dividends to measure how a targeted stock compares to the prevailing yield on the 10-year Treasury benchmark note. In other words, what is the equity bond rate of the common shares?

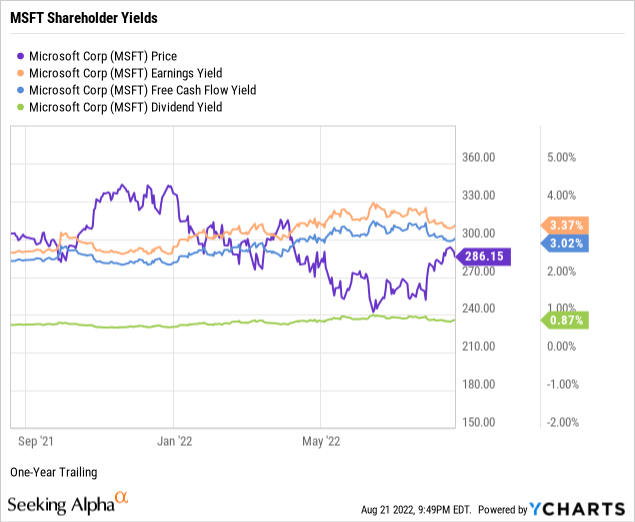

Target an earnings yield greater than 6 percent or the equivalent P/E multiple below 17 times. MSFT is trading under the floor at 3.37%, as demonstrated in the below chart.

Target a free cash flow yield of 7 percent or higher, or fewer than 15 times the inverted price-to-free cash flow multiple. At 3.02%, MSFT is under the threshold.

Whether or not you are an income investor, consider dividend-paying stocks for compensation in the short term while waiting for capital gains to compound over time. For example, Microsoft offers a modest dividend yield of 0.87% with a conservative 26.96% payout ratio, below the ideal 60% payout ratio ceiling, thus indicating a safe, well-covered dividend with room for annual raises.

Seek high dividend yields only when calculated on a cost basis. For example, MSFT was yielding 12.09% on our adjusted cost basis of $20.51 per share since June of 2011, or 1,122 basis points above the forward yield. Yet another reminder that buy and hold quality value investing works.

Next, take the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 2.99% on the 10-year Treasury benchmark note. For example, the average shareholder yield for MSFT was 2.42%. However, the average yield was 6.16%, using the stock’s dividend yield on our cost. Arguably, equities are deemed riskier than U.S. bonds. Thus, securities such as MSFT that reward shareholders with yields higher than the government benchmark favor owning the stock instead of the bond.

Remember that earnings and free cash flow yields are inverse valuation multiples, suggesting that MSFT trades at a premium. I’ll further explore valuation later in this report.

My shareholder yields rating for MSFT: Neutral, based on the forward yield.

Executives Are Superior Capital Allocators

Let’s explore the fundamentals of Microsoft, uncovering the performance strength of the company’s senior management.

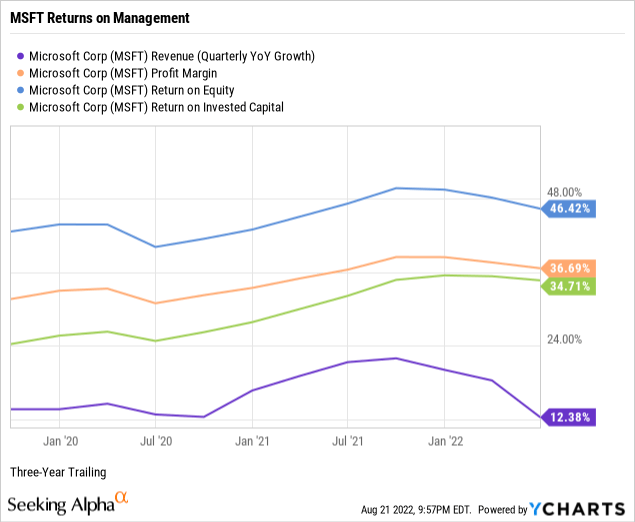

When analyzing a business, stay biased toward established growth instead of executive guidance and sell-side analyst projections. For example, per the below chart, Microsoft had three-year revenue growth of 12.38%, double the 6.16% median growth for the information technology sector.

Microsoft had a spectacular trailing three-year pre-tax net profit margin of 36.69%, far outperforming the sector’s median net margin of 4.25%. Remember to screen for profitable companies to avoid unnecessary speculation.

Return on equity or ROE reveals how much profit a company generates from shareholder investment in the stock. Target an ROE of 15 percent or higher to discover shareholder-friendly management. For example, Microsoft was producing trailing three-year returns on equity at an astounding 46.42% against a median ROE of just 7.28% for the sector.

Target a return on invested capital or ROIC above 12%. At 34.71%, Microsoft almost triples the threshold and destroys the sector’s median ROIC of 3.98%, indicating that Microsoft’s senior executives are superior capital allocators. Return on invested capital measures how well a company invests its resources to generate excess returns.

ROIC needs to exceed the weighted average cost of capital or WACC by a comfortable margin, giving management’s ability to outperform its capital costs. For example, Microsoft’s ROIC far exceeds its trailing WACC of 8.17% (Source: GuruFocus).

The consistent double-digit growth, phenomenal profit margin, and high returns on equity and capital under Nadella’s leadership indicate a world-class management performance in Redmond.

My fundamentals rating for MSFT: Bullish.

MSFT Undersold by the Market

A retail investor can rely on just four valuation multiples to estimate the intrinsic value of a targeted quality enterprise’s stock price.

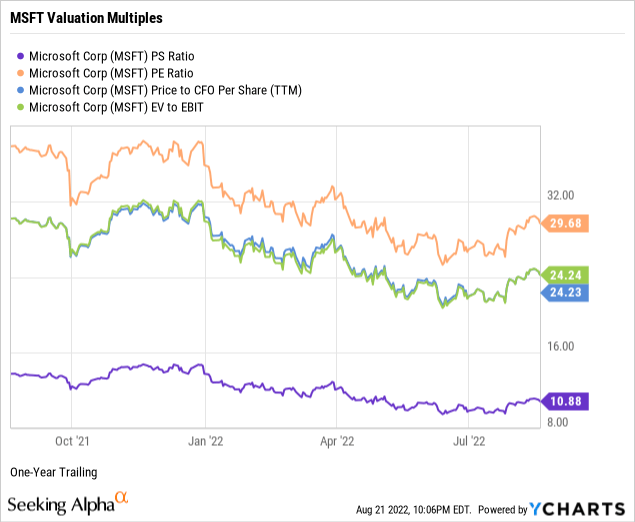

The price-to-sales ratio or P/S measures the stock price relative to revenues. Target fewer than 2.0 times, and at 10.88, MSFT was trading far above the ceiling. In addition, the trailing P/S ratio exceeded 3.01 times for the information technology sector and 2.55 times sales for the S&P 500. Thus, the weighted industry plus market sentiment suggests an overvalued stock price relative to Microsoft’s topline.

Although often a hit or miss multiple, target price-to-trailing earnings or P/E multiples fewer than 17 times or below the target stock’s sector averages. MSFT had a price-to-earnings multiple of 29.68 times against a sector P/E of 25.14, indicating investor sentiment reasonably prices the stock relative to earnings per share. However, MSFT was trading at a higher multiple than the S&P 500’s recent overall P/E of 23.18. (Source of S&P 500 P/E: Barron’s).

Target single-digit price-to-operating cash flow multiples for the best value. At 24.23 times, MSFT was trading well above the ceiling but near the sector’s median of 21.36, indicating the market prices the stock at fair value relative to current cash flows.

Enterprise value to operating earnings or EV/EBIT measures whether a stock is overbought, a bearish signal, or oversold, a bullish signal, by the market. Target an EV/EBIT of fewer than 15 times. Against the broader sector median of 20.18 times, MSFT was trading at 24.34 times enterprise value to operating earnings signaling the stock was undersold by the market.

Weighting the preferred valuation multiples suggests the market overvalues Microsoft’s stock price to sales and enterprise value while pricing it at fair value to earnings and cash flow. Therefore, based on the fundamentals and valuation metrics uncovered in this report, risks and potential catalysts notwithstanding, I would call MSFT a premium-priced stock of a legacy AAA-rated technology enterprise.

My valuation rating for MSFT: Neutral.

Microsoft is a Wide-Moat, Low-Risk Enterprise

When assessing the downside risks of a company and its common shares, focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment. Hence, assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below average and low-risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none.

Morningstar assigns Microsoft a wide moat rating.

For Microsoft overall we assign a wide moat rating arising from switching costs, network effects, and cost advantages. We believe that Microsoft’s different segments and products benefit from different moat sources. Microsoft’s Productivity and Business Processes segment includes Office, Dynamics, and LinkedIn. We assign the segment a wide moat rating based on high switching costs and network effects.

-Dan Romanoff, CPA, Senior Equity Analyst, August 3, 2022

A favorite of the legendary value investor Benjamin Graham, long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. Generally, at least one-and-a-half times current assets to long-term debt is ideal. Notably, as reported on its June 2022 quarterly financial statements, Microsoft’s long-term debt coverage of 3.61 times was more than twice the threshold.

In theory, the company could pay off 100% of its longer-term debt obligations in a crisis using its liquid assets such as cash and equivalents, short-term investments, accounts receivables, and inventory.

In a further test of its paydown capacity, Microsoft’s long-term debt to equity was just 36.55%, significantly below my suggested 200% ceiling. In other words, investors should become concerned only when a company’s debt is more than twice its equity.

Current liabilities coverage or current ratio measures the short-term liquidity of the balance sheet. Target higher than 1.00, and Microsoft’s short-term debt coverage was 1.78 times. Thus, its balance sheet provides more than sufficient liquid assets to pay down 100% of its current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes.

As a long-term investor, use a five-year beta trendline and screen for stocks lower than 1.25 or no more than 125% volatility in the market. MSFT’s 60-month trailing beta was 0.93. Its shorter-term 24-month beta was at a slightly more volatile 1.17. With price volatility in line with the S&P 500 standard of 1.00, MSFT presents as a market perform-type core holding.

The short interest percentage of the float for MSFT was 0.51%, well under my 10% ceiling. So perhaps the near-sighted bears view the stock as a safe technology staple with a solid balance sheet, income statement, and free cash flow driven by its cloud and productivity powerhouses.

Microsoft is a fundamentally superior, wide moat company with an appealing risk profile.

My downside risk rating for MSFT: Low.

Legacy Cash Cows Subsidizing Azure Growth

Catalysts confirming or contradicting my overall hold investment thesis on Microsoft Corporation common shares include but are not limited to:

- Confirmations: Microsoft has dominant, legacy tech product positions with Windows and Office that serve as cash cows to help drive its future growth in the cloud with Azure. However, its stock currently appears fully valued.

- Contradictions: The sustainability of Office, a mature product, is being tested in a subscription model, and the company still lacks a meaningful mobile presence, putting pressure on the share price. On the contrary, the stock projects upwards on performance as the market disregards valuation.

- Microsoft’s pending all-cash acquisition of Activision Blizzard (NASDAQ:ATVI) could either confirm or contradict the thesis, depending on the success or failure of its video gaming expansion.

The proverbial chicken and egg question begs, “What comes first, a quality company or competent management?”

Senior executives and board members come and go; therefore, it is imperative to own stock in companies that demonstrate enduring quality operations with an outstanding overall return on management despite the inevitable executive turnover.

And when the occasional and unintentional misfire hire is the newest member of the C-suite, resist pressing the panic button. Instead, sit back and watch as the prowling bears sent in by Mr. Market temporarily move the stock to the bargain bin. Next, chase the bears by adding more shares or initiating a new position as we did with MSFT in 2011.

Then relax, and be confident the board of your quality company will unlock value by adding a dynamic chief executive as Microsoft did with Satya Nadella.

Be the first to comment